In this post, we’ll discuss everything that we have learned in the last 10 years performing startup valuation. You can read along or watch the video, pick the format that you prefer.

Over the past 10 years, we’ve helped north of 140,000 startups to make sure valuation was not a dealbreaker when raising capital. Over this time, we saw many recurring themes on valuation, how to set it, how to prepare for it, and how to discuss it. In this article, we want to share as much as possible of those learnings.

Below we’ll explore:

- how a cohesive story will help drive your fundraising efforts

- best practices for financial projections

- identifying and addressing key business assumptions

- solidifying your valuation

- negotiating with investors

How does the startup valuation journey start?

The journey usually starts with you, the founder or the CEO, realizing that your company has a cash need. So the decision is made to go looking for funding, and starting an investment round. The question follows: ‘What’s the valuation?’, or ‘What’s the offer I’m going to make to investors in return for this capital?’.

Alternatively, you get approached by an investor following a demo day or pitch contest, and the investor is excited about the company and makes you an offer. Suppose he says, ‘I’ll give you half a million dollars for 20% of the company. You have to determine whether that is a fair offer, and how to negotiate it.

That’s how most of our users get started: they get that valuation question, and they end up on Equidam.

Before we get into startup valuation, we need to take a step back. We need to understand that a company is a risky investment, and that – fundamentally – an investment is a sacrifice of money now for a greater amount of money in the future.

When we’re looking at the valuation of a company, we’re looking at how much money somebody would pay for a certain return, with a certain level of risk. Whenever we talk about the valuation of a company, this is what we mean.

Decrease Your Perceived Risk

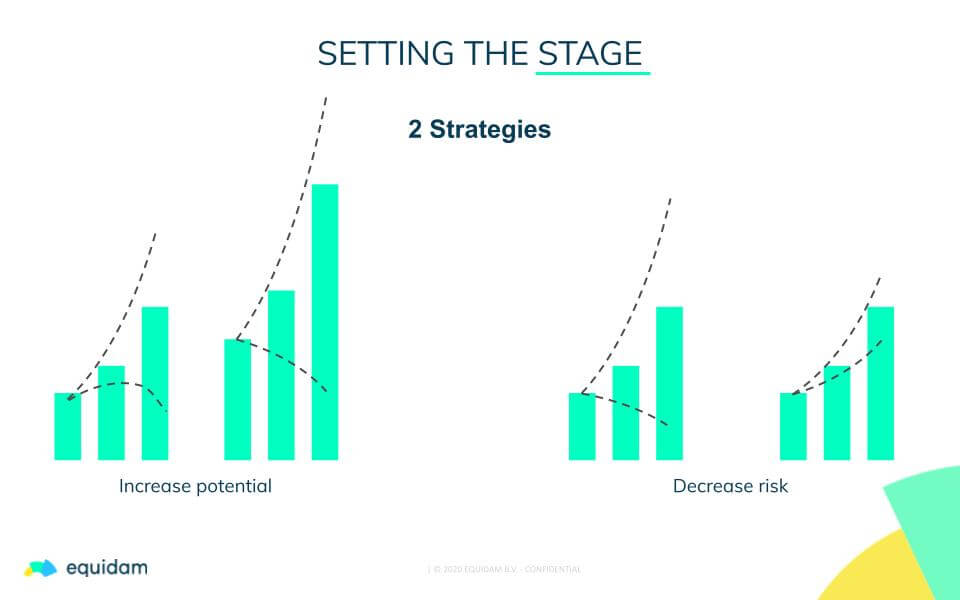

There are two ways to think about risk and return in relation to increasing valuation: One way is to increase potential, for example, entering a new market with a much greater capacity for growth. The other way is to decrease risk, by proving your business model and competence with more and more certainty as the company evolves.

We tend to see entrepreneurs focus on the former, increasing potential, and promising that their company will be everything to everybody. There is a limit to how effective that is, and what tends to be overlooked – as it’s less exciting – is decreasing the risk.

In everything a company does, you are working to prove your initial assumptions, to reduce business risk. You start at the beginning with every business risk: product-market fit, distribution risk, hiring risk, and security risk… As the company progresses, you prove that you have each of these risks figured out.

However, there is another form of risk that we don’t often consider: information asymmetry. When we present the company to investors, we also have the risk of not being understood, of not communicating everything the company has done, and so not properly communicating the risk level. This is really what we are trying to minimise at Equidam, through proper presentation, proper documentation, and a precise valuation.

The story generally for fundraising is crafted in three documents: the pitch deck, financial projections, and valuation.

