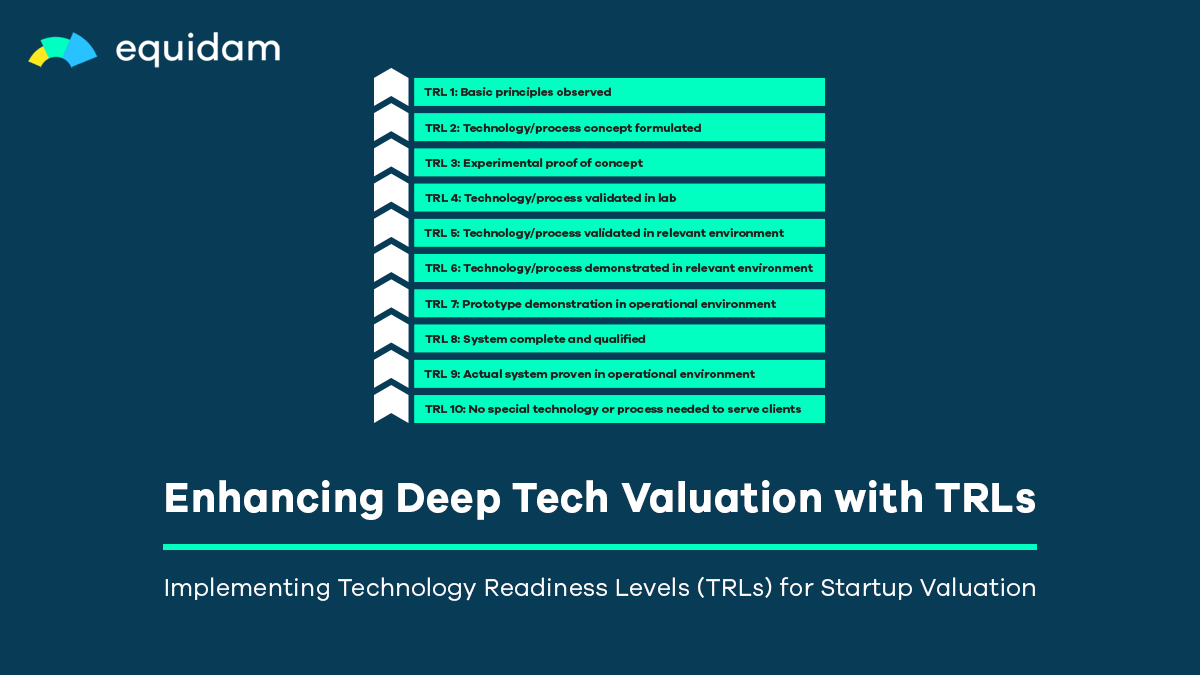

Deep Tech Valuation: Using Technology Readiness Levels

Early-stage valuation has always been about capturing potential before it becomes obvious. For deep…

