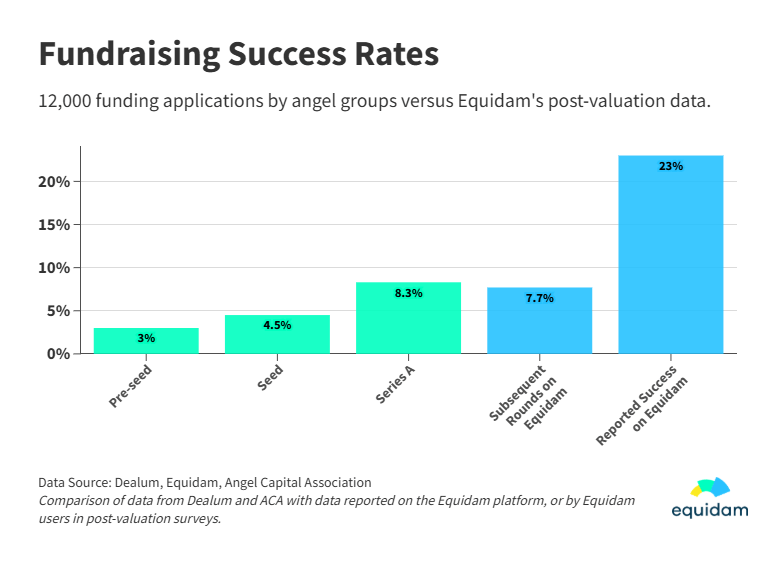

Raising venture capital is notoriously difficult, especially for early-stage startups. Even in boom times, the odds of securing investment are extremely slim for a new founder. Recent data from angel investor networks shows that only about 3% of pre-seed startups manage to raise a first round, rising to roughly 4.5% at the seed stage, 8.3% at Series A, 12.6% at Series B, and 16.4% by Series C. These success rates also fluctuate with market conditions – for instance, the overall funding rate (across all stages) was around 9.2% in 2022 during the peak tech boom, plunged to just 4.3% in 2023 after the market downturn, and has only partially recovered to about 7.3% in 2024. In short, fundraising is an uphill battle for most founders.

However, our recent findings demonstrate that there’s a way to improve your odds; the exercise of startup valuation correlates positively with ultimate fundraising success.

The Power of Valuation Preparedness

Given those daunting odds, any edge can make a difference. One surprising advantage we’ve observed is the effect of going through a rigorous valuation process before fundraising. It turns out that startups whose founders take the time to calculate and articulate a thoughtful valuation (using a platform like Equidam) tend to enjoy significantly higher success rates in raising capital. Our own data at Equidam backs this up. We analyzed outcomes for companies that used our valuation platform and found two compelling signals:

- Post-Valuation Funding Success: In a survey of founders after completing an Equidam valuation, 23% reported successfully raising a funding round subsequently. That’s nearly one in four – a dramatically higher hit rate than the low single-digit market averages for comparable early stages.

- Repeat Valuations Indicating Growth: We also looked at how many startups came back to update their valuation for a new round 9+ months later (implying their initial fundraising was successful). Roughly 8% of companies in this category returned for a second valuation, primarily around the seed stage. This 8% success marker is about double the typical ~4% rate one would expect at Seed, suggesting that founders who leverage a valuation upfront are more likely to reach the next fundraising milestone.

To be clear, correlation isn’t causation – it’s impossible to say, on a case-by-case basis, that the valuation itself directly contributes to closing a funding round. It could be that the kind of founders who do their homework on the terms they would like are particularly high-agency. It might be that the process of getting a good valuation, scrutinising strategies and roadmaps, is a particularly helpful exercise. Either way, the data shows a strong association that shouldn’t be ignored: founders who enter fundraising with a well-grounded valuation in mind tend to outperform their peers.

This finding aligns with broader evidence that thorough preparation and strategy give startups a leg up with investors. For example, startups emerging from accelerators (which emphasize rigorous prep) see funding success rates nearly double those of other companies (5.4% vs. 2.9%), partly because accelerators help “polish the investor pitch” and reduce perceived risk. In the same way, a founder-led valuation exercise can be seen as part of polishing and strengthening your fundraising approach.

Why Does a Valuation Process Improve Fundraising Odds?

