Premium EMI valuations backed by Standard Ledger

In collaboration with Standard Ledger, a top-tier UK accountancy firm for startups, we offer best-in-class EMI valuation support.

Premium EMI valuations backed by Standard Ledger

In collaboration with Standard Ledger, a top-tier UK accountancy firm for startups, we offer best-in-class EMI valuation support.

Why our valuations stand out

Trusted reports. Transparent pricing. Streamlined process.

Everything you need to stay compliant, defend your valuation, and support your equity strategy—without surprises.

HMRC Compliant Valuations

HMRC Compliant Valuations

Reports designed to meet all HMRC requirements, minimizing the risk of tax complications for both your company and employees.

Professional Expertise

Professional Expertise

Valuations prepared by certified professionals with extensive experience in UK tax legislation and EMI scheme requirements.

Comprehensive Documentation

Comprehensive Documentation

Complete valuation report that includes all supporting evidence required for HMRC submissions.

Delivery Time

Delivery Time

Receive your EMI valuation within 7-10 business days, with expedited options available for urgent requirements.

The importance of EMI valuations

Enterprise Management Incentives (EMI) are a UK government-approved, tax-advantaged share option scheme designed specifically for smaller companies to attract and retain talented employees.

Before implementing an EMI scheme, you need to agree on a valuation with HMRC to determine the price at which employees can acquire shares. An incorrect valuation can result in unexpected tax liabilities and compliance issues.

The EMI valuation process

Our efficient process ensures a reliable, HMRC-ready valuation with minimal input from your team.