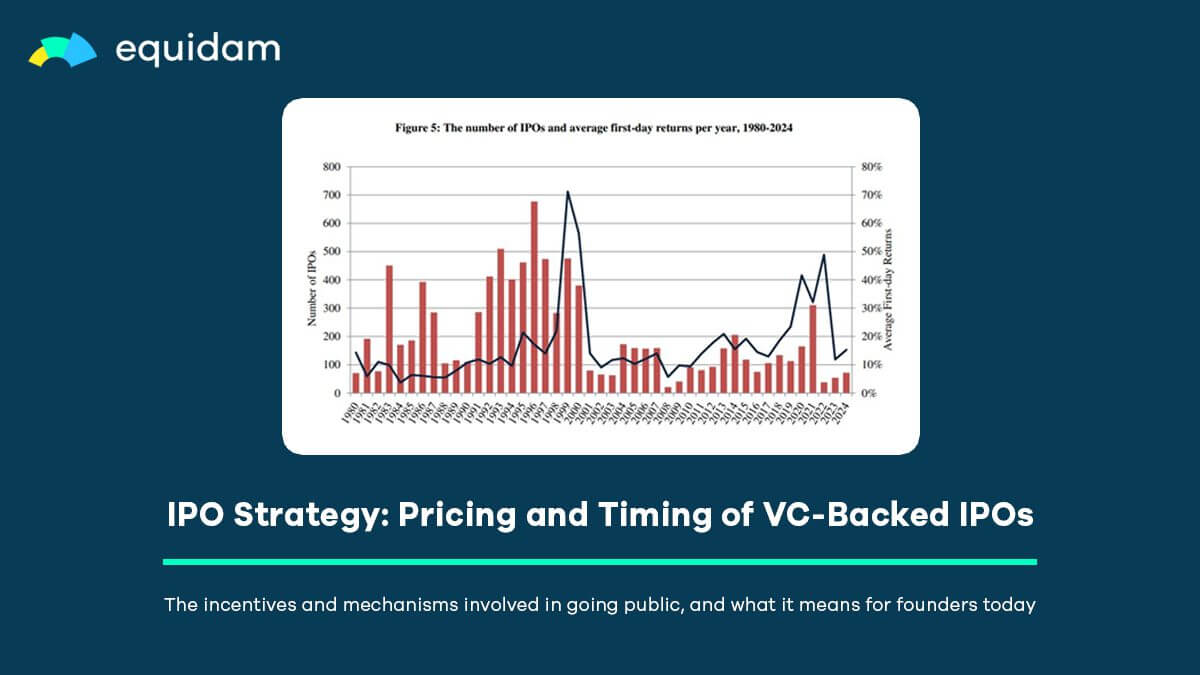

IPO Strategy: Pricing and Timing of VC-Backed IPOs

The recent IPO performances of companies like Chime and Circle have reignited conversations about…

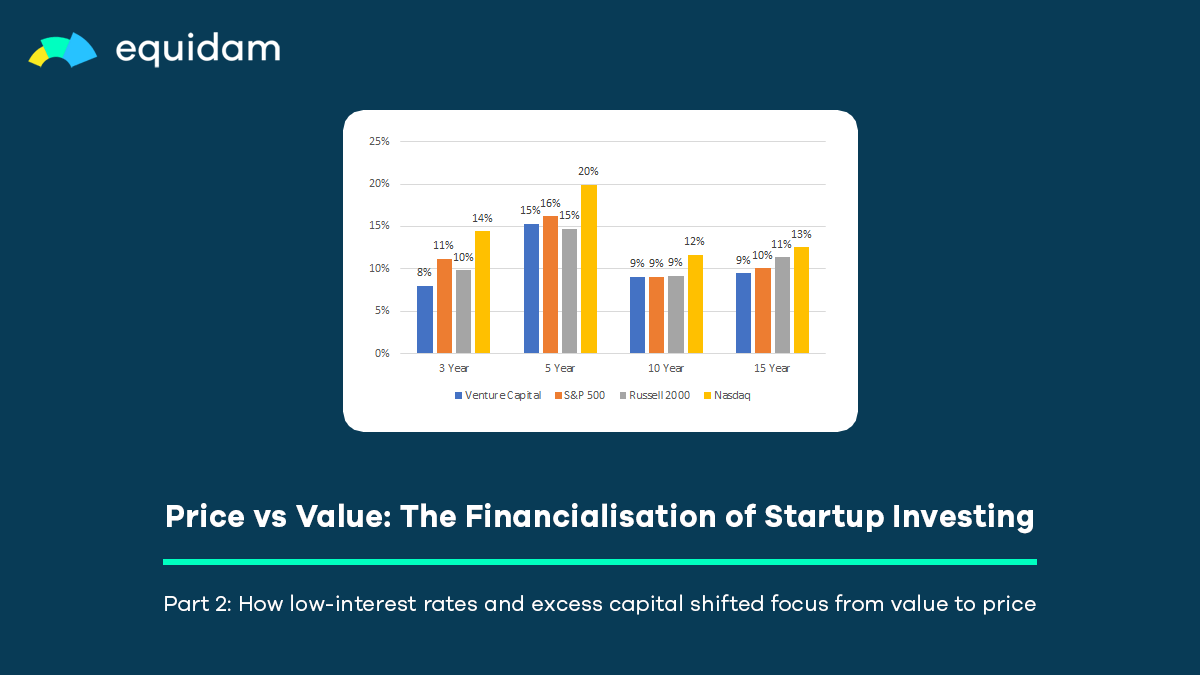

Price vs Value (Part 2): The Financialisation of Startup Investing

Price vs Value (Part 1): The Momentum Trap in VC Venture capital has long been about finding and…

