A few weeks ago, we built and released a convertible note calculator. It’s useful for making scenarios and forecast your equity outcome, but we gave it a twist. Most calculators out there are static, they perform what you, with little financial knowledge, could build in excel in about an hour. Ours is dynamic, it gives data intelligence right back to the user.

The tool provides average discount rates and valuation/cap ratios from all people that used it, thus giving a pretty interesting sample of statistics to look at.

The things that we found looking at those data with maybe a more critical eye are what I’d like to summarise below.

Average Discount Rate for Convertible Notes

When we created the calculator, we had a big question.

If you had to price a convertible note, what is the discount you would give to investors?

Seems like a fair question. And fairness is everything in these negotiations. So what is a fair discount for your investors? Or what is the sentiment in the market for these terms? What’s the length of the period between the issuance of the convertible note and the conversion?

Without further ado, the average Discount Rate For A Convertible Note is 32,59%.

Across a sample of 552 users, it turned out to be pretty stable, with only 35,51% between 30 and 90 and outliers that would give 100% discount to investors (:))

We can see that the actual median is 24,5% and that the distribution is skewed to the left, meaning low discounts are more likely than larger ones.

These results are in line with our initial ideas and with the little information that you can find on the Internet. And we have been really pleased about it. The issue of convertible note discount rates came up in both internal discussions in Equidam and talks we had with other founders. Our hope is that these average statistics will help many founders and investors in achieving a fair compromise when it comes to pricing a convertible note.

But we didn’t want to stop here, ok the discount is important, but it is not the only parameter of a convertible.

When discussing it with the team, we were sort of wandering the same things about the valuation cap.

How do people price their convertible note cap?

We were curious to investigate this because it could have several interpretations. It seems that convertibles are used either for a quick bridge financing with a round in sight, or to avoid the valuation discussion at seed level (a pretty good reason to choose convertibles in our opinion, more here). In these two cases then, how would people set the cap? Would it be really close to the target valuation? Or would it be much lower, thus giving seed investors a higher “premium”?

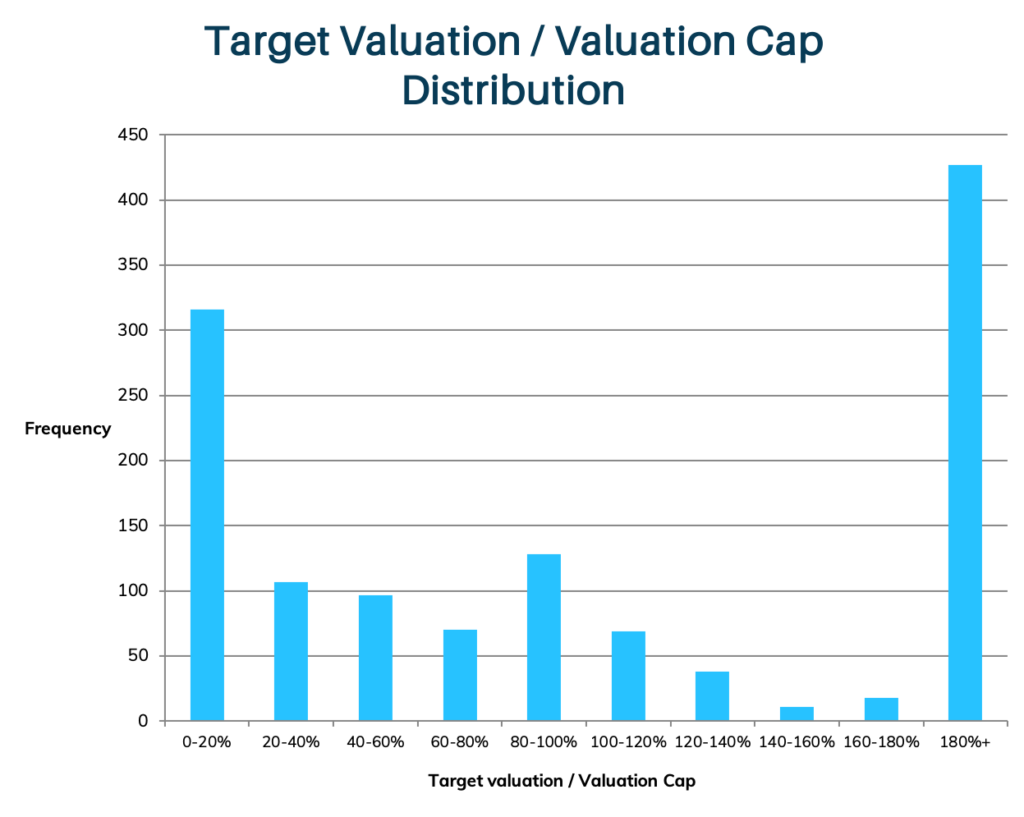

Again, the data came to our rescue. As easily understandable by the chart below, people tend to do two things- either price the cap much higher than their target valuation (target/cap of 10 to 20%), or at about the same price (100%).

Interestingly enough, there is a probability that these two behaviours match how people use convertible notes.

When used for a bridge loan, the cap should be set at about the forecasted valuation (hence the 100%). The convertible holders are going to be debtors for a few months, but not long enough to have a high uncertainty on the follow-up valuation.

When used for seed funding, the main use of the cap is to prevent large seed losses if the company grows extremely fast, and raises at large valuations. In this case, setting a cap of 5 or 10 times the target valuation (10-20%) has exactly that goal.

What is your idea on these ratios? How did you price your convertible notes? Also feel free to try the tool and check out the live charts yourself here!

It is interesting to see that these results are also in line with conjectures in the startup world, but also that, if we are right, convertibles are very much used for seed funding. Actually, assuming that we have a representative sample of worldwide startups, it seems that convertible notes are used 33,02% of the times for seed funding and 62,53% for bridge financing.

Conclusion

Convertible notes are still largely used in early stage funding. Their average discount rate (according to our data) is 32,59% and it is based on 552 data points. We hope this information will be useful to founders and investors in their negotiations and we’d love to hear what you think about it!