Can you measure the value of a company relying entirely on financial tools and models? Should you ignore the story and vision behind the numbers?

We say that an interplay between the numbers and the story produces the most reliable valuation.

Demystifying Valuation

The business valuation process is an agreement between two parties, where the object of transfer is a business, or very often, a portion of this business. To reach an agreement, it is important that the entrepreneur builds a relationship with the investor. Trust and transparency about the business and the investment terms are the two components to build a good relationship with investors.

There are essentially three important things to keep in mind (and be transparent about) during the negotiation process – the equity percentage to give away, the investment amount and the valuation.

During the initial investment discussions, your goal should be to find out what the most sensitive variable for your counterpart is – the one they feel less inclined to negotiate on. That way you can prepare and adjust your own negotiation strategy. The equity stake is usually the less flexible lever, while the investment amount and valuation have larger variation.

Let’s take the following example:

If you feel that the people on the other side of the table are less willing to discuss valuation ranges, emphasise on the amount of capital you need to meet your target and reach a subsequent funding round. Having a clear step-by-step plan of how the capital will be invested as well as a comprehensible definition of your growth strategy will further reinforce your investment proposition.

Many investors enter into negotiations bearing in mind the equity percentage that they want to receive. To succeed in negotiations, you need to consider the stage of development of your startup, since oftentimes, the percentage is respective to the stage. Generally, for an initial fundraising round (pre-seed stage) you would be negotiating within 10% -20% of equity. At the following stage – seed to Series A, the range of negotiation increases to 15%-35%.

For a clear overview of the ranges of negotiations for startups in different stages of development, take a look at the Startup Fundraising Path.

There are two things you can do:

1) Try to negotiate within these ranges

2) Present strong assumptions supported by data and prove the preconceptions of the VCs wrong

One of the approaches towards creating solid assumptions is looking into comparables – those companies or deals that are similar in size, type of company and industry. Having solid arguments for your assumptions clears the path to negotiate on the investment capital that you need and the equity percentage you are prepared to give away.

The other point you can negotiate on is your valuation – the fair market value of your business.

First things first, let’s clarify what valuation means.

Valuation is:

- an instrument to support your claim

- a disciplined process to measure and quantify the future (based on a set of assumptions)

Valuation is NOT:

- a purpose on its own: numbers are just numbers

- a science – a perfect and indisputable picture of the future

To recap, valuation is not a stand-alone concept. You should use your financial modelling, strategy and growth plans to help you get your point across.

But,

Financial modelling, strategy and growth plans do not mean much without a narrative to back them up.

Numbers vs Story

The current valuation landscape is divided in two – the narratives people and the numbers people.

As you can tell from their name, the numbers people believe that valuation is primarily about numbers and that narratives and stories are distractions that just include a factor of irrationality in investing. Most traditional valuation practitioners support this creed.

On the other side, we find the narratives people, who believe in the power of storytelling when it comes to valuing companies. The narratives people say valuation, and investing in general, are about great stories and find that it is impossible to try to estimate specific numbers when faced with uncertainty.

We believe that it’s never as simple as one or the other.

Valuation is a mix of narrative and data crunching

So how should you build your valuation case?

You need to have strong and defensible argumentation to solidify the assumptions behind your financial model and valuation. That will make the overall investment proposition more well-grounded. One thing you can do to prove the credibility of your assumptions is to use market data.

Equidam relies on a database of 10M data points on market transaction to find comparables and provide accurate financial parameters and valuation!

Another way to make your assumptions more feasible is to use your story.

The story makes people see the vision, the potential behind your company and helps translate that to numbers. Ultimately, investors are buying the potential of your company, so you need to make sure that they have a clear picture of your vision for the company.

Additional perk: The presence of a narrative will engage your potential investor at an emotional level and help them remember more information about your investment proposition.

“If you believe the story attached to it, you believe the valuation”

Valuation Process

NYU professor Aswath Damodaran – expert in startup valuation – created a step-by-step framework to follow when valuing a company.

Step 1 | Develop a narrative

Develop a vision, a feeling of mission, a credible plan with milestones and communicate that with a sense of urgency.

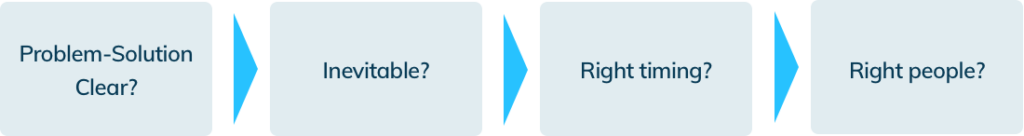

Here’s a useful framework to define urgency:

When answering these questions, try to emphasise on your related experience and previous track-record in the industry. Display enthusiasm and passion while telling your startup’s story and try to show leadership and assertiveness – investors look for these qualities in entrepreneurs.

Step 2 | Test the narrative

Choose a story that is possible, plausible and probable. Test it and be receptive to feedback.

