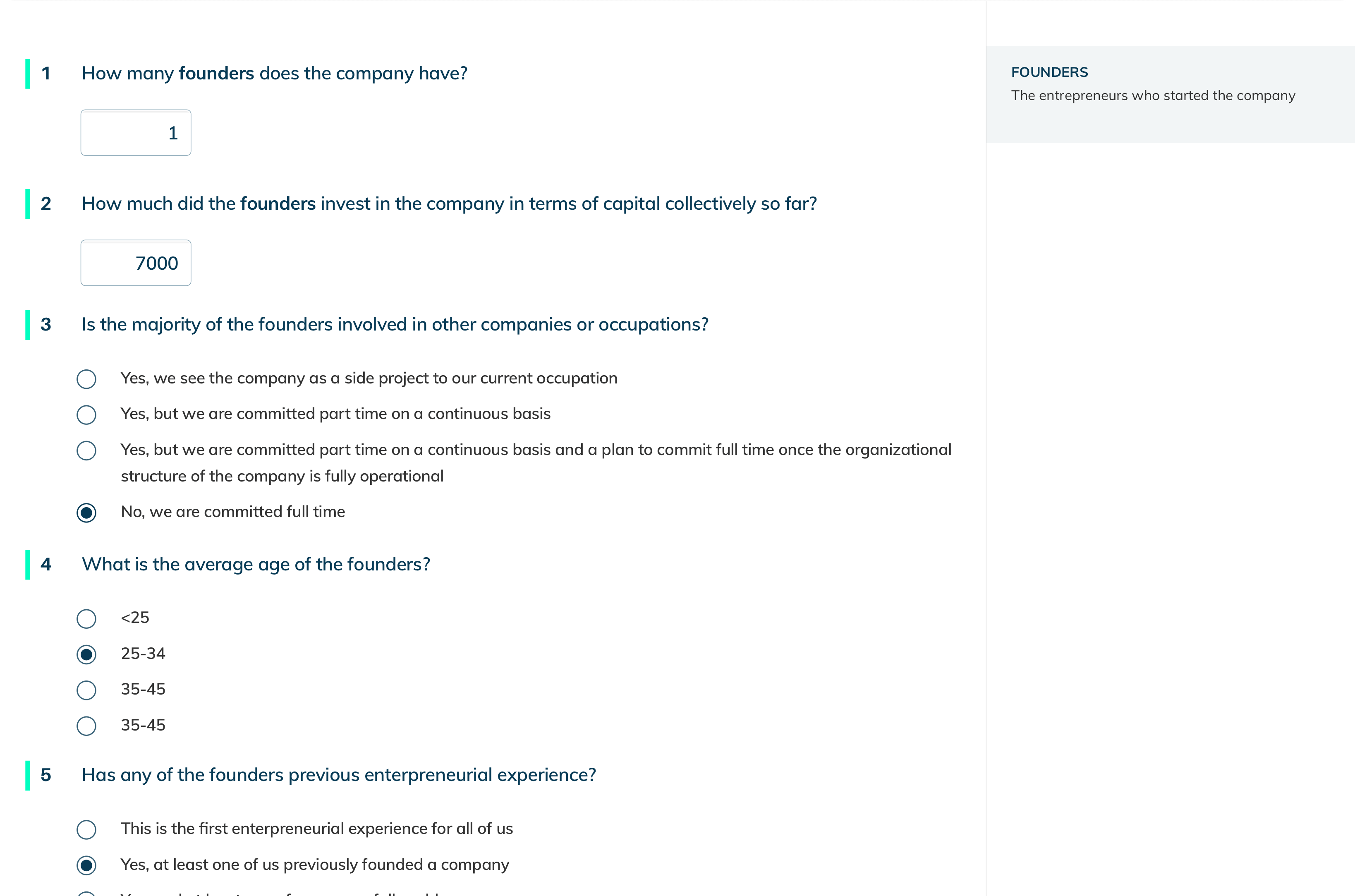

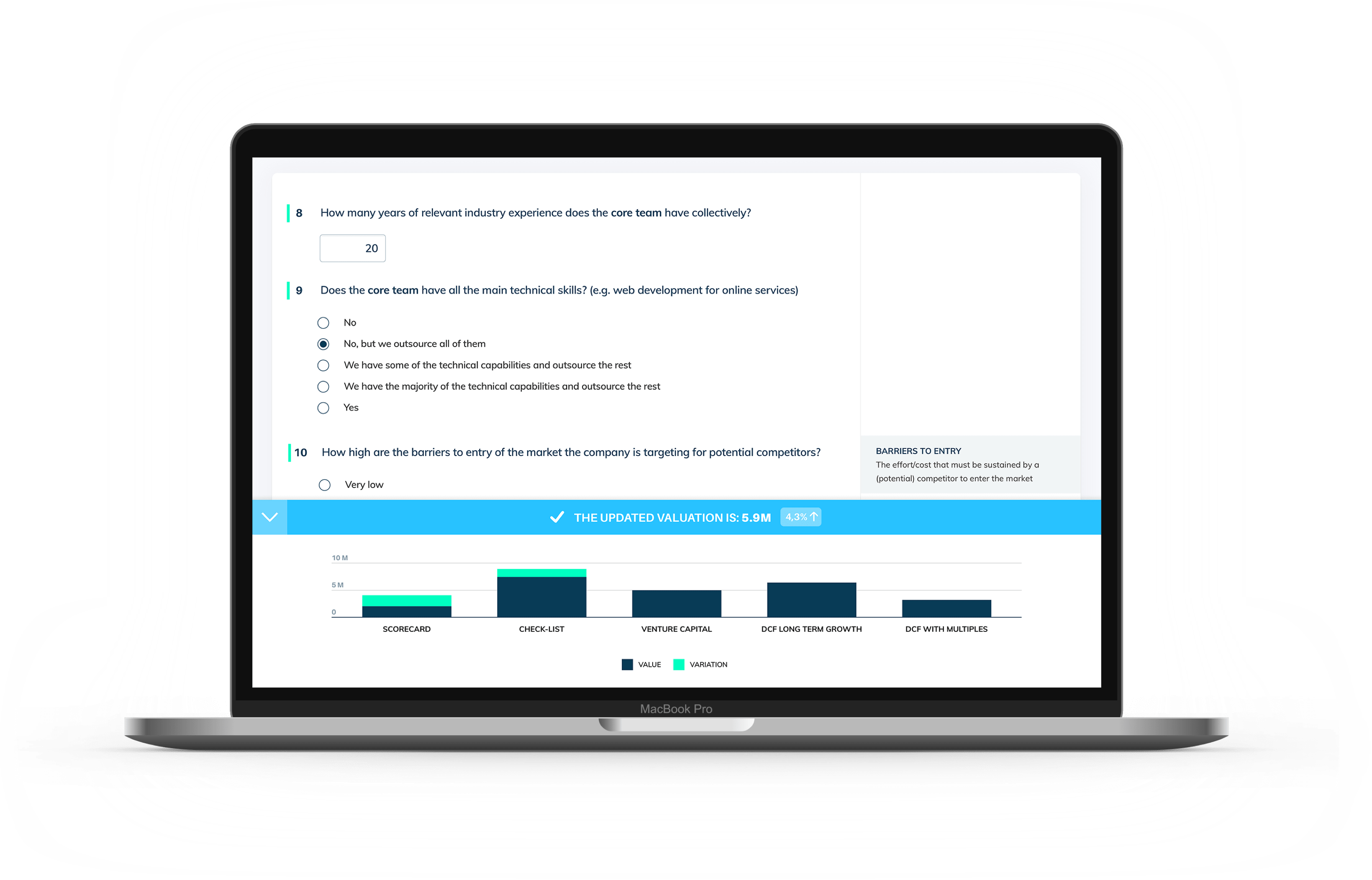

Questionnaire

Capture the qualitative aspects of your business

37 multiple choice questions completed in 5 mins to capture elements such as team experience, market competition, and barriers to entry

