Valuation is too often where the conversation between investors and founders falls apart. With a grounded methodology, the result is easier to discuss and the chance of closing a fair deal increases.

In this article, we are going to walk you through a startup valuation using 5 of the most commonly used valuation methodologies.

First, let’s define ‘valuation’ for startups

Valuing a business means determining how much the business is worth, coming up with its fair market value.

Calculating the company valuation becomes important in several occasions – looking for investment, creating employee stock option agreement or planning an exit strategy.

The valuation depends on a large amount of external and internal factors including current economic conditions and similar companies or competitors.

Depending on the development stage of the business, different methods can be used to determine the business value. These are the 5 most common valuation methods:

- The Scorecard method

- The Checklist method

- The DCF method with Multiples

- The DCF method with Long-Term Growth

- The VC method

Calculating the business value of a company with untested and unproven business model – often pre-revenues – largely depends on factors such as the strength of the entrepreneurial team, the idea, whether or not there is a prototype, IP, etc.

The most formalized methods that business angels use for early-stage companies are the scorecard method and the checklist method.

1| The Scorecard method

Bill Payne, an angel investor, originally came up with the scorecard method. He described this method in his book “The Definitive Guide to Raising Money From Angels” (2006).

The scorecard method is often used for startups because it compares them to other – already funded – companies while also taking into account the differences.

The first step here is to determine the average pre-money valuation of companies in the same business sector as the target company. This information is not often disclosed, however, some sources can be used as benchmarks – i.e. Angel List valuations

The second step is to consider the following elements:

- Strength of the Entrepreneur & Team

- Size of the Opportunity

- Product/Technology

- Competitive Environment

- Marketing/Sales/Partnerships

- Need for Additional Investment.

The weight of these factors in the final valuation ranges from 0 to 100%. The factors are then given a score based on a comparison with similar businesses.

After you have assigned weights and scores for each comparison, you can calculate the factors by multiplying the range by the score of the company.

This is probably easier to explain with an example. Your company, Company X, developed an innovative piece of technology for smartphones. You and your team are looking to raise capital to finalize the product and bring it to market. You have done some prior research and have found that the average pre-money valuation of similar startups in the industry is about $800,000. You project that for the first three years your company will have an EBITDA of roughly $200,000.

Based on the previous entrepreneurial experience of the founding team (all participated in startup founding teams before) you decide on a score of 125% on the first element. Your product is also highly innovative, but untested in the market, you decide to give the Product element also 100% based on the fact that competitors have much less advanced products. You look at the information available online about your competitors, and give scores to the other factors as follows.

You have now a factor of 0.30*1.25 = 0.375 for the first element. The other elements should be calculated in the same way. This table describes the scores and weights of the factors:

| Comparisons | Range | Target company | Factor |

| Strength of Entrepreneur & Team | 30% max | 125% | 0.3750 |

| Size of the Opportunity | 25% max | 80% | 0.2000 |

| Product/Technology | 15% max | 100% | 0.1500 |

| Competitive Environment | 10% max | 60% | 0.0600 |

| Marketing/Sales/Partnerships | 10% max | 90% | 0.0900 |

| Need for Additional Investment | 10% max | 60% | 0.0600 |

To calculate the business value, multiply the sum of all factors by the average pre-money valuation of similar businesses in your industry:

Business valuation = 0.935 * $800,000 = $748,000

According to the scorecard method, Company X is worth about $750,000. This is in line with companies in the same stage that received funding, but it also takes into account the strengths and weaknesses of Company X itself.

Different investors will weight the factors in a different way. Some value more the market over the product or the team, while others will highly stress competition and market defensibility. It is your job to understand which investors value which aspects but also to have a clear picture and clear reply for any of them.

2| Checklist method

The checklist, created by Dave Berkus, is similar to the scorecard method. However, the checklist method has fixed value amounts attached to each of the elements.

The checklist valuation method considers a startup individually, without taking into account market or competitive environment.

The elements considered in the Checklist method are

- Quality of the Management Team

- Sound Idea

- Product and technology

- Strategic Relationships

- Product Rollout or Sales

Then a scale is applied rating each component at up to $500, 000. The sum of the values of each element then becomes the valuation of the business.

| Characteristic | Factor | Score | Max val. | Value |

| Quality of Management Team | 24% | 100% | $0.5m | 24%*100%*0.5m= 120k |

| Sound Idea | 20% | 80% | $0.5m | 20%*80%*0.5m= 80k |

| Product and technology | 12% | 100% | $0.5m | 12%*100%*0.5m= 60k |

| Strategic Relationships | 20% | 90% | $0.5m | 20%*90%*0.5m= 90k |

| Product Rollout or Sales | 24% | 50% | $0.5m | 24%*50%*0.5m= 60k |

Business valuation = $120,000 + $80,000 + $60,000 + $90,000 + $60,000 = $410,000

In the case of Company X, this method produces a valuation that is slightly lower than the Scorecard Method. This is ok!

All methods of valuation will produce slightly different values because of their unique point of view on potential and risk.

Using multiple methods improves the valuation outcome by putting together these different viewpoints.

The financial methods to value a business

Before working out the financial methods with an example, let’s go over some key concepts.

Present Value

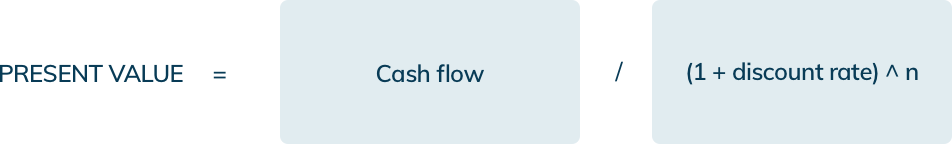

The financial methods of valuing a business take into account the projected cash flows of the company and use the discounted cash flow methodology to find the present value of the cash flows.

