What is dilution?

TL;DR Dilution is the reduction in the ownership percentage in a certain company as an effect of the issuance of shares.

Dilution refers to the reduction of an individual shareholder’s ownership percentage in a company as a result of the issuance of new shares. In the context of startup investing, dilution can occur when a company raises capital through the sale of additional shares to investors. This can be done through a variety of means, such as issuing new shares in exchange for cash or issuing shares to employees as part of a compensation package. Dilution can also occur when a company issues new shares to acquire other companies or as a result of stock splits. While dilution can dilute the value of an individual shareholder’s stake in a company, it can also provide the company with much-needed capital to fund its operations and growth.

How to calculate dilution?

There is a number of calculations to make before getting your final percentage of dilution. Let’s work them out with an example.

Let’s say you are the only owner of a company and you own 1000 shares. What happens if you issue 100 more shares?

The new total number of shares is 1000+100 = 1100 shares. You own 91% (1000 / 1100) and the buyer of the newly issued shares owns 9%.

But what is the formula behind the dilution calculation?

Continuing the example from above, you now own 91% of the company. What’s the dilution? It is 9%.

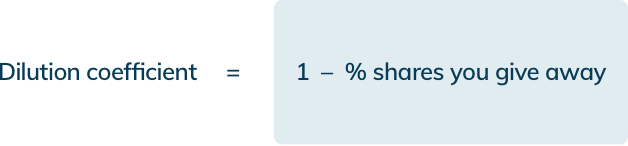

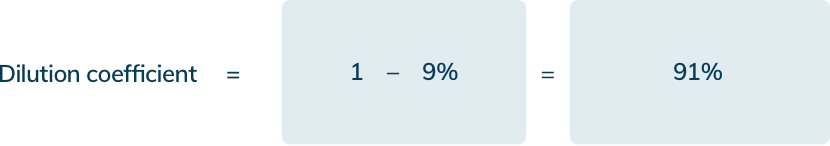

To calculate this, you first need to calculate the dilution coefficient.

The number of shares you give away in the example is 9%. So this is what the calculation would look like

In the previous case, there is only one owner of the company. But what happens if there were two initial owners of the company and new shares are issued?

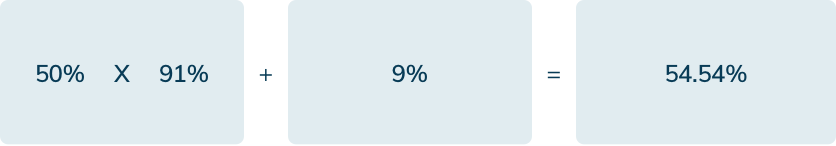

Let’s take the case when only one of the owners buys the shares. As above, we have 1000 shares in total. Each owner has 50% of the shares, which is 500 shares respectively.

100 more shares are issued, which brings the total amount of shares to 1100. Post issuance, one of the owners has 600 shares and the other has 500 shares, so 54,54% and 45,45% respectively.

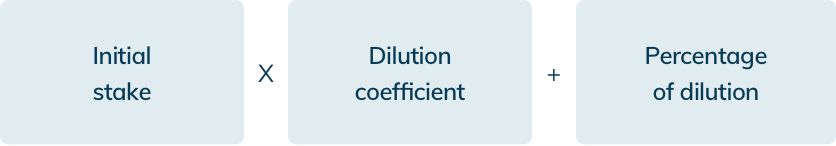

In this case the formula for the dilution coefficient is slightly adjusted and it goes this way

Following the formula, the calculation looks like this:

This is the dilution calculation for the person who buys the additional shares, assuming that he buys them all.

If we talk about the shareholder that doesn’t buy any of the new shares, his situation doesn’t change.

Prepare yourself for fundraising with a clear and transparent Startup Valuation report

Why would you be subject to dilution?

There are three occasions when you issue shares:

1| Raising capital

When you are raising capital, you give away equity. This is the typical case and it is identical to the example above.

2| Stock options or warrants

These two cases are usually quite similar. Stock options and warrants are the type securities that do not trigger the issuance of shares right away – at the time the contract is signed. These two securities only imply that a person will be able to enter your capital structure in the future.

In this case, debt holders will convert to shareholders at a trigger event, usually a funding round or an exit. Hence, this causes dilution for the initial shareholders.

There are other situations when a company issues shares and is subject to dilution, but these are the main three.

