Early-stage founders often treat “country” as a paperwork detail: pick your HQ and you’re done. In reality, geography shapes the economics investors are underwriting. Country choice influences the discount rate that powers a DCF, the survival curve applied to your forecasts, the corporate tax that flows into cash flows, and the local pricing anchors investors use when deals are scarce or data is noisy. Get the region wrong and you risk telling an incoherent story—either over- or under-pricing the very risk the round is supposed to finance.

See how valuations have shifted globally in our regular Valuation Delta™ report series.

This article unpacks the core regional drivers of valuation, explains why coherence matters more than cosmetics, and offers a practical way to frame cross-border cases. Where helpful, we reference the principles laid out in Equidam’s methodology and sample report, because they mirror how many investors actually think about risk and price.

The four big regional levers

- The discount rate is local risk, quantified

At its core, the cost of equity is risk-free rate + beta × market risk premium (MRP)—a CAPM framing that depends on country inputs. The risk-free rate typically comes from the 10-year government bond in your country, and the MRP is calculated for the country where the company is based. Both figures are refreshed periodically, and together they determine much of your discount rate. Two companies with identical forecasts but different countries can therefore have very different present values, simply because investors demand higher returns in markets with higher sovereign yields or risk premia. - Survival curves reflect local company durability

Most DCFs quietly assume survival. Early-stage reality is harsher, so many professional approaches weight projected cash flows by country-level survival rates derived from national statistics offices. A higher local failure probability reduces expected cash flows and, by extension, valuation. - Taxes flow through to free cash flow

Default corporate tax rates are country-specific, and they affect net profit and free cash flow even when top-line growth looks great. Whatever jurisdiction you actually pay in should match the tax logic in your model (or be explicitly overridden). - Local fundraising anchors shape price discovery

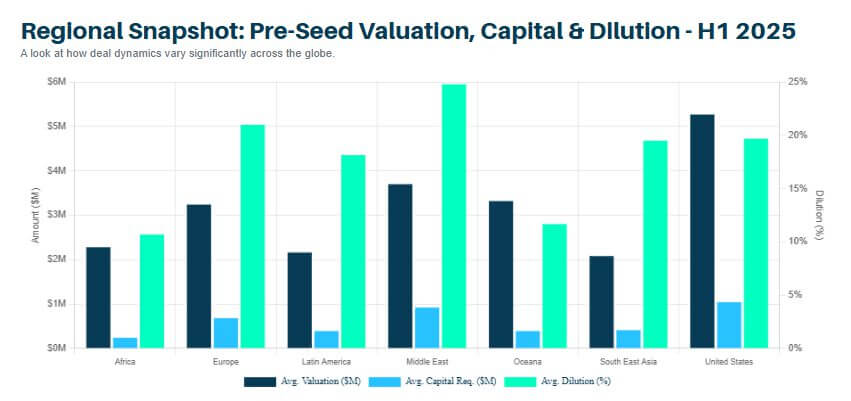

When forecasts are slim and comps are messy, investors lean on country/region benchmarks—what similar companies have recently raised at pre-seed and seed. Methodologies based on average or maximum pre-money levels use country-level deal data, refreshed twice a year, and then adjust up or down based on qualitative traits. These anchors don’t “decide” the value, but they frame negotiations.

A simple rule of thumb

Choose the country where your business actually “lives” economically. That typically means the country where you operate, hire, and where your near-term customers and revenue will come from. Why? Because the country determines your risk-free rate, MRP, survival curve, and tax defaults, and those should match the risk and cash-flow reality investors are underwriting.

Put differently: pick the country that best captures operating and market risk—not just where the holding company is incorporated.

Decision guide for cross-border startups

Use this quick, founder-friendly checklist to resolve tricky situations:

- Revenue locus (next 24–36 months): Where will most revenue originate? This should weigh heavily: survival rates and the discount rate should reflect the market you’re executing in.

- Team and cost base: Where are you building and spending? That affects costs and taxes (and often the practical risks that survival rates are meant to capture).

- Tax residency: Ensure your default corporate tax matches your real tax jurisdiction.

- Local fundraising benchmarks: For Scorecard and Checklist, use the geography that reflects the funding market you actually compete in; those anchors are taken from country/region-specific activity and are updated biannually.

The Kenya + Delaware C-Corp example

Imagine a startup that operates in Kenya (customers, team, and near-term revenue are Kenyan) but holds a Delaware C-Corp to raise from U.S. VCs. Which country should define the risk profile in your valuation?

Kenya. Your risk-free rate should be the Kenyan 10-year government yield; your MRP should reflect Kenya; your cash flows should be weighted by Kenyan survival probabilities; and your default corporate tax should align with where profits will actually be taxed. Those parameters are, by design, country-specific and they directly drive discounting and cash-flow mechanics.

Elevating above local benchmarks. A Kenya-based startup with credible access to U.S. capital may indeed target more capital at a higher price than its local peers. But that upside isn’t automatic; it must be earned. Founders need to justify why their actual potential clears a higher risk bar: outlier traction and growth, disciplined unit economics, investor-grade governance and reporting, reputable references (accelerators, angels, customers), and a clear route to regional or global scale. In short, reduce perceived execution, legal, currency, and market-access risk so investors can rationalize a premium to local pricing, even while the discount-rate engine remains Kenyan. Country-level benchmarks are adjustable because they are meant to reflect genuine fundraising conditions supported by evidence, not wishful thinking.

Coherence over cosmetics. Keep country choice aligned with operating reality (Kenya) and then aim for the high end of Kenya’s reasonable range if your evidence supports it. That balance (accurate risk inputs with a justified premium) reads as honest and investable. Reframing the company as “U.S.” solely to chase a bigger headline rarely survives diligence and can slow the round. Aim for the upper bound of a truthful valuation, rather than a mischaracterization that risks credibility.

Common pitfalls to avoid

- Picking the holdco country by default. If your holding company is in Delaware but all execution and customers are in Nairobi, the financial risk you’re discounting is Kenyan. Align the country so that CAPM, survival weighting, and tax reflect that reality.

- Confusing benchmarking with valuation inputs. Benchmarking is great for context and negotiations, but the formula inputs (risk-free rate, MRP, survival rates) still come from your selected country. Use Valuation Delta™ to communicate, not to mask a mismatch in risk.

- Forgetting taxes. If your tax residency differs from where you operate, make sure your projections reflect the correct statutory corporate tax (or override the default accordingly).

- Over-relying on one method. Equidam uses five methods and weights them by stage; DCF becomes more important with maturity, while qualitative methods dominate when forecasts are less reliable. Keep the whole mix in view.

Bottom line

Valuation is a story about risk and reward; geography shapes both. Country inputs influence your discount rate, survival assumptions, taxes, and the pricing anchors investors use to reality-check your ask. If you’re cross-border, anchor your valuation in the country where the business actually lives economically, then use credible evidence—traction, governance, partners, and benchmarking—to argue for the upper end of that country’s reasonable range. That’s how you present a valuation that is coherent, comparable, and investable—and how you avoid the credibility tax that comes from chasing numbers a spreadsheet can’t defend.