In 2024–25, the most informative market prices for late-stage startups increasingly come from secondary transactions (platform trades, company-run tender offers, and structured liquidity programs) not primary rounds. For founders, CFOs, and investors, that means re-anchoring valuation, 409A, and board expectations to actual clearing prices where insiders and outside buyers meet.

Why now

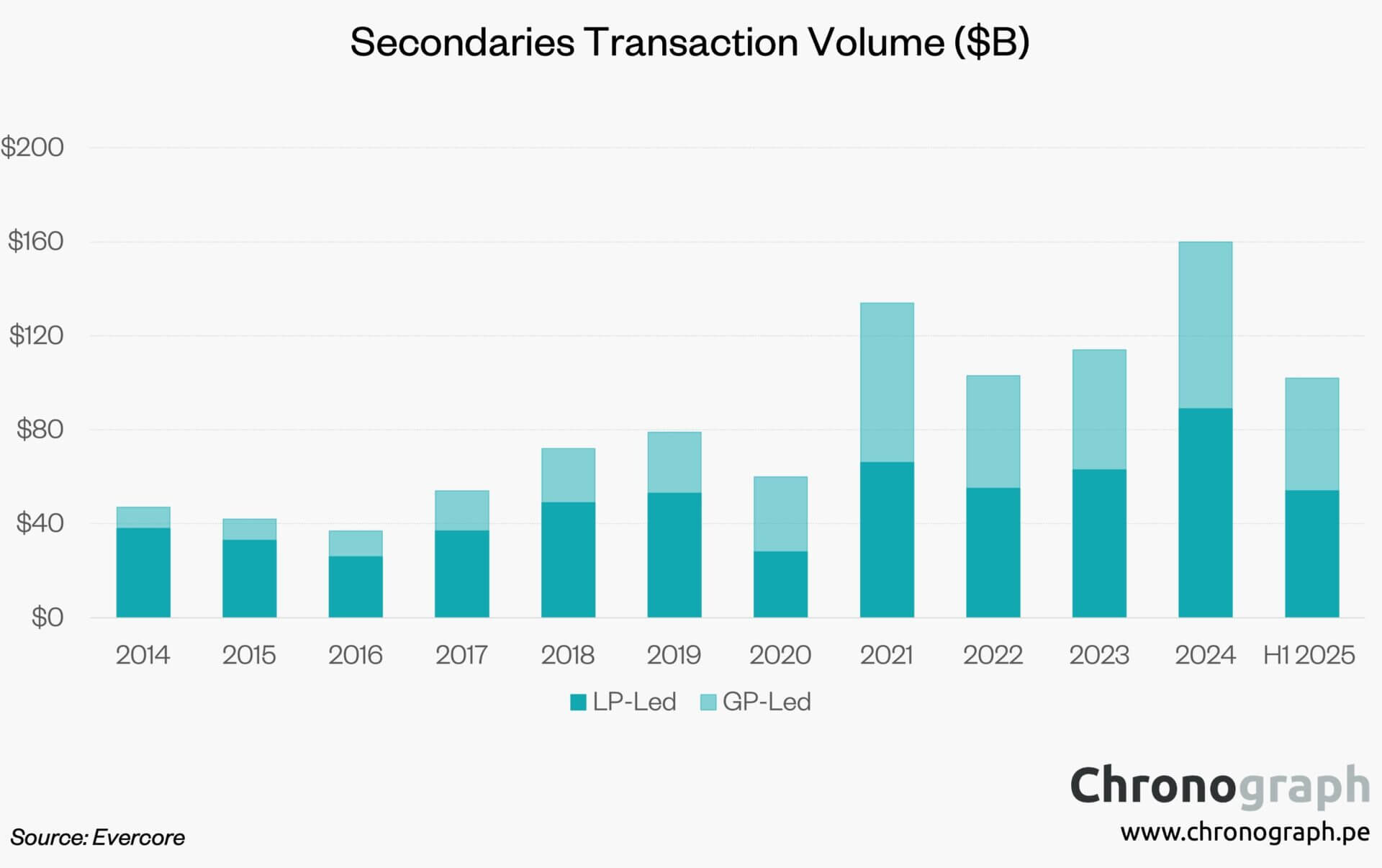

- Primary rounds are fewer, slower, and more selective, especially outside AI. Meanwhile, secondary activity (LP- and GP-led, plus company-run tenders) has surged to record levels, giving markets a thicker tape to read. Evercore and Jefferies both describe 2024–H1’25 as record/near-record years for secondaries, with robust buyer demand and growing program counts.

- Company-run tender offers have become a mainstream liquidity tool. Nasdaq Private Market reports that in 2024, proceeds raised via secondary tender offers exceeded VC-backed IPO volume, and by Q4 2024 nearly a quarter of NPM-facilitated programs priced at a premium to the last preferred round (up from 0% a year earlier). .

- The market is actively repricing the 2021–22 vintages. A recent WSJ readout of Forge data shows shares of companies that last raised in 2021 trading at a median 62% discount to their prior round; 2022 vintage at –59%; by contrast, 2024 vintages trade at only about an –8% discount. Translation: secondaries are where the air comes out (or not).

