How Much to Raise: The Competitive Angle Most Founders Miss

Every founder preparing to raise asks the same question: how much should I raise? The standard…

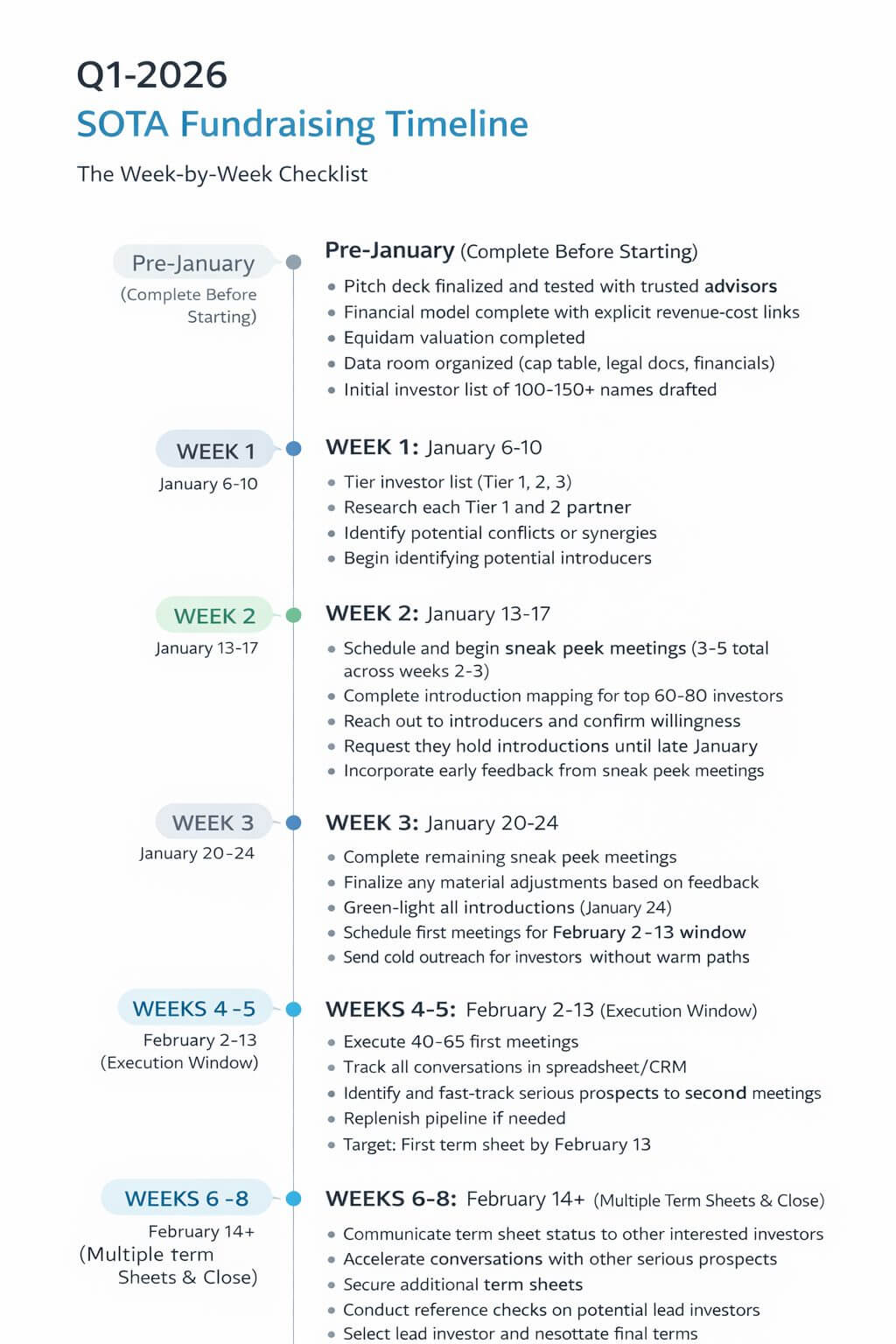

The Q1 Sprint: Your 6-Week Fundraising Timeline for Early 2026

The best founders don't just raise capital—they time it. And if you're planning to fundraise in…

