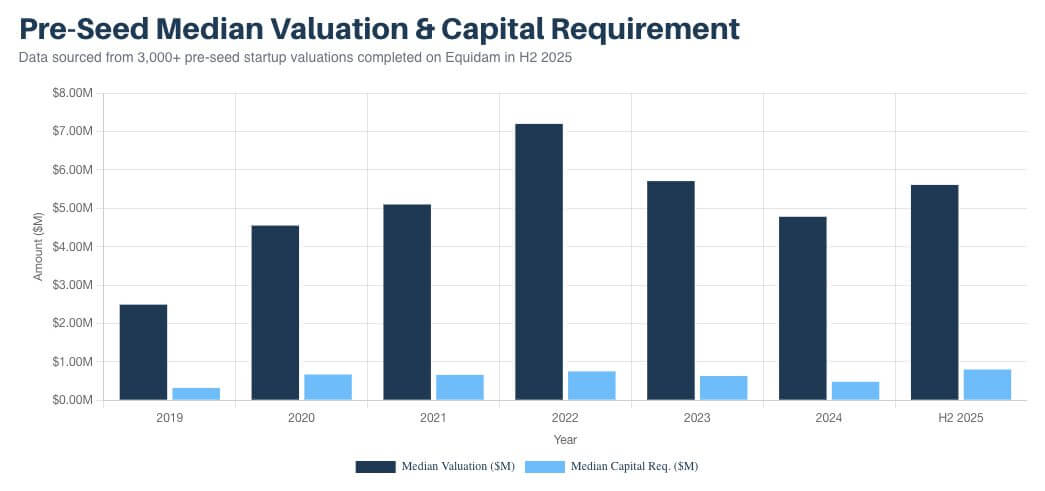

Startup Valuation Delta: H2 2025

Pre-seed is the least analyzed stage of startup fundraising — and the most predictive. In H2 2025, valuations and capital requirements are both rising, signaling a shift away from capital-light software toward harder, more capital-intensive ventures. This analysis breaks down what that means across regions and industries.

