49 reports downloaded in Argentina 🇦🇷 from 140.000 globally

The perfect starting point for transparent and fruitful negotiations

A number, without context, is meaningless. During negotiations, it’s important to put all information on the table so that both parties can fairly be on-board.

33 pages to clearly display:

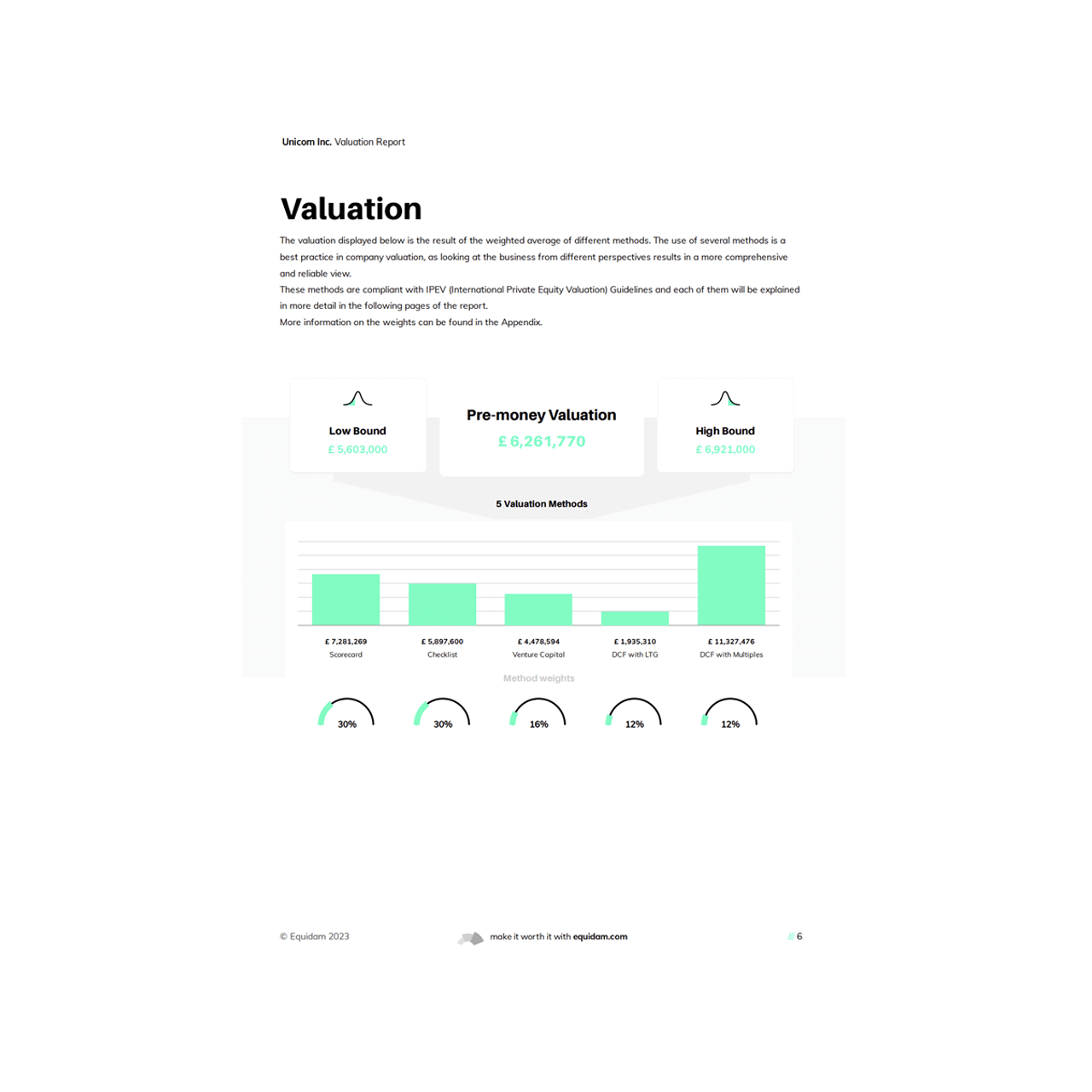

Valuation Summary

The summary breaks down the valuation into its five different methods, and shows how they combine in the final valuation as a weighted average.

From the variance of the methods, Equidam also estimates a valuation range to facilitate wiggle room in negotiations.

Valuation Summary

The summary breaks down the valuation into its five different methods, and shows how they combine in the final valuation as a weighted average.

From the variance of the methods, Equidam also estimates a valuation range to facilitate wiggle room in negotiations.