How does this package become as solid as possible? How do you minimize the perceived risk as much as possible? By being coherent, by presenting a unified story, and by being as precise as possible. Minimize the unknowns wherever you can. Ensure everything is in-line and coherent.

(Company risk is decreased differently, by actually going out and proving assumptions.)

How to Craft The Best Startup Strategy (and Story)?

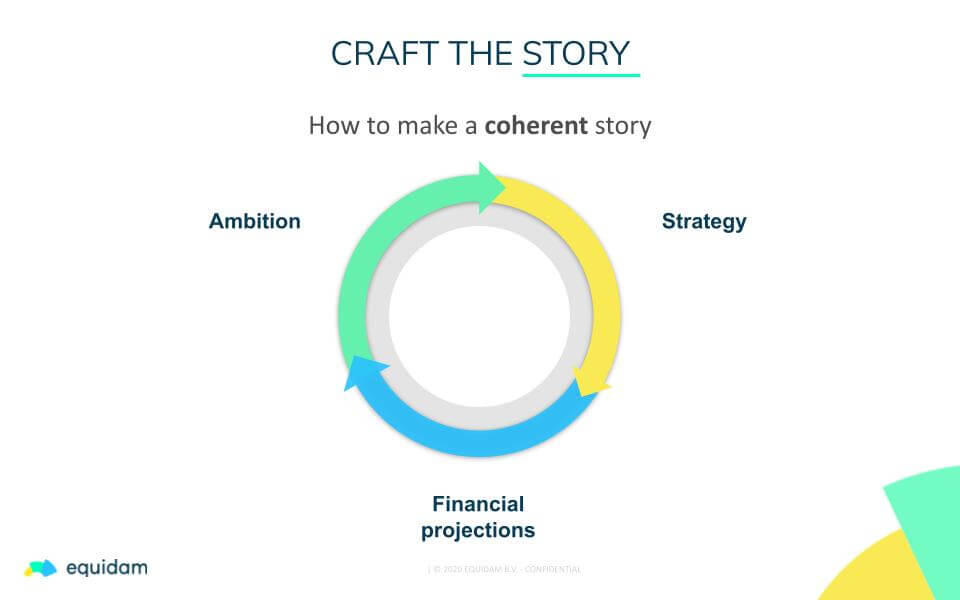

The startup business idea starts with ambition, coming from the founders, which is then converted to a strategy as they work out the rough details of bringing that ambition to market. What many founders miss is to properly closing the loop with financial projections, and going full-circle back to ambition.

Let’s say my ambition is to start the largest fast-food chain in the world. I craft a strategy: I will start with one burger place, and expand the franchise from there. So I make the financial projections based on that strategy, and when I’ve made enough money, I open the next.

After testing this assumption with real data, I might see that the numbers in my financial projections no longer support this ambition, and growth will be too slow. I might understand from this that I need to raise capital, and based on my ambition and projections, I need to raise $500M. So now the strategy is to raise $500M, to continue following my ambition.

The next step is to go to the market, but perhaps now I find no seed investment for $500M. The maximum I can raise is $5M. Perhaps this means I can’t be the biggest in the market, not the next Mcdonald’s, but maybe the third biggest is still within my grasp. So with this, I go back to revise financial projections, revise my ambition, and then finally my strategy.

This process is a cycle that converges onto the ideal plan to fit the ambition that you have.

