Guest post by Equidam partner, Hatty Fawcett of Focused for Business

There’s no sugar-coating it — raising investment in 2025 isn’t a walk in the park. As elsewhere, the UK startup investment landscape has shifted in the last few years, and founders need to adjust their tactics accordingly if they want to cut through the noise and get the right kind of backing.

Gone are the days when a pitch deck with a slick product demo and a compelling “what if” could pull in pre-seed funding overnight. Today’s investors are cautious, more selective, and expecting more from founders — even at the earliest stages.

So, what’s changed? What’s staying the same? And what do you, as a founder at pre-seed or seed stage, need to understand about how the market operates today?

Let’s break it down.

A Two-Speed Market: The New Reality of Fundraising

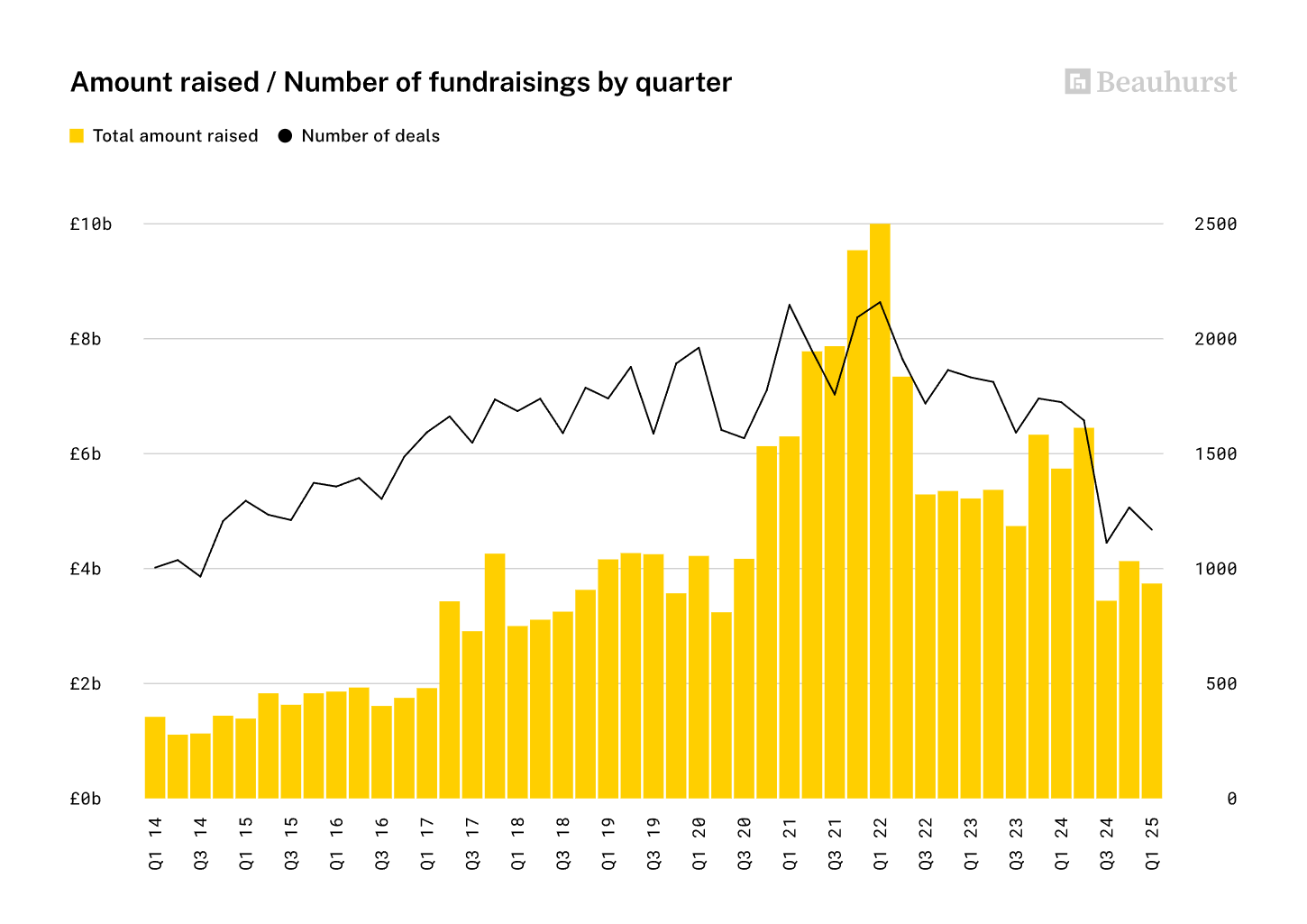

According to Beauhurst’s State of UK Investment report for Q1 2025, there’s been a significant drop in the number of deals being done overall. In fact, the number of investment rounds completed is at its lowest level since Q2 2018. But before you let that send you spiralling, let’s look closer.