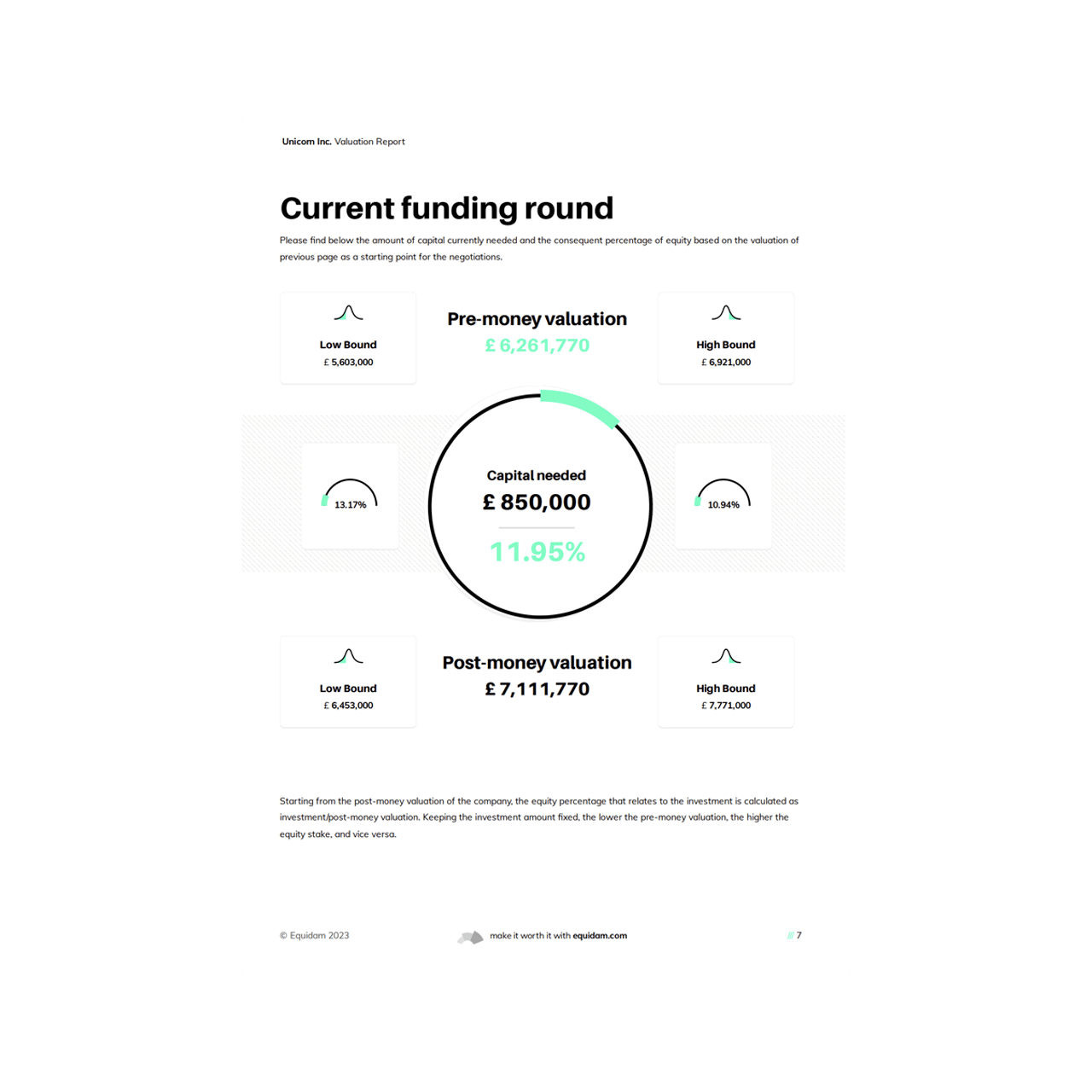

Round information

If you are raising capital, the report will include a page which breaks down how the valuation — and the valuation range —are reflected in terms of an equity percentage.

A further page will detail how you intend to allocate the funds.

Round information

If you are raising capital, the report will include a page which breaks down how the valuation — and the valuation range —are reflected in terms of an equity percentage.

A further page will detail how you intend to allocate the funds.

