Valuation for high growth startups

Equidam's methodology and data serve the specific valuation challenges of early-stage high growth potential companies. Valuation is made accessible and practical for founders.

Valuation is a tool in your fundraising strategy.

Help potential investors understand the numbers that go alongside your pitch, reflecting your ambition and the implied valuation.

Valuation for high growth startups

Equidam's methodology and data serve the specific valuation challenges of early-stage high growth potential companies. Valuation is made accessible and practical for founders.

Valuation is a tool in your fundraising strategy.

Help potential investors understand the numbers that go alongside your pitch, reflecting your ambition and the implied valuation.

Setting the standardfor startup valuation

Valuation methods for early stage companies

Our approach is designed for the unique challenges of valuation for early stage companies, referencing public and private market data, research-backed risk factors, and 5 different perspectives on value.

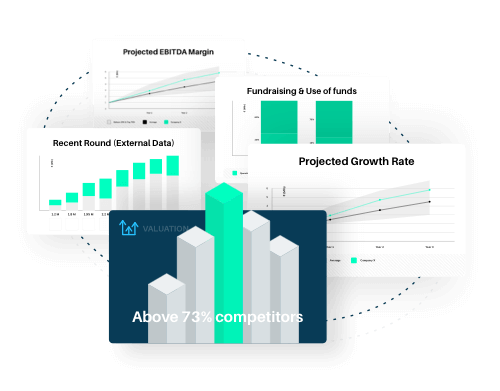

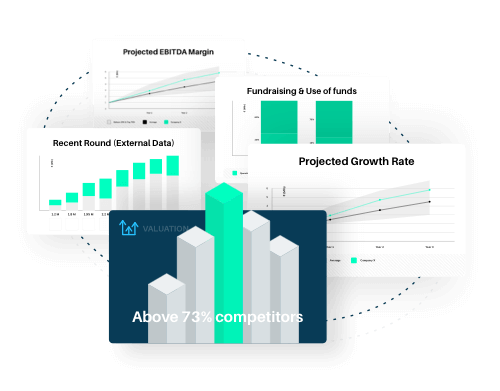

Clear and detailed valuation reports

Our valuation reports provide a comprehensive and transparent overview of the company, key qualitative factors, financial performance, current shareholders, past rounds, and funding targets.

Up-to-date benchmarks and market data

Finding updated parameters, relevant comparable companies, average peer performance and funding market information is a huge hurdle, which Equidam automates for you.

