Revenue Multiples by Industry in 2026

You can find in the table below a list of revenue multiples broken down into the same industry…

How to Value a Hit-Driven Business: Startups in Music, Gaming, and Creative Industries

Practical valuation frameworks for industries where the average is meaningless and the upside is…

EBITDA Multiples by Industry in 2025

You can find in the table below the EBITDA multiples for the industries available on the Equidam…

PARAMETERS UPDATE P6.2

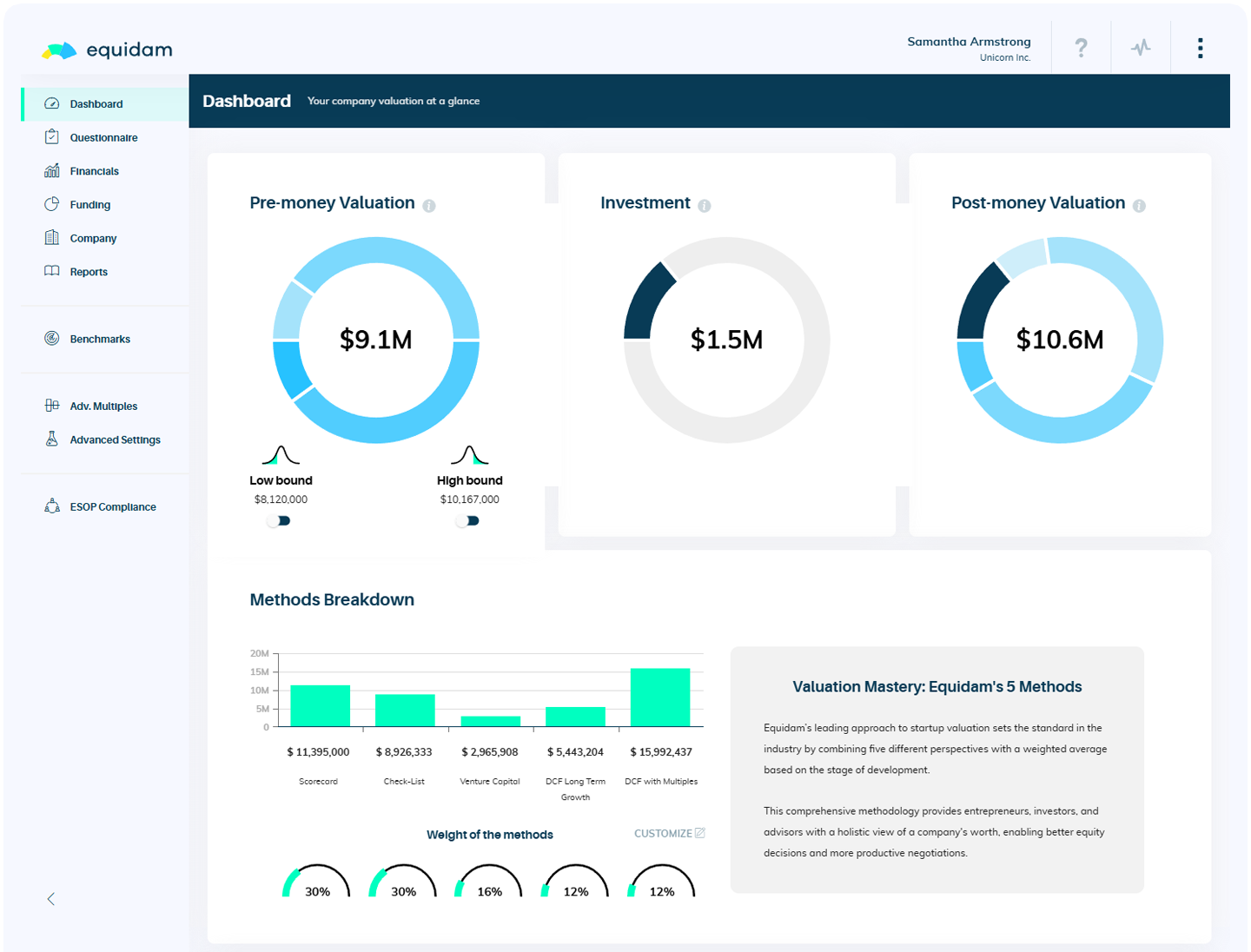

On February 16th, 2026, you’ll be upgraded to the latest version of Equidam with updated…