Henry Whorwood, Head of Research and Consultancy at Beauhurst, explains:

“We’re seeing a two-speed market: one where early-stage funding remains active but lean, while mid-to-late stage companies are securing fewer but significantly larger rounds.”

So what does that mean for you as a pre-seed or seed-stage founder?

Early-stage investors are still backing businesses — but they’re being more selective, and they’re expecting to see more evidence that you’re building something that can really fly. In short, you need to stand out with traction, a strong team, and a credible plan to grow.

Why Is This Happening?

Looking at the current UK startup investment landscape, while it’s certainly not a complete drought, the environment has shifted significantly from the exuberant years of 2020-2021. We can focus on three key factors driving this change:

- The UK startup investment landscape is under pressure from persistent macroeconomic challenges.

The dramatic shift in interest rates since the low-rate environment of 2020-2021 has significantly altered investor behavior. With central bank rates elevated, safer assets now offer competitive returns, reducing the incentive for risk-heavy venture capital deployment. This has led to a marked drop in startup funding, as data suggests each percentage point increase in interest rates slashes venture capital availability by roughly 25%. Compounding the issue, inflation has increased operating costs for startups, particularly affecting early-stage companies with high burn rates and delayed profitability.

- Startup valuations have undergone a substantial correction from their 2021 peaks, driven by both public market tech selloffs and investor recalibration.

Down rounds have surged, with over 21% of European deals affected—nearly a third of which occurred in the UK and Ireland. High-profile startups have accepted lower valuations, reflecting the new climate. Fundraising today demands greater maturity and evidence of traction, making it harder for companies to justify lofty valuations based on potential alone.

- In a landscape with fewer deals and heightened caution, investors have become significantly more selective.

The power dynamic has shifted toward capital allocators who now prioritize startups with demonstrable execution, clear paths to profitability, and sustainable unit economics. Enhanced due diligence, a renewed focus on B2B cost efficiency, and a surge in down rounds underscore the scrutiny startups now face. Rather than chasing hype (outside of AI), VCs are allocating capital to companies that show operational discipline and resilient growth models—only the strongest are breaking through.

A maturing market with selective opportunities

The UK maintained its position as Europe’s most significant startup ecosystem, with startups raising more than France and Germany combined. Total VC investment reached £9 billion in 2024, representing a 12.5% increase from 2023, while supporting over 378,000 jobs across 9,000+ portfolio companies. However, the focus has fundamentally shifted toward quality over quantity.

Early-stage funding dynamics have shifted significantly. Pre-seed valuations averaged £3.2 million (31% increase from 2023) according to Pitchbook reporting, while seed valuations reached £4 million in the UK. Yet raising capital now takes considerably longer – the average time from launch to Series C has nearly doubled to 9.6 years, with seed to Series A stretching over two years. This extension reflects higher traction requirements and more rigorous due diligence processes.

Sector concentration has intensified around AI and fintech. AI companies captured 33% of global venture funding in 2024, with UK AI startups raising a record $4.5 billion. Fintech remained dominant with £2.42 billion raised, though it was briefly surpassed by cleantech in 2023. The robotics sector has emerged as the fastest-growing area, signaling a shift toward automation and hardware innovation.

Underrepresented founders face persistent systemic barriers

Despite growing awareness and initiatives, funding disparities remain stark.

- All-female founding teams receive only 1.9% of UK VC funding, while mixed-gender teams significantly outperform all-female teams in funding amounts. The gender gap actually widened in early 2025, with female founders receiving just 3.7% of funding compared to 6.5% in Q4 2024.

- Ethnic disparities are even more pronounced. Over the decade 2009-2019, only 0.24% of UK venture capital went to Black founders, with 0.02% going to Black female founders. Just 38 Black entrepreneurs received VC funding across the entire decade, highlighting the scale of the challenge.

- Socioeconomic barriers compound these issues. 75% of VC-funded founders come from advantaged backgrounds, while 43% of seed funding goes to teams with elite university connections. These disparities persist despite initiatives like the Investing in Women Code, which has 250+ signatories and demonstrates that focused diversity efforts can achieve better outcomes.

Several specialised funds and programs have emerged to address these gaps. Ada Ventures raised a £36 million second fund, while Impact X Capita and Cornerstone VC focus specifically on underrepresented entrepreneurs. Virgin StartUp’s Empower 100 program provides fully-funded acceleration for diverse founders, and Google’s Black Founders Fund and 1000 Black Voices offer non-equity support.

Alternative funding sources provide viable equity alternatives

- Beyond traditional VC, UK startups have access to diverse non-equity funding options. Government schemes like SEIS have supported over 32,965 companies with £24 billion in total funding since inception. The scheme was enhanced in 2023, extending eligibility to companies up to three years old and increasing the maximum funding to £250,000.