New on Equidam: Sensitivity Analysis and Enhanced Multiples—Why Defensible Valuations Need Visible Assumptions

Every valuation conversation eventually hits the same wall. The founder has done the work. They've…

Startup Valuation & Fundraising Strategy: The Deep-Tech Playbook

Fundraising for deeptech is nothing like the copy-and-paste playbooks you see for SaaS: timelines…

Equidam vs EQVISTA: Choosing the Best Startup Valuation Platform

Valuing a startup is a complex endeavor, blending quantitative financial projections with…

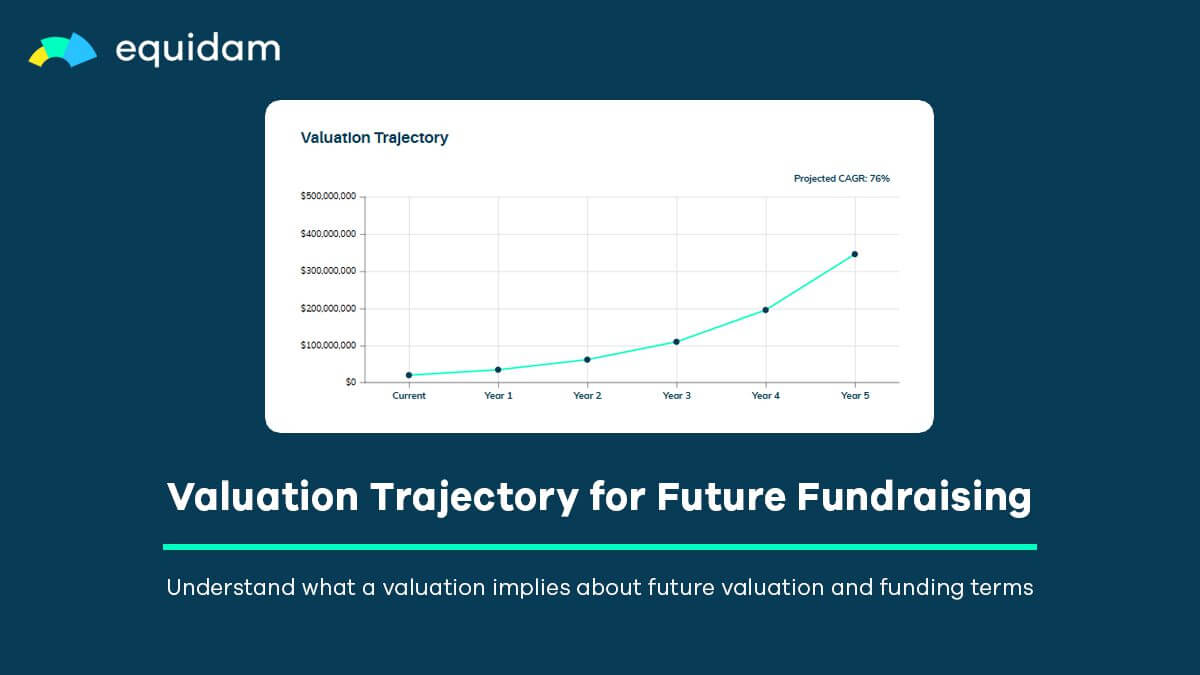

How Equidam Models Valuation Trajectory for Easier Future Fundraising

Venture capital is built on staged commitments. Rather than betting the farm up front, investors…

Simple Priced Seed Fundraising Documents: Founder Guide

The Series First documents, crafted by Rimon Law partner Brian Dirkmaat, are an innovative…

Top 10 Startup Valuation Platforms for Effective Fundraising

If you’re raising a round, you don’t need an audit memo; you need a valuation you can explain,…

Standard Capital's Series A Fundraising Documents: Founder Guide

In startup financing, standardized fundraising documents transform what was once a maze of bespoke…