Your Growth Engine is The Starting Point of Your Projections

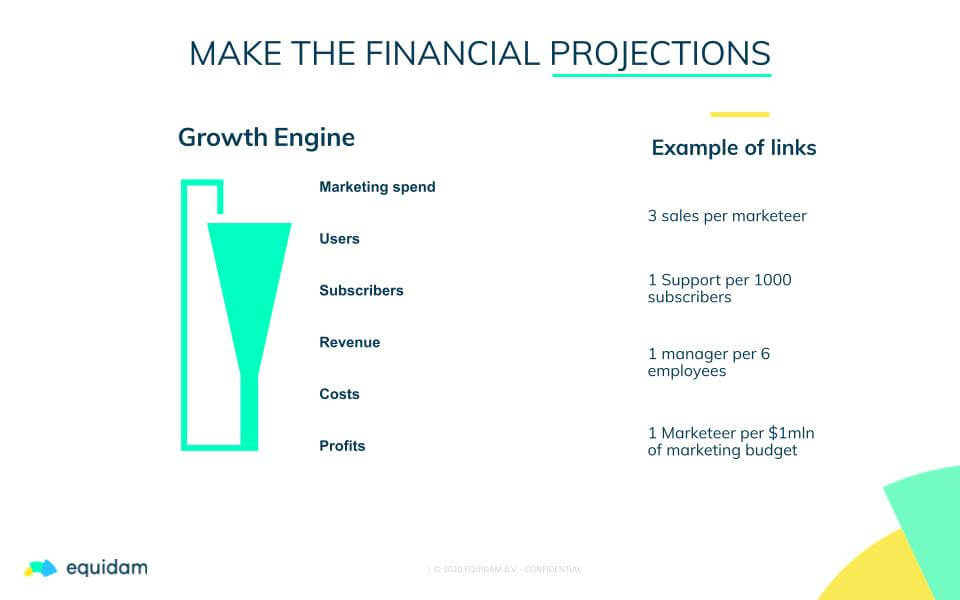

Let’s say you have a digital SaaS product, your growth engine could be something like what you see in the example above.

Essentially: your marketing spend is going to drive your users, your users will drive subscribers, your subscribers drive your revenue, and revenue will, for the most part, will drive costs and profits. At the end you may decide to put those profits back into your growth engine. This is how you create a virtuous cycle that grows until you reach saturation of your market or another company outcompetes you.

The more precise this growth engine is, the more proven it is, the less business risk we have to cope with. To an extreme where all of these factors and links are well understood, we know that if we pour $100M into the top of the growth engine, we’ll take $110M out at the end.

This is what you are trying to specify in your financial projections. For example, by adjusting your marketing spend – which is a variable you can control – you can determine how much you want to push for the company’s growth. And then, you can check with your ambition, and with your strategy, to make sure it makes sense.

The idea is to link every step of this process, and determine the relationship. The one that is often missed is the link between revenue and costs. We link everything back to the main variable, which could be conversion rates or marketing spending, and then we have a much more solid model to rely upon to contemplate the strategy. We increase the solidity of the whole thing by an order of magnitude.

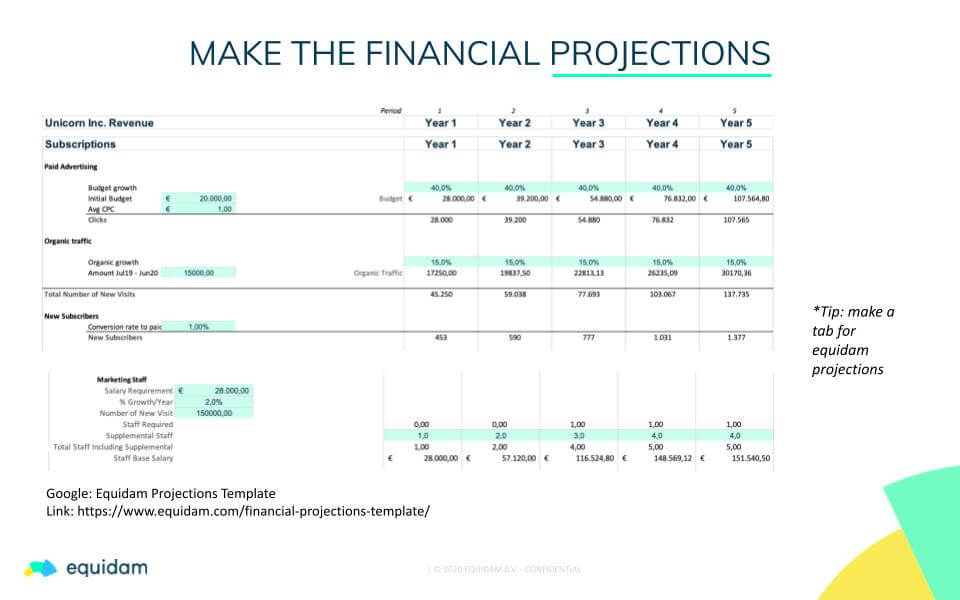

So how does that look in Excel? Here we go:

A small tip: if you make your Excel file, make a tab for Equidam projections – which is something we have online. You can map your Excel file to our financial projections, which will make using the platform easier later on. Check out our step-by-step guide and Excel template, here!

This allows you to present a solid model that investors can understand and experiment with: What’s going to happen if the marketing grows at 20%? What would happen if the conversion rate was 0.5% instead of 1%? It opens up the model to probing, which can help to find some of the more sensitive assumptions, impacting how investors might rely on those numbers more in their decisions and decreasing the perceived risk of the company.

We are trying to make our assumptions as reasonable as possible, and by playing with the variables in these forecasts, we will see which assumptions carry a lot of weight. At the beginning, you are unlikely to know what they are, but with time they can be addressed and proven with greater certainty.

