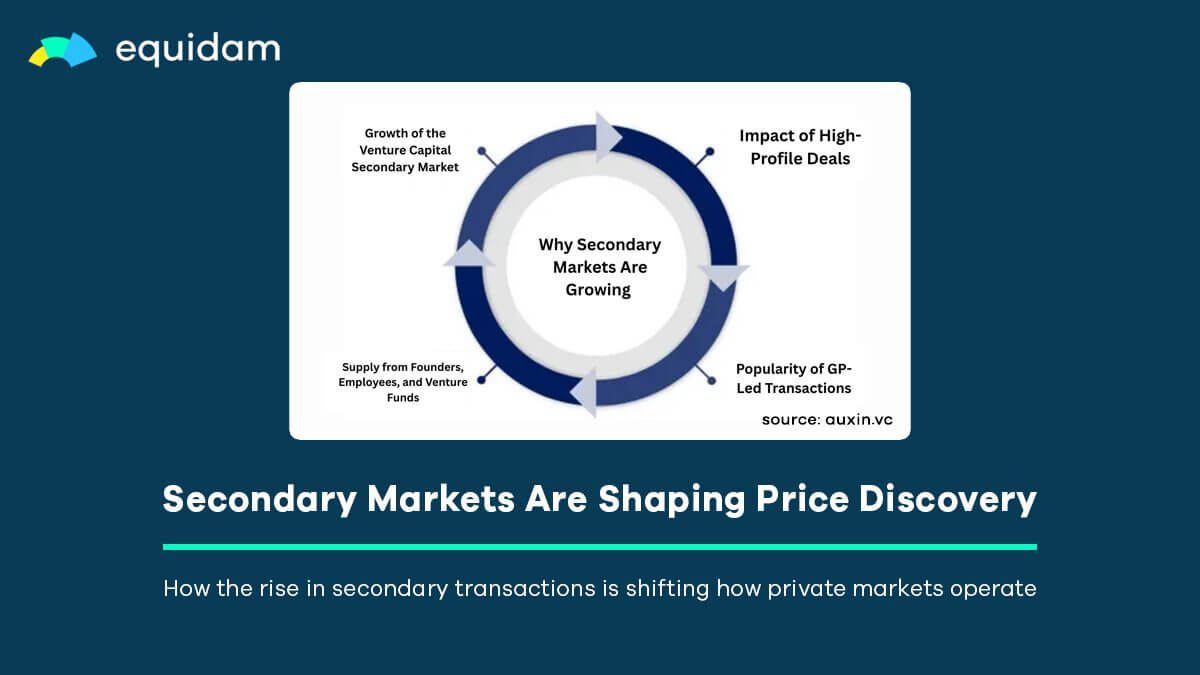

Secondary Markets Are Shaping Price Discovery in VC

In 2024–25, the most informative market prices for late-stage startups increasingly come from…

Startup Valuation & Fundraising Strategy: The Deep-Tech Playbook

Fundraising for deeptech is nothing like the copy-and-paste playbooks you see for SaaS: timelines…