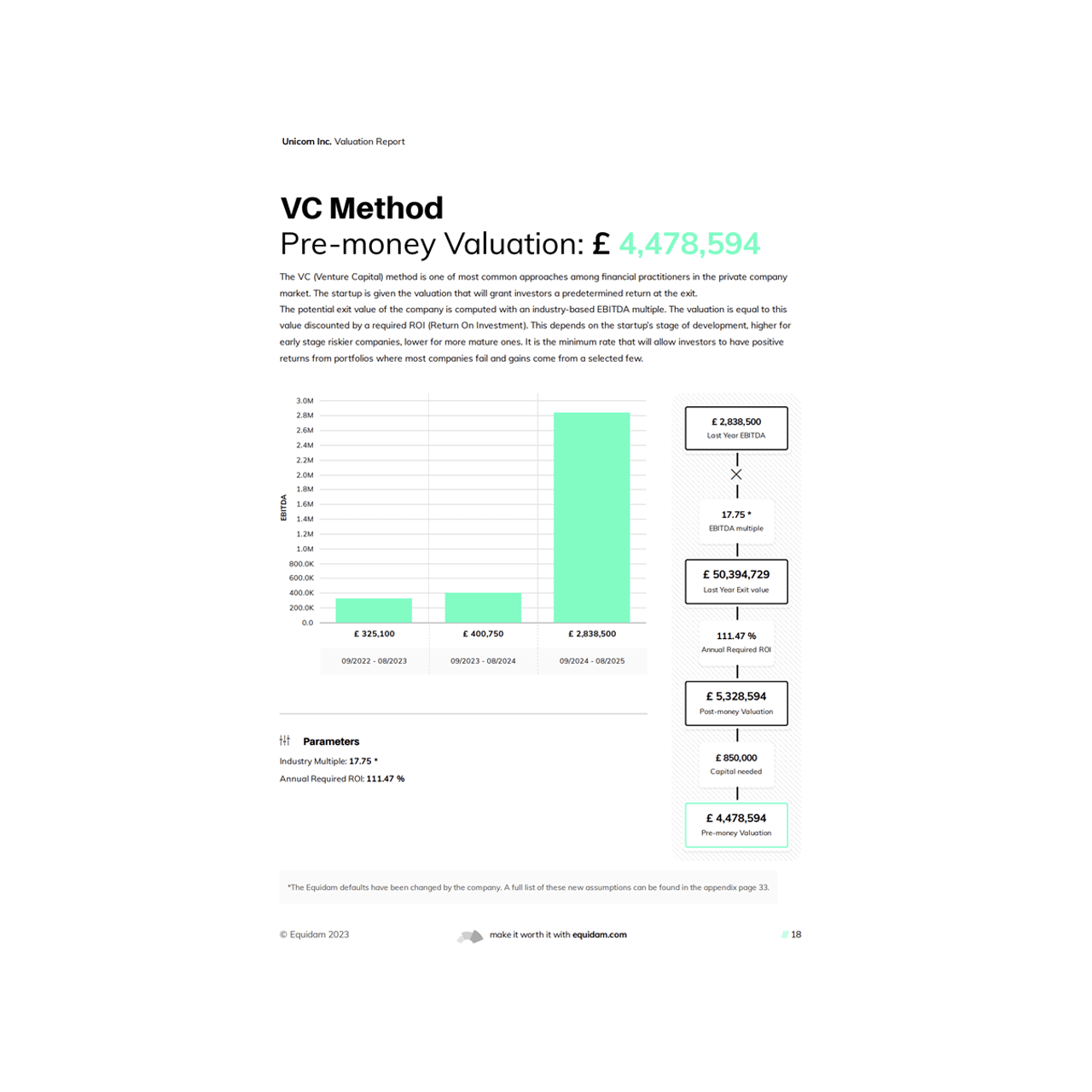

Valuation Details

Every step of our valuation methodology is clearly detailed and transparently explained.

The report includes one page for each of the five methods, detailing the background information, intent, full calculation, valuation parameters and any additional data sources.

