Raising capital is a pivotal milestone for early-stage startups. Yet, one of the most challenging aspects of this process is establishing a mutual understanding of the company’s value between founders and investors. This challenge intensifies when dealing with novel business ideas or emerging technologies, where traditional valuation metrics may fall short. Enter startup valuation tools.

Platforms like Equidam offer structured, data-driven insights that bridge the gap between a founder’s vision and an investor’s expectations. By providing a transparent and comprehensive view of a startup’s potential, valuation tools become strategic assets in fundraising efforts, particularly when included in the data room.

Why Alignment on Valuation Matters

In the early stages of a startup, tangible metrics such as revenue or profit margins are often limited or non-existent. This scarcity of concrete data can lead to divergent perceptions of value between founders and investors.

Research in behavioral finance highlights the concept of familiarity bias, where investors prefer ventures they understand or have experience with. This bias can result in undervaluing innovative startups simply because their models or technologies are unfamiliar. Additionally, if investors are unfamiliar with a type of business, their inability to intuit a valuation often introduces fundraising friction, to the extent it actually shifts founders towards better understood ideas — at a cost to project quality.

Generally speaking, misalignment in valuation expectations can have several repercussions:

-

Delayed Fundraising: Prolonged negotiations can stall funding rounds.

-

Missed Opportunities: Promising startups might be overlooked due to perceived risks.

-

Strained Relationships: Disagreements over valuation can sour founder-investor relations.

Therefore, alignment on valuation is not just about agreeing on a suitable price; it’s about exploring future potential and getting everyone on the same page..

How Valuation Tools Foster Understanding

Valuation tools like Equidam play a crucial role in bridging the understanding gap between founders and investors. By leveraging a combination of qualitative (factors related to the team, product, market) and quantitative data (measuring the future ambition), these tools provide a holistic view of a startup’s potential.

• Structured Methodologies

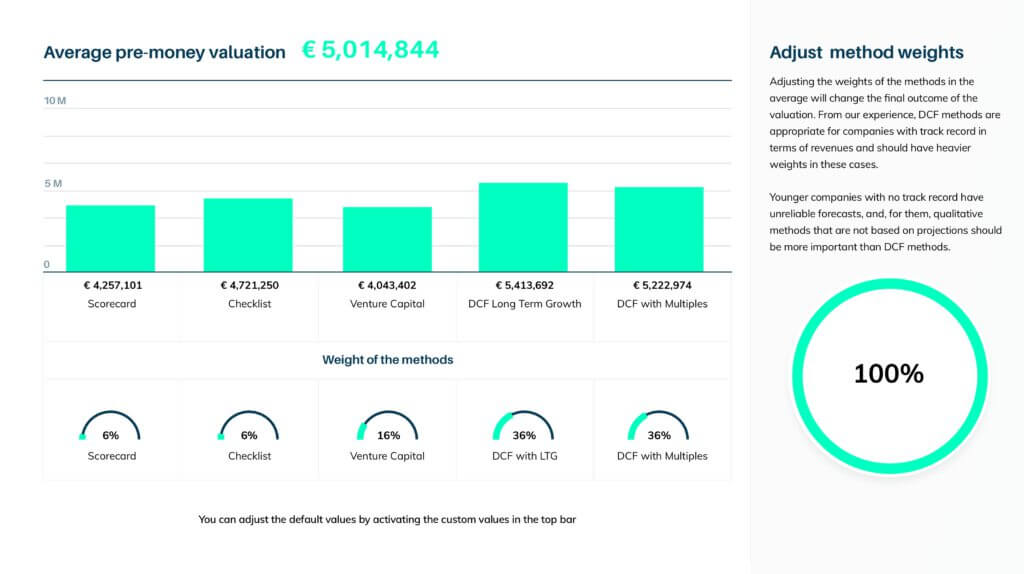

Equidam employs five different valuation methods, including the Discounted Cash Flow (DCF) and the Venture Capital method, to assess a startup’s worth. This multifaceted approach ensures that both current performance and future potential are considered.

