Early-stage valuation has always been about capturing potential before it becomes obvious. For deep tech startups—companies developing breakthrough technologies in areas like quantum computing, advanced materials, biotechnology, and cleantech—this challenge becomes even more complex. Unlike software startups that can iterate rapidly and achieve product-market fit within months, deep tech ventures often require years of development before reaching commercial viability.

Today, we’re excited to announce a significant enhancement to the Equidam platform: the integration of Technology Readiness Levels (TRLs) into our valuation methodology. This update replaces our previous rollout stage assessment with a more granular, industry-standard framework that better captures the development milestones critical to deep tech valuations.

The Deep Tech Valuation Challenge

Traditional startup valuation methods often fall short when applied to deep tech companies. As highlighted in our research on valuation practices and innovation, “Those that could see value where others couldn’t were able to make decisions that resulted in outsized returns. Consider the investors who recognized the potential for online marketplaces in 1997, the space industry in 2002, or crypto in 2012.”

The challenge with deep tech lies in its extended development timeline. While a SaaS startup might launch an MVP within six months, a quantum computing company could spend years developing core technology before any commercial application becomes feasible. Our previous rollout stage framework, while useful for traditional startups, didn’t adequately capture these nuanced development phases that are crucial for investor confidence and valuation accuracy.

What Are Technology Readiness Levels?

