Powered by our exclusive partnership with EtonVS

We've partnered with EtonVS, one of the most respected firms in the industry, to deliver high-quality 409A valuations that stand up to IRS scrutiny.

EtonVS brings:

15+ years of expertise

5.000+ valuations across all industries

Audit defence and acceptance by major accounting firms

Powered by our exclusive partnership with EtonVS

We've partnered with EtonVS, one of the most respected firms in the industry, to deliver high-quality 409A valuations that stand up to IRS scrutiny.

EtonVS brings:

15+ years of expertise

5.000+ valuations across all industries

Audit defence and acceptance by major accounting firms

Key benefits of our valuation service

Trusted reports. Transparent pricing. Streamlined process.

Everything you need to stay compliant, defend your valuation, and support your equity strategy—without surprises.

Independent & Reliable Valuations

Independent & Reliable Valuations

Our 409A reports are prepared by certified valuation professionals with extensive expertise in IRS compliance requirements for US companies.

Competitive Pricing

Competitive Pricing

Get a fully compliant 409A valuation at a startup-friendly price. No hidden fees, just clear, affordable pricing designed for U.S. companies.

Full Audit Defense

Full Audit Defense

Every 409A valuation includes complete audit defense support at no additional cost – complete support to keep you protected and confident.

Fast Delivery Time

Fast Delivery Time

Receive your comprehensive valuation report within 7-10 business days, with direct contact with advisor to discuss the different drafts until you get the perfect report.

Why you need a 409A valuation

Section 409A of the Internal Revenue Code requires companies to issue stock options at or above fair market value to avoid tax penalties. A 409A valuation provides a defensible fair market value for your company's common stock.

Without a compliant valuation, both your company and your employees could face severe tax consequences, including immediate taxation, a 20% federal penalty tax, and additional interest charges.

The 409A valuation process

Our streamlined valuation process is designed to be efficient and hassle-free, delivering a high-quality, defensible valuation with minimal time investment from your team.