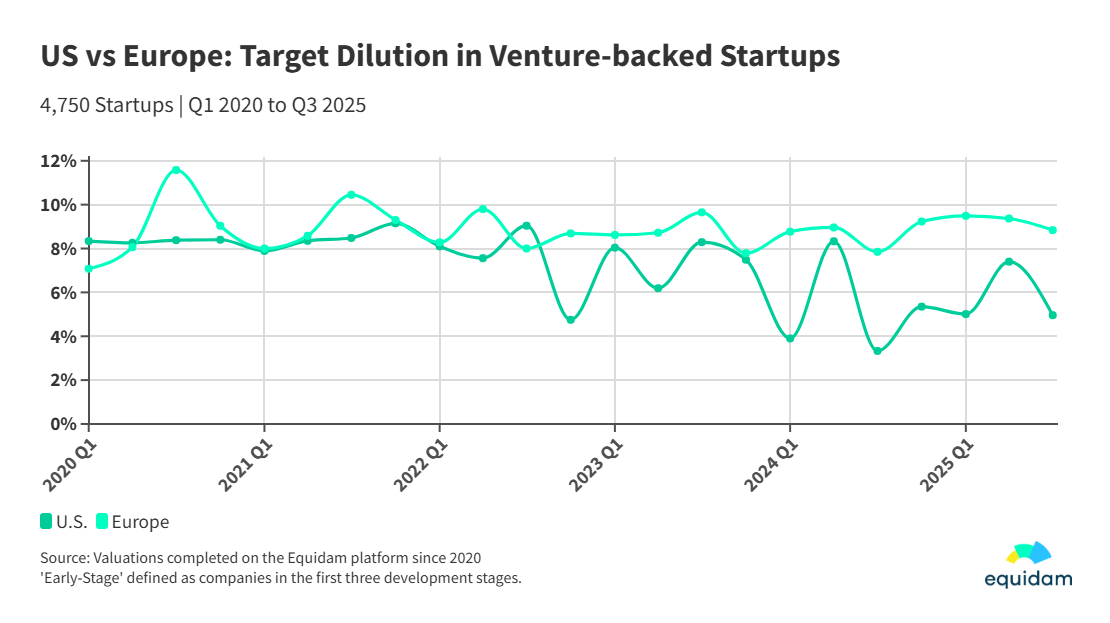

Startup Valuation Delta: Q3 2025

Our latest report analyzes early-stage fundraising data from 2020 to 2025, revealing that European startups consistently raise less capital at lower valuations than their U.S. counterparts, despite operating at the same development stages. The key differences lie in traction thresholds and pricing: European startups typically raise at higher revenue levels but receive smaller funding rounds, face higher dilution, and project more conservative growth.

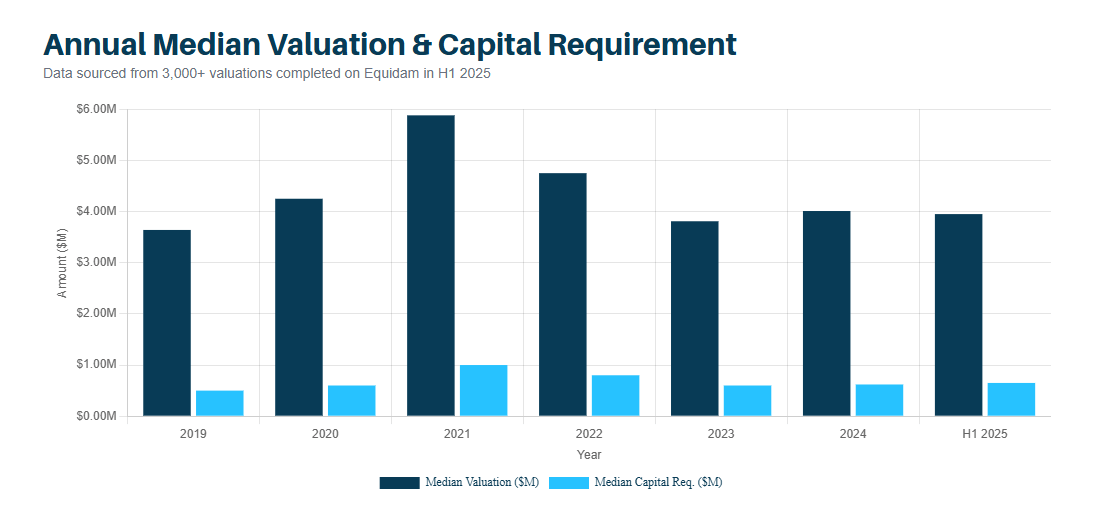

Startup Valuation Delta: H1 2025

In a market defined by macroeconomic caution, a "flight to quality" has created a bifurcated landscape. Capital is abundant for a select few, while most face a higher bar for funding. This analysis reveals the anatomy of an investable startup in the new era of disciplined execution.