“The present value is based on the assumption that money now is worth more than money in the future because of risk and inflation. $100 today is worth more than $100 tomorrow which is worth more than $100 three days from now. This notion is referred to as the time value of money. “

Terminal Value

The Terminal Value captures the value of a company at the end of a designated period of time.

There are three general approaches to calculate the terminal value of a business

1. Liquidation

You sell all the business’ assets.

2. Multiples

You sell the business for X times the monthly gross turnover, cash flow, or profit.

3. Perpetual growth model

You sell the business based on X percentage of future estimated yearly growth.

3| DCF Method with Multiples

The discounted cash flow method with multiples is based on a multiple of the earnings before interest, taxes, depreciation and amortization (EBITDA).

The multiple is based on the average multiple of companies comparable to the one you are analyzing. Generally, comparable companies are:

- Direct competitors

- Indirect competitors

- Companies with the same business model

- Companies in the same industry

In this order of priority. Generally, you should find the same multiple (in this case EBITDA multiple) for 5-10 companies working the previous list downwards.

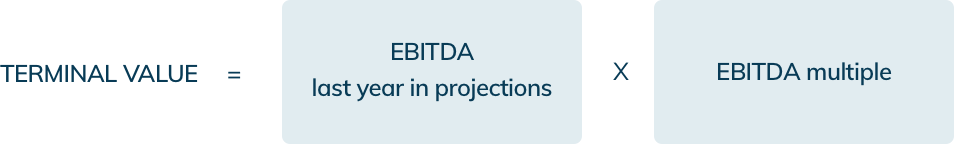

The first step to calculate this method is to calculate the terminal value. The basic formula for the terminal value in a DCF with Multiples valuation is:

The second step is to come up with a discount rate.

Keep in mind that the discount rate is usually based on the weighted average cost of capital (WACC) but in the example for simplicity reasons we’ve used 10%.

After you have all numbers ready and forecasted for a period of 3 to 5 years, you can start calculating the Present Value (PV) of each year based on the discount rate.

*Where n is the number of periods

For the last year, sum the Terminal Value to the cash flow and discount it, as well. The final valuation of the company is going to be the sum of the present values of all cash flows.

Continuing our example, let’s calculate the terminal value by multiplying the last projected year (year 3) with a multiple that can be justified. Let’s assume the multiple is 6, our valuation calculation will then look like this:

| YEAR 1 | YEAR 2 | YEAR 3 | |

| Free cash flow | $200,000 | $200,000 | $200,000 |

| Discount rate 10% | .90 | .83 | .75 |

| Net present value | $180,000 | $166,000 | $150,000 |

Terminal value = $200,000 x 0.75 x 6 = $900,000

Adding the projected years discounted cash flow to the terminal value to get our final valuation:

Business value = $900,000 + $180,000 + $166,000 + $150,000 = $1,396, 000

4| DCF Method with Long-Term Growth

The underlying assumption behind this method is that cash flows will continue to grow consistently at an estimated long-term growth rate.

The basic formula for the terminal value using the DCF with Long-Term Growth is:

* Growth rate is Long-Term Cash Flow Growth Rate

The growth rate is the rate you believe the company will grow at.

This rate shouldn’t be higher than the growth rate of the economy the business operates in (else it will eventually grow larger than the economy itself).

Let’s say that company X has $200,000 projected cash flows for year 1, 2 & 3. After that, company X is projected to grow consistently at 5% per year. (Remember we are still using 10% discount rate)

The formula to calculate the terminal value of company X then looks as follows:

Terminal value = $200,000*(1 +5%) / (10% – 5%) = $420,000

The terminal value is calculated in year 3, it will then need to be discounted for three years to get to its present value.

As per our coefficient above, $420,000 * 0,75 = $315,000.

Now, to reach our final valuation we will need to add up the terminal value and discounted cash flow for each year of projections:

Business valuation = $315,000 + $200,000*0.9 + $200,000*0.83 + $200,000*0.75 = $811.000

5| Venture Capital (VC) Method

The venture capital (VC) method is one of the most adopted rule-of-thumb approaches for valuing innovative early stage companies.

The biggest difference between the VC method and the other valuation approaches is that the valuation of a business is basically reverse engineered.

In other words, the valuation is determined based on the desired ROI of the VC firm and the amount a business can reasonably be expected to be sold for.

The VC method reverse engineers the valuation of a business to see if it has enough potential to yield solid returns.

The basic principle underlying the model is the estimation of the exit value of the company and its subsequent discount for a high year-on-year return on investment (ROI).

The VC method excludes cash flows generated by the company before the exit and accounts for possible risks like bankruptcy or illiquidity.

The basic formula for a valuation using the VC method is:

So after re-organising the formula, the post-money valuation is as follows:

In other words, this method assumes an exit value of the company and then discounts it back using the return rate that the VC firm desires.

For our example, let’s assume that the VC firm is looking to get at least a 10x return in 10 years (Keep in mind that usually VC firms are looking for even higher returns).

Remember that the estimated terminal value is $420,000. Then the post-money valuation is

Post-money valuation = ($200,000 * 6) / 10 = $120,000

To reach the pre-money valuation, simply subtract the investment amount from the post-money valuation.

Take-Away

Ideally, you use a combination of these methods to value a business. Why? Because it gives you a deeper understanding of both the value of the business and which are the factors that influence your valuation.

As you probably noticed, a lot of research in the market is necessary to conduct a full valuation of the company. On top, a vast number of assumptions need to be made. That is the reason why valuation is a mix of science and art. However, by taking into account the proper methods and assumptions, you can be more confident in calculating and explaining your valuation to shareholders and stakeholders.