Initial Consultation

Brief kickoff call to understand your company

Document Collection

Submit financial statements and cap table

Valuation Analysis

EtonVS experts perform comprehensive analysis

Draft Review

Review and discuss preliminary findings

Final Delivery

Receive your complete 409A valuation report

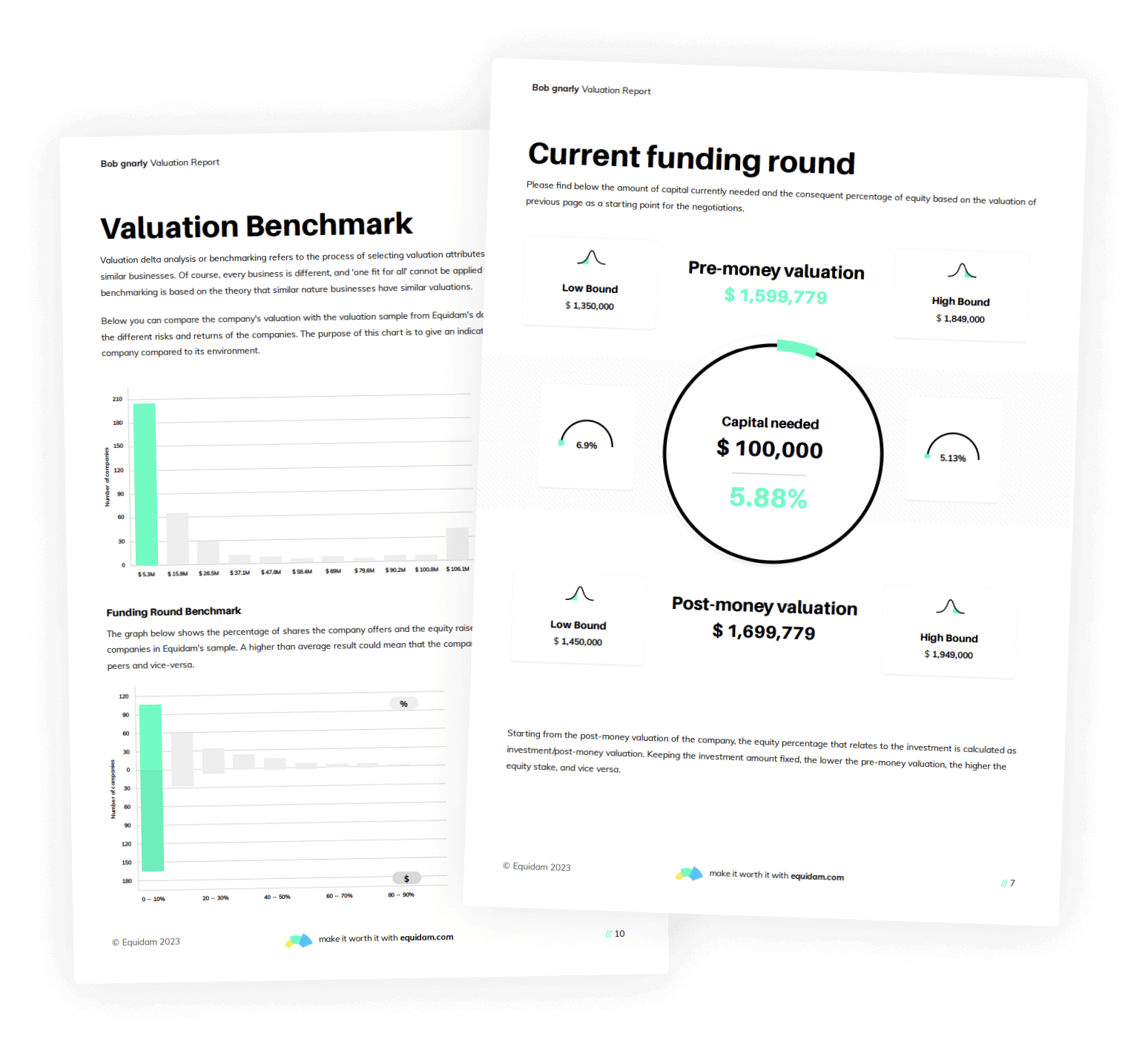

What's included in your report

Our comprehensive valuation package includes everything you need to demonstrate compliance and make informed decisions about equity compensation.

The Valuation Report

– In-depth fair market value analysis with defensible share price.

– Customized industry benchmarks and relevant market comparables.

– Strategic financial analysis with growth trajectory projections.

– Transparent methodology documentation that satisfies regulatory requirements.

Get your 409A valuation

Comprehensive 409A Valuation

$1,990

Complete 409A valuation report for US companies with comprehensive analysis

Detailed fair market value report

7 to 10-day turnaround time

Full audit defence support

Complex cap table analysis

Pre-valuation consultation

One year of follow-up support

Comprehensive 409A Valuation

$1,990

Complete 409A valuation report for US companies with comprehensive analysis

Detailed fair market value report

7 to 10-day turnaround time

Full audit defence support

Complex cap table analysis

Pre-valuation consultation

One year of follow-up support

Frequently asked questions

Everything you need to know about our 409A valuation service.

A 409A valuation determines the fair market value (FMV) of your company’s common stock. It’s required by the IRS for setting strike prices on stock options, ensuring that they are not subject to additional taxes. If you’re granting equity (especially options) to employees, investors, or advisors, a compliant 409A valuation is essential to avoid legal and tax risks.

Typically, the process takes 7-10 business days from submission of all required documentation to the delivery of your final report. Rush options are available for time-sensitive situations.

You should update your 409A valuation:

– At least every 12 months, or

– Whenever a material event occurs, such as a new funding round, major financial milestone, or market shift.

This ensures continued IRS compliance and accurate equity pricing.

Our 409A valuations are conducted through a partnership with EtonVS, a US-based valuation company that provides us expert analysts with extensive experience in startup and private company valuations. They follow industry-standard methods and IRS-safe harbor rules, ensuring that your valuation is robust, defendable, and ready for audit or board review.

Yes. The valuation complies with IRS Section 409A regulations and adheres to safe harbor methodologies. It includes complete supporting documentation and is built to stand up to scrutiny from auditors, investors, and legal teams alike.

If you’re shopping around, we recommend exploring our site a bit — you’ll find information about why to choose us, our valuation report, data sources, methodology, and more. Plus, our Help Center has lots of helpful information.

If you need to get in touch with our team, you can always do so via the chat on the bottom right corner.

GET STARTED NOW

Simplify your 409A valuations

Join 140.000 startups who trust Equidam for compliant, reliable valuations.