Fundraising for your startup is more than just a quest for capital; it’s about creating a narrative that embodies your team’s vision and attracts the right investors. This guide will delve into crafting an impactful fundraising story, strategizing your campaign, and choosing the best time to fundraise.

Crafting Your Story: Where to Start

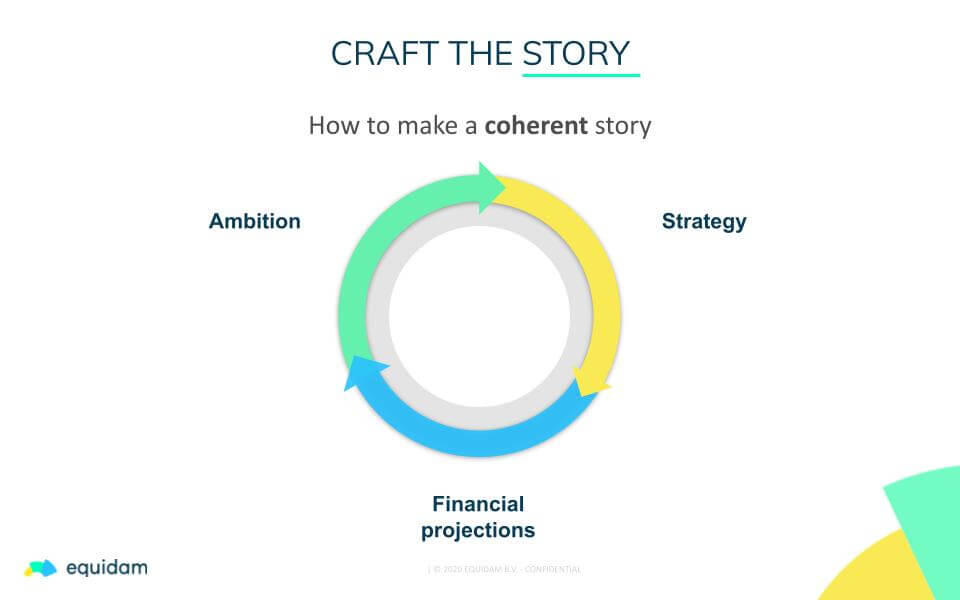

- Start with Your Ambition

- Refine Your Strategy

- Create Financial Projections

- Iterate

Your fundraising journey begins with the core ambition of your startup. Work closely with your co-founders to ensure you have a shared vision that resonates deeply with your collective goals.

This vision is the heart of the fundraising narrative, and should be consistent in everything from your one-line summary to the investor emails you send. At every point in the process this vision should be presented in high fidelity, with total coherence, to inspire confidence in even the most cynical investor.

Next, develop a strategy that brings your ambition to life. This is where your team’s creativity and problem-solving skills come into play. Consider all aspects of your business and how you plan to execute in order to deliver on the vision you have established.

A crucial step is preparing financial projections. These projections are not just numbers; they represent the financial embodiment of your strategy. Importantly, the focus is not on accuracy (you are not trying to predict the future) but on demonstrating that you understand what must be done, the growth required, and the future potential.

Assess the viability of your strategy financially, considering various funding sources. Could bootstrapping extend your runway? Is debt a viable option, especially for asset-heavy ventures? Are there grants or other funding opportunities you can tap into? Are you going to hit a rate of growth that makes you attractive to venture capitalists? This financial narrative should be a compelling and thorough reflection of your vision.

As you refine your story into a pitch, it should become a compelling and cohesive narrative that clearly outlines your startup’s potential and how you plan to realize it.

Strategizing Your Campaign

- Prepare essential documents

- Gather initial feedback from 3-5 investors

- Finalize materials and set a date

- Create a list of 50-100 potential investors, ranked by preference.

- Initial Outreach: 10 investors to warm up

- Full outreach

- Schedule meetings and push for term sheets within the deadline

- Sign term sheets

With your story in hand, the next step is to get your campaign ready. This involves gathering all necessary documents, including a persuasive deck, detailed financial projections, and any legal due diligence like incorporation proofs or patents. These documents should be easily accessible, ideally in a shared digital space like Dropbox.

Before launching your campaign, it’s essential to test the waters. Engage with a few investors, and founders which have successfully raised capital, to gauge their feedback on your proposition’s risk and return potential. Their insights can be invaluable in fine-tuning your story and materials.

Set a launch date for your campaign, ideally giving yourself a 3-5 week lead time. This period is crucial for final preparations and adjustments based on early investor feedback.

Create a comprehensive list of potential investors. This list should be extensive, ranging between 50 to 100 names, ranked according to your preference. Initially, reach out to investors who are not in your top or bottom ranks. This approach allows you to refine your pitch before approaching your most preferred investors.

The actual campaign should be concise, ideally spanning two weeks from the date of your first investor meeting. Schedule all meetings within this timeframe, and aim for quick follow-ups like term sheets. A well-orchestrated campaign can create a sense of urgency and competition among investors, potentially leading to more favourable terms for your startup.

The Role of Milestones

- Investors want to see proof in order to justify funding growth, they do not want to fund the process of finding proof

- Fundraising as you achieve milestones (‘island hopping’) is a great way to inspire confidence and focus on execution

For an early-stage startup preparing for your first funding round, aligning your fundraising efforts with key milestones and traction is crucial. Defining and achieving specific, measurable milestones, such as significant product development stages, user acquisition targets, or revenue growth, enhances a startup’s appeal to investors by derisking the key assumptions which will ultimately determine product:market fit.

Demonstrating traction through concrete metrics like user growth or revenue will strengthen your fundraising narrative. By timing fundraising to coincide with these achievements, you not only boost your credibility but also show potential investors the capacity for setting and achieving ambitious goals, thereby laying a strong foundation for long-term success and investor confidence.

Understanding the Seasonal Timeline

- Ideally, raise early in the season (February and September) while investors are fresh and there is less competition for attention

- Don’t raise so close to winter or summer holidays that you risk conversations being postponed, and potentially abandoned

Timing is crucial in fundraising. Generally, the best times to initiate your campaign are in February and September. These periods see less pitching activity, giving your startup more visibility among investors. Later on, the market gets crowded with more opportunities, and typically lower quality startups who weren’t as well prepared to kick things off.

Equally important is avoiding the bad periods, specifically just before summer or winter holidays. Fundraising during these times can significantly hinder your chances as investors and decision-makers are often out of office.

Finally, it’s important to consider regional differences. If you’re fundraising in Europe, you might find that the Summer break lasts longer than in the US. However, if you’re fundraising in the US you also have to consider that the winter break really starts with Thanksgiving, at the end of November.

Conclusion

Fundraising is an intricate dance of storytelling, strategy, and timing. While securing funds is the end goal, the process is also about building lasting relationships with investors who fully understand and believe in your vision. Prioritize finding partners who offer more than just capital – those who provide expertise, networks, and a shared passion for your venture.

By following these guidelines, you can craft a fundraising story that not only captivates investors but also lays the strongest possible foundation for your startup’s future growth and success.