50,000

Valuation Reports Generated

140,000

Startups Valued

2,000

Investors use Equidam

25

Accelerator Partners

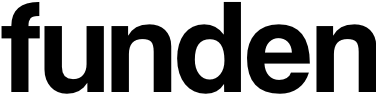

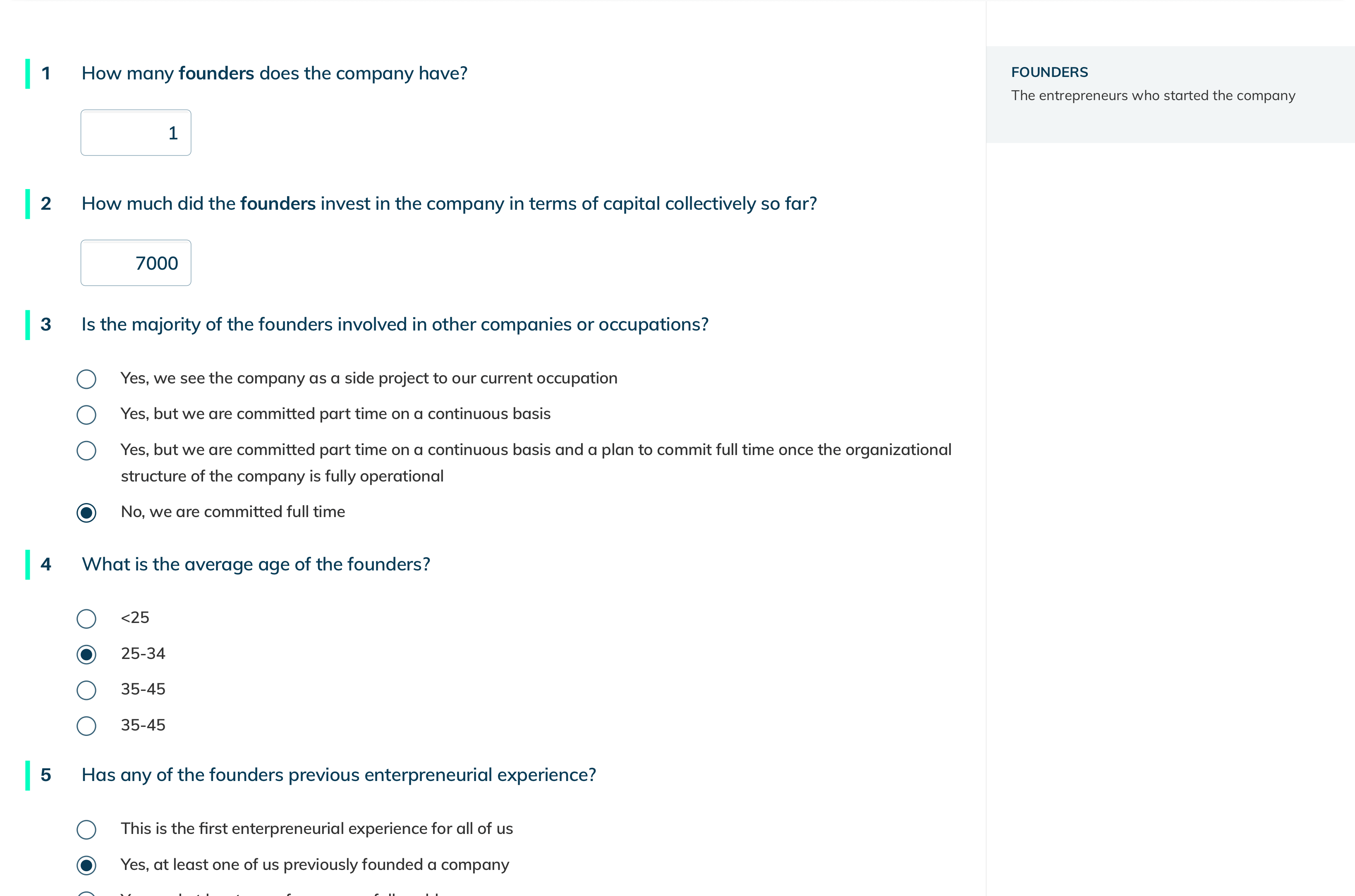

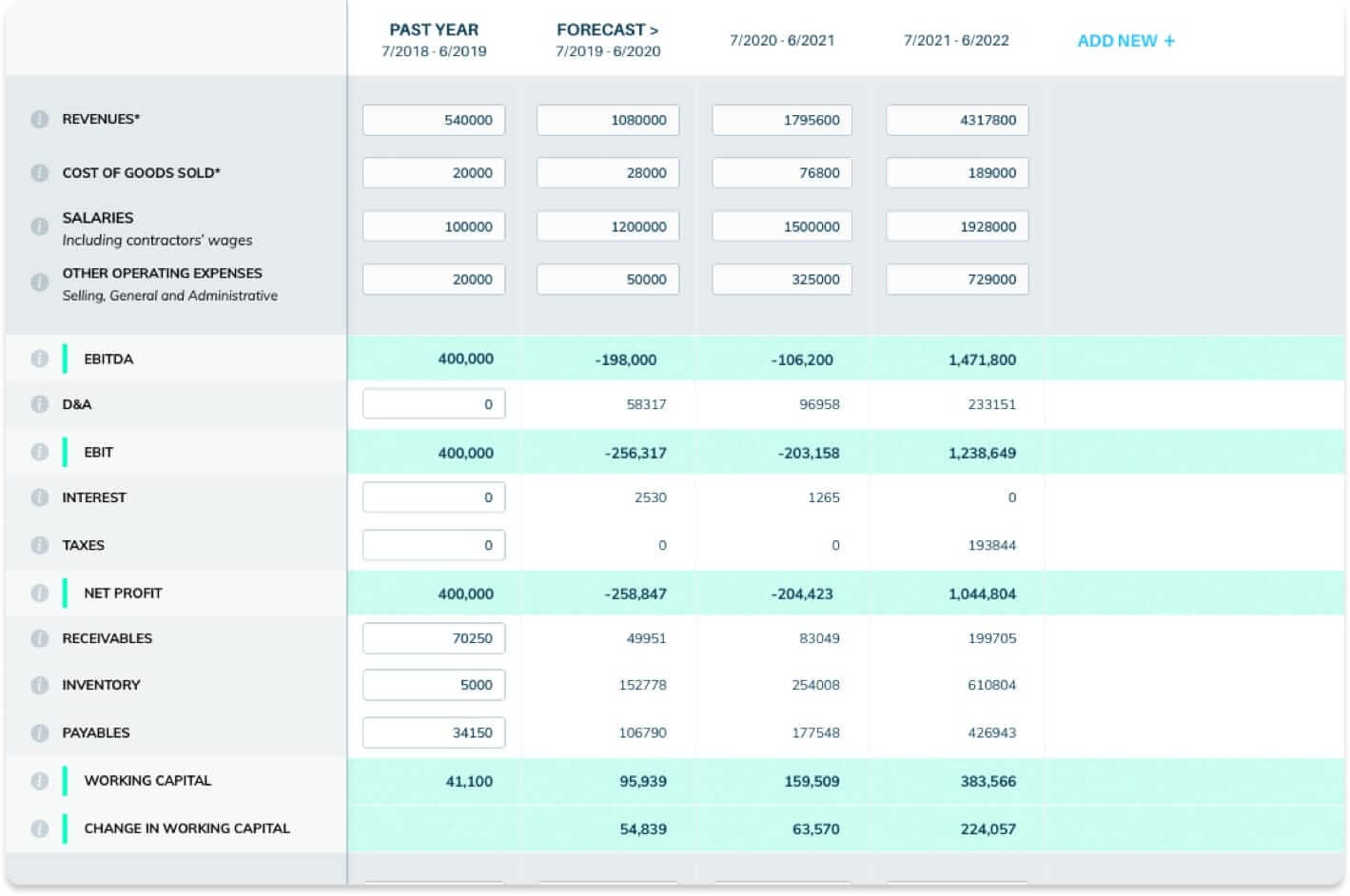

Qualitative methods capture intangibles

Early stage & pre-revenue companies cannot be valued on financials alone. Our proprietary combination of financial and qualitative methods is perfect for valuing companies from idea to IPO.

Built for early stage

Qualitative methods tackle early-stage uncertainty by analysing verifiable characteristics of the team, market, and business model

Private market data

Private market data from Crunchbase™ provide benchmark valuations, tailored to stage and region and editable if needed.

Backed by research

Research-backed risk factors relating to startup success shape the underlying calculation of these methods.

Qualitative methods capture intangibles

Early stage & pre-revenue companies cannot be valued on financials alone. Our proprietary combination of financial and qualitative methods is perfect for valuing companies from idea to IPO.

Built for early stage

Qualitative methods tackle early-stage uncertainty by analysing verifiable characteristics of the team, market, and business model

Private market data

Private market data from Crunchbase™ provide benchmark valuations, tailored to stage and region and editable if needed.

Backed by research

Research-backed risk factors relating to startup success shape the underlying calculation of these methods.

