Our exclusive french partnership with Futurz

We've partnered with Futurz, a specialized French firm with deep expertise in startup ecosystems and equity compensation regulations.

Premium EMI valuations backed by Standard Ledger

In collaboration with Standard Ledger, a top-tier UK accountancy firm for startups, we offer best-in-class EMI valuation support.

Key benefits of our french equity valuation service

Trusted reports. Transparent pricing. Streamlined process.

Everything you need to stay compliant, defend your valuation, and support your equity strategy—without surprises.

French Tax Authority Compliant

French Tax Authority Compliant

Our BSPCE valuations fully satisfy Direction Générale des Finances Publiques (DGFIP) requirements for share-option and free-share plans, giving you confidence in any tax inspection.

BSPCE & Stock Options Expertise

BSPCE & Stock Options Expertise

Combining Equidam’s data-driven valuation engine with FUTURZ’s hands-on knowledge of Bons de Souscription de Parts de Créateur d’Entreprise (BSPCE).

Social Security Optimization

Social Security Optimization

Valuations designed to minimize social security contributions while maintaining compliance with URSSAF requirements.

Rapid Turnaround

Rapid Turnaround

Receive your French equity valuation within 7-10 days, with expedited options available for urgent needs.

Valuation methods accepted by french tax authorities

French authorities accept the same core methodologies used globally, as long as they're well-documented.

Discounted Cash Flow

Projects future cash flows and discounts to present value.

Best for: Established startups with predictable revenue streams

Market Comparables

Uses multiples (EV/Revenue, EV/EBITDA) from public peers or recent transactions.

Best for: Companies with clear industry comparables (Market Approach)

Last Financing Round

If arm’s-length and recent (< 6 months), share price can directly set FMV.

Best for: Recently funded companies with external investors

Key Considerations:

Adjust for preferences and liquidity discounts where applicable

Document all assumptions and methodologies clearly

Ensure compliance with French tax authority expectations

Consider using multiple methods for validation

Legal requirements for BSPCE valuation

French tax authorities insist that the strike price reflect the fair market value (FMV) of ordinary shares at grant.

FMV Requirements

Must come from recent arm’s-length financing

(≤ 6 months old)

Or objective valuation (DCF, comparables)

Discounts must be documented with

professional rationale

Documentation Standards

No pre-approval exists (unlike UK EMI safe-harbour)

Maintain audit-ready documentation

Include board minutes and term sheets

Professional valuation report required

Important Note:

Unlike the UK's EMI safe-harbour, no pre-approval exists in France. Keep full audit-ready documentation including board minutes, term sheets, and valuation reports.

Why french equity valuations matter

In France’s competitive startup landscape, offering equity through BSPCE (Bons de Souscription de Parts de Créateur d’Entreprise), traditional stock options, or free shares is key to attracting and retaining top talent. However, French tax and regulatory bodies demand rigorously documented valuations—so having a fully compliant, defensible report isn’t just best practice, it’s essential for safeguarding your team’s incentives and ensuring smooth audits.

The BSPCE valuation process

Our streamlined process ensures compliance with French tax authorities while minimizing administrative burden on your team.

Intro Assessment

Brief call to understand the appropiate valuation methods based on your equity instruments and company structure

Documentation Review

Submit financial statements, cap table, and business plan with French-specific requirements

Valuation Analysis

Our French tax specialists perform comprehensive analysis following DGFiP guidelines