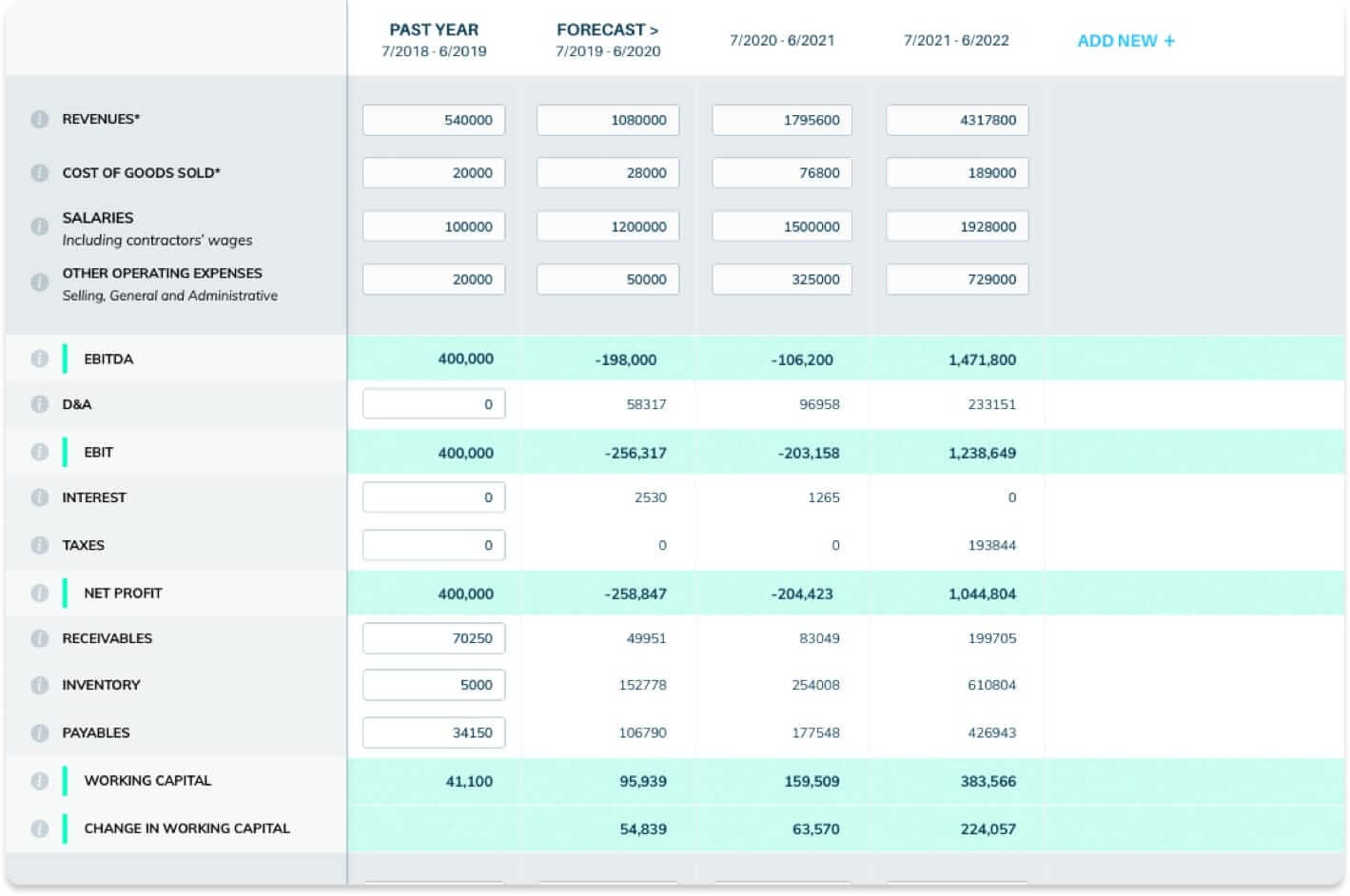

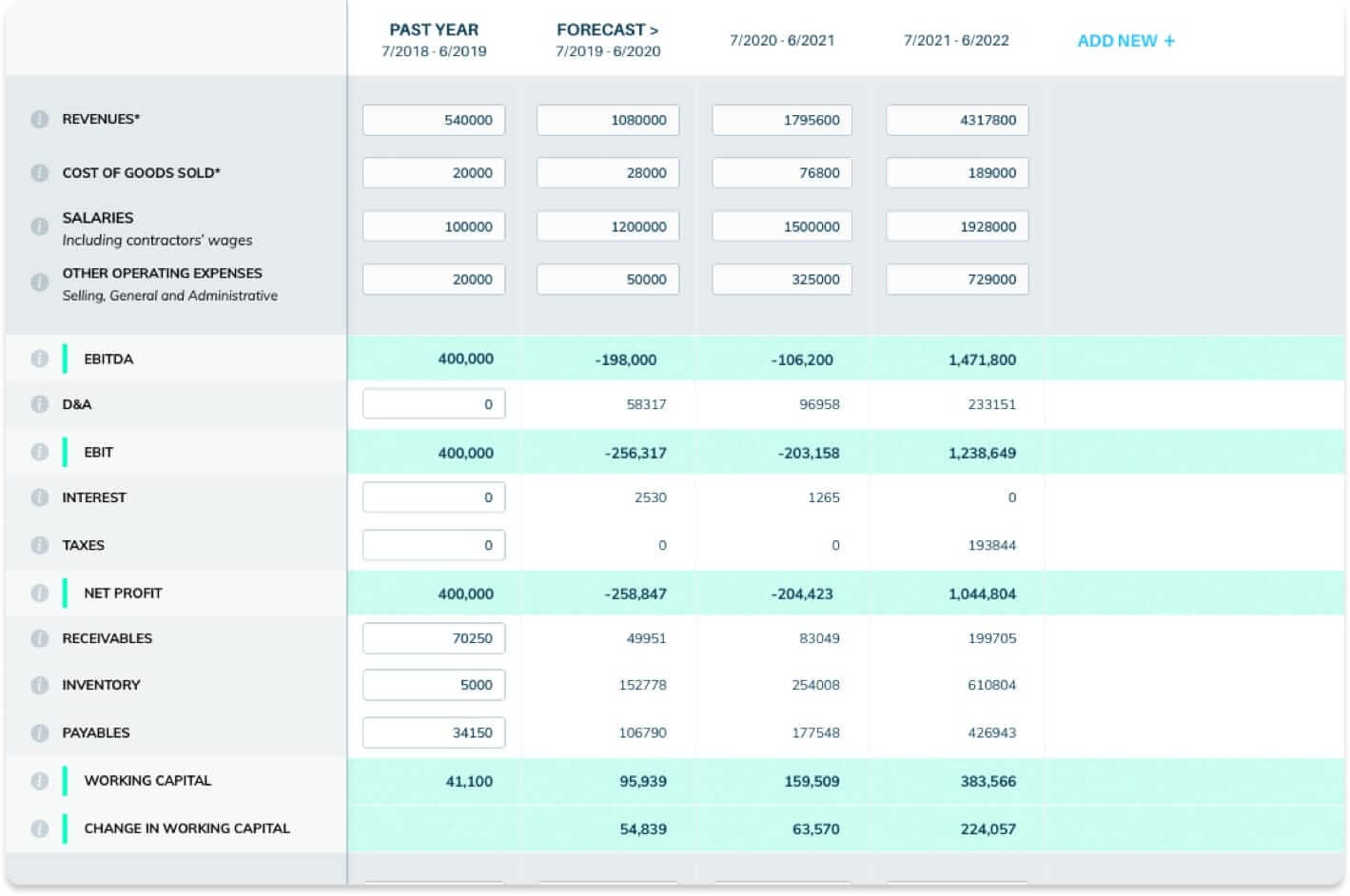

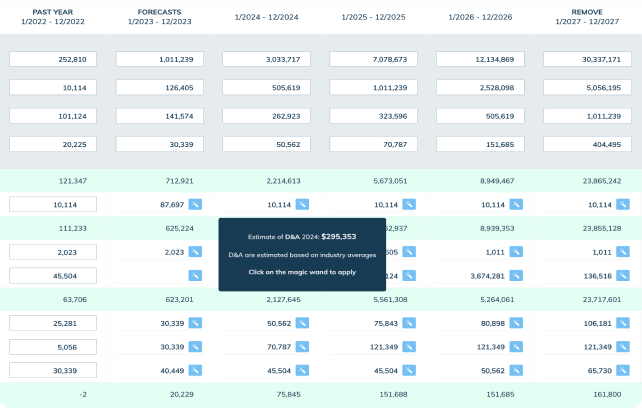

Financial Projections

Capture the value of future cash flows

Insert the financial projections for the next 3 years to capture the value of the future financial performance of your company

Financial Projections

Capture the value of future cash flows

Insert the financial projections for the next 3 years to capture the value of the future financial performance of your company

Valuation parameters

Reliable and tailored data sources

We provide the necessary parameters (e.g. multiples and discount rates) for the valuation of your company, curated from the most reliable providers

90

Countries

136

Industries

30000

Companies

Valuation parameters

Reliable and tailored data sources

We provide the necessary parameters (e.g. multiples and discount rates) for the valuation of your company, curated from the most reliable providers