Intro Call

Brief call to understand your business and EMI needs

Document Collection

Submit financial statements, cap table, and business plan

Valuation Analysis

Comprehensive analysis based on HMRC guidelines

Preliminary Report

Review draft findings and discuss assumptions

Final Report

Receive your complete EMI valuation report

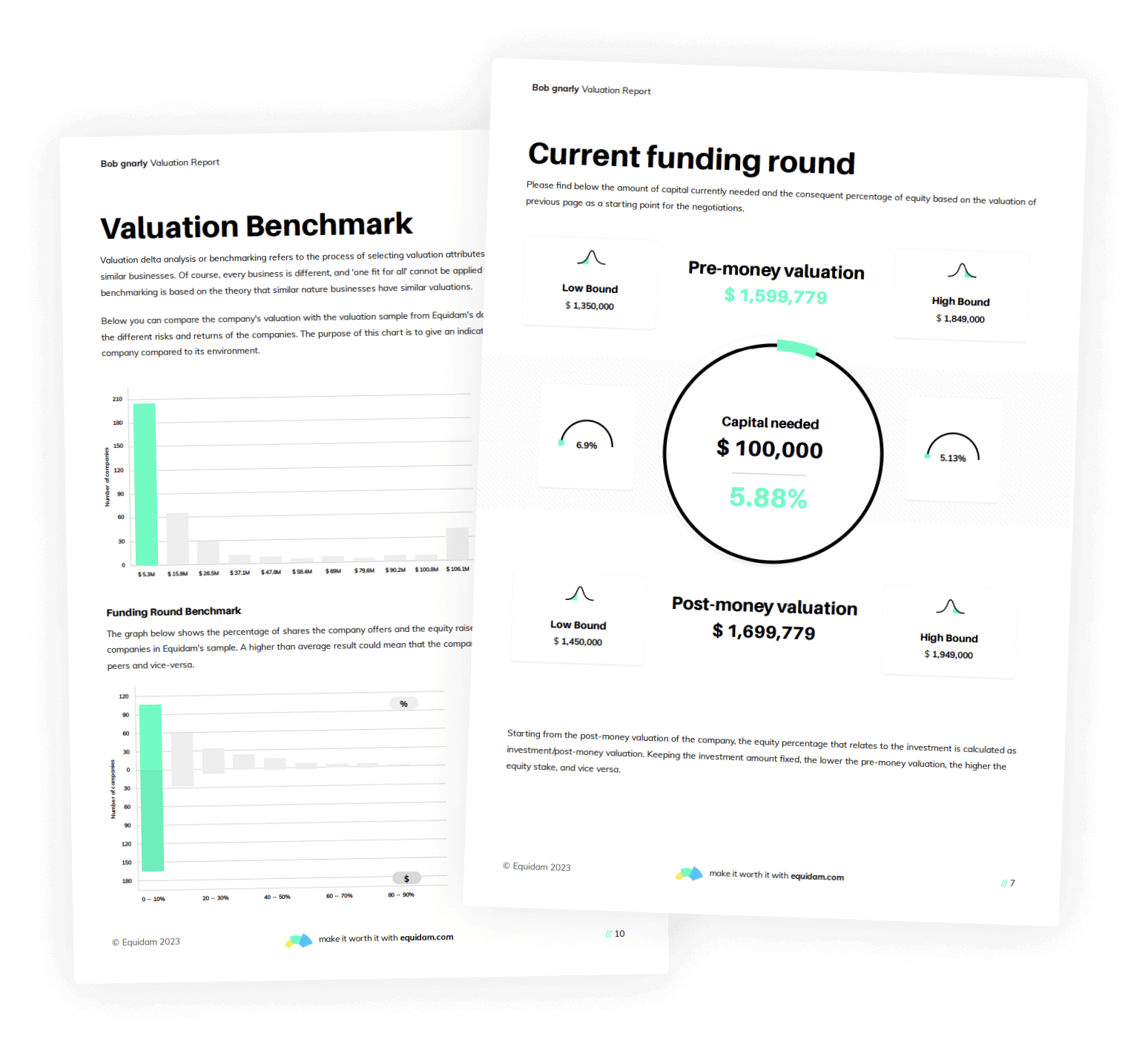

Inside your valuation report

Our detailed EMI valuation delivers you with everything needed for regulatory compliance and equity decisions.

Included in the EMI Report

– Robust fair market value analysis with defendable conclusions

– Customized industry benchmarking and peer comparisons.

– Strategic financial forecasting with growth assumptions.

– Clear explanation of valuation methodology to meet HMRC standards.

Get your EMI valuation

Comprehensive EMI Valuation

£1,000

Complete EMI valuation report for UK companies with comprehensive analysis

HMRC-compliant valuation report

7 to 10-day turnaround time

Supporting documentation for HMRC submission

Cap table analysis

Pre-valuation consultation

12 months of follow-up support

Comprehensive EMI Valuation

£1,000

Complete EMI valuation report for UK companies with comprehensive analysis

HMRC-compliant valuation report

7 to 10-day turnaround time

Supporting documentation for HMRC submission

Cap table analysis

Pre-valuation consultation

12 months of follow-up support

Frequently asked questions

Everything you need to know about our EMI valuation service.

An EMI (Enterprise Management Incentive) valuation is an independent assessment of a private company’s share price, conducted to facilitate the granting of share options under the UK’s EMI scheme. This valuation ensures that share options offered to employees are priced correctly, satisfying HMRC guidelines and maximizing available tax benefits. If you’re planning to grant EMI share options to UK-based employees, obtaining an EMI valuation is typically required to support the option price.

Typically, the process takes 7-10 business days from submission of all required documentation to the delivery of your final report. Rush options are available for time-sensitive situations.

You should consider updating your EMI valuation in the following circumstances:

– Every 90 days: HMRC requires that EMI valuations be no older than 90 days at the time options are granted.

– Material changes in your business: Events such as new funding rounds, significant revenue changes, or major strategic shifts may necessitate a new valuation.

– Approaching an exit or liquidity event: Preparing for events like mergers, acquisitions, or IPOs often requires an updated valuation to ensure compliance and accuracy.

Regular updates help maintain compliance with HMRC requirements and ensure that option pricing remains fair and defensible.

Our EMI valuations are conducted in partnership with Standard Ledger, a UK-based financial services firm with deep expertise in startup accounting, compliance, and tax valuation. Their team of specialists provides the technical rigour and local knowledge required to ensure each EMI valuation meets HMRC guidelines and is tailored to your company’s stage and structure.

By working with Standard Ledger, we combine Equidam’s fast and standardized data-driven platform with the expert oversight of experienced UK financial professionals—so you get a valuation that is both defensible and HMRC-compliant, without the delays or high costs of traditional advisory firms.

Yes. A professionally conducted EMI valuation that adheres to HMRC guidelines is designed to withstand scrutiny from auditors and tax authorities. Ensuring that your valuation is up-to-date and reflects any material changes in your business is crucial for maintaining compliance and avoiding potential disputes.

If you’re shopping around, we recommend exploring our site a bit — you’ll find information about why to choose us, our valuation report, data sources, methodology, and more. Plus, our Help Center has lots of helpful information.

If you need to get in touch with our team, you can always do so via the chat on the bottom right corner.

GET STARTED NOW

We make EMI valuations easy

Trusted by thousands of startups, Equidam delivers accurate, compliant valuations you can count on.