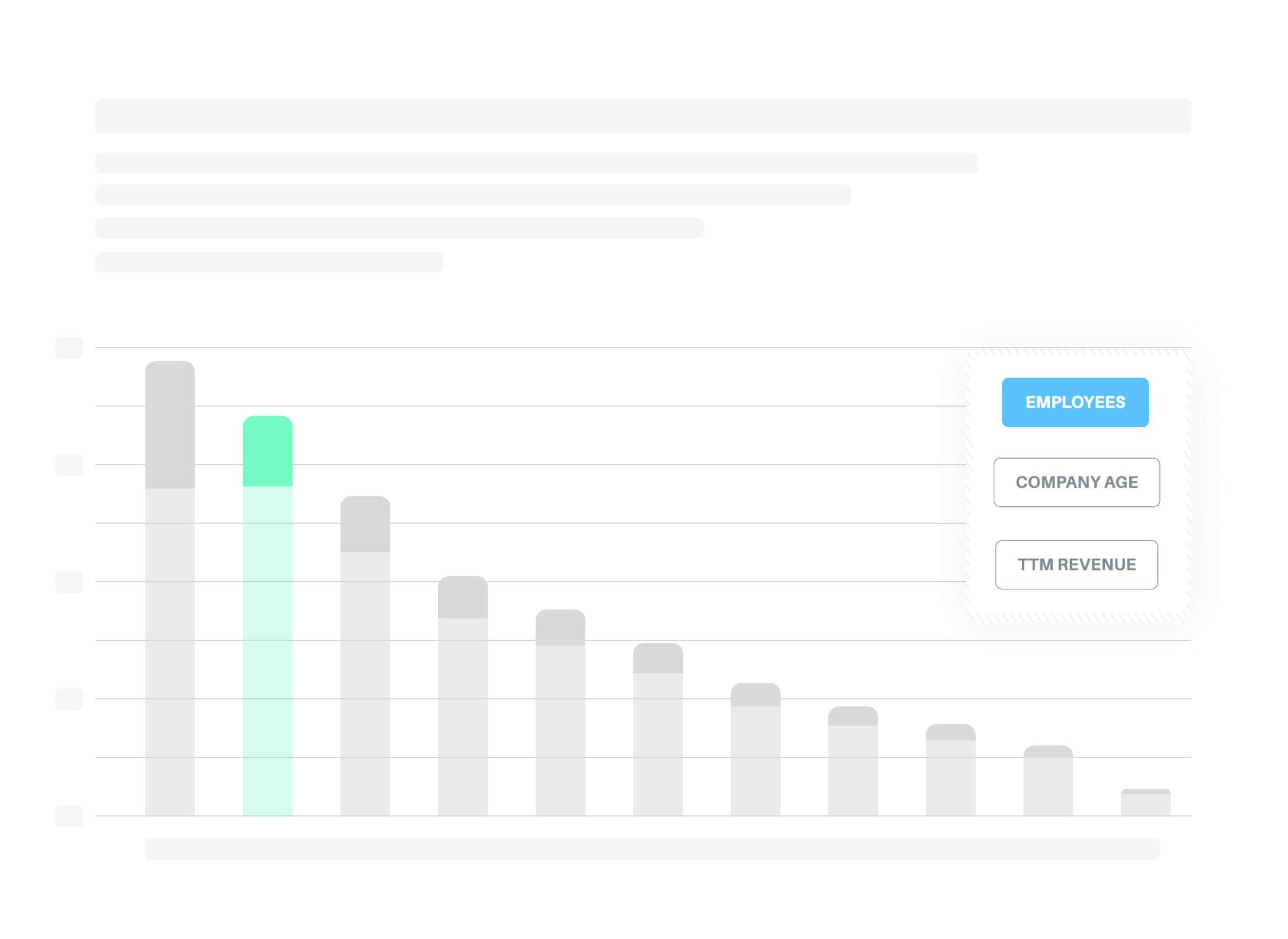

New on Equidam: Sensitivity Analysis and Enhanced Multiples—Why Defensible Valuations Need Visible Assumptions

Every valuation conversation eventually hits the same wall. The founder has done the work. They've…

