Use Equidam to calculate a fair valuation for your company at any stage of development, with the expansion of our industry leading methodology to account for risk and growth potential at later stages.

While Equidam is primarily used for startup valuation around the pre-seed to series A stages, our framework is entirely applicable through the full life-cycle of a company. This flexibility is thanks to our approach of balancing a combination of methods according to the stage of development of the venture.

Over the past few months we’ve seen increased interest in valuation from companies further along on their journey, where there is more certainty around product, market and revenue. In response to this, we’ve expanded our methodology to account for two new development stages: Growth and Maturity.

Focusing on the financials

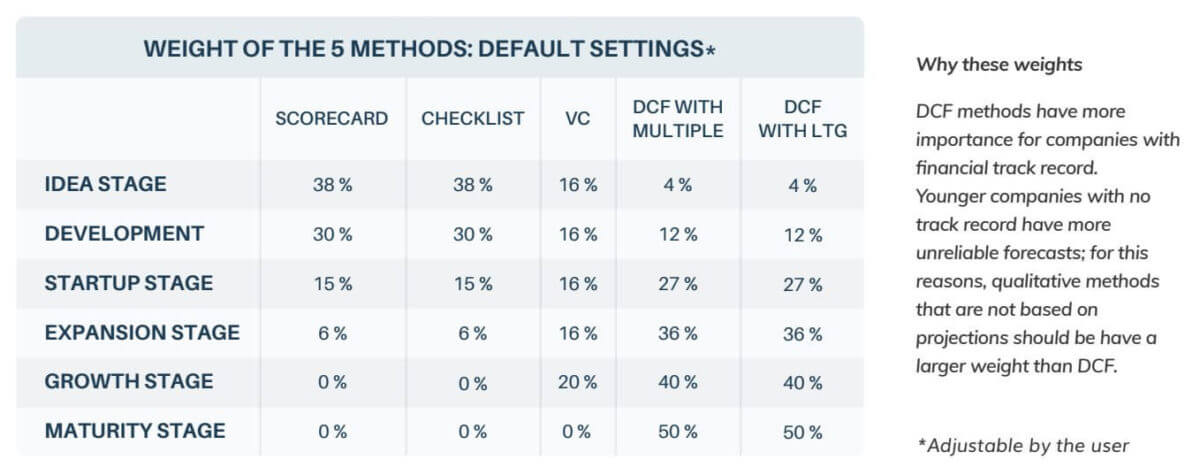

As with the other development stages, this influences the weighting of the five methods which form Equidam’s valuation methodology:

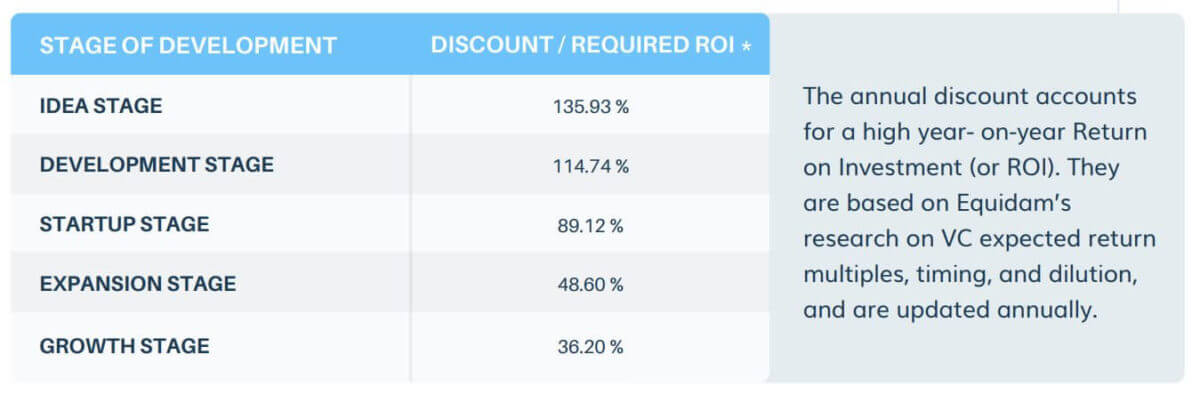

At the Growth stage we eliminate the qualitative methods, as the founder / team risk has now all but been eliminated by the revenue milestones achieved. The VC method remains, as the future growth potential at that stage will be attractive to later stage venture capital firms, though with a slightly lower required ROI to reflect the reduced risk.

At the Maturity stage, we’re now looking exclusively at the two DCF methods, as the value of the company at this point can be linked almost entirely to future cash flows. The company will have moved into the ‘slow and steady’ part of the growth curve where private equity becomes more relevant than venture capital and valuation is much more of a science than an art.

So do team and assets no longer matter?

The qualitative methods used by Equidam, Scorecard and Checklist, are geared towards understanding the future potential of a startup, early on in its journey. This includes considering the potential of the current product and business model, as well as the potential for that team to successfully evolve or pivot as required in future.

As a company grows, and as more is proved about the market, revenue potential and unit economics, the qualitative factors have less and less relevance to the future of the business. At pre-seed investors will focus a lot on the founding team of a company, by Series E and beyond they will be looking almost exclusively at the numbers.

This does not mean the qualitative assets of your company no longer hold value; given the achieved scale and predictability of the company, the value of those assets is better approximated by their influence on future cash flow.

Evolution and collaboration

The venture landscape is constantly evolving, and so is our platform and our approach to valuation. Regular users will have noticed a number of new features appear over the last few weeks, and we’re constantly in talks with partners about ways to make Equidam valuations even more practical and accessible.

For this update, we give significant credit to the team at WET FOREST, whose research helped us to properly define and integrate these two additional growth stages into the platform. We’re hugely grateful for their support and collaboration.

If you are an Equidam partner (or would like to be) and would like to discuss how we approach valuation, feel free to get in touch!