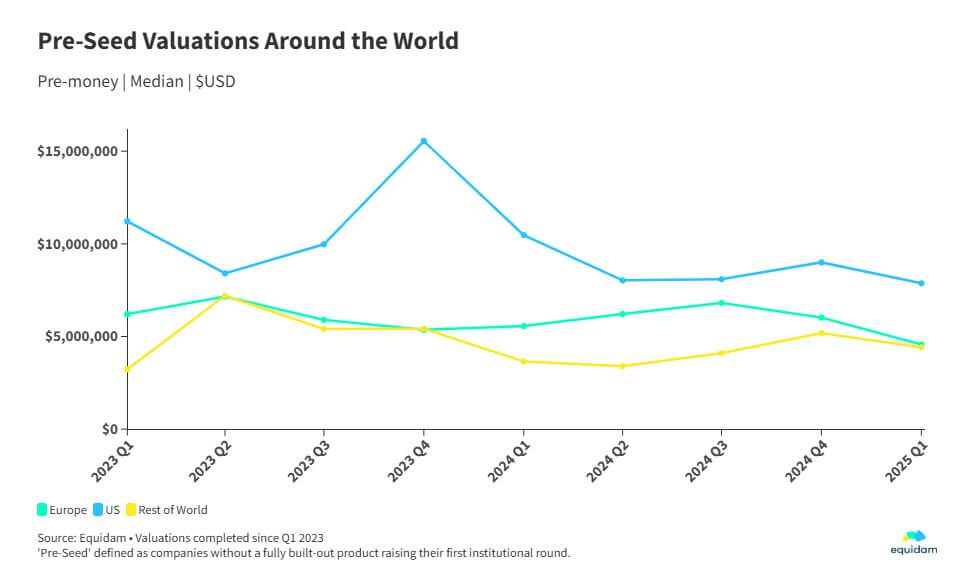

Startup Valuation Delta: Q1 2025

Pre-seed fundraising globally entered a relatively stable period from mid-2024, following a flattening trend that began in 2023. This stabilization occurred after a significant wave of AI-driven enthusiasm peaked around the end of 2023—particularly in the US market. In contrast, regions outside the US experienced less pronounced AI-related valuation surges.

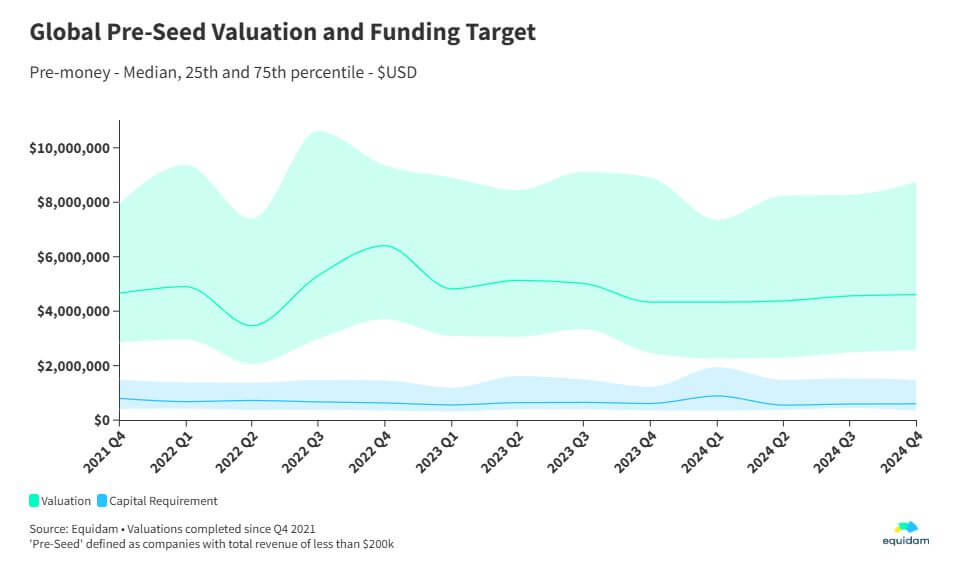

Startup Valuation Delta: Q4 2024

Pre-seed startup valuations have shown notable stability across 2024, with the global median continuing a slight upward trend from $4.3 million in Q1 to $4.6 million in Q4. This consistency marks a sharp contrast to the volatility of 2022 and the fluctuations seen in 2023, ending in the dip in Q4 2023.