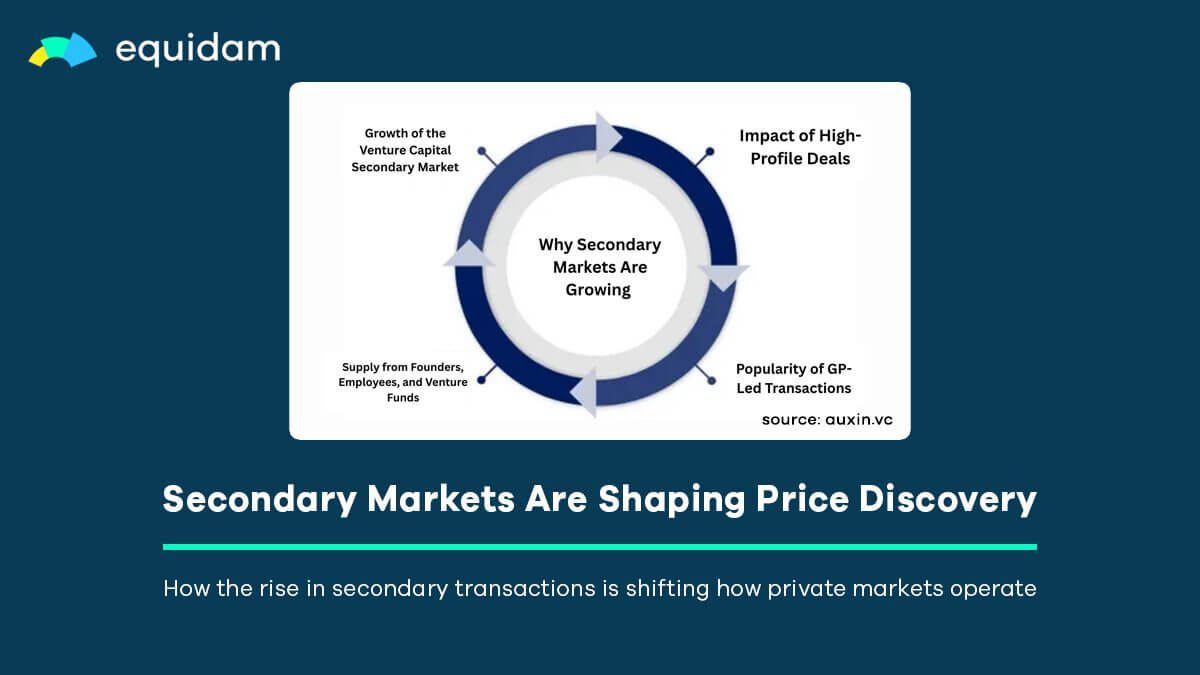

Secondary Markets Are Shaping Price Discovery in VC

In 2024–25, the most informative market prices for late-stage startups increasingly come from…

Startup Valuation & Fundraising Strategy: The Deep-Tech Playbook

Fundraising for deeptech is nothing like the copy-and-paste playbooks you see for SaaS: timelines…

