More than an estimate

Startups valuation should not be performed as a rule of thumb, or with black box practices that leave space for arbitrary conclusions

Traditionally innovative

Traditional valuation approaches are methodological and grounded, but they need to be adjusted to capture the value of startups

Leading valuation approaches, formalized

We analyzed all valuation practices for early stage companies, selected the leading ones and made them available for you.

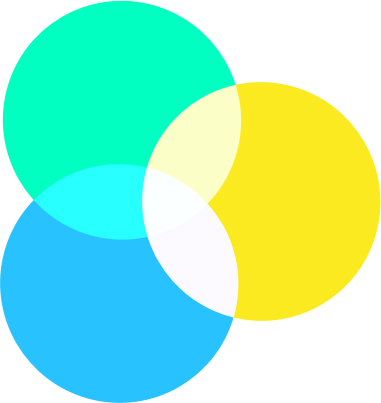

5 valuation

methods in one

Looking at the business from different perspectives results in a more comprehensive and reliable view. Our methods look at the value of a startup from 3 different points of view.

Qualitative aspects

Scorecard Method

Checklist Method

Developed by renowned American business angels to value the elements that guarantee future success in pre-revenues, early stage companies

Future cash flows

DCF with Long Term Growth

DCF with Multiple

The standard and most traditional methods according to which a company is worth the cash that it’s going to generate in the future

Investors returns

Venture Capital Method

This method takes into account the returns investors expect to earn upon exit in order to have a profitable portfolio

Future cash flows

DCF with Long Term Growth

DCF with Multiple

The standard and most traditional methods according to which a company is worth the cash that it’s going to generate in the future

Investors returns

Venture Capital Method

This method takes into account the returns investors expect to earn upon exit in order to have a profitable portfolio

Qualitative aspects

Scorecard Method

Checklist Method

Developed by renowned American business angels to value the elements that guarantee future success in pre-revenues, early stage companies

Future cash flows

DCF with Long Term Growth

DCF with Multiple

The standard and most traditional methods according to which a company is worth the cash that it’s going to generate in the future

Qualitative aspects

Scorecard Method

Checklist Method

Developed by renowned American business angels to value the elements that guarantee future success in pre-revenues, early stage companies

Investors returns

Venture Capital Method

This method takes into account the returns investors expect to earn upon exit in order to have a profitable portfolio

Read the full methodology

We support and promote transparency – which is why we made our methodology open to everyone.

Compliant with IPEV (International Private Equity Valuation) Guidelines

1600+ investors use Equidam to value opportunities

Over the years, we’ve learned from thousands of investors interactions and improved our platform and report to allow for smoother and fairer negotiations.

When both parties enter the negotiation with transparent assumptions, valuation can be fairly and openly discussed, leading to better outcomes and a higher probability of closing the deal.

“As entrepreneur and investor, I’m using the Equidam report for every fundraising I’m involved in.“

Maarten Timmerman

Founder and CEO at AWAREWAYS

Backed by the most reliable data

Equidam accurately curates and updates data sources of valuation parameters such as multiples and discount rates. They are tailored to 90 countries and 136 industries.

30,000 Companies

We provide updated revenue and EBITDA multiples from a database of globally listed public companies.

Methods handpicked for startups

From pre-revenue to IPO

Qualitative methods to value intangibles

Factors like team strength, idea quality, and market entry barriers are key signals of a startup’s potential—especially in early stages where financials are very uncertain.

Equidam incorporates widely used business angel frameworks to help quantify and compare these qualitative drivers in a consistent way.

Yes, DCF for startups

Even at early stage, when forecasts are highly uncertain, Discounted Cash Flow methods remain the only way to incorporate the startup's unique roadmap to growth and cash generation in the valuation.

