Understanding AI Startups: Moats, Revenue & Diligence

Artificial intelligence is reshaping how work gets done, and the flood of startups riding this wave…

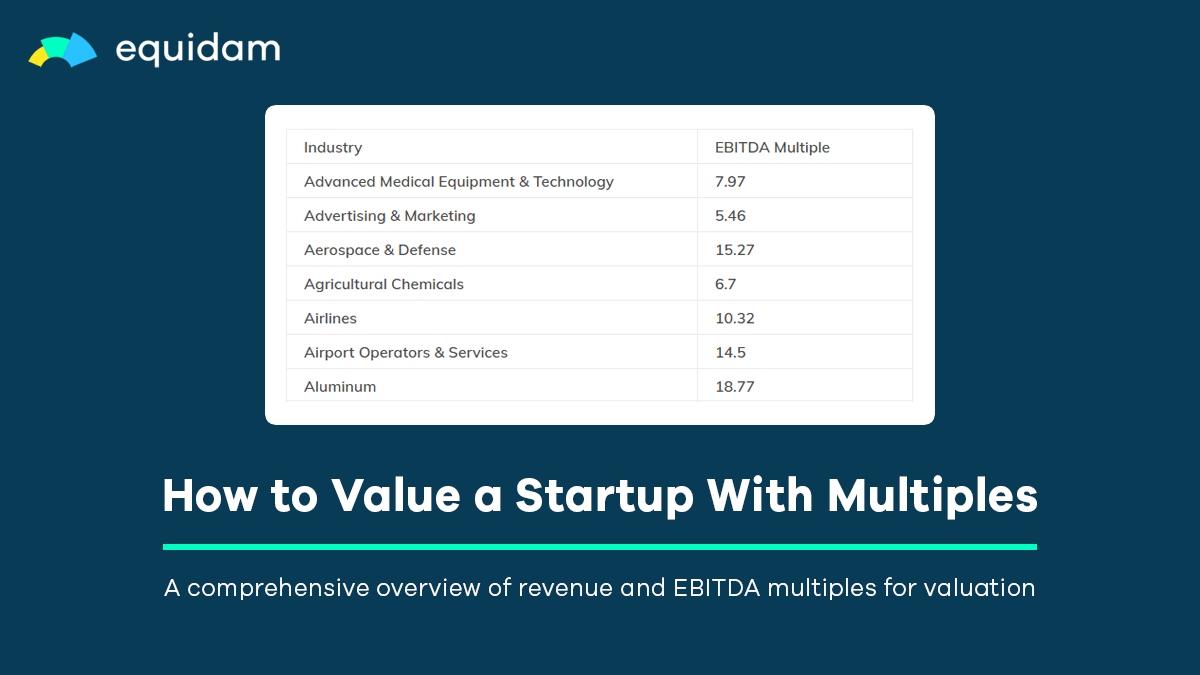

How to Value a Startup with Multiples

Valuation multiples are a simple, powerful way to translate business performance into price.…

Simple Priced Seed Fundraising Documents: Founder Guide

The Series First documents, crafted by Rimon Law partner Brian Dirkmaat, are an innovative…

Top 10 Startup Valuation Platforms for Effective Fundraising

If you’re raising a round, you don’t need an audit memo; you need a valuation you can explain,…

Equidam vs AI Valuation: A Comparison of Startup Valuation Approaches

Valuing a startup is notoriously difficult: early revenue is lumpy, risk is multi-dimensional, and…

Standard Capital's Series A Fundraising Documents: Founder Guide

In startup financing, standardized fundraising documents transform what was once a maze of bespoke…

Equidam vs Excel: A Comparison of Startup Valuation Approaches

Valuing a startup remains one of the most challenging aspects of entrepreneurship and investment,…

Equidam vs Kaaria: Choosing the Best Startup Valuation Platform

Valuing a startup is a complex endeavor, blending quantitative financial projections with…

Choosing the Right Tool: What to Expect from a Top-Tier Startup Valuation Platform

Valuing an early-stage startup is notoriously difficult. With uncertain cash flows and significant…

AI Valuation Explained: Surge AI vs Scale AI

The artificial intelligence sector is currently defined by dizzying valuations and capital raises…