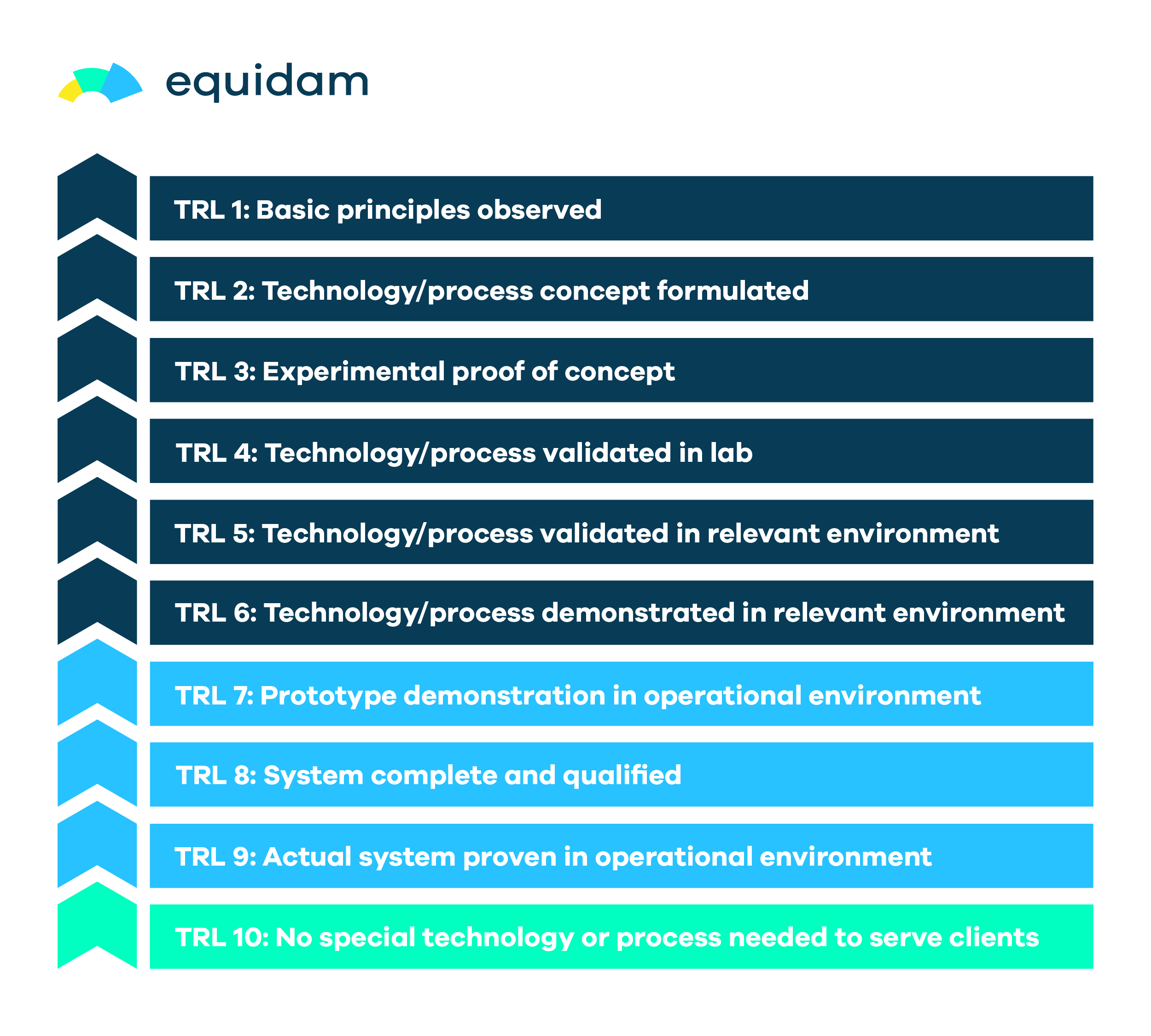

Technology Readiness Levels originated at NASA in the 1970s and have since become the industry standard for assessing technological maturity across sectors from aerospace to energy. The TRL framework provides a systematic methodology for evaluating technology development from basic research through full commercial deployment.

The nine-level scale offers several advantages for startup valuation:

- TRLs provide standardized milestones that investors can understand across different technologies

- Each level represents a significant de-risking milestone, directly impacting valuation

- Clear progression criteria help founders and investors align on development expectations

- TRLs are widely understood by technical investors, particularly those focused on deep tech

The implementation of TRLs on Equidam includes two main changes from the original schema:

- It more intuitively accommodates both hardware and software-based technologies

- It includes a TRL 10, covering products or services which do not require novel technology