The last two types of securities signal to investors that dilution will happen at a future event. However, they are interested in finding out what exactly the dilution is prior to committing to invest. This is why some contracts ask for the shares on a fully diluted basis.

What’s a “fully diluted basis”?

Let’s say that you own 50% of the shares of a company and the other 50% belongs to another shareholder. There is also a person who is holding a stock option.

Stock options usually refer to a specific number of shares, which means that at the time that the option is exercised, a certain amount of shares will be issued.

“On fully diluted basis” means that you need to calculate how much you are going to own at the time the options is exercised. You can do that by subtracting the dilution you are going to get at the issuance of shares from the amount of shares you own today.

What usually happens when you are raising capital from a VC firm is that you are issuing shares for them, but you will also issue some additional equity. That ranges between 5-10%. You will allocate these shares in a separate entity – for instance, foundation or an escrow. These shares will be reserved for securities such as employee stock options or convertible debt.

The reason why you do that is that makes it easier to discuss equity stakes on a fully diluted basis. This amount of shares might never be used entirely. But on the plus side, even though they are shares with voting rights, they are controlled by the company. So they don’t impact the voting process.

Calculating the dilution for stock options is relatively easy, because you know the exact amount of shares that are going to be issued. However, calculating dilution for convertible debt is a bit more difficult. In this case the number of shares at conversion will be determined by the valuation at the trigger event.

To make the dilution calculations you take the worst case scenario – you assume that the debt holders will convert at the cap. Since the cap is the maximum, so you can already calculate the maximum number of shares that will be issued.

What about you? What is your experience with dilution? Did you have any difficulties or were you prepared to talk about it during investment negotiations? Let us know in the comments!

Hi, I have been reading your responses with interest. We have a small SCorp with 7 shareholders. So far we have done 3 optional capital calls where every sharholder partcipated in their prorate share of ownership. No additional shares were issued. We are doing an additional capital call but one of the minority shareholders does not with to participate. His share is 9.9%. How do I calculate his dilution without issuing additional shares?

Hi John,

Thanks for the question!

Happy to give you some guidance here, though it would be useful to know why you are reluctant to issue additional shares?

Best regards,

Dan

To whom it concerns:

I have a company that is growing significantly and need to raise capital. We are a C-Corp and have 1,000,000 shares authorized but only 315,500 issued. I currently own 78% and have 4 other investors with smaller percentages. I am looking to raise 2.0M at a valuation of 10.0M. Do I issue additional shares that are available and how do I finalize my dilution?

Hi Ray,

Thanks for the question! Is the 10m pre-money or post-money?

The number of shares issued pre-money gives you the price per share. You’re raising 2.0M so, 2M/Price per share = how many shares you would need to assign to the investor. You have 1M shares authorized and only 315,500 assigned, so you just need to assign the right number to the investor out of the ones that are authorized but not assigned.

I hope that answers your question, but let us know if you need further clarification!

Hello!

If there were 2 shareholders, 51% and 49% and the valuation of company is $150,000. The 51% shareholder have already funded $51k in a new funding round but the other shareholder decided not to participate – in this case how much can the other shareholder be diluted down to?

Thank you!

Hi Chris, thanks for the question!

The answer to that would depend on the valuation of the second funding round, presuming it’s not at the same valuation.

Hello, Quick question for you guys.

A startup that I’m invested in has decided to do a voluntary capital call instead of raising equity at this time. Theyre looking for $300k from current investors. I own 4.5% which would make my share of the capital call roughly $13,500. If I decide not to put up additional capital, how much would I dilute? Not sure if this matters but the last equity round they raised was at 10m valuation.

Thanks

JS

Hard to say without knowing the new valuation, but assuming they give new investors 10%, then your share would be 4.5% * (100% – 10%).

Hey guys,

Curious to hear your opinion about this one:

Company xyz has 1M of shares outstanding and needs $5M of funding at year0. Our VC wants to invest these $5M but want an IRR of 50% and we know that at the end of year5 the company will be valued 100M. What % of the company should our VC own in order to keep IRR 50% ?

Before offering the 5M, it’s mutually agreed that a stock option pool must be created to offer to the senior mgmt team the options utltimately to own 15% of the company. It’s also agreed that options will not vest until the end of year3. Considering this new assumption, what % of the company should our VC own to keep the same IRR ?

Also, during year2 another VC steps in, they agree to keep the stock option pool at 15% and they invest $3M and they just need an IRR of 30% bearing less risk than our VC at 1st round of financing. What % of the company do they need to get to have an IRR 30% ? And what % of the compant would our VC have at this stage, after the 3M new round ?

