Navigate Secondary Transactions with Confidence

Join 19,500+ founders who've managed co-founder exits and shareholder transfers with transparent, data-driven valuations

Objective Valuation

Remove emotion from the equation. Our methodology provides an impartial assessment that all parties can trust, ensuring fair outcomes for departing founders and shareholders.

Real-Time Market Data

Access benchmarks from 140,000 startups to ensure your secondary pricing reflects current market conditions. Compare your transaction to similar deals in your industry.

Scenario Modeling

Test different share prices, volumes, and terms to find the sweet spot for all stakeholders. Model multiple scenarios side-by-side to facilitate negotiations.

When Stakes Get Personal

Secondary transactions aren't just numbers—they're about people, relationships, and futures. Whether it's a co-founder moving on, early employees cashing out, or investors restructuring, these moments demand precision and fairness.

Co-founder Exits

Departing founders need fair compensation

Employee Stock Sales

Team members seeking partial liquidity

Investor Transfers

VCs restructuring portfolios or funds

Growth Capital Events

Existing shareholders making room for new investors

How It Works

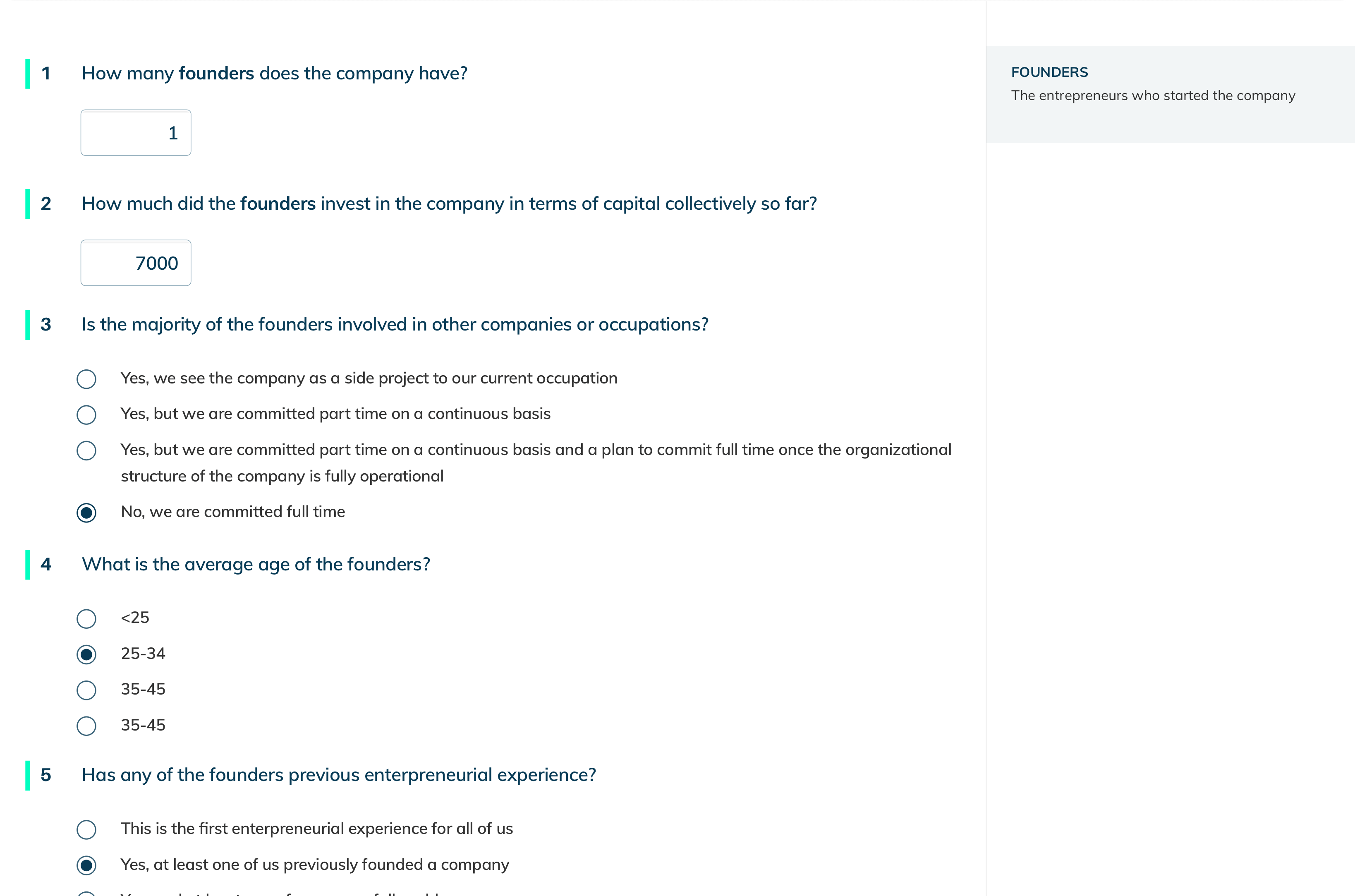

2