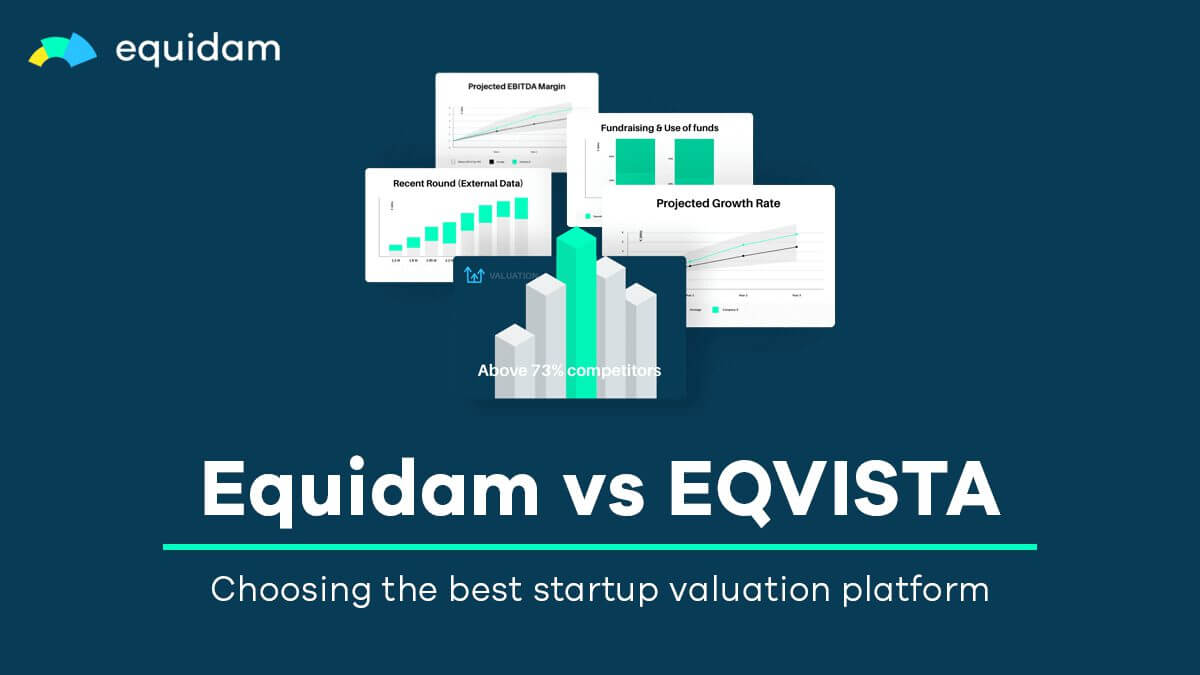

Equidam vs EQVISTA: Choosing the Best Startup Valuation Platform

Valuing a startup is a complex endeavor, blending quantitative financial projections with…