Thanks in advance !

Hey LP,

Thank you for the interesting questions.

For the first question, it’s easier to reverse the calculation. They are investing $5m which in 5 years at a 50% return will be $37.96m ($5m*((1+50%)^5)), which means they will have to have a 37.96% stake in the company in 5 years time, and so also now.

Regarding your second question, the stock option pool is granted before the investment, so it is only diluting other investors, not the $5m VC. The stake of the VC should be unvaried from the previous case. The fact that the stock option vest in a number of years generally is not relevant in these calculation because it is normal to consider the fully diluted percentages of everybody, so the stock options, even if not assigned and vested yet, they count as already assigned and vested.

The calculation for the third case are the same one, $3m will become $8.56m in year 5, when the valuation is 100m so they’ll need a stake of 8.56% in order to make that return. The percentage of the original VC will be shrunk by 8.56% then, becoming 37.96% * (1-8.56%) or 34.71%.

Now a few words of caveats, what you are performing is a very simplified version of the VC method, which is not a bad valuation method per se, but it should always be used in conjunctions with other valuation methods to have a better picture of the value of the company.

In your third scenario, the original VC is not going to get the 50% planned return anymore, because they have been diluted. Follow on dilutions are generally taken into account in the discount rate of the VC method (what you refer to as IRR), so the calculations should not change but, as a word of caution, the realised return of the original VC will be less than 50%.

Another important thing is that VC’s investments are rarely this simple, they generally include liquidation preferences for example. Liquidation preferences can change the return significantly. Another factor is your stock option pool, it is quite normal to replenish the stock option pool in order to make space for new talent, this will also affect the % and returns of the various investors.

Overall, because of the above, we find it much easier to negotiate the valuation of the company itself than the IRR and subsequent equity percentage of the investor! Hope this helps!

Hello!

If I may suggest, it would be a great ideia if you could prepare a list with share dilution exercises using easy, medium and hard levels, just like college’s. We would learn a lot.

Hi,

A firm has a pre-money valuation of $1.2mn and are looking to raise another $0.55mn. They would like to create an ESOP pool of 8% before raising funds. What would be the equity dilution of the founders after the investment closes if the entire 8% pool had to be diluted only from their stake? Founders – 6000 shares ; Angel investors – 3000 shares ; Total – 9000 shares

Thanks!

Hi There,

Assuming the shares at the end of the message are the current situation, founders own 2/3 of the company (6000/9000 shares). In order to have ESOP for 8% coming only from the founders, they’ll have to “cancel” 720 shares and dedicate them to ESOP. They’ll be left after that with 5280 shares which represent 58.66% (the company still has 9000 shares because of the ESOP).

$0.55m raised at a $1.2m premoney means the new investors will receive 31,43% of the company (0.55/(0.55+1.2)). Meaning every investor before will be diluted by that percentage. The 58.66% of the founders will become 40.22% (58.66*(100%-31,43%)). ESOP and original angel investors will be diluted in the same way!

Hope this helps!

Regards

Daniel

Hi

if i invest 1000$ in company with pre-valuation of 10M$ in series A

and the company make another round with valuation let’s see 20M$

how i calculate the percentage of the dilution in this case

Hi Faisal,

Thank you for your comment on our article! I hope it was informative. To respond to your question, you would need to know the investment amount in the second fundraising round. Once you know this you can calculate what percentage of the company the second round investors will receive of the company. This is going to squeeze yours and every other pre-investor’s percentages. If the second round investor gets 20% for example, it means that the pre-investors will only have 80%. If you had 1% before, you can just do 1% * 80% to understand your final percentage!

I hope this proves helpful in answering your question. As always we remain available to discuss any questions ahead.

kind regards,

Giulio

If I have 3 partners 25%, 37% and 38%. We spinoff the 37% owner. What percent do the 2 remaining partners have? What is the math?

Thanks,

Hi Bill,

Thank you for your question, a spinoff to my understanding means that he’s not part of the shareholders anymore either because those shares are cancelled or the company is divided in 2, but the same calculation apply also if the remaining shareholders purchase the 37% of shares pro rata. Basically those shares will not be there anymore, and the two partners will be left with their respective shares. The sum of the two percentages (25% + 38%) will be the “new” 100%. The partner with 25% will have 25% of (25%+38%=63%) so 39.7% while the partner that has 38%, per the same formula is going to have 60.3%. Hope this is what you meant and that it helps!

