Venture capital is built on staged commitments. Rather than betting the farm up front, investors release capital as companies reach milestones, with an implied step-up in valuation at each round. It’s a smart risk-management strategy—but in practice it can devolve into a signaling game. Prices drift toward “what the market is paying,” conviction is outsourced to social proof, and everyone spends cycles renegotiating terms because no one is truly aligned on *why* a given price today makes sense relative to the future.

There’s a better way. Treat valuation as the transparent financial “source code” of the startup’s story—*what happens if things go right?*—and then make the downstream financing plan an explicit part of that model. That is exactly what Equidam enables.

This article explains how Equidam helps founders and investors understand the trajectory of valuation growth, why this matters for efficient staged financing, and how to put it to work immediately.

Valuation as a Coordination Tool, Not a One-Off Number

Three misconceptions get in the way of productive conversations:

- “Valuation is transient.” Many assume each round requires a fresh, ground-up reprice. In reality, a good valuation includes a forward view: clear drivers, milestones, and an expected path of value creation. Updating that view is a matter of revising assumptions—not starting from zero.

- “Valuation = price.” Price is an outcome of a negotiation. Valuation is the disciplined assessment of a company’s future cash-generating potential, discounted to today with appropriate risk and return expectations. When price drifts far from valuation, systemic fragility creeps in.

- “It’s too uncertain for early stage.” All investing is uncertain. The only question is whether assumptions are explicit and comparable—or implicit and unexamined. Making them explicit increases signal quality and shortens cycles.

Equidam operationalizes this perspective. It translates the startup’s narrative and data into a set of linked assumptions: forecasted performance, risk, expected VC returns, and terminal outcomes. From there, it produces both a current valuation *and* a trajectory of expected valuations across the forecast horizon.

From Today’s Valuation to Tomorrow’s Entry Points

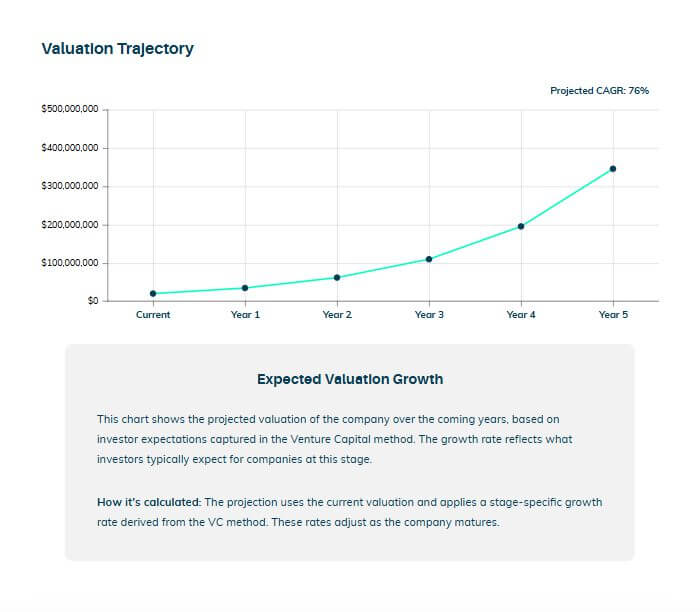

Consider a simple example. Suppose Equidam values a Seed-stage company at just over $20M today. Because the valuation is grounded in a forecast and a target rate of return, Equidam can also show the expected valuation growth over time—the curve the company is “supposed” to ride if milestones are met.

On that trajectory, if the company raises a Series A around month 30, the implied valuation might be ~$85M. This is not a prophecy; it’s a coordination device. It tells founders and investors: *If the plan is on track, this is a healthy, risk-adjusted entry price for the next round.*

Instead of hand-waving, everyone now has a shared frame:

- What revenue, margin, and efficiency improvements underpin the curve?

- How sensitive is it to CAC, payback, or burn?

- What if hiring slows, or the market shifts? What does that do to the next expected entry point?

With Equidam, these become fast, structured adjustments, rather than philosophical debates.

Why This Makes Downstream Fundraising Faster

1) Alignment on Drivers, Not Just Numbers

Equidam’s approach forces clarity on what actually creates value: growth, margins, capital efficiency, and risk. When the next round approaches, investors can evaluate relative performance against the plan: maybe top-line ARR is on track but costs are running high; maybe revenue lags but gross margin and retention are well ahead. The model shows how those tradeoffs affect the curve—and therefore the round’s sensible price band.

2) Built-In Price Discovery for the Next Investor

Downstream VCs don’t have to reconstruct the logic from scratch. The prior round’s model already includes a discount rate matching expected venture returns. If the company is broadly on track, the updated trajectory implies a price that still offers the next investor a fair discount to the future. That reduces the time spent “agonizing over terms” and shortens the path from first meeting to term sheet.

3) Reduced Sensitivity to Market Whiplash

When pricing is purely “what similar companies are trading at,” booms and busts whipsaw founders and LPs alike. Tying entry points to a fundamental trajectory insulates both sides from herd dynamics. It also helps allocate capital to sectors that may start slowly but compound into outsized value—deep tech, bio, climate—precisely because the work connects near-term milestones to long-term outcomes.

