More than an estimate

Startups valuation should not be performed as a rule of thumb, or with black box practices that leave space for arbitrary conclusions

Traditionally innovative

Traditional valuation approaches are methodological and grounded, but they need to be adjusted to capture the value of startups

Leading valuation approaches, formalized

We analyzed all valuation practices for early stage companies, selected the leading ones and made them available for you.

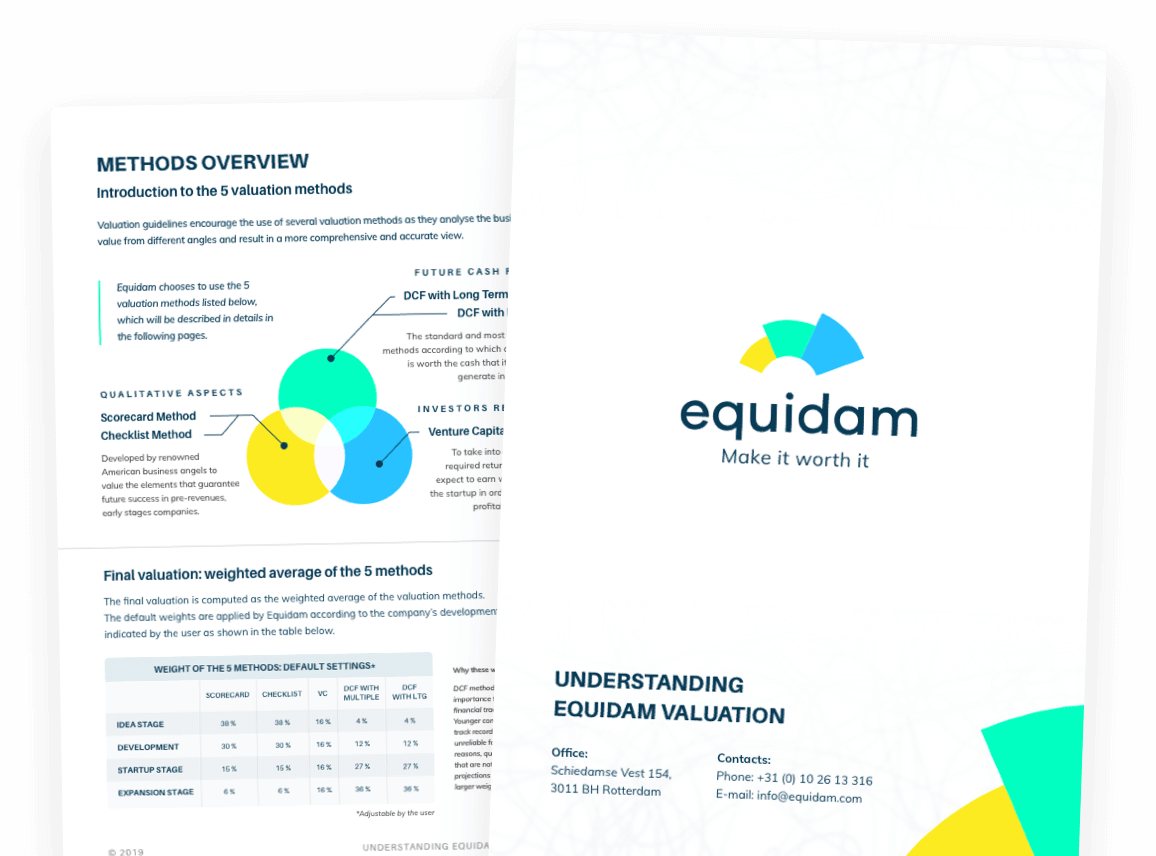

5 valuation

methods in one

Looking at the business from different perspectives results in a more comprehensive and reliable view. Our methods look at the value of a startup from 3 different points of view.

Qualitative aspects

Scorecard Method

Checklist Method

Developed by renowned American business angels to value the elements that guarantee future success in pre-revenues, early stage companies

Future cash flows

DCF with Long Term Growth

DCF with Multiple

The standard and most traditional methods according to which a company is worth the cash that it’s going to generate in the future

Investors returns

Venture Capital Method

This method takes into account the returns investors expect to earn upon exit in order to have a profitable portfolio

Future cash flows

DCF with Long Term Growth

DCF with Multiple

The standard and most traditional methods according to which a company is worth the cash that it’s going to generate in the future

Investors returns

Venture Capital Method

This method takes into account the returns investors expect to earn upon exit in order to have a profitable portfolio

Qualitative aspects

Scorecard Method

Checklist Method

Developed by renowned American business angels to value the elements that guarantee future success in pre-revenues, early stage companies

Future cash flows

DCF with Long Term Growth

DCF with Multiple

The standard and most traditional methods according to which a company is worth the cash that it’s going to generate in the future

Qualitative aspects

Scorecard Method

Checklist Method

Developed by renowned American business angels to value the elements that guarantee future success in pre-revenues, early stage companies

Investors returns

Venture Capital Method

This method takes into account the returns investors expect to earn upon exit in order to have a profitable portfolio

Read the full methodology

We support and promote transparency – which is why we made our methodology open to everyone.