Here it is important to note a few details. When it comes to the narrative, people genuinely only understand up to 2 layers of complexity. If it takes more than that for them to understand, your story is probably too complex. Once your narrative is complete, try telling your story to different people to check if they understand and relate to it.

Quick tip: Try different audiences and take their feedback with a pinch of salt – not everybody can understand it, but the more the better.

Step 3 | Convert the narrative into value drivers

Once you have tested your story, convert it to value drivers. In other words, attach numbers to your story in order to reinforce your narrative and make it concrete.

There are two approaches to do that – top-down and bottom-up.

Top-down approach (from the outside-in): Focus on the big picture – total available market size, target market share, etc. Break these components down in terms of number of acquisitions, conversion rates, and other metrics to give an estimate of the company’s expected performance.

Bottom-up approach (from the inside-out): Focus on the company and it’s drivers such as productivity, price, hiring, etc. Make assumptions on the future evolution of these metrics and use these assumptions to derive the company’s expected performance.

Choosing between the two approaches depends entirely on the type of company and the availability of the data that you need to make the assumptions. Whichever approach you choose, the number that constitutes your company’s performance needs to be supported by evidence that the company can reach these goals. For example, you can use the performance of similar companies (comparables) as a benchmark.

Quick tip: The top-down approach is preferable for young, high-growth companies. The bottom-up approach is applicable when you don’t have reliable market figures.

Step 4 | Connect the drivers to a valuation

This is the moment where you make the actual valuation estimation. There are tools and resources you can use to determine the specific value of your company. We recommend using a combination of methods and calculations to arrive at a comprehensive valuation estimate.

Equidam calculates your valuation based on the 5 most frequently used valuation methods and does it at 1/10 the time and price of standard valuation services!

Don’t forget that the valuation is just a reflection of the assumptions you make in the financial modelling process. So, continuously question and challenge your own assumptions.

In the negotiation process, focus on the assumptions rather than on the valuation itself. If the other party agrees on them, then they will most likely agree with the valuation.

Step 5 | Keep the feedback loop open

One last piece of advice on this, be passionate about your story but don’t make it a dogma. Defend the narrative that you have created but be receptive to criticism. If a disagreement arises on the assumptions you have presented, try to pinpoint the main criticism and work towards smoothing that over.

Quick tip: Make assumptions and value drivers clear and ask for feedback on them, that makes setting common milestones much easier.

If you do steps 1 to 3 right, chances are steps 4 and 5 will go pretty smoothly. But get ready for negotiations. Remember that trust remains an important aspect of every investment: without trust it will take much much longer to complete the negotiations stage.

Case Study: Uber Narrative (as of September 2014)

The story of Uber and its unicorn valuation have been highly controversial. This also makes it the perfect example of how narrative can influence the valuation and increase several times the value of one company.

In a post on FiveThirtyEight, professor Damodaran tries to discredit the big number given for the valuation of the ride-sharing company. He said that “Uber’s growth potential rests not only on being able to claim a larger share of the car-service market but also on expanding this market by attracting those who use public transportation or drive their own cars”.

He took the top-down approach as mentioned above to estimate the value of the company. One of the ways to do that is to find the present value of the future cash flows of that company. The future cash flows of Uber were dependent on three components, according to professor Damodaran – size of potential market, Uber’s market share and percentage of gross receipts Uber takes.

One pivotal assumption he made is that Uber is focusing entirely on the car-service market. He estimated a 6% year-on-year growth for the global taxi and car-service market, hence projecting the total available market in 2024 at $183 billion.

Another assumption that he made is the estimate of the market share of Uber. The global market for car-services is still splintered – there are local leaders in every city. Network effects are limited, since a customer looking for a taxi in New York does not benefit from available taxis or cars in a different location. Then, the estimate of Uber’s target market share was 10%.

In order to estimate the value of the company, he assumed that Uber would retain their 20% commission on the fare as well as their low-cost model.

Professor Damodaran arrived at a concrete number for the valuation of Uber – $5.9 billion, which was a staggering 3 times less than what Uber was valued at in 2014 (the time the analysis was made).

In September 2014 the valuation of Uber was $17bn, based on its recent investment of $1.2bn.

How can numbers explain that?

The answer is they cannot.

Bill Gurley addressed the issue in his post (a reply to Damodaran), where he discredited Damodaran’s assumptions. Gurley explained that Uber is car-company set out to disrupt and replace not only the car-service industry but also the car ownership industry.

Taking into account the global car industry, the total available market for Uber greatly exceeds the one in Damodaran’s calculations.

Gurley also made the point that the larger the user base of Uber, the more partnerships they are able to secure. Hence, global network effects also exist, which affects the size of the market share Uber can take.

Based on that he claims that Uber’s valuation was at least 25X what Damodaran estimated at the time.

And the difference comes entirely from the story around the numbers!

As a matter of fact, Uber is growing so fast that everything seems possible. But is it? Time will tell…

What’s your opinion? Do you trust only the numbers or will the vision and drive of Uber determine its value?