4) A Common Language for Syndicates

If venture is closer to bridge than poker, as the coordination metaphor suggests, then co-investors should be reading the same bidding system. Equidam gives syndicates a shared worksheet: assumptions, sensitivities, and the resulting path. That curbs the unproductive “signaling spiral” and replaces it with transparent conviction.

How Equidam Builds the Valuation Trajectory

While Equidam includes multiple methods, the venture-style perspective is intuitive:

1. Narrative → Forecast. Translate the plan into drivers: customer acquisition, conversion, retention, pricing, unit costs, opex, hiring. Equidam structures this forecast at the right fidelity for early-stage companies.

2. Terminal Value & Target Returns. Estimate a terminal outcome consistent with the story (e.g., steady-state profitability or an exit multiple), then apply an expected VC rate of return to discount that future back to today. This pins the *entry point* to a risk-adjusted future—exactly what investors want.

3. Stage-Adjusted Growth Expectations. Growth rates aren’t static. Equidam reflects how expectations typically moderate as a company matures, which produces a smoother, more realistic curve rather than a straight-line extrapolation.

4. Scenario & Sensitivity Analysis. Small changes in churn, gross margin, or payback can move the curve meaningfully. Equidam makes it easy to run downside, base, and upside cases so everyone sees the range—and the levers that matter most.

The outcome is twofold: a point estimate (today’s valuation) and a path (expected valuations over time). The path is the power.

Practical Workflow for Founders

Practical Workflow for Founders

You can adopt this approach in a single afternoon and improve it continuously:

- Write the one-page story. Problem, product, go-to-market, and the 3–5 milestones that transform risk into value over the next 24–36 months.

- Enter the core drivers in Equidam. Start with pragmatic assumptions. If you don’t have perfect metrics, use ranges and be explicit about what’s uncertain.

- Set investor-realistic return expectations. Choose discount rates appropriate for your stage and risk. Equidam handles the math so your logic is clear.

- Generate the trajectory & round price bands. Note where the model suggests healthy Series A/B entry points if you’re on track—and what “on track” means in drivers.

- Create two alternate scenarios. A conservative case (slower growth, tighter burn) and an upside case (better retention, faster sales cycles). Observe how the next round’s price band moves.

- Share the model in your data room. Invite your current and potential investors to review the assumptions. Encourage them to tweak inputs and see the resulting path. This turns negotiation into collaboration.

- Track actuals and update quarterly. When the numbers hit, revise the model. If something deviates, show how you’ll correct course and what that does to the curve.

This cadence converts valuation from an episodic event into an operating rhythm—a feedback loop between plan, performance, and capital formation.

Practical Workflow for Investors

For lead and follow-on investors, Equidam becomes an underwriting and portfolio tool:

IC-Ready Write-ups. Move from “market says X ARR multiple” to “at these drivers and target returns, the implied entry is Y.” Your partners will thank you.

Follow-On Discipline. Compare each company’s realized path against its prior trajectory. If performance is inside the cone, support the round quickly. If it’s outside, diagnose which drivers moved and whether the new plan still clears return hurdles.

Downstream Partner Alignment. Share the trajectory—as a living artifact—with prospective Series A/B partners. It clarifies what “good” looks like and shortens diligence.

Sector Inclusion. For non-SaaS or science-heavy startups, replace blunt ARR heuristics with value-linked drivers. This broadens your opportunity set without compromising discipline.

What About Uncertainty?

Forecasts will be wrong. That’s not a failure; it’s the point. The curve is a relative yardstick, not a contract. It lets you say, “We’re behind on revenue, but gross margin improved faster than planned and CAC payback dropped by two months—so the Series A price band is still justified.” Or, “Burn and CAC both rose; our updated band is lower, and here’s the plan to recover.”

Because Equidam makes updating cheap and fast, uncertainty becomes manageable. You *expect* to revise; you just do it deliberately, with shared facts.

Results: Faster Rounds, Better Capital Allocation

When founders and investors adopt this method, three things happen:

- Rounds close faster. The next investor’s entry point is not a mystery; it’s grounded in the last model and the latest actuals. Negotiations shrink to adjusting assumptions and confirming performance.

- Capital is staged more rationally. Milestones are tied to value creation, not vibes. Everyone knows what must be true for the next step-up to make sense.

- Risk is priced, not avoided. Rather than defaulting to herd consensus, investors can fund novel innovation with confidence because the path from early uncertainty to durable value is explicit.

The Equidam Advantage

Plenty of spreadsheets can spit out a number. Equidam’s advantage is that it packages the right level of structure for early-stage reality, aligns it with venture-style return logic, and produces a clean, shareable view of the valuation trajectory. That turns valuation into a collaboration surface for staged capital deployment.

If you want the staged nature of venture to work in your favor (less time on haggling, more time on building) start modeling the path, not just the point. Use Equidam to show where value is headed, what must be true to get there, and how the next investor earns a fair return for joining the journey.

That’s how you coordinate capital with clarity.

Practical Workflow for Founders

Practical Workflow for Founders