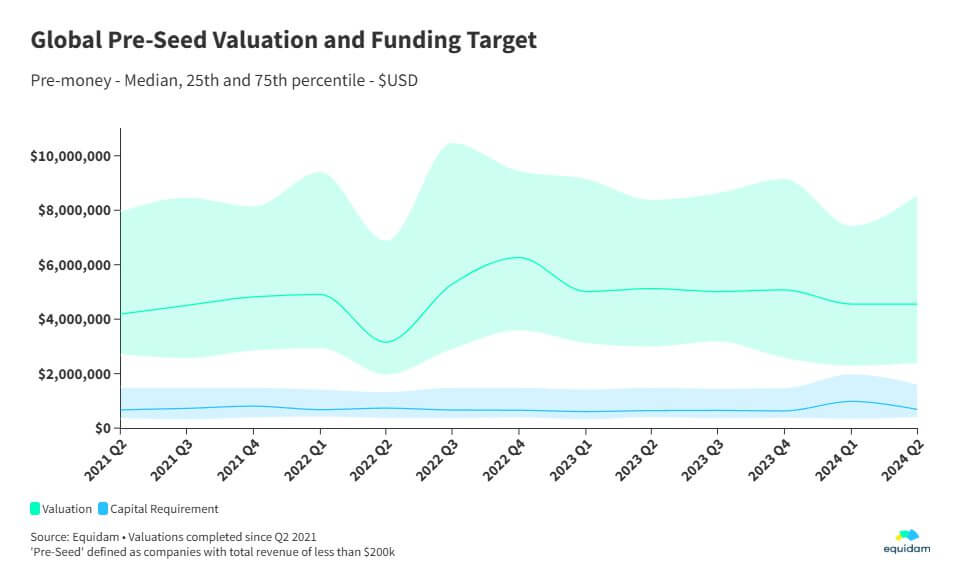

Startup Valuation Delta: Q2 2024

On the surface, Q2 doesn’t appear to have produced any optimism for the market, with cash raised by venture capital firms reaching a new low — as reported by Juniper Square. This coincides with the previously red-hot sector of Generative AI also seeing a decline in fundraising activity.

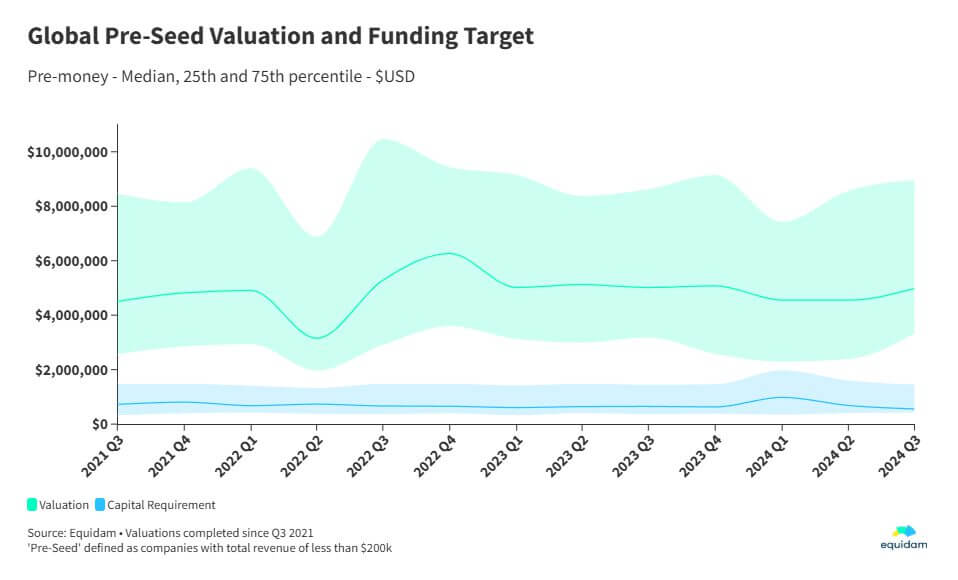

Startup Valuation Delta: Q3 2024

The analysis of the Q3 2024 market shifts in venture capital, particularly at the pre-seed stage, reflects an interesting balance between rising valuations and decreasing fundraising targets, suggesting a cautious environment despite the slight optimism shown by the higher valuations.