136

Industries

90

Countries

30000

Companies

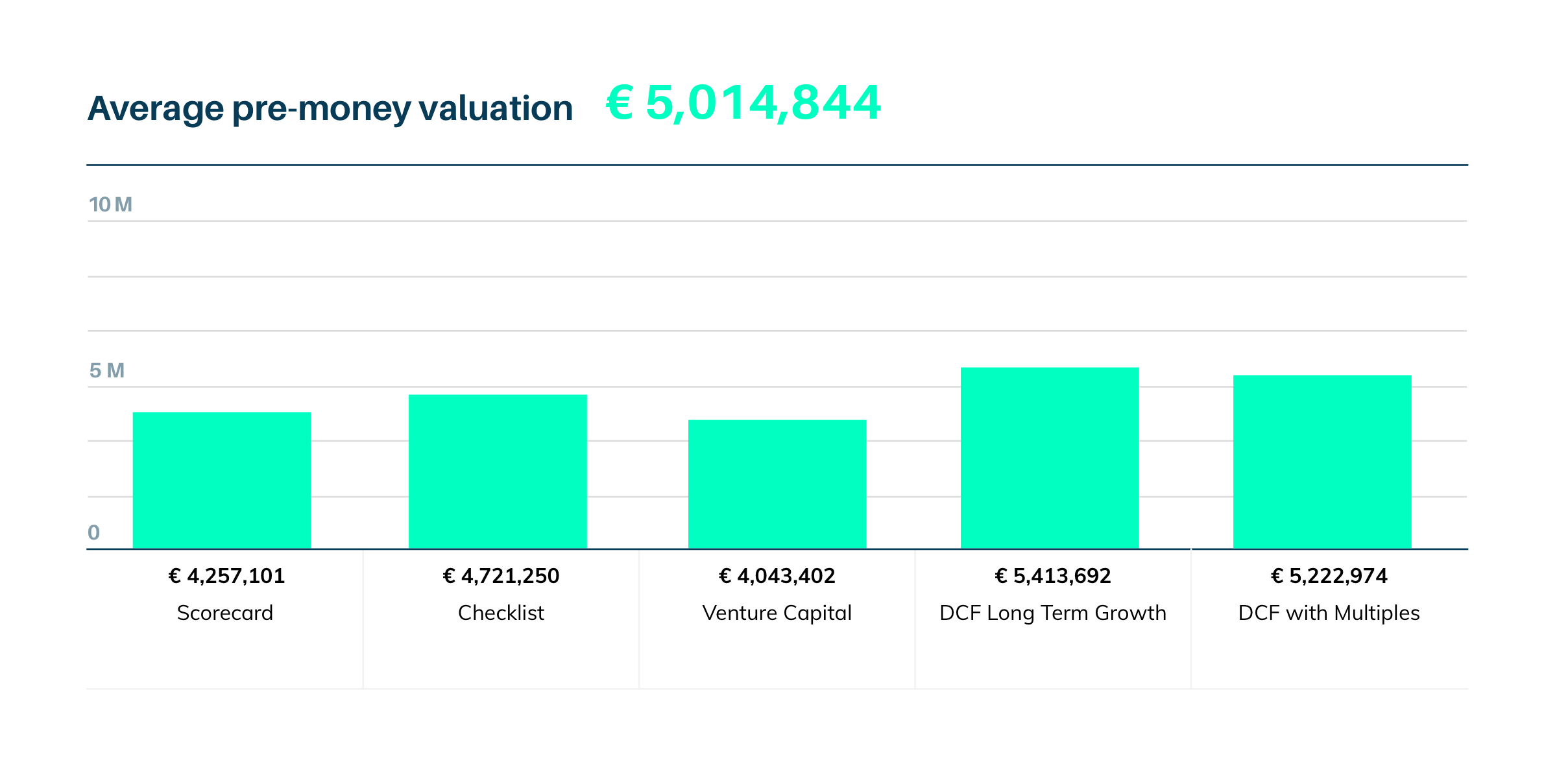

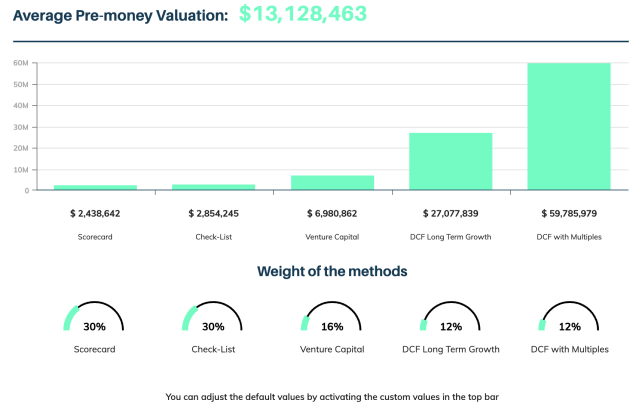

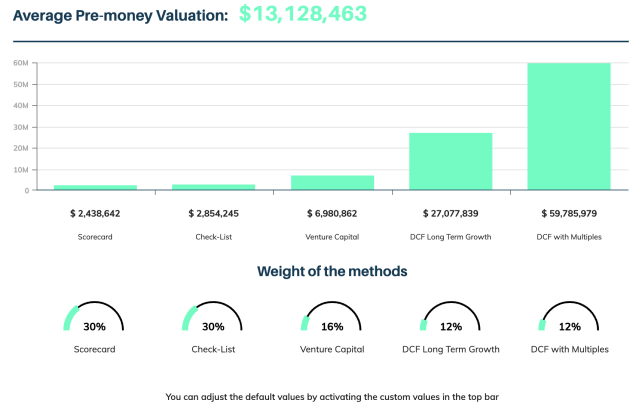

5 valuation methods in 1

Methods handpicked to value startups

Your inputs and our data are combined into 5 valuation methods to give you a comprehensive and reliable view of the valuation of your company

All you can do with Equidam

Everything you need to be confindent in your valuation.