17 June 2025

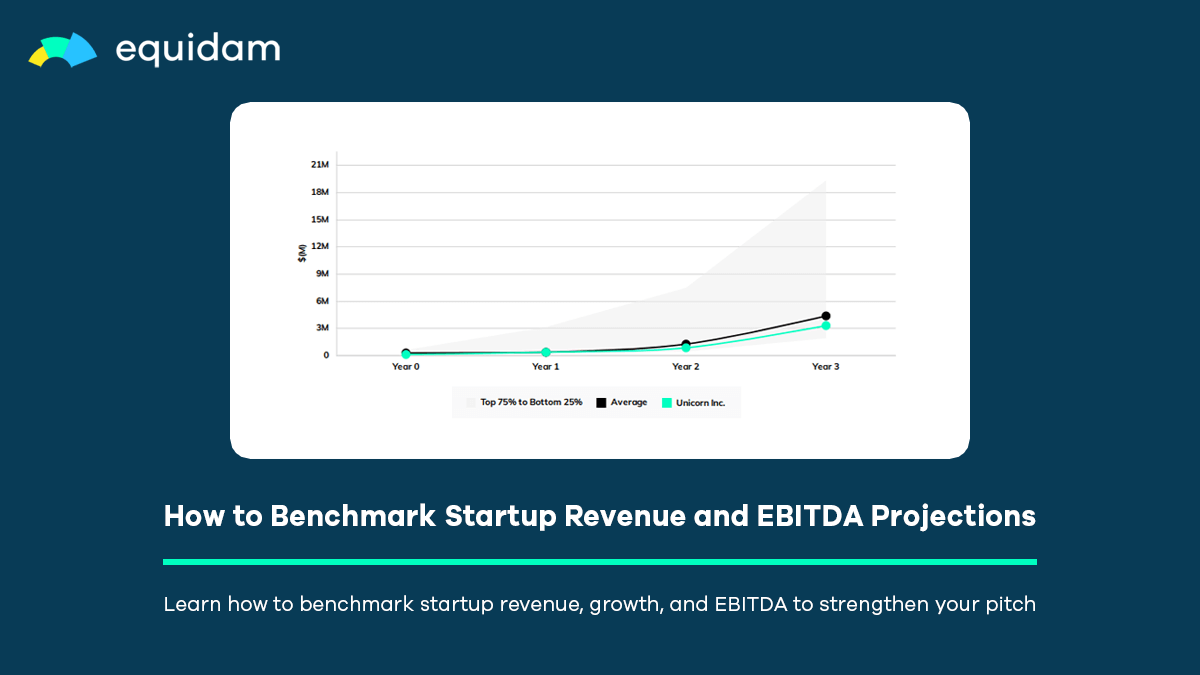

How to Benchmark Startup Revenue and EBITDA Projections

Financial projections form the backbone of startup valuation. While qualitative methods like our…

How to Get a BSPCE Valuation for Your Startup’s Employee Share Plan

BSPCE (Bons de Souscription de Parts de Créateur d’Entreprise) are a special type of employee stock…