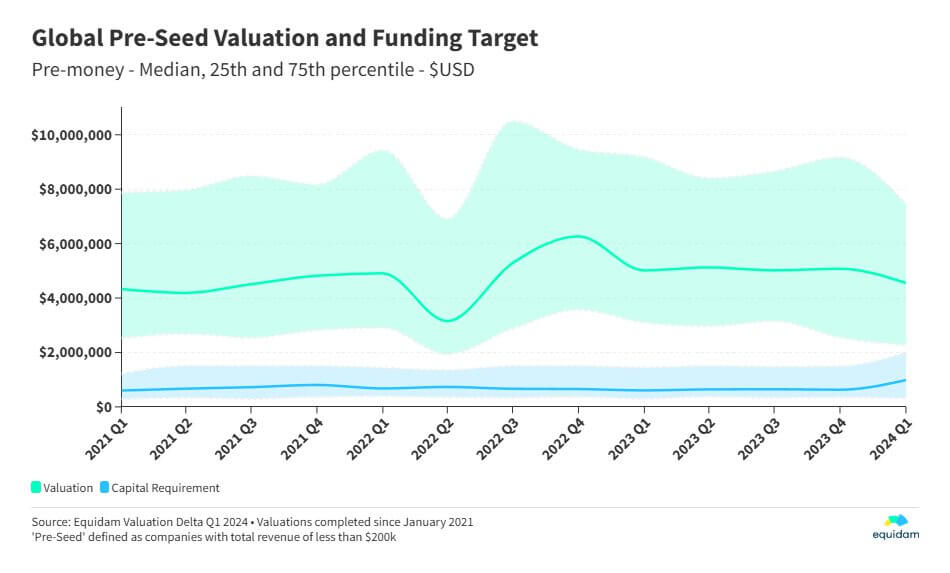

Startup Valuation Delta: Q1 2024

For the first time since Q1 of last year, we see a real dip in valuations, with a 10% fall in the median. This is likely due to a number of factors (continued pressure on VCs to correct from 2021, AI absorbing more of the available capital, seasonality) which we will explore in more detail further on.

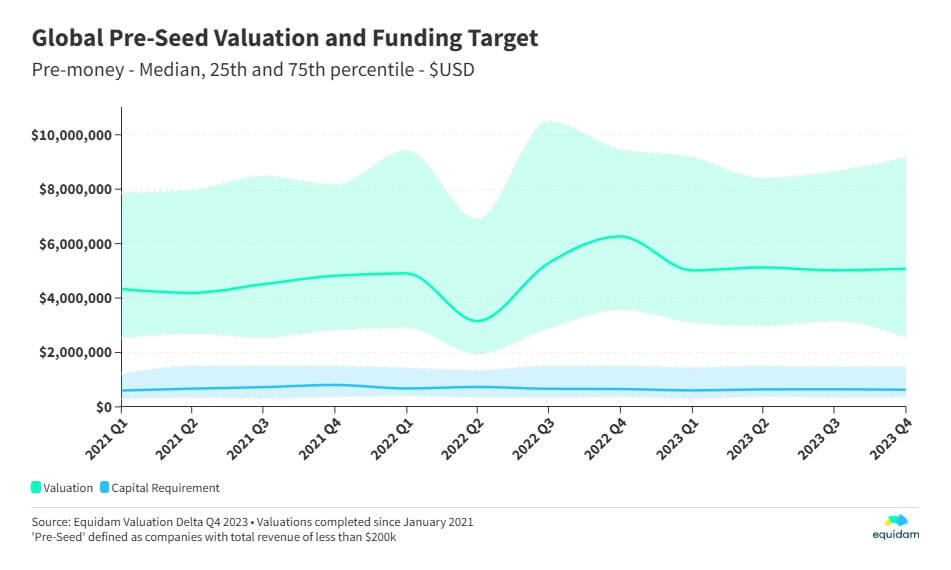

Startup Valuation Delta: Q4 2023

The stability of the median valuation at around $5 million across all four quarters of 2023 is the most remarkable finding of Q4, contrasting with the turbulence of the previous year and setting a real benchmark for pre-seed startups.