Hey Daniel,

Thanks so much that helped loads. Just one more question. If the founders were to accept another investment of $2,000,000 for 50% in the future, on top of kevins investments, what % would each founder have now and how much is that equity now worth? Just want to ensure my calculations aren’t wrong. Thank you!!!

Hi Jill,

So after Kevin’s they’d be left with 70%, if they further dilute with another investment issuing shares for 50% of they company, all previous shareholders will have the remaining 50%. Then the founders will have 70% * 50% = 35%

Hope this answers! Thank you for asking!

Hello, confused regarding how I would go about this calculation about equity dilution.

Two equal partners pitch Kevin O’Leary a $100,000 investment for 10%.

Kevin counters with an offer of $250,000 for 30%. Jim Treliving offers $200,000 for 15% Which deal is likely to happen? How much will each cofounder own if a deal gets done.

Hi Jill,

According to the formula above, the partners will own 70% after Kevin’s offer, so 35% each, and 85% after Jim’s offer, so 42.5% each.

The question over which deal to accept would go the following way, they were asking for 100k, so both amounts are more than what they need. Having checked that box, and excluding other factors (Kevin is always the best angel to have 😉 ), they should pick the deal with the highest pre-money valuation.

In the case of Kevin, the pre-money is (250k/30%)*70% =583k and in the case of Jim, (200k/15%)*85% = 1.133m, Jim is valuing the company about twice as much as Kevin (who would have thought 🙂 ), so they should probably go for Jim’s offer.

Hello,

Shareholder A owns 25% in a company (509 shares of 2035) and I need to issue new shares to increase A’s shareholding to 30%…how do I do that bearing in mind the mechanical dilution of his original 25%…

Merci

Hi Georges,

Thanks for your message. You need to issue and assign to shareholder A 145 additional shares, that’s going to make the total of Shareholder A of 654 shares, over a total number of shares of 2180, so 30% ownership.

Hope this helps, and I remain available for any further questions,

Have a nice day,

Giulia

Hi Giulia, I’m just wondering how you went about the calculation for this? Thanks!

Hi Harith,

It’s a proportionate calculation, because you need to calculate at the same time how many shares to give him and the new total. The equation is as follows:

(509 + x)/(2035 + x) = 30%

which means

509 = 30%*(2035+x) – x

So ‘x’ (which is the new shares to be issued and given to Shareholder A) is

509 – 30%*2035 = -0.7*x and from there

x = (30%*2035 – 509)/0.7

= 145 new shares to be assigned to shareholder A

I hope this equation helps to understand how the shares are computed. If you have any further questions about this, please don’t hesitate to get in touch!

All the best,

Giulio

Hi Vinny,

Normally F would buy newly issued shares, in that case, you’ll have to issue enough to give him/her 15% on the new total. You can get that by a proportion, the 1m shares indeed will be only 85% of the new total, so 15% : 85% = X : 1m. X, the number of shares of F, is going to be 176.471, and the new total is going to be 1.176.471, which would mean 176.471/1.176.471 = 15% of the new total of shares.

Regarding the % of ownership of previous shareholders, they are each diluted by 15%, so you can just multiply their current %, say the 36.5% of D, by (1-15%), and his resulting percentage will be 31,025%

Hope this helps!!

Hi!

IF there’s a company with 1 Million issued shares with 5 shareholders: A-5% B-10% C-12% D-36.5% E-36.5%, and F wants to join with 15% stake. How do I know how many shares to give F, and what the new shareholding % are for the other 5 holders?

Thanks, the article is great! what’s the next step? do you have a easy-to-use calculator for me to try?

Hi! Thanks, happy that you find it useful!

We are still working on a easy-to-use calculator. In the meantime, we can provide you with one-to-one assistance with it if you wish, feel free to contact us directly to discuss it further – we look forward to getting in touch!

Good and simple, post more articles on share trading

I was reading this short article and there is a confusing paragraph ” If we talk about the shareholder that doesn’t buy any of the new shares, his situation doesn’t change”. The shareholder that does not buy new shares dilutes proportionaly, so his situation does change.

Hi Gustavo,

Thank you for your reply! In this case, when stating ‘situation’ doesn’t change, we are referring to the number of shares don’t actually change, but the the overall percentage of the company does.

I hope this helps in clearing up your doubts. If you have any further questions, please don’t hesitate to get in touch!

Kind regards,

Giulio