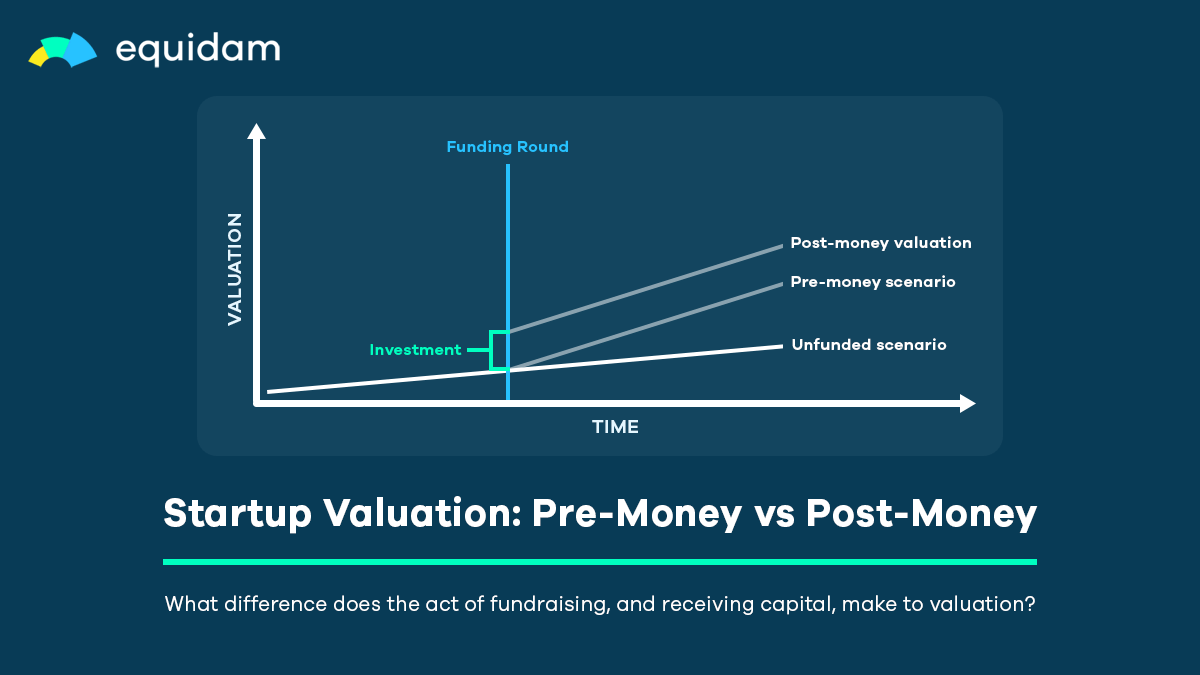

Startup Valuation Explained: Pre-Money vs Post-Money

One of the most fundamental yet confusing aspects of startup fundraising is understanding the…

The Multiple Method: A New Tool for Investor Flexibility

We’re pleased to announce the addition of a new valuation method to the Equidam platform:…

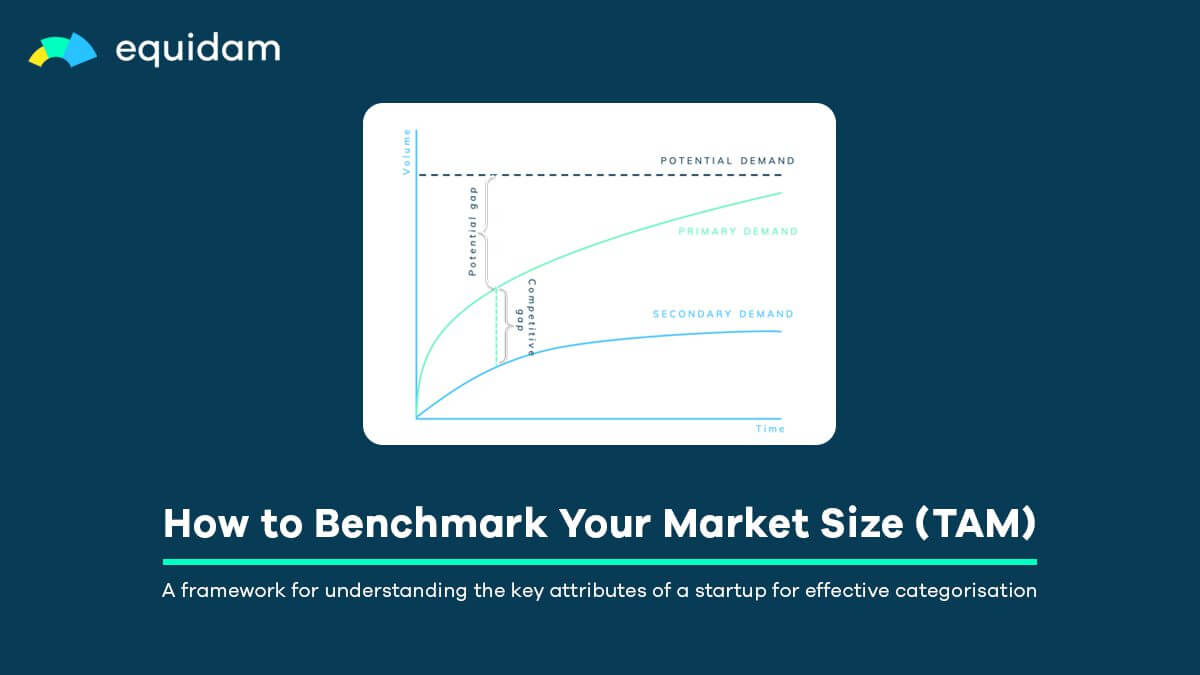

How to Benchmark Your TAM and Build Investor Confidence in Your Market Size

The Role of TAM in Startup Fundraising For startups navigating a funding round, a well-defined and…

How to Categorise a Startup (for Valuation)

Categorisation poses a significant challenge in startup valuation, with investors and founders…