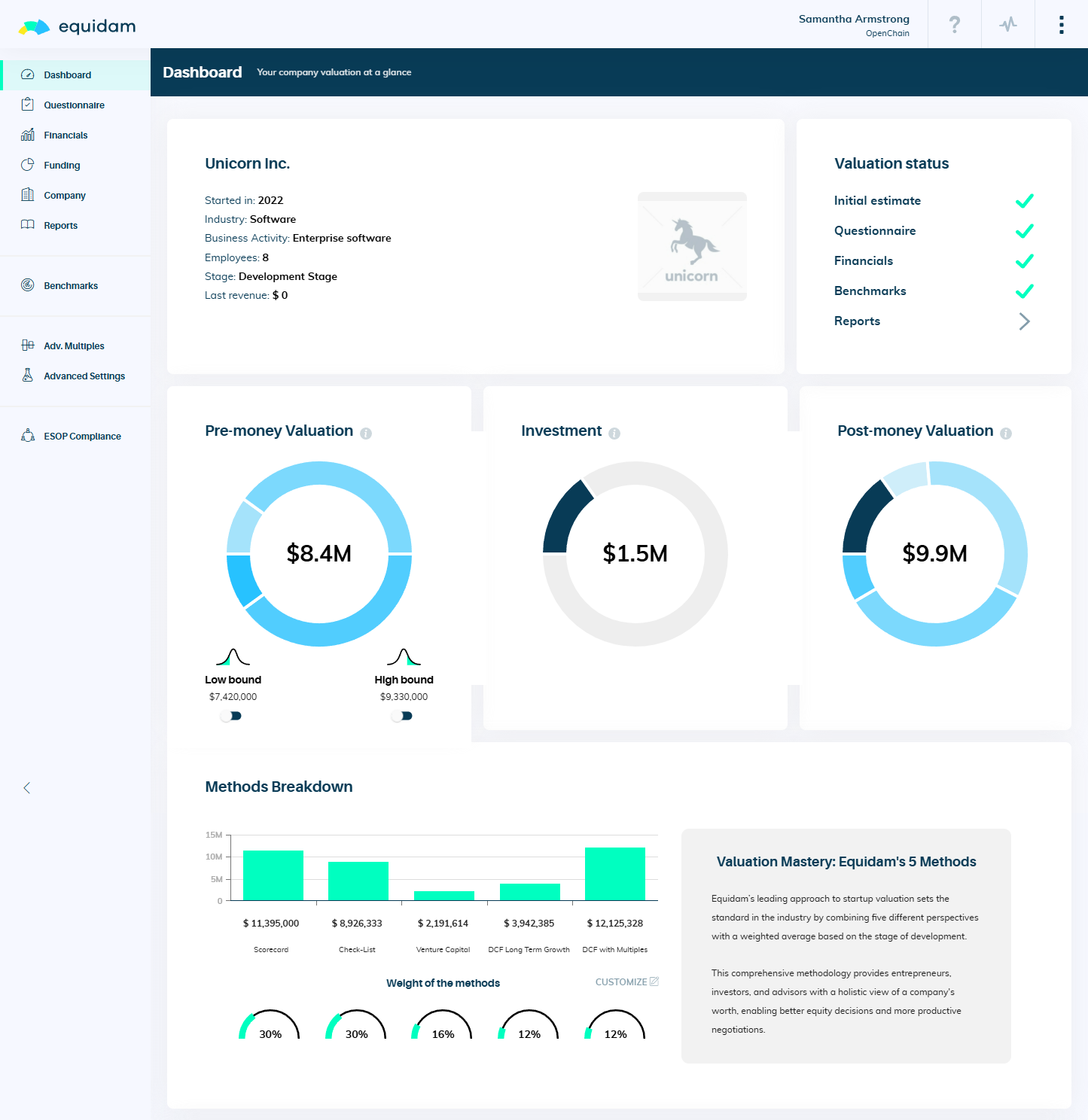

Generate Base Valuation

Complete questionnaire, upload financials, get 5-method valuation

3

Model Scenarios

Test different prices and terms to find optimal structure

4

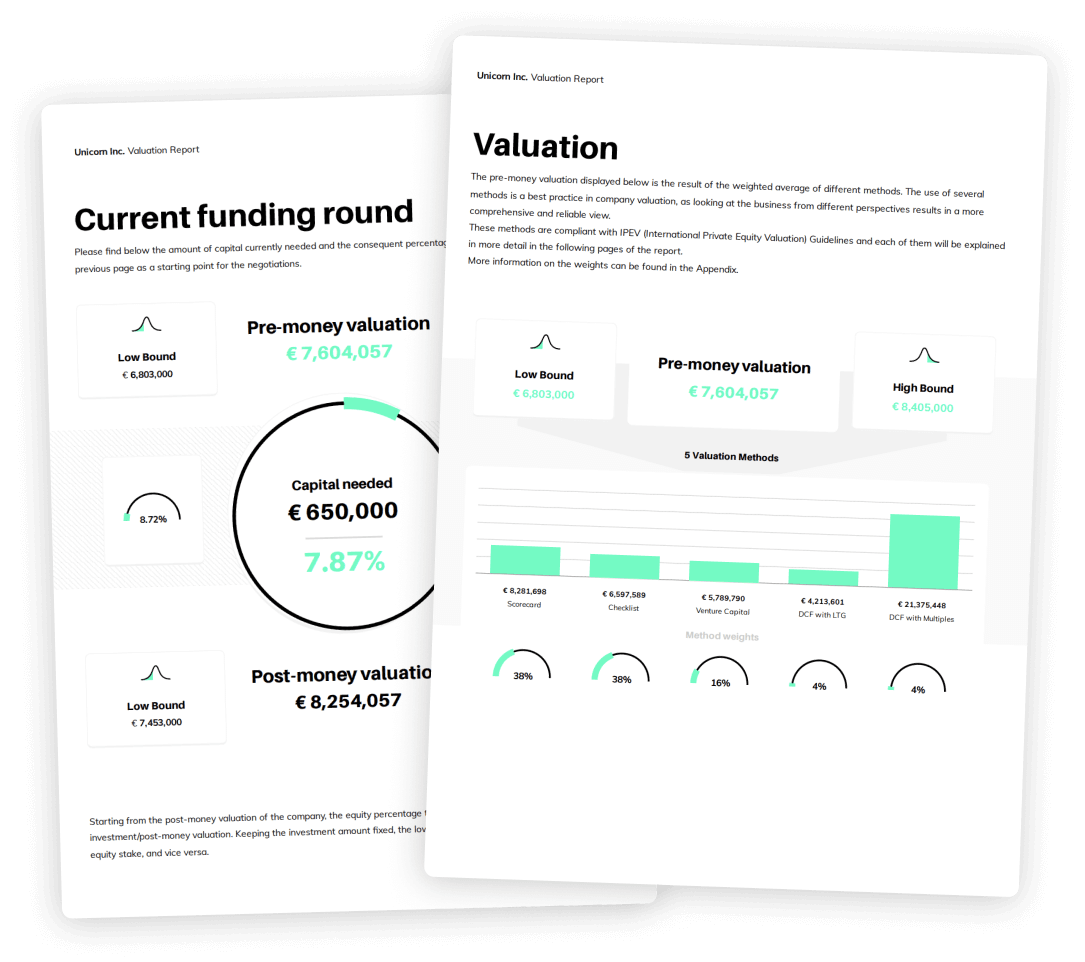

Create Documentation

Professional report for all parties with tax filing support

19,500

Secondary Transactions

250m+

Annual Secondary Volume

Secondary Valuations in Practice

Challenge

The number 1 reason for startup failures are co-founder disputes. When the stakes and the emotions are high, it is very tough to agree on any term.

Solution

An objective, cost-effective valuation that each party can get to independently in order to stir the negotiation towards assumptions and fairness.

Result

Founders relationships are less strained, negotiations are faster and smoother, the team can go back and focus on growing the company. The relationships are less in jeopardy than they would otherwise be.

Challenge

Growing tech companies often need to provide liquidity options for early employees while maintaining control and avoiding dilution

Solution

Structure employee share program with transparent, data-driven valuations that aligned interests between founders and team members, keep employees informed yearly and be able to provide liquidity in full transparency when the time comes.

Result

Employees are confident in the value of their equity compensation, startups and growth companies have predictable negotiations and cash flows.

Challenge

Founders often need to sell a small position to a strategic market partner but they generally lacked an independent, credible valuation to anchor negotiations, which larger, more traditional corporate require.

Solution

Founders can use Equidam to calculate a detailed secondary valuation range—highlighting the partner’s strategic value—so they can confidently ask for a fair price and support it with solid, third-party analysis.

Result

“I was using the valuation to negotiate the cost of a small stake on the part of a market partner. The potential market partner agreed with the range of valuation which was very helpful to me.”

Christopher Stanford, CEO Aparon Ltd

Transform Your Secondary Transaction Today

Whether you're handling a simple co-founder exit or a complex multi-party transaction, Equidam provides the tools and data you need at a fraction of traditional costs.

What you get:

Fair valuations through 5 proven methods

Real-time market benchmarks from 140,000 companies

Unlimited valuations and scenarios

Professional reports for all parties

Ready to Simplify Your Secondary Transaction?