Similar to startups, valuing residential real estate presents a particular set of challenges: each property is unique in terms of location, condition, design, and a host of other qualitative factors that influence its value. Market conditions can fluctuate widely, and a property’s worth can be affected by both micro and macroeconomic factors that are often difficult to predict. Emotional and subjective judgments can also sway the perceived value of a home.

The parallel challenges in valuing both startups and real estate stem from the same root: the difficulty of forecasting future potential and the subjective nature of qualitative factors. This is where the art of valuation meets the science, requiring a blend of data analysis and market insight which can help you to arrive at a credible assessment of worth.

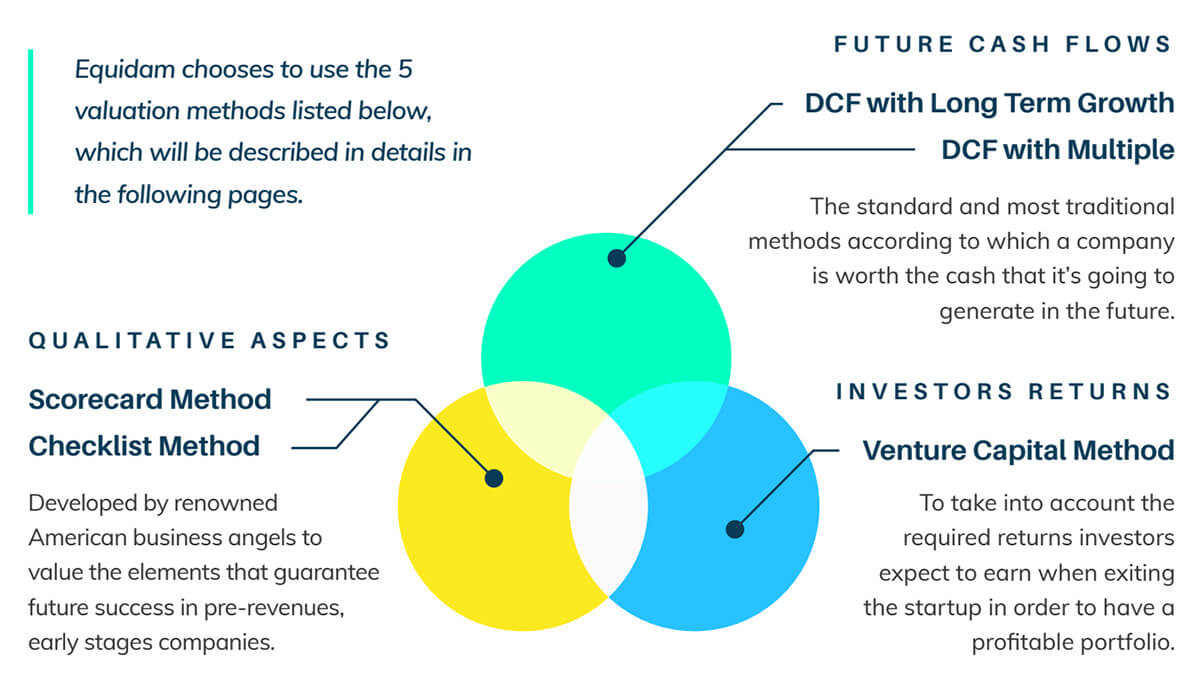

By examining prevalent startup valuation methods, specifically the five we use at Equidam, we can explore how they mirror the process of appraising properties in residential real estate, offering a more rounded perspective on an asset’s true value. Credit for this perspective goes to Dr Ola Brown’s fantastic video on Deal Sourcing, Valuation and Due Diligence, in which she also uses real estate as an analogy for valuation – the inspiration of this article, and well worth a watch.

Qualitative Aspects:

The Scorecard Approach: Neighborhood Benchmarking

The Scorecard method evaluates a new venture by benchmarking it against average regional valuations and adjusting for strengths and weaknesses based on verifiable characteristics. This is particularly appropriate for early stage companies, where these factors help derisk the future vision for revenue and exit potential.

Translated into real estate, this approach would compare a house to the average price within its neighborhood. Adjustments are then made based on unique features — much like startup valuations consider management team quality or product uniqueness. Location, size, condition, and additional amenities become the features that shift a property’s value from the neighborhood mean.