Compliant with IPEV (International Private Equity Valuation) Guidelines

1400+ investors use Equidam to value opportunities

Investors should be acquainted with our methods, but their practices vary based on professionalism and philosophy.

No matter the methods used, both parties should enter negotiations prepared with their fair valuation so that they openly discuss its assumptions and consciously decide how far they want to go from their ideal case scenario.

“As entrepreneur and investor, I’m using the Equidam report for every fundraising I’m involved in.“

Maarten Timmerman

Founder and CEO at AWAREWAYS

Backed by the most reliable data

Equidam accurately curates and updates data sources of valuation parameters such as multiples and discount rates. They are tailored to 90 countries and 136 industries.

30,000 Companies

We provide updated revenue and EBITDA multiples from a database of globally listed public companies.

Handpicked for startups

From pre-revenue to series A

Qualitative methods to value intangibles

Elements like strength of the team, quality of the idea and barriers to entry are a guarantee of future success, thus valuable per se. Equidam structured commonly used business angels approaches to capture these qualitative aspects.

Yes, DCF for startups

Even at early stage, when forecasts are highly uncertain, Discounted Cash Flow methods remain the only way to incorporate the startup's unique roadmap to growth and cash generation in the valuation.

Suitable for:

Fundraising

Selling the company

Intra-partners agreements

Not suitable for:

Liquidating the company

Africa's most influential angel investor

“As a start-up valuations can be contentious, Equidam’s tool provides a clear and objective framework at determining a fair value for a venture”

H’ Tomi Davies (TD), President of the African Business Angel Network (ABAN)

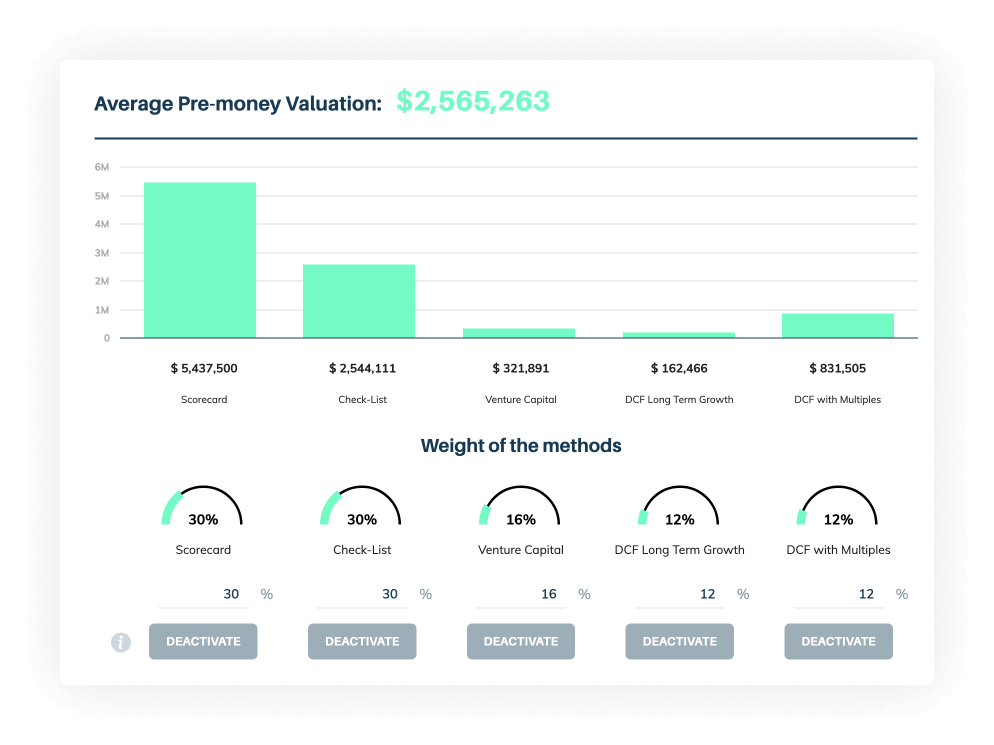

Powerful defaults, and customizable

Equidam is built in a way to allow seamless usage across all levels of financial knowledge and company stage