• Data-Driven Insights

By analyzing financial projections, market trends, and industry benchmarks, valuation tools offer objective insights into a startup’s scalability and growth prospects. This data-driven approach helps demystify complex or innovative business models, making them more palatable to investors.

• Enhanced Communication

A comprehensive valuation report serves as a communication tool, articulating the startup’s value proposition in a language that investors understand. It facilitates transparent discussions, enabling both parties to align their expectations effectively.

Practical Application in the Pitch

Integrating valuation tools into the fundraising process has a lot of practical value, though that doesn’t necessarily mean sending a 30+ page report before the first meeting. Most of the time, you want to get to know investors and help build their conviction in what you are building before you start talking about valuation.

• Inclusion in the Data Room

A detailed valuation report in the data room provides investors with immediate access to critical financial insights. It demonstrates the founder’s preparedness and commitment to transparency.

• Supporting Negotiations

During term sheet discussions, a third-party valuation can serve as a neutral reference point, facilitating fair negotiations and reducing potential conflicts.

• Case Study: Spiro Carbon

Spiro Carbon, a startup in the carbon credit industry, utilized Equidam to defend its valuation during fundraising. The tool provided a robust framework that simplified complex valuation discussions, allowing the founders to focus on enhancing their business pitch and securing the right investors.

Strengthening Founder-Investor Relationships

Transparent valuation processes lay the foundation for strong, trust-based relationships between founders and investors. It shows a willingness to look diligently and thoroughly at the economics of the company, rather than just trying to talk up the price.

• Setting Clear Expectations

Clearly defined valuation processes enable founders and investors to openly discuss and agree on realistic growth targets, expected milestones, and potential returns. This clarity reduces misunderstandings and enhances mutual trust, making it easier to work towards shared objectives.

• Facilitating Future Rounds

Regular, transparent valuation practices provide a reliable historical record, making future fundraising rounds more straightforward and less contentious. Investors gain confidence from a clear valuation history, allowing quicker decisions and smoother negotiations in subsequent rounds.

Comparing the Main Options

- Unlike consultants, valuation tools like Equidam offfer a more cost-effective, scalable, and rapid solution.

- Excel models, although flexible, often lack objectivity, are error-prone, and require significant expertise, making them less accessible.

- Meanwhile, comparables methods, although quick and simple, offer limited depth and scalability — and leave both sides cherry-picking examples.

| Feature | Valuation Tools | Excel Models | Consultant Analysis | Comparables Method |

|---|---|---|---|---|

| Data-driven analysis | ✅ | ⚠️ | ✅ | ⚠️ |

| Industry-specific benchmarks | ✅ | ⚠️ | ✅ | ✅ |

| Structured valuation methodologies | ✅ | ✅ | ✅ | ⚠️ |

| Cost-effectiveness | ✅ | ✅ | ❌ | ✅ |

| Speed and convenience | ✅ | ⚠️ | ❌ | ✅ |

| Objectivity and neutrality | ✅ | ⚠️ | ⚠️ | ✅ |

| Scalability for multiple scenarios | ✅ | ⚠️ | ❌ | ⚠️ |

| Ease of use and accessibility | ✅ | ⚠️ | ✅ | ✅ |

| Investor credibility | ✅ | ⚠️ | ✅ | ⚠️ |

The best tools effectively balance convenience, depth, and credibility, providing startups a strategic advantage in fundraising.

Conclusion

Startup valuation tools like Equidam are more than just number-crunching platforms; they are strategic instruments that help develop understanding, transparency, and trust between founders and investors.

By providing structured, data-driven insights, these tools help align expectations, particularly in the context of innovative or novel business ideas. Incorporating them into your pitch and data room not only enhances your credibility but also positions your startup for successful fundraising and long-term growth.