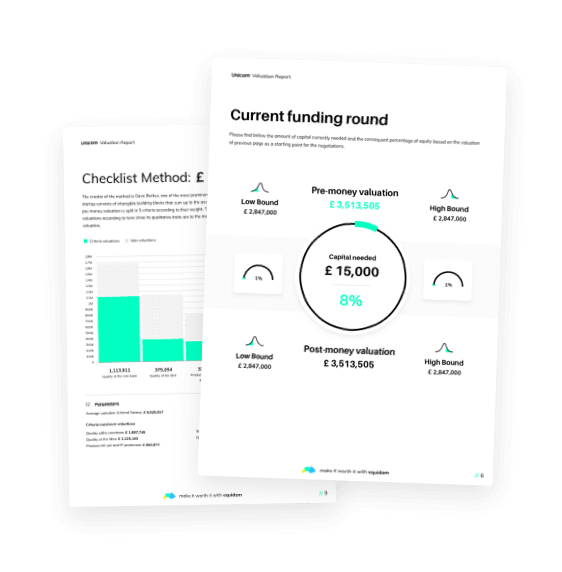

Transparent financial calculations

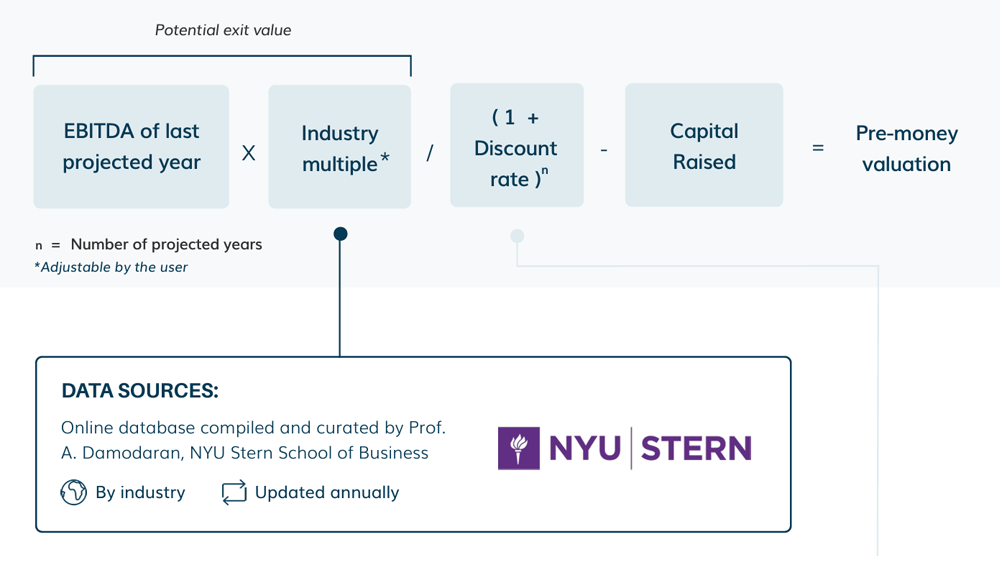

While financial projections are uncertain for early stage companies, they provide a valuable window into the economics of a startup, and the future revenue-generating potential. Our quantiative methods add this perspective to the valuation.

Quantitative valuation methods like discounted cash flow models (DCFs) are a staple of private market valuation, but are notoriously difficult to apply to startups. We address this by automating the process of collecting the range of parameters involved (discount rates, multiples, growth rates), and guiding founders to develop financial projections that are a coherent reflection of their future vision.

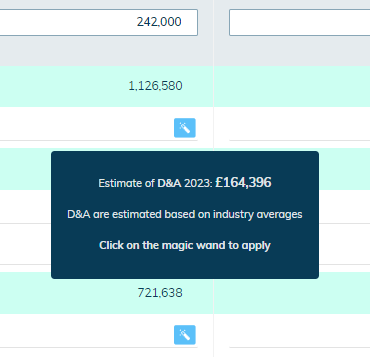

As a part of completing a valuation on Equidam, you will be asked to fill out a simple financial projections template — covering a minimum of three years. In addition to calculating many of the fields automatically, Equidam can also suggest inputs for depreciation and amortization, interest, taxes, receivables, payables and inventory based on research on industry averages. Our goal is to get you to a solid and reasonable forecast as quickly as possible.