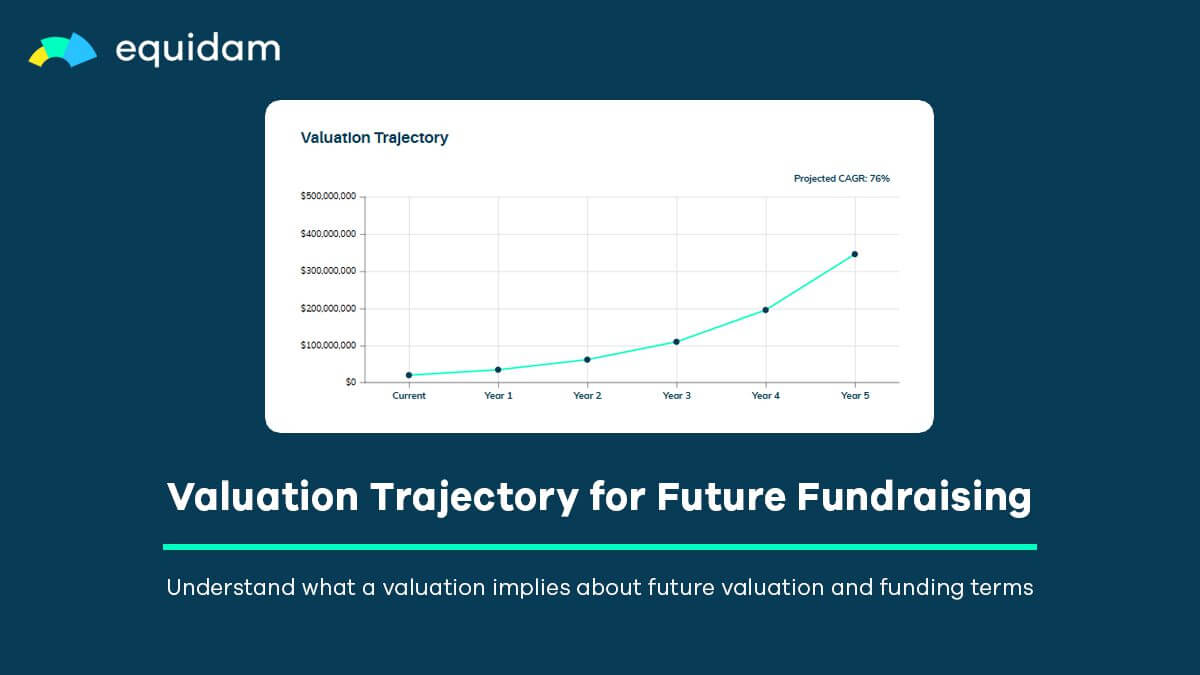

How Equidam Models Valuation Trajectory for Easier Future Fundraising

Venture capital is built on staged commitments. Rather than betting the farm up front, investors…

Financial Best Practices for Startups: Navigating Revenue Recognition, GAAP Guardrails, and Clean ARR

For founders and finance teams, revenue is the headline number investors remember — and the one…

What is Startup Valuation?

Startup valuation is the disciplined act of translating a fundraising story into numbers, and…

Understanding AI Startups: Moats, Revenue & Diligence

Artificial intelligence is reshaping how work gets done, and the flood of startups riding this wave…

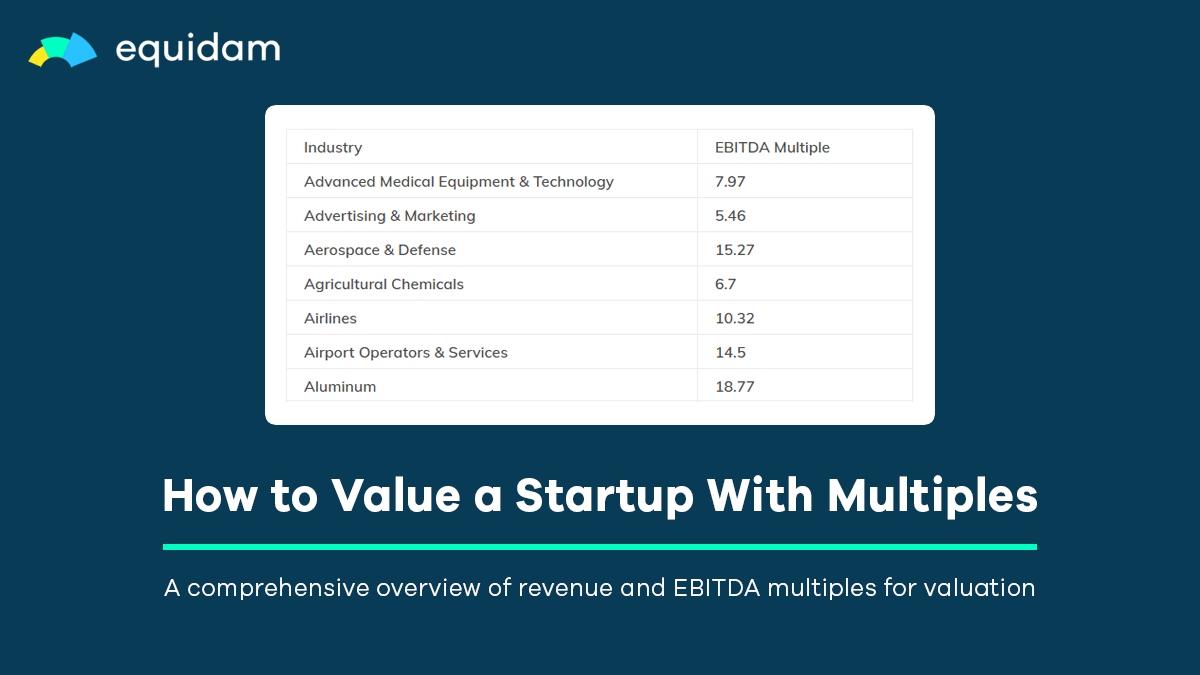

How to Value a Startup with Multiples

Valuation multiples are a simple, powerful way to translate business performance into price.…

Top 10 Startup Valuation Platforms for Effective Fundraising

If you’re raising a round, you don’t need an audit memo; you need a valuation you can explain,…