Draft Review

Review and discuss preliminary findings

Final Report

Receive comprehensive documentation ready for tax authority submission

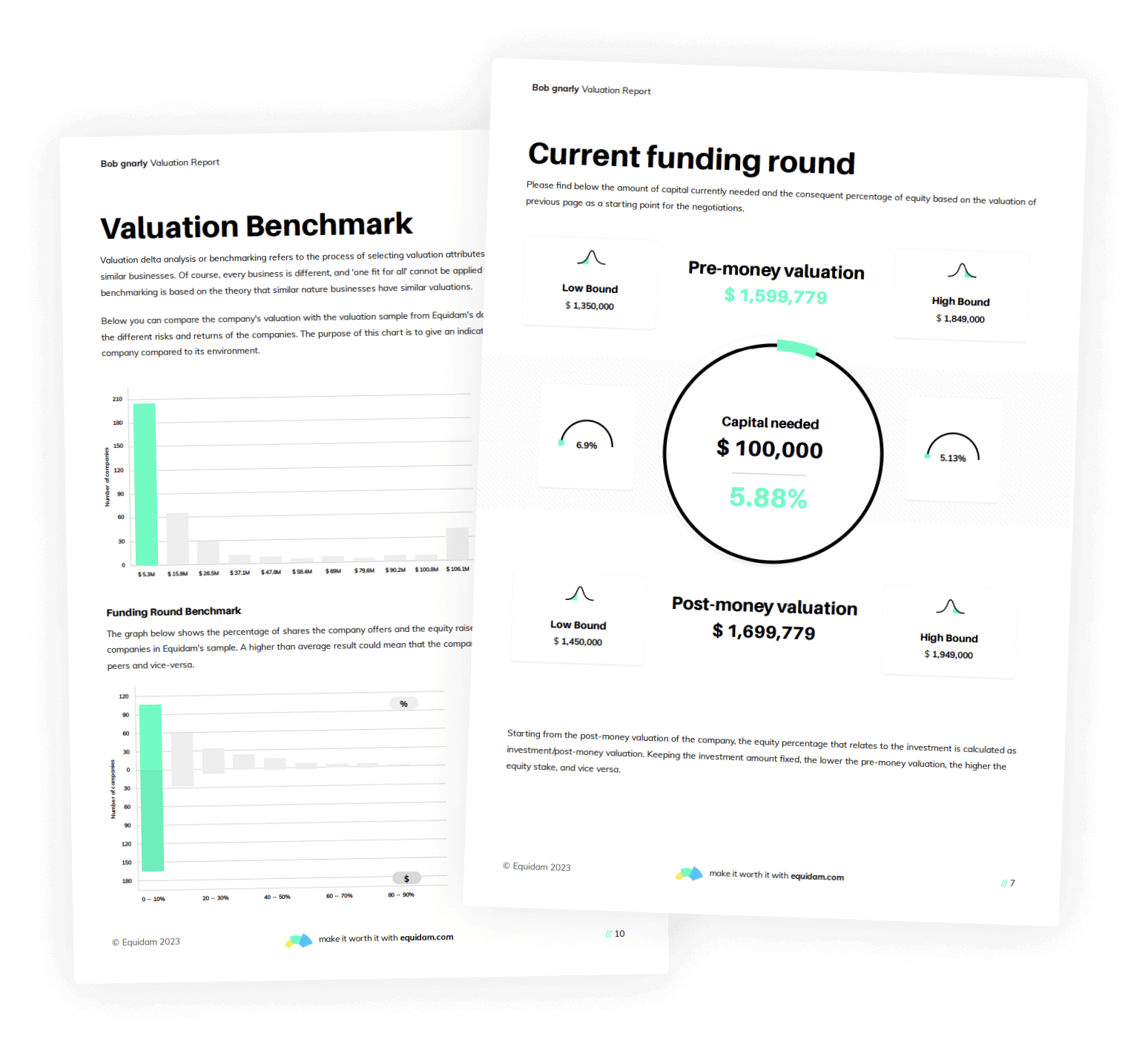

Inside your final valuation report

Our detailed BSPCE valuation delivers you with everything needed for regulatory compliance and equity decisions.

Included in the BSPCE Report

– Robust fair market value analysis with defendable conclusions

– Customized industry benchmarking and peer comparisons.

– Strategic financial forecasting with growth assumptions.

– Clear explanation of valuation to meet AMF standards.

Get your BSPCE valuation

Comprehensive BSPCE Valuation

€3,500

Complete BSPCE valuation report for french companies with comprehensive analysis

AMF-compliant valuation report

7 to 10-day turnaround time

Supporting documentation for AMF submission

Cap table analysis

Pre-valuation consultation

12 months of follow-up support

Comprehensive BSPCE Valuation

€3,500

Complete EMI valuation report for UK companies with comprehensive analysis

AMF-compliant valuation report

7 to 10-day turnaround time

Supporting documentation for AMF submission

Cap table analysis

Pre-valuation consultation

12 months of follow-up support

Frequently asked questions

Everything you need to know about our BSPCE valuation service.

BSPCEs (Bons de Souscription de Parts de Créateur d’Entreprise) are French-only share warrants that let employees subscribe to new company shares at a fixed strike price after vesting. They’re prized by startups because:

-

Powerful incentive: Employees pay nothing at grant or exercise and only face capital-gains tax on eventual sale—at a flat ~30% if held ≥3 years (vs. up to ~47% if <3 years).

-

Cost-efficient for employers: No employer social contributions on grant or exercise, unlike free shares (AGA) or traditional stock options.

-

Startup-only eligibility: Reserved for private French SAS/SA companies < 15 years old, with ≤ €150 M market cap and ≥ 25% held by individuals.

Typically, the process takes 7-10 business days from submission of all required documentation to the delivery of your final report. Rush options are available for time-sensitive situations.

To stay fully compliant with French tax authorities and AMF expectations, you should update your valuation:

-

Annually, or

-

After any material event, such as:

-

A new financing round

-

Major changes to your cap table

-

Significant shifts in business model or market environment

-

Your BSPCE valuation is produced through a joint effort between Equidam’s seasoned valuation experts—who bring deep data-driven modeling and global best practices—and FUTURZ’s French-based legal and compliance specialists—who ensure full alignment with AMF guidance and French tax rules.

Yes. Our reports are:

-

Prepared in line with Article 39-1-5° of the French Tax Code and AMF guidance

-

Backed by documented assumptions on discount rates, comparables, and forecast drivers

-

Reviewed by senior legal counsel to ensure full defensibility in the event of an inspection or audit

That means both your tax office and external auditors will recognize the valuation as valid.

If you’re shopping around, we recommend exploring our site a bit — you’ll find information about why to choose us, our valuation report, data sources, methodology, and more. Plus, our Help Center has lots of helpful information.

If you need to get in touch with our team, you can always do so via the chat on the bottom right corner.

GET STARTED NOW

We make BSPCE valuations easy

Trusted by thousands of startups, Equidam delivers accurate, compliant valuations you can count on.