One of the most fundamental yet confusing aspects of startup fundraising is understanding the difference between valuation, pre-money valuation, and post-money valuation. While these terms are often used interchangeably, they represent distinct concepts that can significantly impact your fundraising strategy, dilution calculations, and investor negotiations.

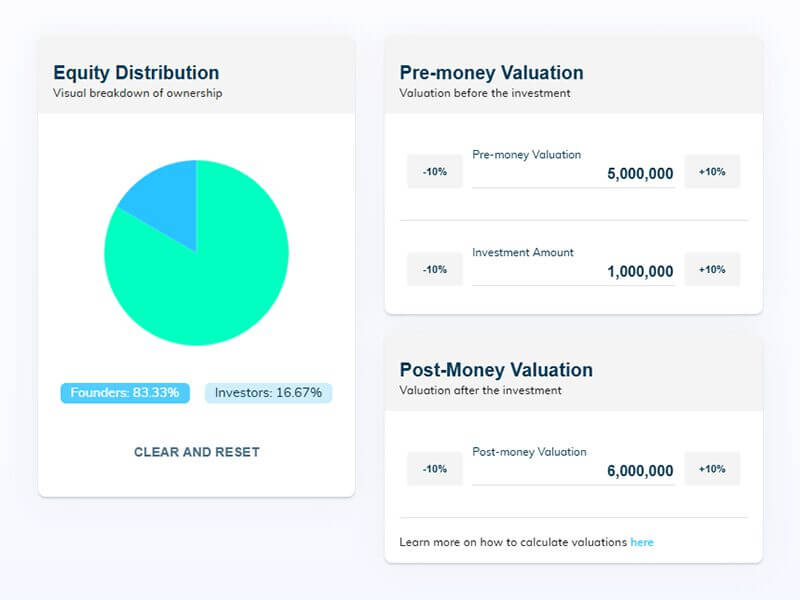

This guide will clarify these three critical concepts, explain how they work in practice, and help you navigate fundraising conversations with greater confidence. You can also use our pre-money vs post-money valuation calculator to experiment with different scenarios and the resulting dilution.

What is Valuation? The Foundation of Company Worth

At its core, valuation represents the economic worth of your company at a specific point in time. It’s an assessment based on your startup’s future potential, incorporating factors such as:

- Future cash flows: The money your company is expected to generate

- Growth trajectory: Your projected path to scale and market expansion

- Risk factors: The uncertainties and challenges that could impact success

- Market opportunity: The size and accessibility of your target market

- Team strength: The capability and track record of your founding team

- Competitive position: Your defensibility and unique advantages

Importantly, while valuation is fundamentally forward-looking, it’s also informed by past achievements. Reached milestones, current traction, and demonstrated progress all help de-risk your vision for the future, making your projections more credible to investors.

When is a standard valuation used?

- Employee stock option plans (409A valuations in the US)

- Acquisition scenarios

- Strategic planning and internal assessment

- Any valuation exercise independent of fundraising

Pre-Money Valuation: Your Worth Before Investment

Pre-money valuation is specifically used in the context of fundraising and represents your company’s value immediately before new investment capital is added. However, this concept is more nuanced than it initially appears.

The Critical Nuance: Future Plans with Present Value

When calculating a pre-money valuation, the financial projections and growth assumptions already incorporate the capital you plan to raise. If you’re seeking $1 million in funding, your pre-money valuation is built on a future scenario that assumes:

- That $1 million will be deployed for growth initiatives

- Additional hires will be made with that capital

- Marketing spend will increase to drive customer acquisition

- Infrastructure investments will support scaling

The key distinction: While the growth enabled by this capital is factored into the valuation, the actual cash hasn’t been transferred to your company yet.

Example in Practice

Let’s say your startup has a pre-money valuation of $5 million based on raising $1 million. This $5 million valuation assumes you’ll use that $1 million to:

- Hire 3 additional engineers

- Launch a marketing campaign

- Expand to two new markets

- Build out your sales infrastructure

The valuation reflects the expected value creation from these activities, but your bank account doesn’t yet contain the $1 million to execute them.

Post-Money Valuation: Your Worth After Investment

Post-money valuation is straightforward: it’s your pre-money valuation plus the amount of capital raised.

Formula: Post-Money Valuation = Pre-Money Valuation + Investment Amount

Using our previous example:

- Pre-money valuation: $5 million

- Investment raised: $1 million

- Post-money valuation: $6 million

The post-money valuation represents your company’s worth once the investment has been completed and the cash is in your bank account.

