Nothing can be priced in a vacuum, and so there is always some comparative element to startup valuation. This is where ‘multiples’ come into play.

Multiples are an important building block of valuation, providing easy calibration to the fundraising market, and are used in two of the five methods on the Equidam platform. They are designed to be a quick reference to comparable companies and walk a fine line between simplicity and relevance.

Our new Advanced Multiples feature offers a searchable index of +30,000 public company EBITDA and revenue multiples, solving the problem of finding reliable, accessible data on comparable companies, providing greater solidity and clarity to your valuation.

What is a multiple?

A multiple is a ratio that represents the relationship between a company’s valuation and a particular value, such as revenue, EBITDA, employee count, etc. This ratio is typically based on the average across the industry in which the company operates, or derived by looking at comparable companies. Checking a company’s implied valuation using a multiple becomes a quick and easy calculation.

The problem with private multiples

In an ideal world, a multiple would be derived from the valuation of a company which very closely resembles your own, at a similar stage of development, in the same region, which raised in the same market conditions. By the use of that multiple, you are exploiting that similarity to duplicate all of the work which went into valuing that original company.

There’s a number of problems with this:

- That company probably doesn’t exist.

- Even if it does, the accounting and valuation data is usually private.

- For a full picture you’ll also need a view on the deal structure.

Often this leaves people hunting for the closest possible comparable companies, but it’s a fruitless endeavor: you’ll waste time trying to find something impossibly specific, only for that to focus an investors attention on all of the specific differences in product, market or team.

Why use public multiples

There are no perfect approaches to the problem of finding appropriate multiples for private company valuation, but looking at public company multiples is a reasonable work-around, with its own set of pros and cons.

On one hand, it gives you a more stable and reliable picture of the future potential in that industry, with data that is readily available and always updated. On the other hand, it is applying a broad industry average from late stage companies to a specific early stage scenario, which means some resolution is lost.

The best solution to this, a compromise between the two, is to do your own research on relevant public multiples. This can take a significant amount of time and knowledge in order to ensure the validity of sources and values.

Equidam’s Advanced Multiples

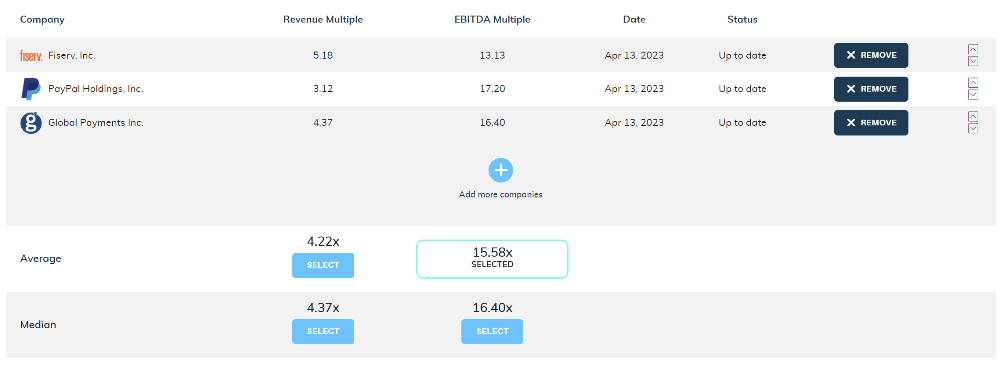

The new Advanced Multiples feature on the Equidam platform allows you to build your own set of comparable public companies with a searchable index of public company EBITDA and revenue multiples.

With this approach, you can select examples which have a clear resemblance to your own company, in terms of product and market, providing a multiple with greater specific relevance to your company while also ensuring the availability and reliability of data. It will also demonstrate to investors that there is a clear rationale behind your calculation, driving investment conversations in a productive direction.

Equidam’s Advanced Multiples tool gives you access to public stock market data from global exchanges, covering more than 30,000 companies, and is updated on a weekly basis.