Integration with Equidam’s Methodology

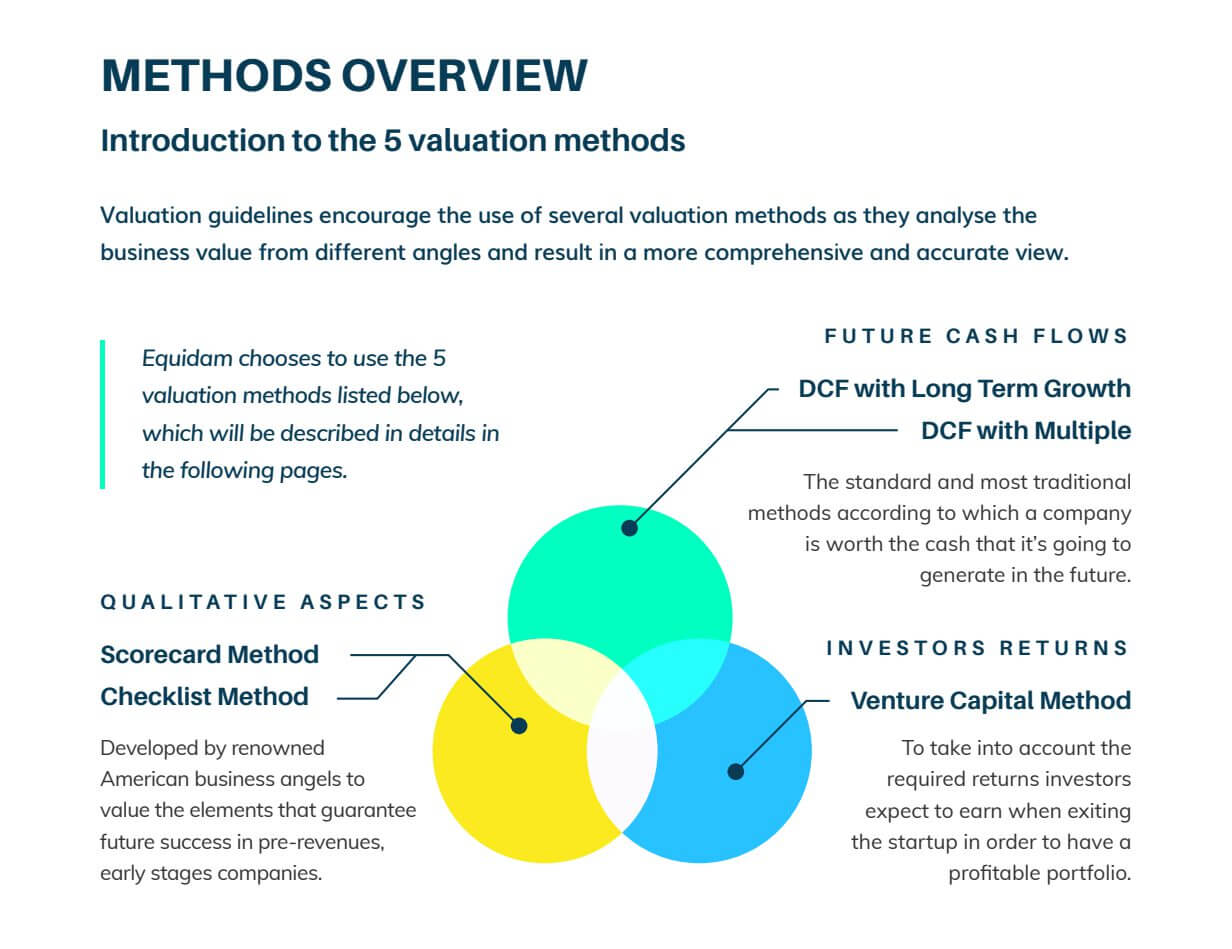

Our five-method valuation approach has always emphasized the importance of qualitative factors in early-stage assessment. The Scorecard and Checklist methods, which form the qualitative foundation of our framework, particularly benefit from this enhancement.

Previously, our “rollout stage” assessment provided a broad categorization of market readiness. The new TRL integration offers several improvements:

Enhanced Granularity

Instead of general categories like “prototype” or “pilot,” TRLs provide nine distinct levels that precisely capture where a technology stands in its development journey. This granularity is particularly valuable for deep tech companies where the difference between TRL 4 (laboratory validation) and TRL 6 (demonstration in relevant environment) can represent years of development and millions in investment.

Risk-Adjusted Scoring

Each TRL represents a different risk profile. Our updated methodology now weights these levels appropriately within our qualitative assessment, recognizing that a TRL 3 startup (proof of concept) carries significantly different risk than a TRL 7 venture (system demonstration).

Better Investor Communication

By adopting this industry-standard framework, founders can more effectively communicate their development status to technical investors who already understand TRL implications. This reduces information asymmetry—a key challenge highlighted in our analysis of founder-led valuations.

Impact on Valuation

This update directly addresses one of our core principles: that valuation should focus on potential over performance. For pre-revenue deep tech companies, TRLs provide crucial indicators of future potential that revenue metrics simply cannot capture.

The integration affects our valuation methodology in several ways:

- Scorecard Method: TRL assessment now contributes to the “Strength & Protection of Product/Service” criterion, providing more nuanced scoring

- Checklist Method: “Product Roll-out and IP Protection” evaluation benefits from standardized TRL benchmarks

- DCF Analysis: TRL-based timeline estimates allow for better interpretation of financial projections, particularly for companies with extended development cycles

Looking Forward

As noted in our research on AI startup valuations, “It’s important to consider the technology’s practical applications and the startups’ ability to execute on their promises.” TRL integration helps bridge the gap between technological innovation and commercial potential.

This update reflects our commitment to evolving our methodology to serve the changing landscape of startup innovation. As more capital flows into deep tech sectors—from quantum computing to fusion energy—having valuation tools that properly assess technological readiness becomes increasingly critical.

For founders in deep tech sectors, this enhancement provides a more accurate reflection of your company’s true stage and potential. For investors, it offers better risk assessment and comparison capabilities across technical ventures.

The integration of TRLs represents another step in our mission to provide transparent, comprehensive valuation methodologies that support better capital allocation decisions. By capturing the nuanced reality of deep tech development, we’re helping ensure that breakthrough innovations receive the funding and valuation they deserve.