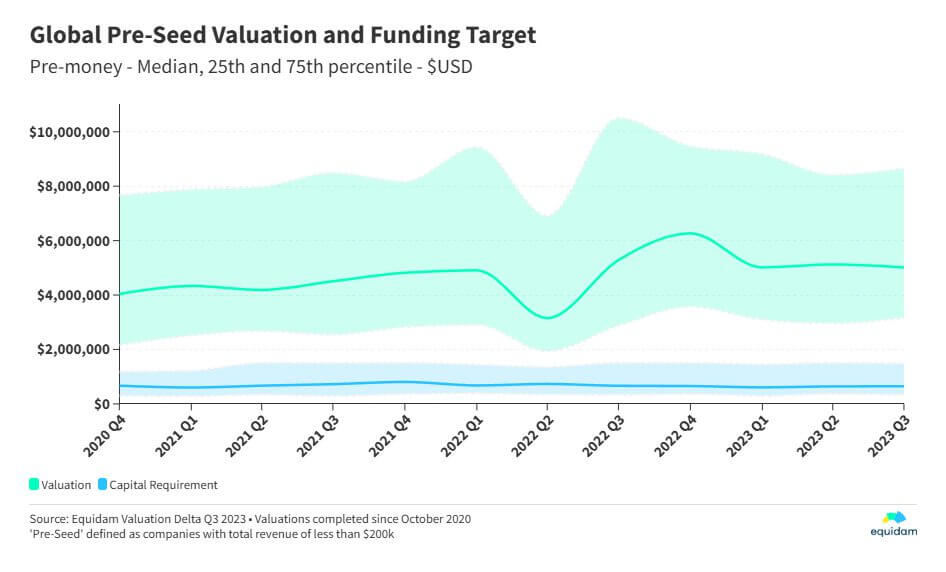

Startup Valuation Delta: Q3 2023

It appears that the volatility in startup valuations experienced between Q1 2022 and Q1 2023 is over. While this update isn’t good news for everyone, with some regions and industries down, on the whole it can be interpreted as a positive signal for the rest of the year.

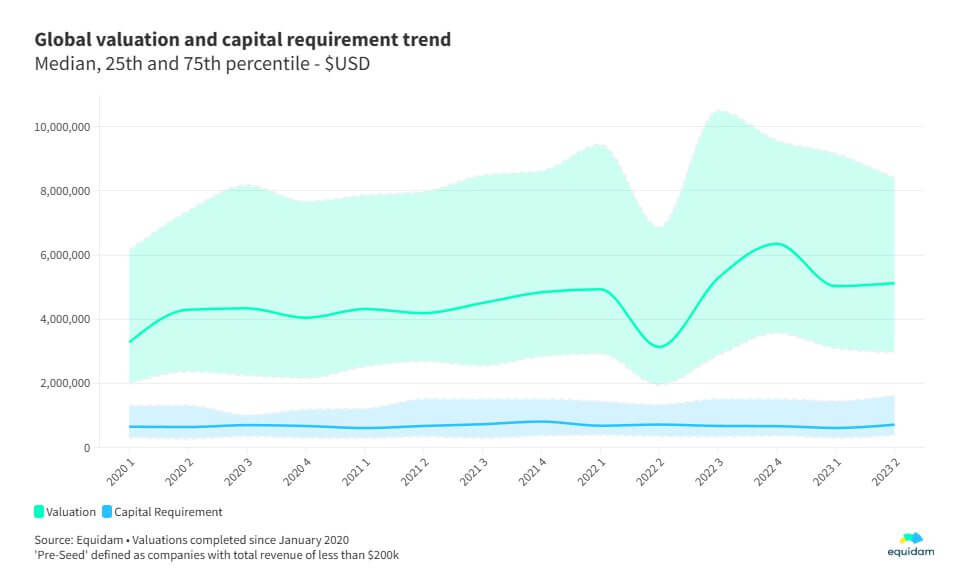

Startup Valuation Delta: Q2 2023

As we enter Q3 2023, we can see that early stage valuations have continued a steady and modest upward trend over the past two and half years. This is to be expected, as these companies are largely insulated from macro-economic conditions and market shocks.