Valuation Benchmarks

You can benchmark your valuation against similar companies. See how your projections and valuation compare with the market tailored to your industry, development stage, and country.

Explore our databases of benchmarks

Investigate comparable data on valuation, projections and other recent funding rounds.

Understand your fundraising market

Assess performance gaps compared to similar companies and determine the underlying factors.

Generate extended valuation reports

Add context to your valuation report with 5 additional pages of benchmarking.

30.000 Company Multiples

Access EBITDA multiples of 30.000+ listed companies updated on a weekly basis. Add your own comparables, select between Average and Median, and fully support your calculated valuation.

Identify Relevant Comparables

Include Revenue or EBITDA Multiples

Select Between Average or Median

Add Your Own Comparables

Identify Relevant Comparables

Include Revenue or EBITDA Multiples

Select Between Average or Median

Add Your Own Comparables

Total Valuation Control

Review and customize all the parameters behind your valuation.

Adjust the full range of valuation parameters, including discount rate, EBITDA multiple, survival rate, WACC, and more.

![]() Explore and modify Equidam’s 5 valuation methods.

Explore and modify Equidam’s 5 valuation methods.

![]() Adjusting the weights of the methods and fine-tune the outcome of the valuation.

Adjusting the weights of the methods and fine-tune the outcome of the valuation.

![]() All the flexibility required by valuation experts, but with incredibly powerful starting points

All the flexibility required by valuation experts, but with incredibly powerful starting points

Adjust the full range of valuation parameters, including discount rate, EBITDA multiple, survival rate, WACC, and more.

![]() Explore and modify Equidam’s 5 valuation methods.

Explore and modify Equidam’s 5 valuation methods.

![]() Adjusting the weights of the methods will change the outcome of the valuation.

Adjusting the weights of the methods will change the outcome of the valuation.

![]() These settings are intended for experts on the matter, our default values should be good enough for you.

These settings are intended for experts on the matter, our default values should be good enough for you.

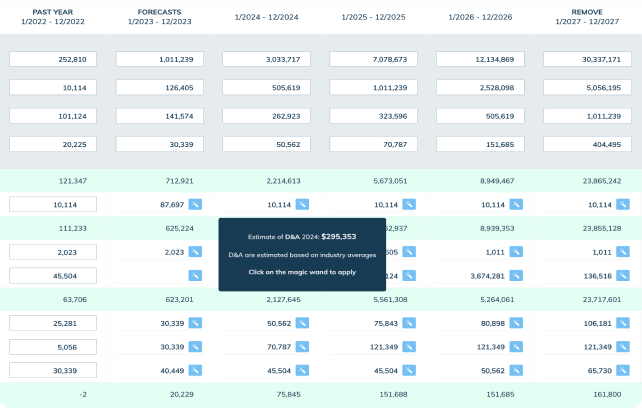

Financial Projections Made Easy

Efficiently streamline your forecasts with our intuitive tools. Save time and enhance the accuracy of your numbers.

Assisted Financial Projections

For the most technical items to forecast, we provide defaults based on the average performance of companies in the same industry.

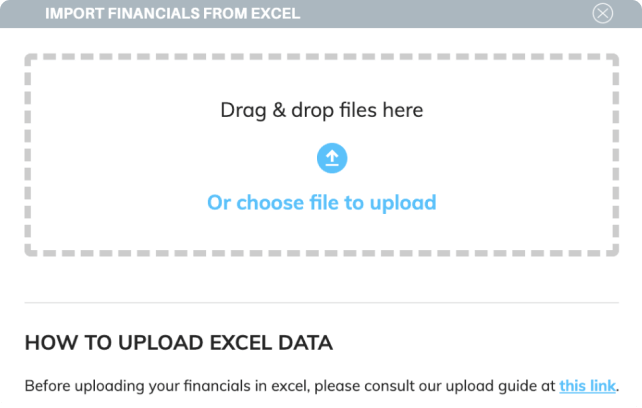

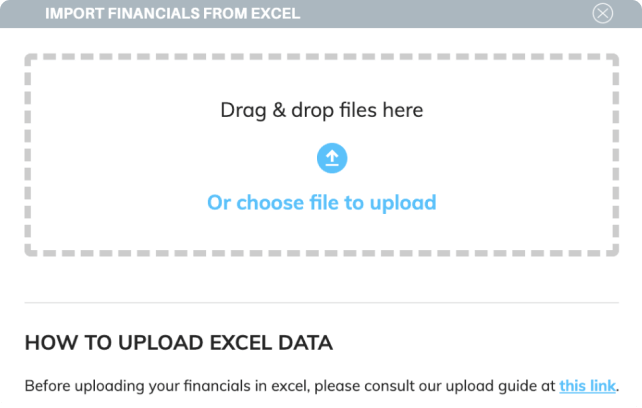

Excel Upload

Build your financial model in Excel and upload it directly to Equidam. We provide formatting tips and a template file to make this even easier.