(read more: the Scorecard method)

The Checklist Method: Setting the Price Ceiling

The Checklist method in startups involves a comparison against the high achievers of the region, applying discounts for each area where the startup may fall short. Similar to Scorecard, this is a qualitative method focused on verifiable characteristics and is most appropriate for early stage companies without much traction.

In real estate, this translates to evaluating a house against the most opulent homes in the area. Discounts are then applied for less desirable locations, outdated features, or lack of modern amenities. This approach ensures that while aspirational benchmarks are set, reality tempers the final valuation by first establishing a reasonable ceiling.

(read more: the Checklist method)

Investor Returns:

The Venture Capital (VC) Method: Estimating Return

Startups are often assessed by VCs through potential future returns on investment over a given time frame, commonly 5-10 years. The exit potential is established, and is weighed against typical returns in the asset class. In real estate, this equates to appraising the investment value of a property, gauging its future sale price, and measuring this against typically expected returns for similar properties. This method shines in highlighting properties with significant appreciation potential, akin to startups with high growth trajectories.

To understand that growth trajectory, a real estate investor might look at the average price per square meter of sold properties in that area, compared to the property they are evaluating, to understand whether it’s a good deal. This is similar to how revenue and EBITDA multiples are used for startups.

(read more: the VC method)

Future Cash Flows:

Discounted Cash Flow (DCF) with Multiple: Investment Comparison

The DCF with Multiples method in startup valuation computes the present value of future earnings, adjusted by a multiplier reflective of market conditions. In residential real estate, this method can assess investment value by comparing a property against various investment types, such as stocks or bonds. This approach weighs the property’s potential return against other vehicles, offering investors a broader investment context.

Similar to the Venture Capital method, this relies on using a multiple to establish the method of pricing a house appropriately with the market. Unlike the VC method, here we are making a more sophisticated calculation to understand how this investment compares to other assets in terms of risk and return. The level of detail involved makes this method most appropriate for later stage companies with more certainty in their financials, or in real estate terms, well-established neighborhoods with little pricing volatility.

(read more: DCF with Multiple)

DCF with Long-Term Growth: The Rental Yield Potential

Startups are also valued by estimating long-term growth and cash flow. To quote famed American economist Alfred Rappaport, “cash is a fact; profit is an opinion”.

In real estate, this is akin to calculating a property’s cash-generating potential, if it were rented rather than sold, to understand the value of the asset. It’s a forecast not just of the property’s ability to produce consistent rental income over time, offering an insight into its sustainable earning power. Similar to the DCF with Multiples method, this is a more sophisticated financial calculation which is most appropriate for cases with more certainty around the outcome.

(read more: DCF with LTG)

The Best Approach: A Combination of Perspectives

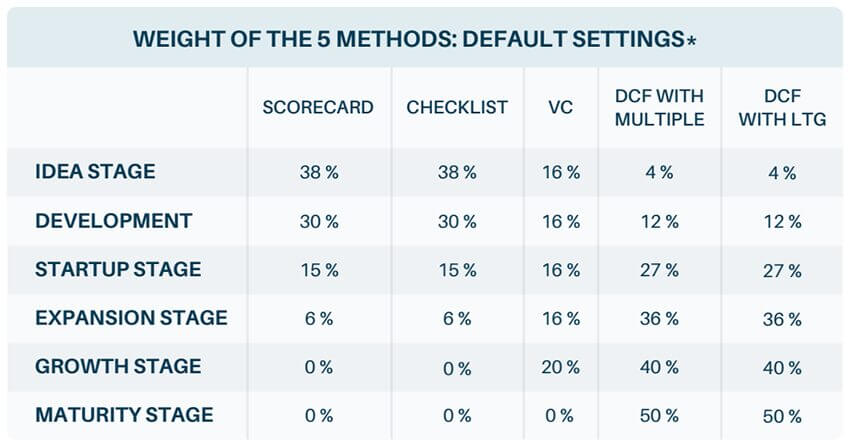

By employing a weighted combination of these methods, valuators in both domains can gain a comprehensive view of an asset’s worth. In real estate, as in startups, this multifaceted approach allows for a holistic understanding of value, considering not just the present, but the potential and the position within a larger economic landscape.

Importantly, a combination of perspectives means that market-based methods aren’t allowed to spiral out of control with their procyclical influence on price trends. Both in startups and real estate, an overreliance on comparables can create bubbles which strain the limits of rationality, and then implode.