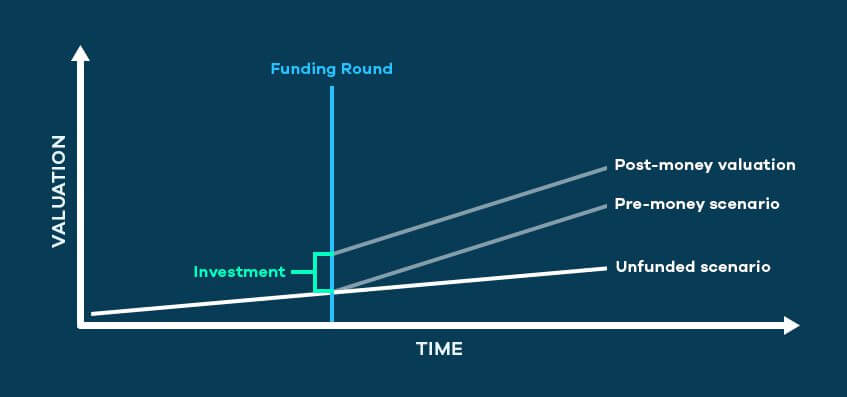

The Timeline: How Valuation Changes Around Funding

Understanding the timeline helps clarify these concepts:

Immediately Before Funding Round: Your company is worth $5 million (pre-money), assuming investors believe in your vision and plan for deploying their capital.

Immediately After Funding Round: Your company is worth $6 million (post-money) because you now have both the original business value and the additional $1 million in cash.

Alternative Scenario (No Fundraising): If you conducted a valuation without any fundraising context, it might only reach (e.g.) $3.5-4 million because:

- You can’t factor in growth from additional capital you don’t have

- You can’t include the value of cash that won’t be added to the business

Why These Distinctions Matter for Founders

1. Dilution Calculations

Your ownership dilution is calculated based on pre-money and post-money valuations:

Dilution Formula: Investment Amount ÷ Post-Money Valuation = Investor Ownership %

In our example: $1M ÷ $6M = 16.67% investor ownership

This means you (and existing shareholders) will be diluted by 16.67%.

2. Negotiation Strategy

Understanding these concepts helps you:

- Articulate your value: Explain how the investment will create value beyond just adding cash

- Justify your ask: Demonstrate that your pre-money reflects realistic growth enabled by the capital

- Compare offers: Evaluate different investor proposals on equal terms

3. Future Planning

These valuations set expectations for:

- Next round pricing: Your post-money becomes a baseline for future valuations

- Employee equity: Stock option strike prices are often based on current valuations

- Strategic decisions: Understanding your value helps with acquisition offers and partnerships

Common Pitfalls to Avoid

Pitfall 1: Confusing Pre-Money with Standalone Valuation

Don’t assume your pre-money valuation represents what your company is worth without the planned investment. The pre-money already assumes you’ll receive and deploy that capital effectively.

Pitfall 2: Ignoring the Growth Assumption

If your pre-money valuation is based on aggressive growth enabled by the funding, ensure you can credibly execute that plan. Investors will scrutinize whether the projected value creation is realistic.

Pitfall 3: Focusing Only on the Numbers

While understanding the mechanics is important, remember that valuation is ultimately about aligning on your company’s future potential. The conversation should center on your growth strategy, market opportunity, and execution capability.

Practical Application: Using These Concepts in Fundraising

1. Prepare Your Narrative

When presenting to investors, clearly articulate:

- Your current traction and achievements

- How the investment will accelerate growth

- The specific value creation enabled by their capital

- Why your pre-money valuation reflects this enhanced potential

2. Model Different Scenarios

Consider how different funding amounts might affect your valuation:

- Scenario A: Raise $500K for gradual growth

- Scenario B: Raise $1.5M for aggressive expansion

- Scenario C: Raise $3M for market dominance

Each scenario should have corresponding growth assumptions and valuation implications.

3. Benchmark Wisely

When using comparable companies for context, ensure you’re comparing:

- Similar stages of development

- Comparable capital deployment strategies

- Analogous growth trajectories

- Similar market conditions

Building Confidence Through Clarity

Understanding the distinction between valuation, pre-money, and post-money empowers you to:

- Negotiate more effectively by speaking the same language as investors

- Make informed decisions about funding amounts and dilution trade-offs

- Set realistic expectations for your company’s growth trajectory

- Communicate value more clearly to potential investors

Remember, these concepts are tools to facilitate productive conversations about your company’s future. The goal isn’t to maximize any single number, but to find fair terms that align all parties on a shared vision for success.

Key Takeaways

- Valuation is your company’s worth based on future potential, used for general purposes

- Pre-money valuation assumes growth from planned investment but excludes the cash itself

- Post-money valuation includes both your company’s value and the invested capital

- Context matters: The same company can have different valuations depending on funding scenarios

- Focus on fundamentals: Use these concepts to facilitate discussions about value creation, not just price

By mastering these distinctions, you’ll approach fundraising with greater confidence and clarity, enabling more productive negotiations and better outcomes for your startup’s future.