Financials Forecasting

Efficiently streamline your forecasting with our intuitive tools—save time and enhance accuracy in your numbers.

Assisted Financial Projections

For the most technical items to forecast, we provide defaults based on the average performance of companies in the same industry.

Excel Upload

Build your financial model in Excel and upload it directly to Equidam. We provide formatting tips and a template file to make this even easier.

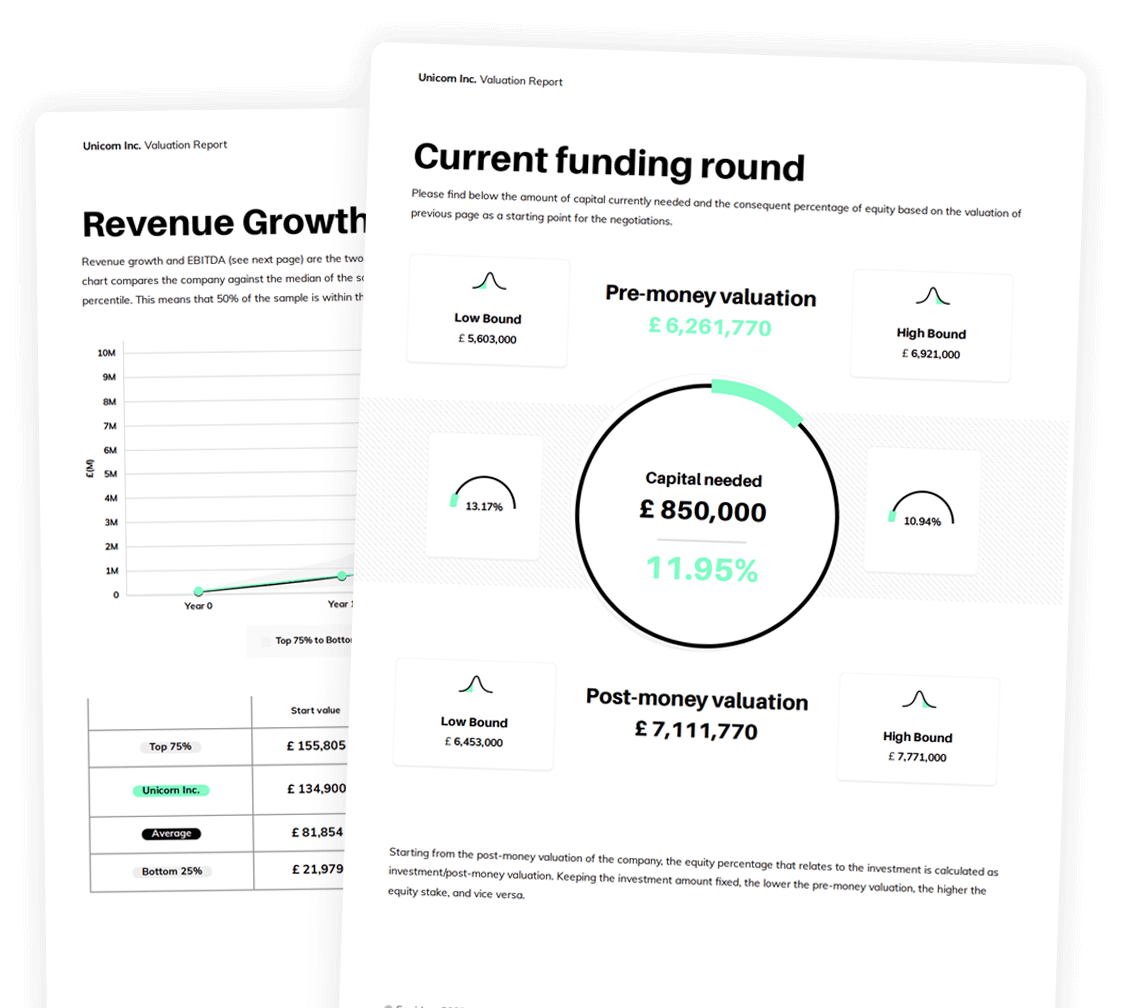

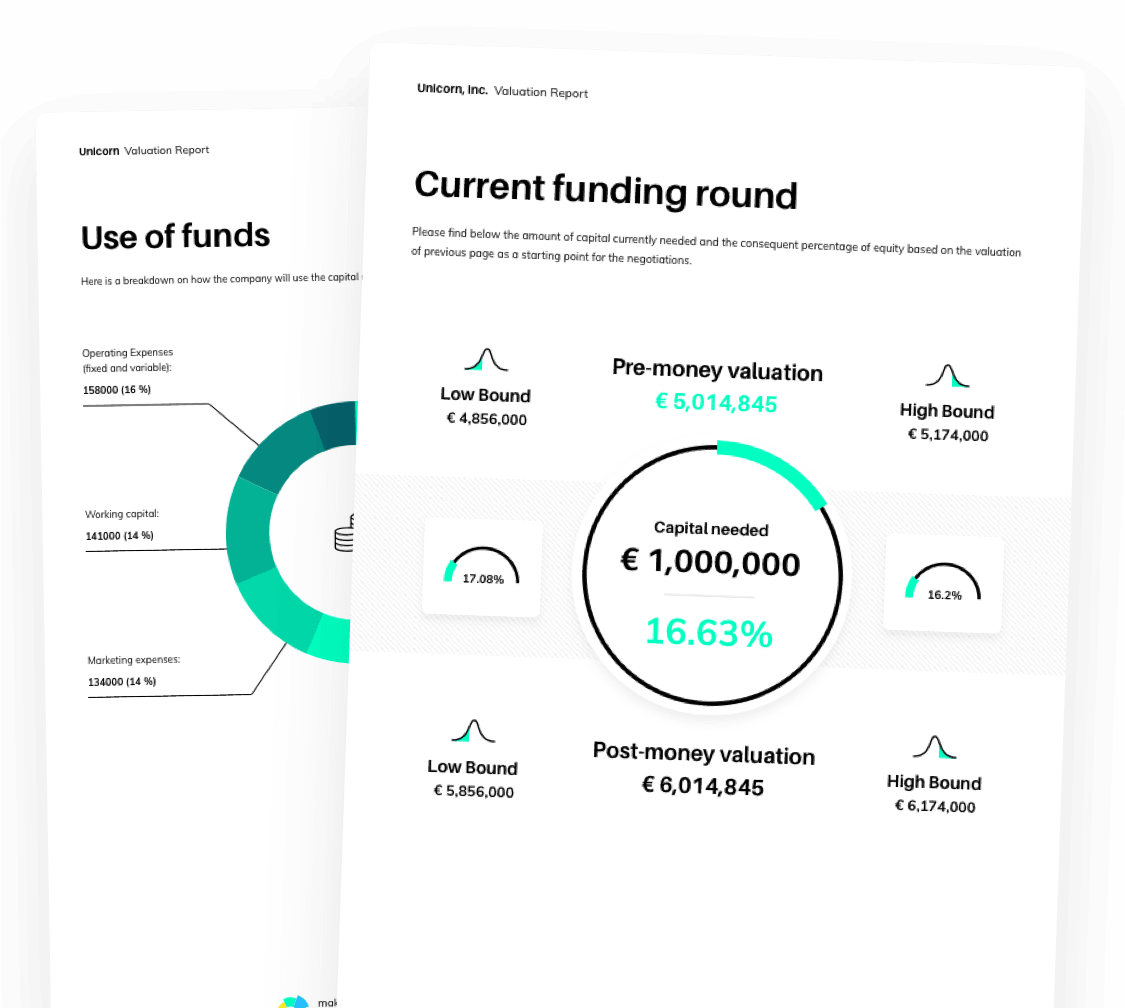

Professional, clear and detailed valuation reports

21 pages to start transparent and fruitful negotiations. Download them in 1 click as soon as the valuation on your Equidam account is complete.

Professional, clear and detailed valuation reports

21 pages to start transparent and fruitful negotiations. Download them in 1 click as soon as the valuation on your Equidam account is complete.

Get to know what influences your value

Equidam is the only valuation platform that lets you see in real time how your inputs directly affect the valuation. This allows you to familiarise yourself with the drivers of valuation and be confident in discussing it.

Suitable for:

Fundraising

Selling the company

Intra-partners agreements

Not suitable for:

Liquidating the company

Additional features

Equidam is built in a way to allow seamless usage across all levels of financial knowledge and company stage

Cherry-pick methods

If needed, you can decide to use a subset of the 5 available methods. This is useful in case of more established companies or special situations.

Unlimited valuation reports

You can adjust the information on the platform and, consequently, the valuation and reports as many times as needed.

Make it worth it

A seamless experience for computing valuation allows you not only to understand its drivers and negotiate transactions, but also to truly grasp its impact on strategic and operational decisions and monitor its growth over time