What these transactions actually tell us

- They reveal current marginal buyers’ willingness to pay for common or preferred, net of current sentiment, growth durability, and exit timing. When programs are competitive—multiple buyers, narrow bid/ask—the implied equity value from secondaries often trumps stale primaries as the best observable input.

- Tender timing matters. Carta’s data shows that tenders conducted immediately after a priced round commonly clear with no discount to that round—management is effectively “printing” a reference price while liquidity demand is highest. The further you are from that round (or the softer the operating data), the higher the odds of a discount.

- LP/GP-led secondaries pull through into late-stage company marks. As buyout and growth funds trade at tighter discounts to NAV than in 2023, the look-through to single-name late-stage tech improves. That doesn’t set your company’s price, but it pushes allocators to rely on secondaries as validation for their own marks and follow-ons.

The 409A and financial-reporting angle

A significant shift over the past year: valuation guidance is pushing practitioners to put more weight on observable secondary prices (when sufficiently frequent, close to the measurement date, orderly, and relevant to the security being valued). The AICPA’s draft updates to its Valuation of Privately-Held-Company Equity Securities Issued as Compensation expand how secondary transactions should be evaluated and calibrated under ASC 820’s “maximize observable inputs” principle—meaning company-run tenders, recurring platform prints, and repurchases can (and often should) move FMV.

Implications:

- If a common-stock tender or repeated common trades occur near the valuation date, expect a tighter gap between 409A FMV and those trade prices (after adjusting for rights/privileges vs. preferred).

- If secondary trades are sporadic, tiny, insider-only, or clearly not orderly, a practitioner may still anchor on income/market methods—with qualitative consideration of the trades.

- Company involvement in employee sales (pricing, selection, or matching) can trigger compensatory accounting under ASC 718 if sale prices exceed FMV; this is increasingly scrutinized. (Plan your controls and documentation.)

How to use secondary signals in your valuation stack

- Build a “secondary tape” section in your valuation memo.

- Summarize every tender and platform print for the past 12–18 months: date, size (shares and % float), buyer type, security (common vs. preferred), any transfer restrictions, and whether the company was involved.

- Note proximity to primary rounds, changes in financial KPIs, and any contemporaneous corporate actions (down-rounds, repricings, debt raises).

- Rights-adjust the prices.

- If you’re comparing a preferred-share secondary to common FMV (409A), adjust for liquidation preferences, dividends, conversion, and protective provisions.

- Conversely, if your print was in common with transfer restrictions, consider a marketability adjustment when bridging to a fully transferable hypothetical common.

- Cross-check against tenders and auctions.

- NPM-facilitated auctions and company tenders with multiple institutional bidders are stronger evidence than ad-hoc bilateral transfers. Where auctions are pricing at premiums/near par to the last round, argue for narrower discounts to preferred in your option-pricing or PWERM models.

- Recalibrate comps and cost of capital to the actual exit path.

- If your investor base expects liquidity via tender before IPO, management projections should reflect realistic dilution/capitalization outcomes from buybacks or new investor blocks.

- Adjust discount rates and terminal value assumptions based on observed buyer return hurdles in secondaries (often higher than in euphoric primaries).

A practical playbook for founders & CFOs

- Quarterly Secondary Dashboard: Track bid/ask, volumes, and spread across key platforms (Forge, NPM, Caplight, Hiive). Include a lane for company-run tender windows and ROFR activity.

- Policy & Controls: Pre-approve windows, eligibility, and information symmetry for employee sales. Document why a transaction is not compensatory if you’re facilitating it.

- 409A Cadence: If you have meaningful secondary prints (or are planning a tender), pull forward your 409A update to keep grants compliant and avoid surprise non-cash comp.

- Narrative Management: If secondaries show a 2021-vintage markdown, explain it. Investors know this movie; demonstrating capital efficiency and milestone traction against a lower base can raise credibility. The market is already pricing the gap: 2021/22 vintages at steep discounts, 2024 at single-digit discounts. (Wall Street Journal)

- Tender Strategy: To minimize discount drift, align tenders close to an evidence-rich primary or a catalyst (major customer, profitability milestone). Carta’s evidence suggests minimal discounts when tenders follow directly after primaries.

What this means for investors

Secondaries are the leading indicator. When you see repeated prints at a given level, that’s the market’s best guess at the clearing price today—use it to challenge “headline” valuations.

- Portfolio triage: Pair secondary prints with operating data to bucket companies into (a) “validated at/near par,” (b) “viable at a discount,” (c) “needs recap.”

- Marking discipline: For funds carrying 2021-era marks, leaning on recent secondary evidence (especially organized tenders/auctions) improves audit defensibility and LP trust.

The bottom line

The private-market “tape” no longer lives only in primary rounds and IPO filings. In 2024–25, secondary markets are where price discovery actually happens, from institutional LP/GP-led deals to company-orchestrated tenders and platform trades. Treat those prices as first-class signals in your valuation, 409A, and fundraising strategy—and you’ll stay aligned with how the market is really underwriting risk today.

Selected sources: Evercore H1’25 Secondary Market Review; Nasdaq Private Market State of the Private Market 2025; WSJ on 2021/22 vintage discounts using Forge data; Carta tender-offer analysis; Jefferies H1’25 Global Secondary Review.