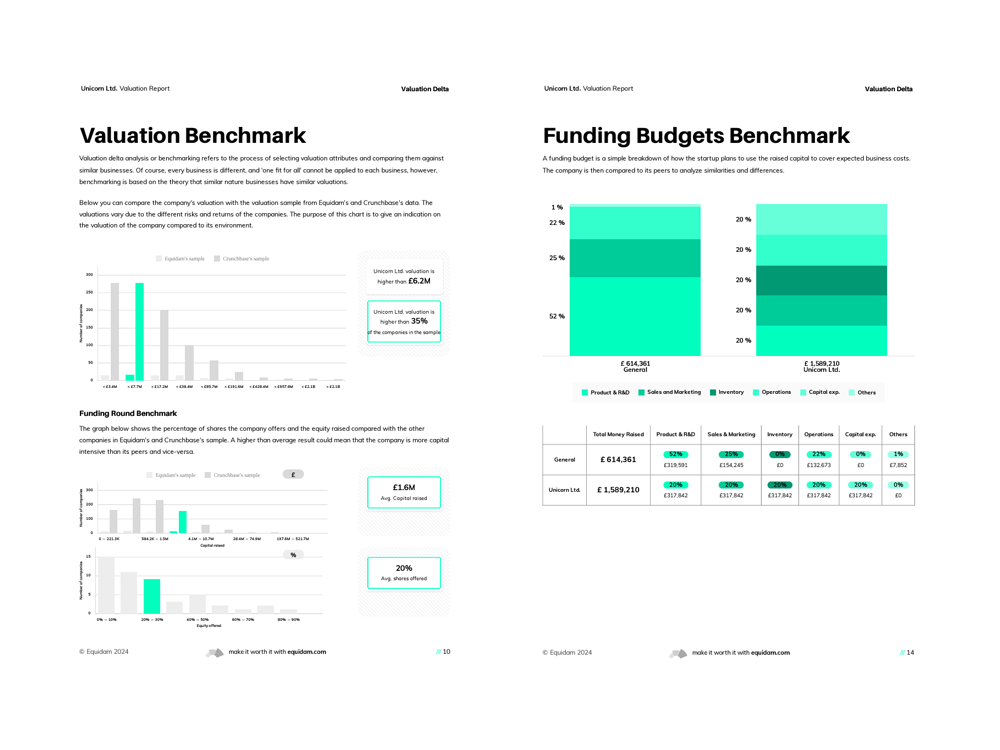

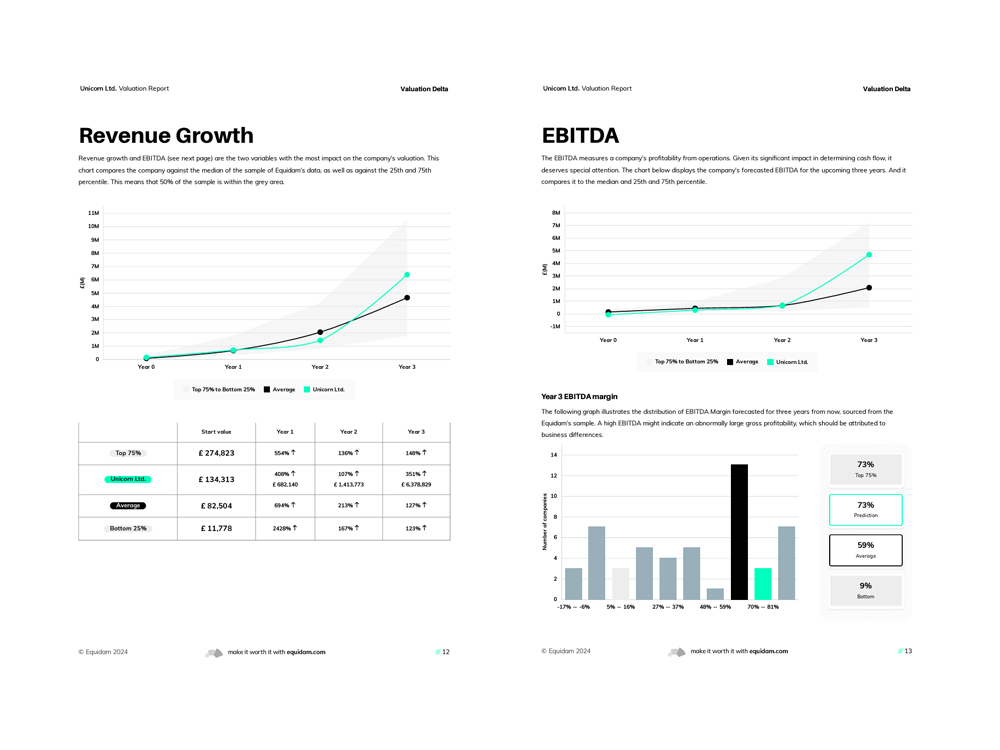

Industry leading benchmarks, for context and confidence

Test your assumptions against historical valuation data and the projected financial performance of companies in your peer-group. Demonstrate to investors how your startup compares against the market, and why.

Explore valuations, funding and characteristics of similar companies

Compare projected revenue and EBITDA against peers

Fundraising FAQs

Equidam applies broadly to any high-growth potential business. The valuation applies to companies headquartered in these 90 countries. Our methods are applicable to any industry however valuation of real estate, pharma, and banking services can sometimes be challenging. If your company operates in these industries, feel free to reach out to us for further confirmation.

Through our guided procedure, we will ask you common questions about your company as well as your financial information for the past year and the future 3 years. If you are closely involved with the company, you should be able to answer our questions without any additional information retrieval. For the financials, it is generally better to start using Equidam once you have your financial projections ready. This will ensure you’ll use your access days effectively.

Yes, indeed! Throughout the access period, you will be able to change and update your company valuation as many times as you need to. Once your access days are over, you’ll be able to download reports generated in the past, but you won’t be able to make changes to your valuation and download new reports. If you wish to do so, you’ll have to purchase additional access days.

If you’re shopping around, we recommend exploring our site a bit — you’ll find information about why to choose us, our valuation report, data sources, methodology, and more. Plus, our Help Center has lots of helpful information.

If you need to get in touch with our team, you can always do so via the chat on the bottom right corner.