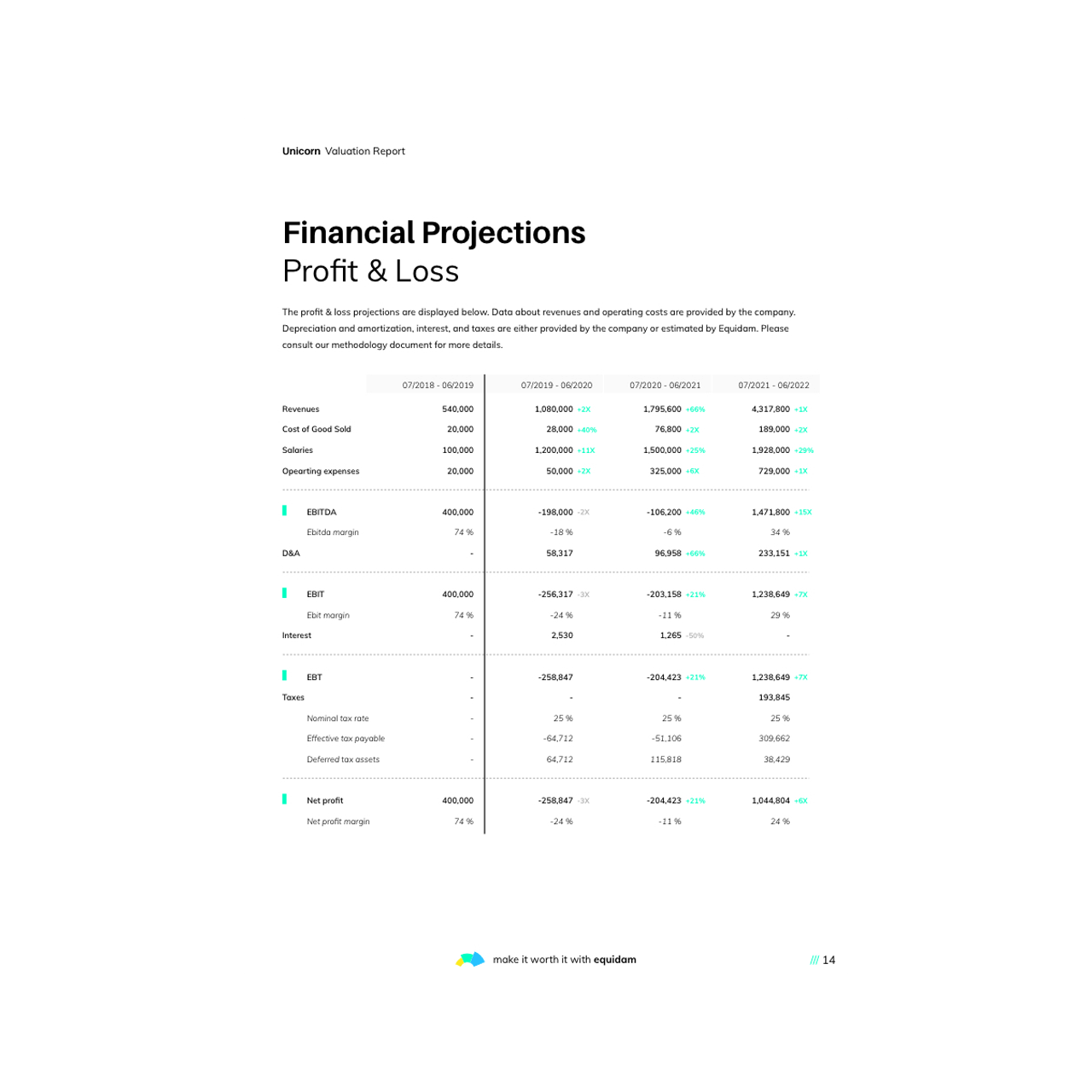

Complete Financial Projections

Financial projections play an important role in understanding the value of a company.

In addition to streamlining the process of generating your projections on Equidam, there will be clear, standardised, and detailed profit & loss and cash flow forecasts automatically included in your report.

Complete Financial Projections

Financial projections play an important role in understanding the value of a company.

In addition to streamlining the process of generating your projections on Equidam, there will be clear, standardised, and detailed profit & loss and cash flow forecasts automatically included in your report.

Complete Financial Projections

Financial projections play an important role in understanding the value of a company.

In addition to streamlining the process of generating your projections on Equidam, there will be clear, standardised, and detailed profit & loss and cash flow forecasts automatically included in your report.