- Assisted financial projections with industry averages

- Customizable valuation parameters

- Adjustable methods selection

- Adaptable weights of each method

- Ability to deactivate valuation methods

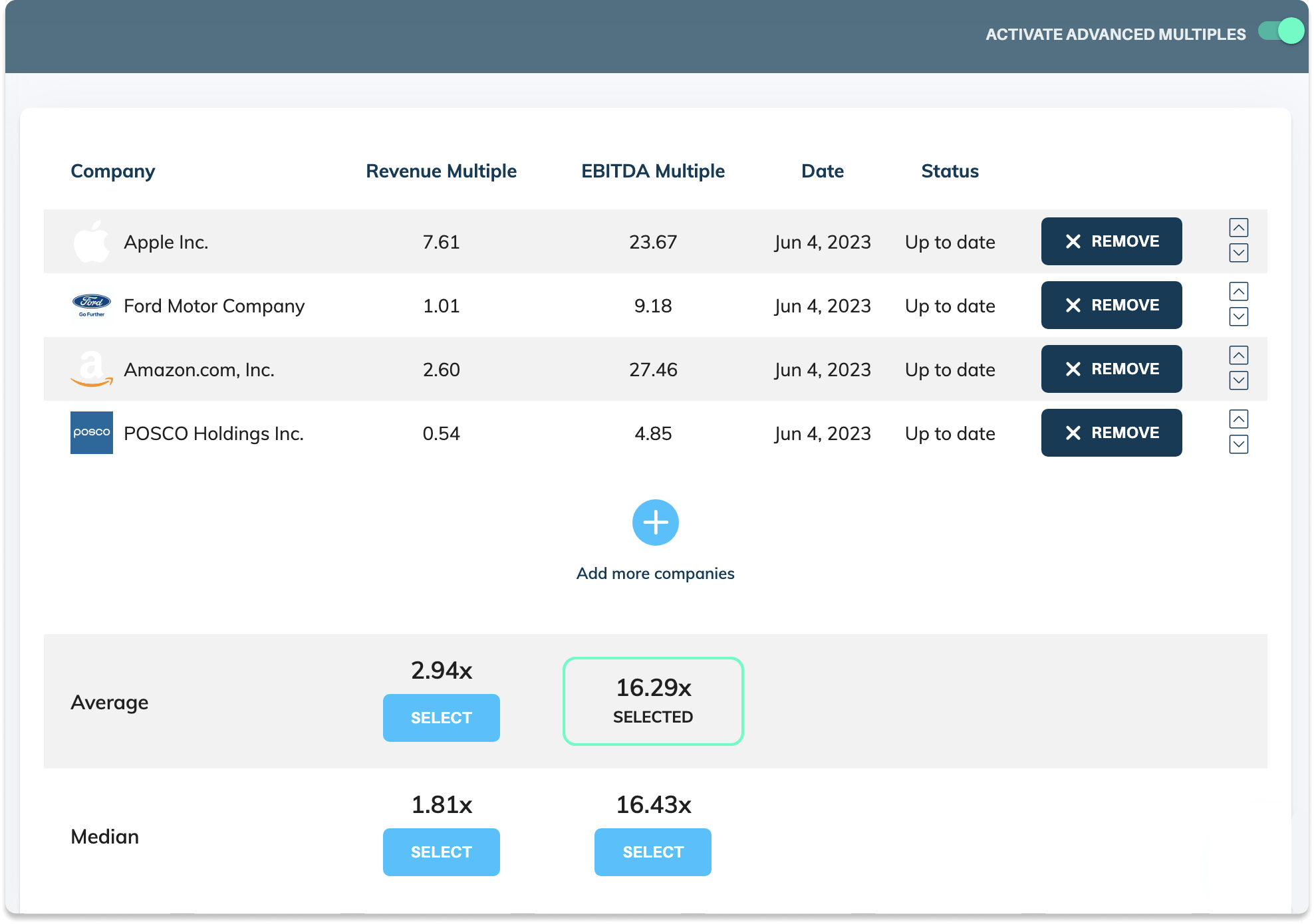

Database of 30.000+ public company multiples

Equidam’s Advanced Multiples tool allows you to build your own set of comparable public companies with a searchable index of public company EBITDA and revenue multiples.

- Select relevant public company comparables

- Include either revenue or EBITDA multiples

- Use the average or median of the group

- Database of multiples updated weekly

- Option to reflect updates in your valuation

Make it worth it

A structured methodology allows you to know the assumptions behind valuation and understand its drivers. This allows you not only to have honest and transparent discussions about it with investors but also to take better strategic decisions.