- Innovate UK Smart Grants offer £25,000-£700,000 for genuinely innovative R&D projects, with highly competitive 3-10% success rates. The scheme distributes £25 million per round and requires clear commercialization plans within three years. Regional variations provide additional opportunities, with Scotland’s £26.6 billion tech sector showing particular strength.

- Revenue-based financing has emerged as a significant alternative, with the global RBF market projected to reach $42 billion by 2027. UK providers like Uncapped, Outfund, and Re:cap serve SaaS, e-commerce, and subscription businesses with funding ranges from £10,000 to £10 million. These platforms offer 3-5 day approval times and 4-15% revenue share repayment terms.

- Venture debt remains a smaller but growing market, with 16 active funds in the UK compared to 100+ in the US. Providers like Claret Capital and CLP typically offer £2.5-5.3 million deals to post-Series A companies, structured as 3-year term loans with equity warrants.

Investor expectations have elevated significantly

- Due diligence processes now typically take anywhere from one week to several months for early-stage rounds, with investors spending 20+ hours per potential investment. The focus has shifted dramatically toward sustainable growth metrics and clear paths to profitability. Investors demand evidence of product-market fit, strong unit economics, and defensive competitive positioning.

- Macroeconomic factors continue to influence valuations. With UK base rates around 5%, investors can achieve attractive returns through safer instruments, reducing appetite for high-risk startups. Despite elevated rates, risk premia have compressed to historic lows, creating vulnerability to sentiment shifts.

- Pitch requirements have become more sophisticated. Investors expect decks with concise insights rather than comprehensive detail. Essential elements include clear problem statements, differentiated solutions, validated market size, strong traction metrics, and detailed financial projections with scenario planning.

- Traction expectations typically require double or triple-digit year-over-year growth, with 15-20% month-over-month growth for early-stage companies. SaaS businesses must demonstrate strong LTV/CAC ratios and recurring revenue models. Customer retention, satisfaction scores, and usage metrics have become critical evaluation criteria.

Successful fundraising strategies emphasize preparation and fundamentals

Recent success stories demonstrate the importance of strong fundamentals over rapid scaling. Zopa Bank achieved €80 million in 2024 funding after focusing on profitability first, reaching £34.2 million in pre-tax profits. Monzo’s $5.9 billion valuation was built on 10+ million consumers and £880 million revenue, while maintaining strong community engagement.

Founder equity preservation has become vital. Experts recommend retaining 50-60% equity post-Series A through strategic use of debt and alternative funding sources. This requires careful planning and often involves multiple funding sources rather than relying solely on equity.

The average fundraising timeline has extended to 15 months, requiring startups to plan 12-18 month cycles while maintaining operational focus. Success increasingly depends on targeting the right investor types by stage, building relationships before needing funding, and demonstrating strong unit economics and customer validation.

Investor relationship building remains essential. Successful founders target 50+ relevant investors and build relationships before needing capital. The Focused for Business accelerator program demonstrates this approach, with 50% of participants successfully raising funding through structured preparation and investor introductions.

Strategic recommendations for early-stage founders

- Preparation should begin many months before fundraising.

Founders must strengthen fundamentals through sustainable growth metrics, clear unit economics, and comprehensive due diligence preparation. Multiple funding scenarios should be developed, including traditional equity, alternative funding, and hybrid approaches.

- Market navigation requires realistic expectations about extended timelines and higher rejection rates.

Founders should prepare for 6-12 month fundraising cycles and focus on defensible competitive advantages. International opportunities, particularly in the US market, should be explored where appropriate.

- Sector-specific strategies vary significantly.

AI and deep tech companies benefit from current investor appetite, while consumer-facing businesses must overcome inflation-related challenges. B2B SaaS companies should emphasize recurring revenue models and strong unit economics.

- Diversity considerations require targeted strategies.

Underrepresented founders might want to prioritize diversity-focused funds, accelerator programs, and alternative funding sources while building networks through specialized communities and mentorship programs.

Conclusion

The UK startup fundraising landscape in 2025 presents a complex picture of adaptation and inequality. While the ecosystem maintains its position as Europe’s leading startup hub with strong government support and diverse funding options, persistent barriers for underrepresented founders and geographic concentration outside London require urgent systemic intervention.

The market rewards companies with strong fundamentals, realistic valuations, and sustainable business models. Success increasingly requires strategic diversification across funding sources, early relationship building with investors, and a comprehensive approach to growth that balances ambition with financial discipline. As alternative funding models mature and government support evolves, the ecosystem’s ability to address structural inequalities will determine its long-term competitiveness and inclusivity.

At Focused For Business, we regularly see that early-stage founders can raise investment even in the most challenging environments. They just need the right strategy, the right support, and the resilience to ride out the bumps. If that sounds like you — join us. You don’t have to do this alone. A great place to start is by joining our online (free) Funding Strategy Workshop, where we’ll focus on what you need to secure investment.