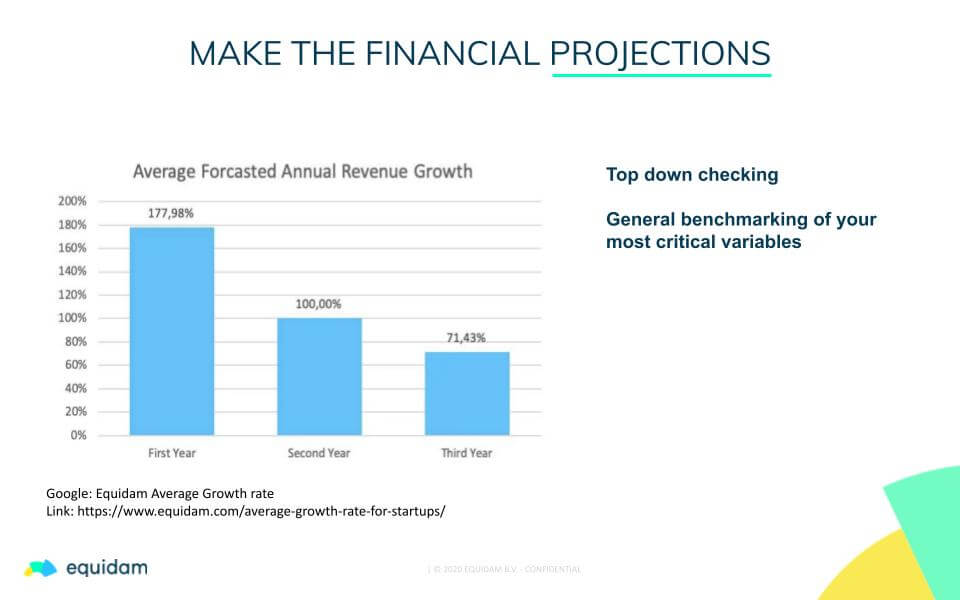

We always suggest you benchmark yourself with the industry. If your company is forecasted to make $10B in an industry worth $2B, then there’s probably an issue with the model. Unless your industry is growing like crazy, which is possible but check that.

The other thing to check is the growth. We have an article on the average growth forecast by our startups, which is useful as a benchmark. We don’t use this to make the forecast, but it can be used to check your forecast.

Over time, you are going to gain more and more experience about what is reasonable in your industry. Making financial projections is a good time to check your most critical variables, your public competitors, and their margins, you should be able to find their growth.

How Precise Should Projections Be?

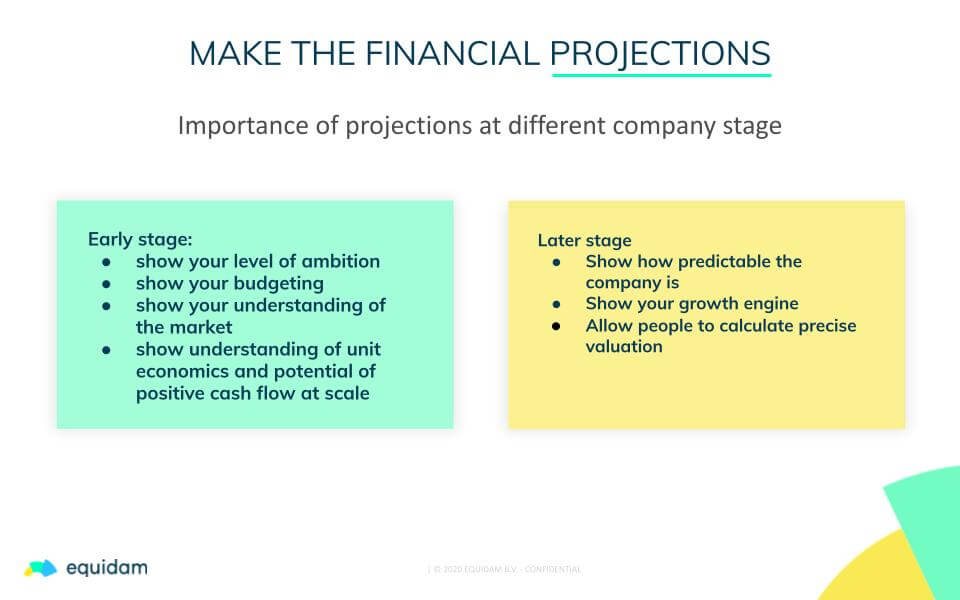

It depends a bit on the stage, but we must remember why financial projections are important at different stages. At an early stage it is important to have projections, but not really for their precision. At an early stage, they are there to decrease the risk on your level of ambition, your budgeting (you’re not just going to burn the money), they show your understanding of the market, and they show to an investor your understanding of unit economics and potential positive cashflow.