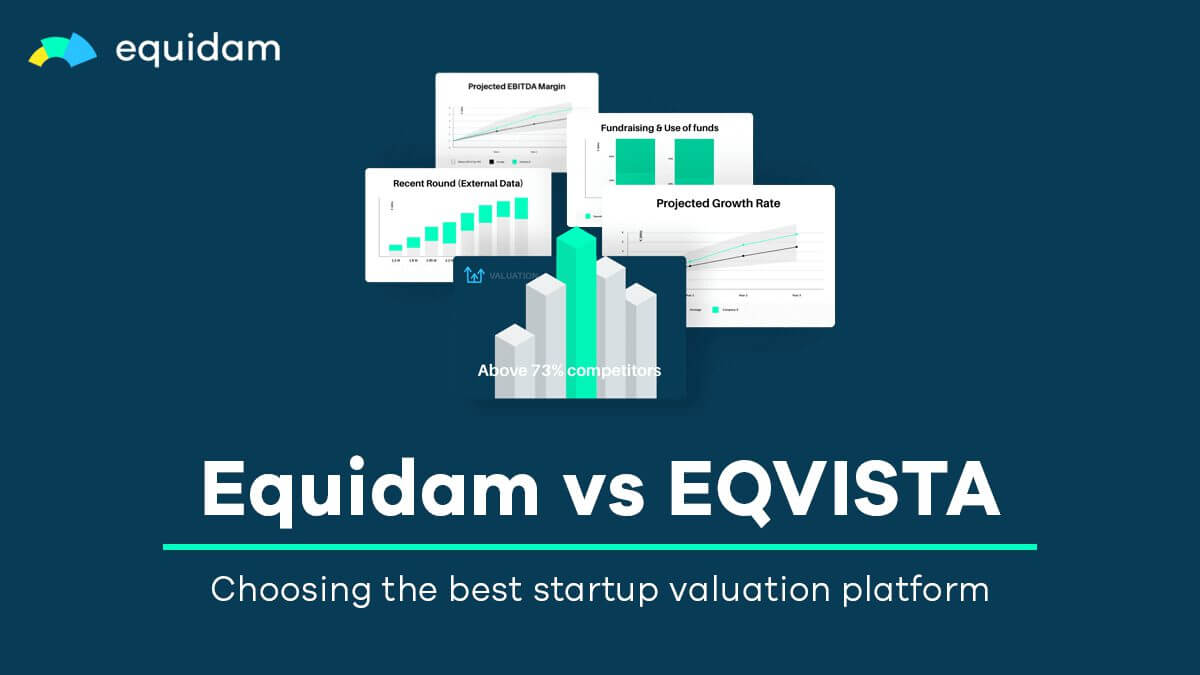

Equidam vs EQVISTA: Choosing the Best Startup Valuation Platform

Valuing a startup is a complex endeavor, blending quantitative financial projections with…

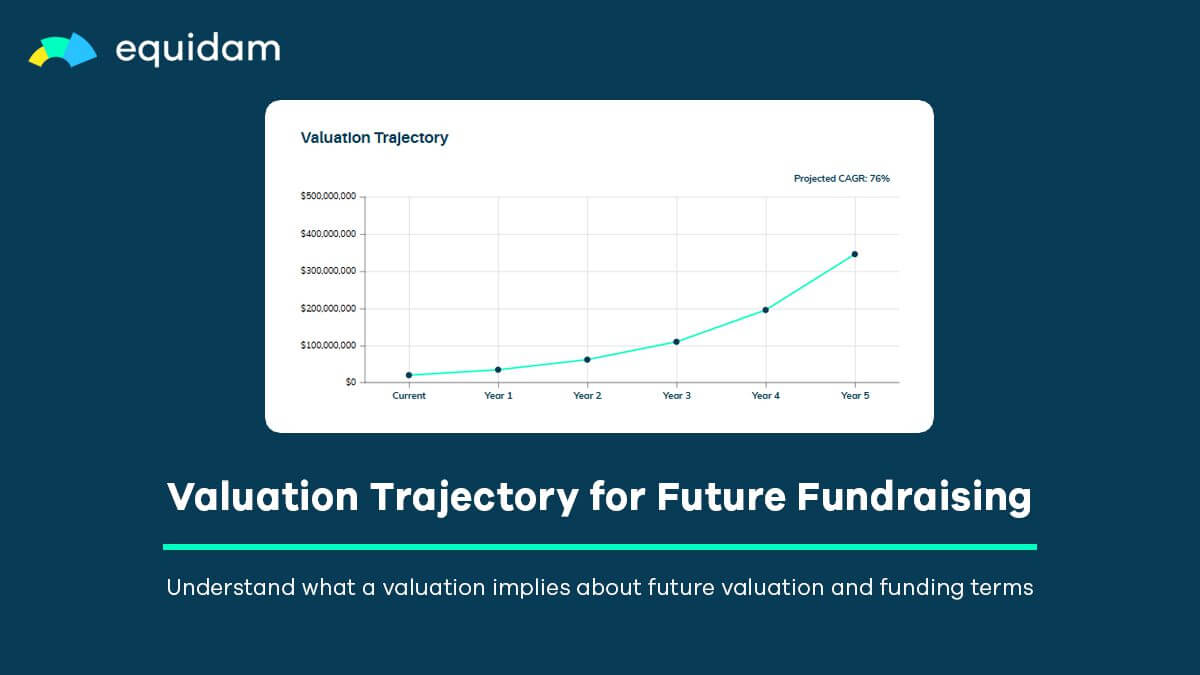

How Equidam Models Valuation Trajectory for Easier Future Fundraising

Venture capital is built on staged commitments. Rather than betting the farm up front, investors…