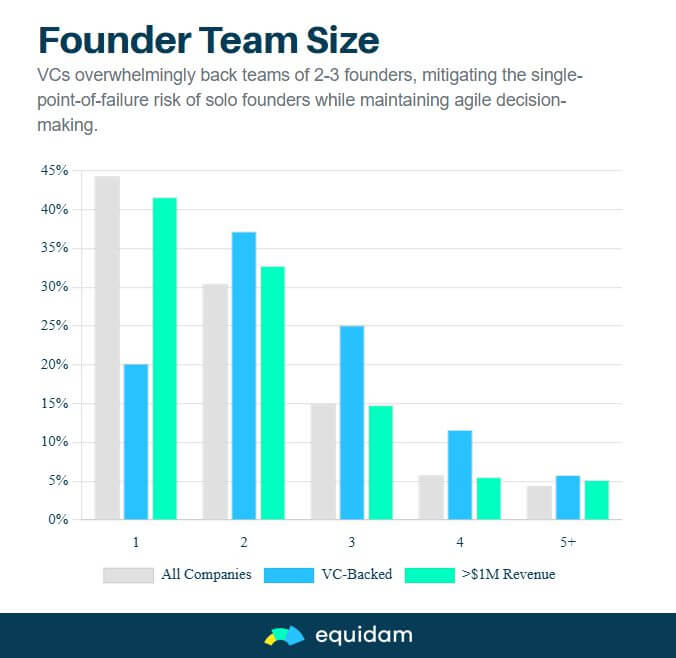

A prevalent belief in the venture capital world is that the ideal startup is launched by a pair of founders. Recent data from the Startup Valuation Delta for the first half of 2025 reveals a significant venture capital bias towards two-person founding teams. The majority of VC-backed companies, 37%, have two founders. This is in contrast to 25% with three-person teams, 20% with a single founder, 12% with four founders, and a mere 6% with five or more.

However, this preference doesn’t align with the makeup of startups generating substantial revenue. Among companies with a million or more in annual revenue, the most common number of founders is one, accounting for 42% of such businesses. Two-founder teams follow at 33%, with three-founder teams at 15%. This discrepancy suggests that the VC preference for duos may be a self-reinforcing bias more than a data-driven conclusion.

The Prevailing Wisdom and Its Flaws

The partiality for two-person teams is based on the long-standing understanding that startups ought to have a “business” co-founder and a “technical” co-founder, covering both ends of the spectrum for what an early stage company may need. This has been highlighted over the years by, for example, Y Combinator’s notorious preference for two-person teams.

Research by Jason Greenberg and Ethan Mollick, “Sole Survivors: Solo Ventures versus Founding Teams,” challenges the conventional wisdom. Their study of companies that secured funding through Kickstarter, rather than traditional venture capital, found that ventures started by solo entrepreneurs tend to survive longer and generate more revenue than those founded by teams, especially two-person teams.

Using a variety of outcome measures and rich controls, we find that ventures started by solo entrepreneurs generally outperform teams of co-founders, particularly two-person teams.

This isn’t to say that all data points in one direction. A study by First Round Capital’s “10 Year Project” found that teams with more than one founder outperformed solo founders by 163%, and solo founders’ seed valuations were 25% lower. This led them to conclude that two is the optimal number of founders. However, this conclusion is drawn from a portfolio of venture-backed startups, where an existing bias for pairs can create a self-fulfilling prophecy. If investors favor two-founder teams, those teams will have an easier time fundraising and are likely to appear more successful, reinforcing the initial bias.

An analysis of Crunchbase data by Haje Kamps for TechCrunch further supports the viability of solo founders. The study found that 52.3% of successfully exited startups had a single founder. In contrast, among startups that had raised over $10 million, only 45.9% were solo-founded, again suggesting a venture capital bias that may not reflect the full picture of success.

More than half of the companies were founded by a solo founder. Again, just under one-third had two co-founders, and around 18 percent had three or more founders. In this category, the average number of founders per startup is 1.72.

Beyond the Co-Founder Binary

The debate over the ideal number of founders is often framed as a simple binary: solo versus co-founder. However, the reality is more nuanced. Many successful “solo” founders have a strong support system of “co-creators,” including employees, alliance partners, and benefactors, who provide many of the same benefits as a traditional co-founder. These relationships can offer the necessary human, social, and financial capital without the potential for destructive conflict and loss of equity and control that can come with a formal co-founder arrangement.

Research by Travis Howell, Christopher Bingham and Bradley Hendricks, “Going Alone or Together? A Configurational Analysis of Solo Founding vs. Cofounding“, examined this “co-creator” dynamic, to find that people working behind the scenes often have a significant influence on startup success:

We examine why and how solo founders can be as successful as their peers in cofounded ventures […] Successful solo founders strategically use a set of co-creators rather than cofounders to overcome liabilities, retain control, and mobilize resources in unique and unexpected ways.

A Call for a More Nuanced Approach

This is not to argue that solo founding is inherently superior or an easier path. The journey of a solo founder can be lonely and challenging. However, the venture capital industry’s preference for two-person teams appears to be more of a heuristic than a scientifically-backed strategy. For an industry that prides itself on identifying outliers, this reliance on a generalized rule is counterintuitive.

The true work of venture capital lies in evaluating each opportunity on its own merits, free from preconceived notions. Rather than adhering to rigid rules about team size, investors should focus on a deeper understanding of the founder’s vision, capabilities, and the broader ecosystem of support they have cultivated. The focus should be on eliminating biases, not adding to them.

Furthermore, the traditional logic of needing a distinct technical co-founder and a business-oriented co-founder is being actively dismantled by the rise of sophisticated AI tools. In the past, a non-technical founder would be heavily reliant on a partner for product development. Today, AI can serve as a powerful force multiplier, enabling a single, business-savvy individual to build, test, and iterate on a product with a level of speed and complexity that was previously unimaginable. As this trend continues, the preference for a two-founder team, based on this division of labor, will look increasingly anachronistic. Investors should be wary of applying yesterday’s heuristics to tomorrow’s companies.