As the company moves forward, and proves itself over more and more milestones, removing more and more risk, the business becomes more predictable, the revenue becomes more predictable. Projections then are there to show just how predictable the company is, decrease the variability risks, prove your growth engine, and allow investors to calculate a more precise valuation based on the financials. To the extreme that when a company is public, or almost public, the only valuation method is based on the projections. But this level of precision is not something to worry about at an early stage.

At an early stage, your main concern is showing an understanding of your ambition, your unit economics, potential positive cash flow, and budgeting. The model needs to reflect your strategy, for the coherence of your story. Let’s say you plan to expand internationally in year 3, then you want to show a change in numbers for year 3 that is coherent with that strategy.

Keep it as simple and as clear as possible, because simplicity and ease of understanding is how you decrease the risk of being misunderstood.

And now, the next step of this process is to actually calculate your startup valuation on Equidam.

How To Negotiate Your Valuation

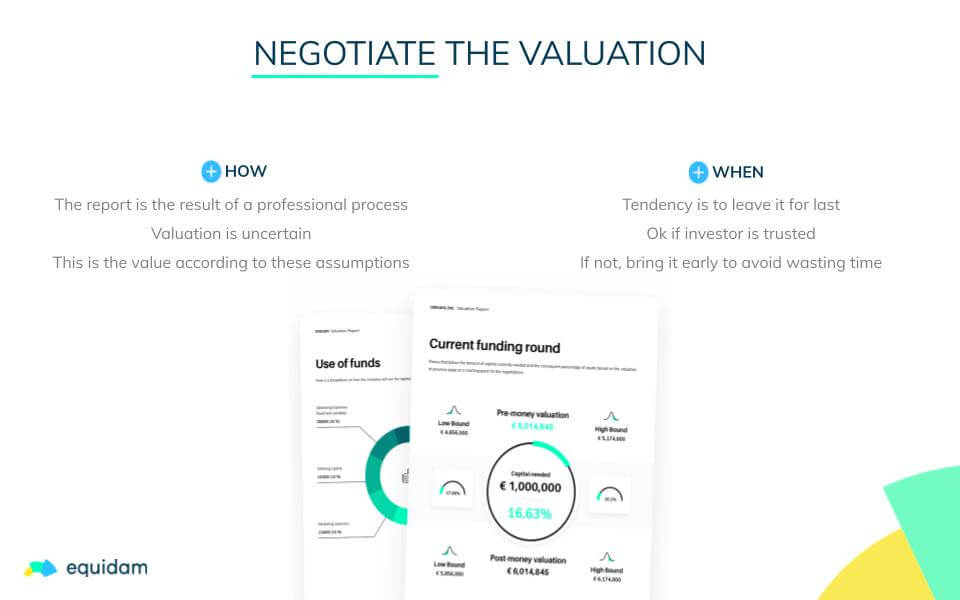

What we see working best is to approach the report as the result of a professional process. It’s not the absolute truth, but it’s not just a guess. We suggest not to claim that it has the exact valuation, because startup valuation is uncertain, especially at an early stage – and it is relative to the investor and their risk appetite.

Always try to bring the discussion to the assumptions that have been made, whether the assumptions are correct, e.g: ‘Why not believe in this growth forecast? Why not believe this margin? Here is the research we have done, which is why we believe in these assumptions.’

There are assumptions that Equidam itself makes in the process. We provide a lot of documentation to back up those assumptions, reach out to us if you are asked questions about the process that you cannot answer.

A question we are asked frequently is whether to bring the report to the investor meetings, and I would say yes. The tendency is to leave the discussion about the valuation for the last meeting. That is ok if the investor is quite well trusted, if you know them already, and they offer fair valuations. If you’re less sure about the investor then I would say bring it on in the first meeting, and find out quickly whether or not they are serious.

It’s important to think about the investor’s point of view, also. When they say no, they are not saying the company has no future, they are just saying they have limited capital, and they may see better uses for it. So don’t be too concerned about an investor rejection. They are looking for a distinguishing factor, an Alpha in finance; what is your unfair advantage in the market? What is your company’s unfair advantage compared to competitors? It could be on an array of things, it could be the milestones you have already achieved, it could be your founder knowledge, whether you are uniquely positioned to tackle the market or the potential return on investment.

Remember, fundraising is an interactive process. Present, listen, modify, repeat. You are the sell side, and you make assumptions, and you don’t necessarily know the appetite of the buy side for what you are selling. The same process of discovering product-market fit applies to the fundraising process. You can never know the assumptions of the other party until you ask.