Suitable for:

Not suitable for:

Liquidating the company

Africa's most influential angel investor

“As a start-up valuations can be contentious, Equidam’s tool provides a clear and objective framework at determining a fair value for a venture”

H’ Tomi Davies (TD), President of the African Business Angel Network (ABAN)

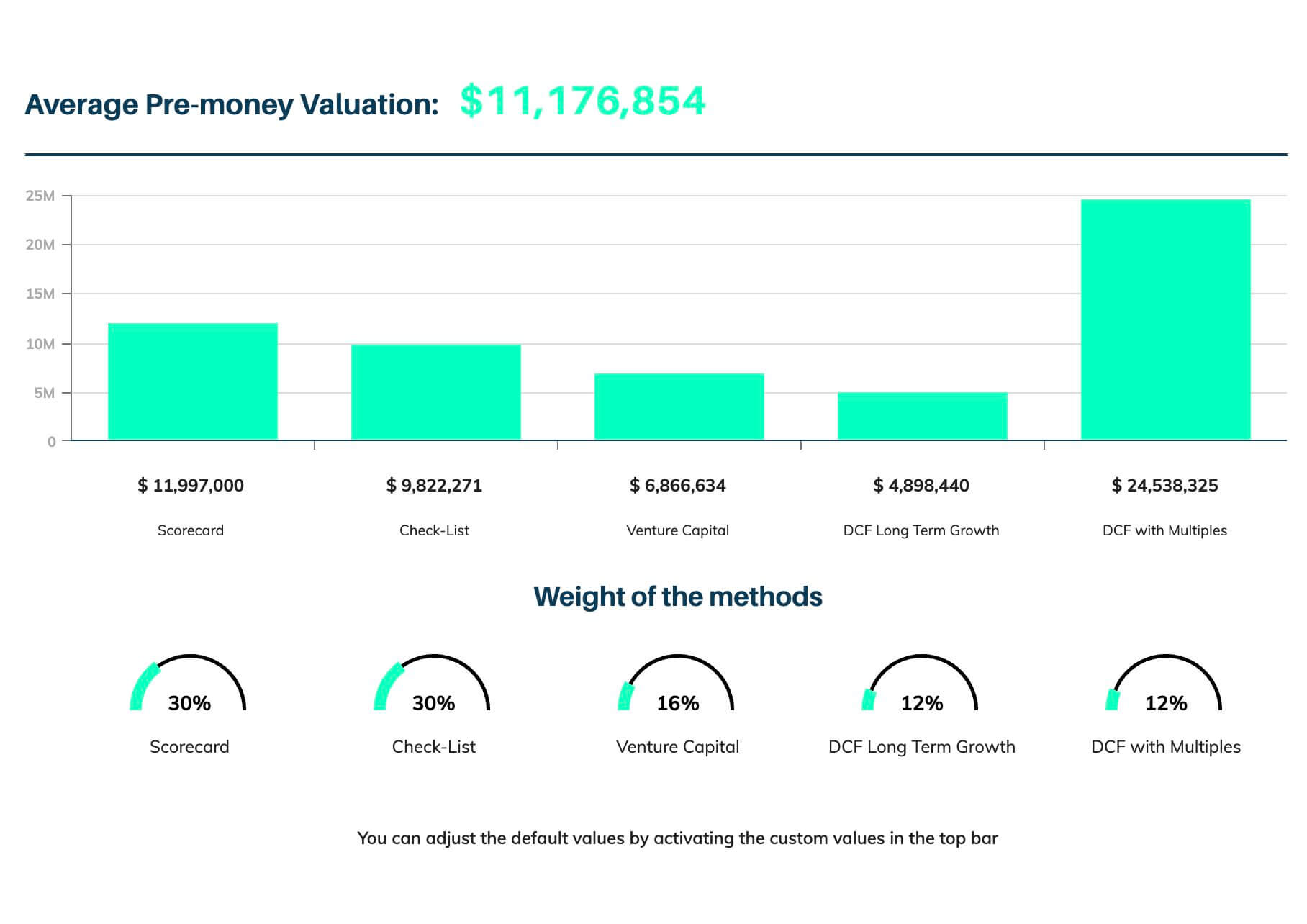

Powerful defaults, and customizable

Equidam is built in a way to allow seamless usage across all levels of financial knowledge and company stage