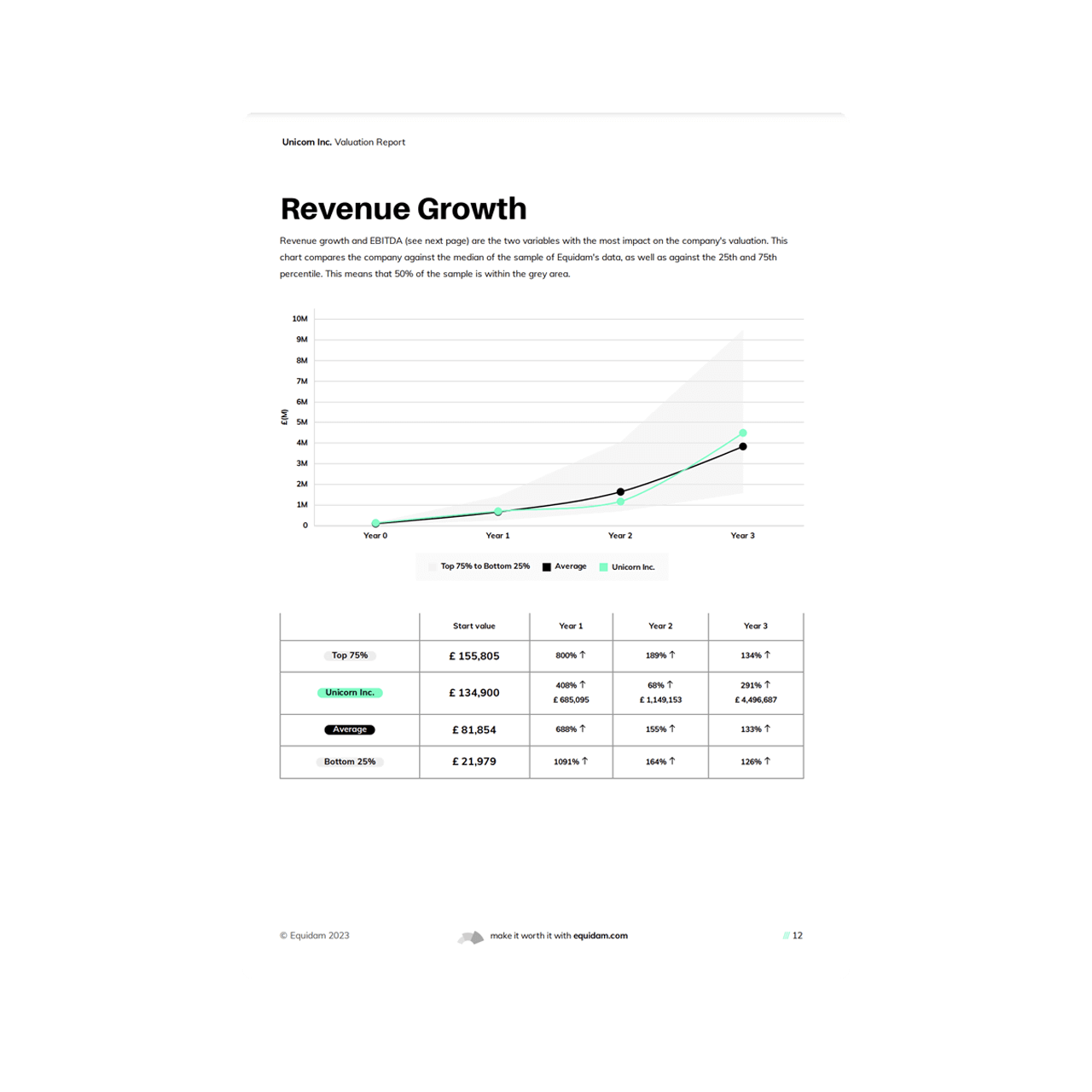

Valuation Benchmarks

Support your valuation with the perspective provided by private market benchmarks.

Filter by industry, stage and geography to build a sample of relevant companies, and include this as context for your valuation, funding target, revenue and EBITDA growth in your report.

As an angel investor, Equidam allows me to make more efficient investment decisions. I no longer have to create financial models for every company I evaluate

Director, Product Management at Tinder

Equidam is a fantastic tool. It gave me confidence in my two valuations. It helped us set a solid pre-money, and we actually over-subscribed our round. The detailed report meant that potential investors could review the methodology without a meeting, by just accessing it in our data room.

President & COO at Omeza

We are using Equidam for our funding round. The report is of great value to get investors in!

Gábor Margés

Head Officer of MeetJune

As entrepreneur and investor, I’m using the Equidam report for every fundraising I’m involved in.

Founder & CEO at AWAREWAYS

Get yours now

20,000+ companies already entered negotiations with an Equidam report. Start making yours now.

Usefulnegotiationstips

Adjust after every interaction

After every discussion with investors, sit down and review the elements of the valuation that raised more questions. Go back to the platform to easily refine the valuation accordingly.

"This valuation is too high!"

In this case, refer back to the assumptions. What makes it too high? Are projected revenues in 3 years not realistic? Are costs not adjusted accordingly? If you agree on the assumptions, you agree on the valuation.

Valuation is both an art and a science

Complement the report with a pitch deck. The methods (science) are one side of it, convincing investors with your story is an art!

Make it worth it

A valuation report is a screenshot of the value of your company at a given point in time. Use it to the next level by updating all stakeholders about the value you are creating on a monthly or quarterly basis.