So why would going through the motions of valuing your startup make such a difference in fundraising success? Simply put, a founder-led valuation forces you to become more prepared, realistic, and persuasive – all qualities that investors reward. Here are some of the key benefits that explain the fundraising edge:

- Clear Financial Roadmap: Working on a valuation compels you to map out your financial projections, capital requirements, and expected dilution. By modeling your startup’s future revenue, costs, and growth scenarios, you gain clarity on how much money you truly need and what it could make your company worth. This means when you meet investors, you can confidently justify your fundraising ask and show exactly how the cash will be used – a level of preparedness that instantly sets you apart.

- Balanced Story and Numbers: Great startup pitches blend vision with data. As valuation expert Aswath Damodaran says, “Every part of your story should have an associated number, and every number should have a story.” Going through a valuation helps you tie your narrative (the market opportunity, your product’s potential, your team’s mission) to concrete metrics and forecasts. The result is a more compelling pitch that appeals both to story-driven listeners and the metrics-driven skeptics. You’re essentially presenting the best-case scenario for your startup in credible financial terms – answering the investor question of “what happens if things go right?” that every early-stage VC is secretly asking.

- Realistic Valuation (No Deal-Killing Surprises): Nothing derails investor interest faster than an unrealistic valuation ask. By calculating your value using transparent methods and comparable data, you avoid the trap of inflating your numbers with wishful thinking. Investors are much more likely to engage when a founder’s price expectation is backed by logic and solid KPIs, rather than hype. As one fundraising advisor put it, “Show us the numbers before asking for millions.” In other words, a well-substantiated valuation shows that you’ve done your homework and keeps negotiations within reasonable bounds – instead of scaring off investors because you “overpriced” your round and got stuck at the negotiating table.

- Alignment and Transparency: Conducting a valuation and sharing that analysis with potential investors helps reduce information asymmetry between you and them. Typically, investors are more familiar with market comparables, while founders are more familiar with their own business. A collaborative valuation discussion bridges that gap. It “opens up the black box of valuation” and lays bare all your key assumptions for scrutiny and discussion. This kind of transparency builds trust and ensures both sides are aligning on a realistic vision of the company’s future value. Instead of a tense haggling over an arbitrary number, valuation talks become a data-driven dialogue where an investor can understand your reasoning (and maybe apply their own discount as needed). The end result is often a fair price that both parties feel confident about – a crucial step toward closing a deal.

- Investor Confidence in Your Preparedness: Perhaps most importantly, going through a valuation process signals to investors that you are a diligent, well-prepared founder. In fact, academic research finds that perceived founder “preparedness” strongly correlates with funding success – the more prepared founders appear, the more investors are willing to support them. By arriving with a thorough valuation, you show that you understand your business deeply and are serious about its potential. This can greatly improve an investor’s confidence in you. Venture firms often advise founders to go into meetings fully prepared and knowing their numbers – and you’ll certainly achieve that by completing a valuation. Moreover, you’ll be equipped to answer tough questions about your financials and growth assumptions, which can turn investor skepticism into respect. Essentially, you’re proving your competence as a founder, one of the key factors every investor evaluates.

Valuation as a Fundraising Catalyst

Undertaking a startup valuation is not about slapping a price tag on your idea and calling it a day. It’s about immersing yourself in the financial reality of your vision and emerging with a clear story to tell. In this sense, the valuation process is a means to an end – that end being a well-prepared founder and a persuasive case for investment. Founders who embrace valuation as a tool tend to approach fundraising with greater confidence and credibility. Our data shows they often translate that preparation into concrete results in the form of closed funding rounds.

Of course, a valuation alone won’t guarantee you funding – you still need a viable business, a solid team, and all the other ingredients of a compelling startup. However, it does ensure that you’ve thought through your venture’s future in detail. By developing a rational valuation, you are honing the narrative and numeric elements of your pitch in tandem. You’re effectively saying to investors, “Here’s how big this could get if everything goes right, and here’s why the numbers make sense.” That level of preparation helps your startup stand out in a crowded field of pitches.

In an environment where only a tiny percentage of startups succeed in raising capital, investing time in your valuation can tilt the odds in your favor. It leads to deeper insight into your own business and a stronger alignment with prospective investors. As the fundraising climate begins to stabilize post-2023, those founders who combine ambition with analysis – the story and the numbers – will be the ones most likely to hear a yes. And if you need help crafting that data-driven story, you know where to find us at Equidam.