- Assisted financial projections with industry averages

- Customizable valuation parameters

- Adjustable methods selection

- Adaptable weights of each method

- Ability to deactivate valuation methods

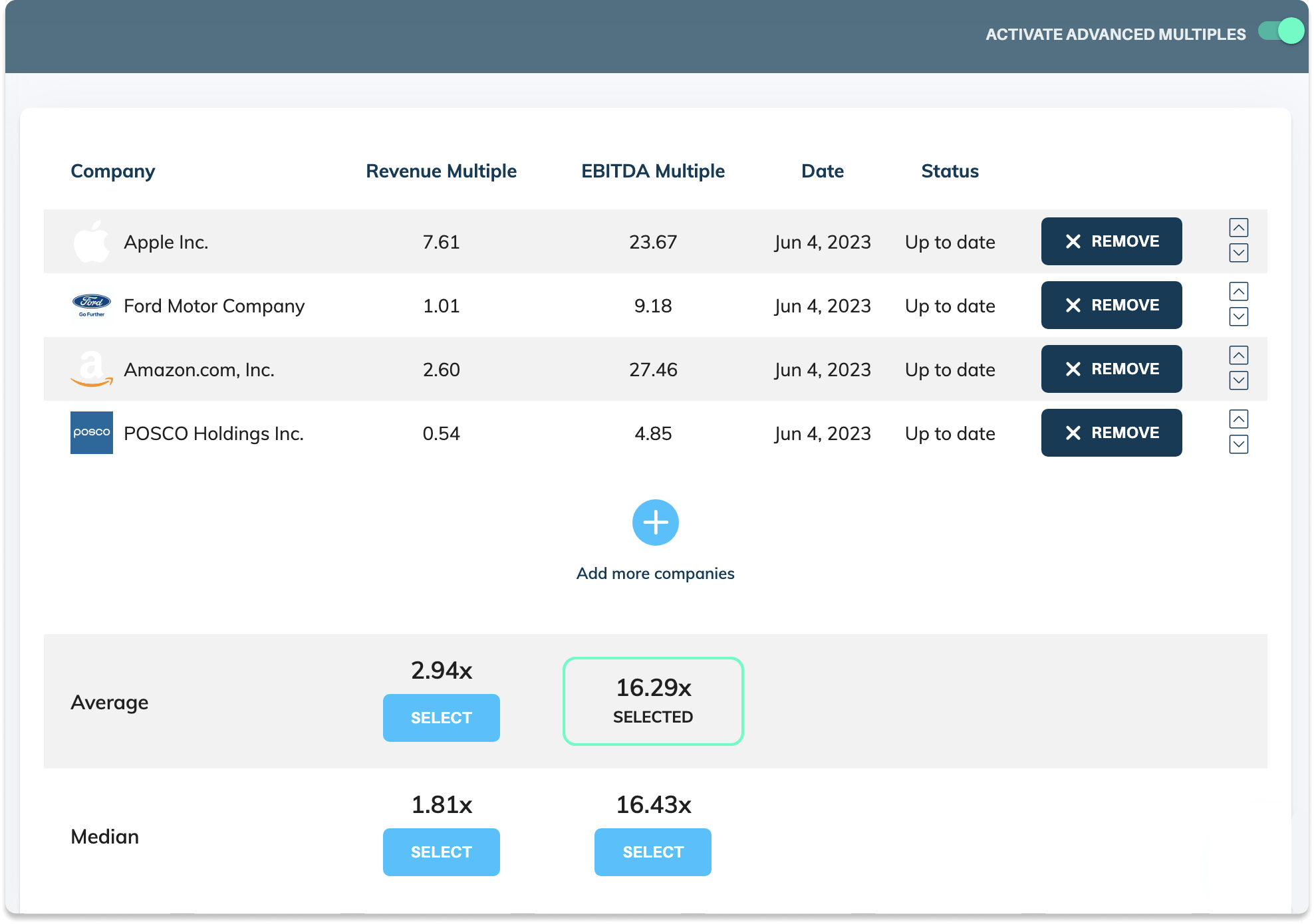

Database of 30.000+ Public Company Multiples

Build your own set of comparables with Equidam’s Advanced Multiples tool. With a searchable database of public company EBITDA and revenue multiples updated weekly and the possibility to add your own companies.

- Select relevant public company comparables

- Include either revenue or EBITDA multiples

- Use the average or median of the group

- Database of multiples updated weekly

- Add your own transaction multiples

The best startups are valued, not priced

A structured methodology allows you to know the assumptions behind valuation and understand its drivers. This allows you not only to have honest and transparent discussions about it with investors but also to take better strategic decisions.