As founders and entrepreneurs, we are not only asked to run our team and our business at maximum speed and efficiency. From time to time, we have to stop our ordinary “routine” and take a picture of our company and its plans for the future. This does not, or should not, happen only at the start of fundraising processes. As we already discussed in our previous post, founders should perform the task of understanding future opportunities way more often.

But, how to start?

Projecting the future of a company that has just started with a business plan and, often, a business model changing on a weekly basis, is hard. However, as its usefulness demands, there are strategies to avoid just pulling numbers out of the blue and actually project financial performance of a venture on concrete basis.

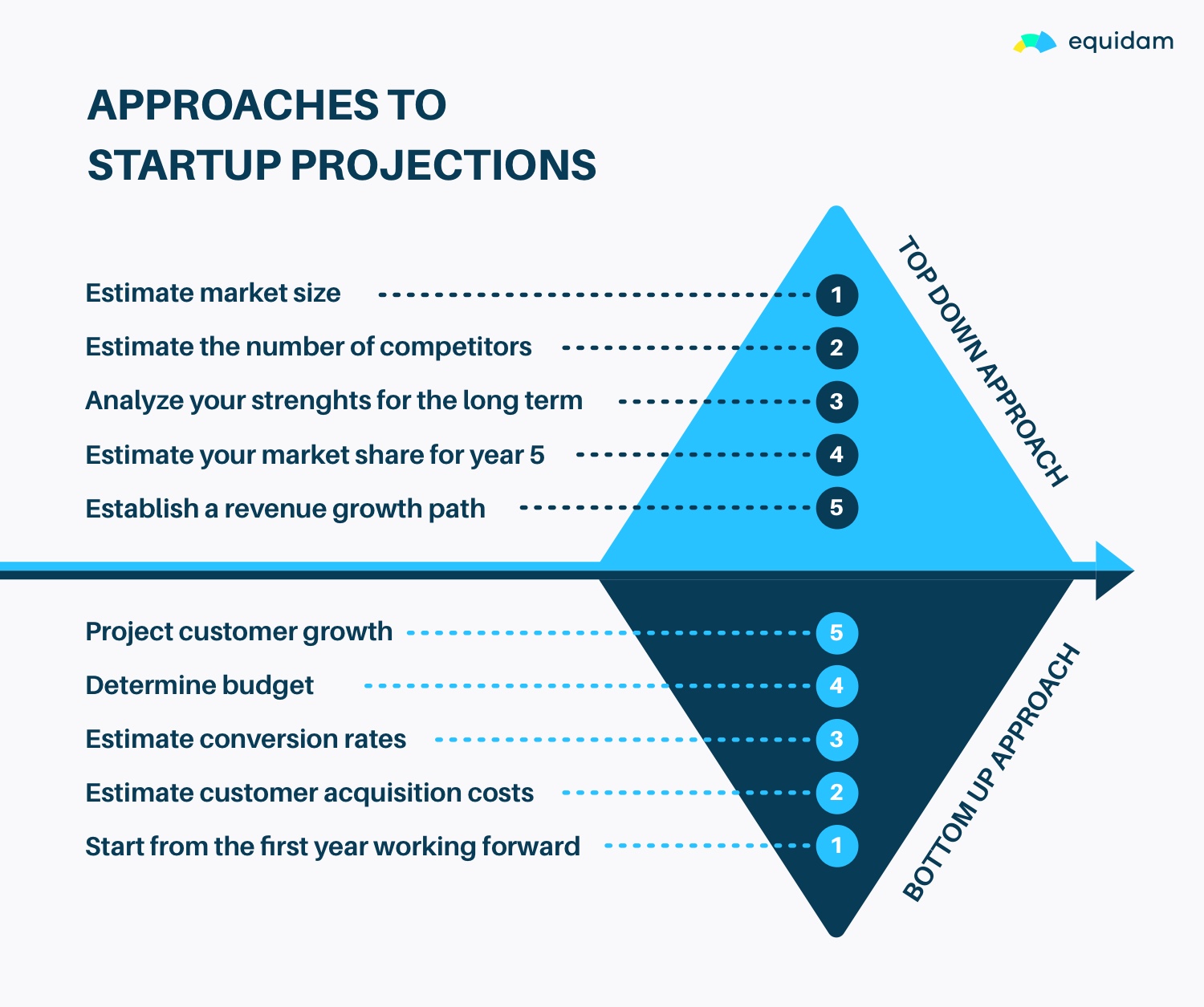

There are two main methodologies to accomplish this task. The two approaches that lead to the same conclusion start however from the two opposite sides of the equation. The first one is defined as the

Top-Down approach

It begins with the estimation of the market size. This can be done via industry reports, by looking at competitors, or at the demographics you aim to target. After that comes the estimation of the number of competitors and, maybe more importantly, the number of competitors who are going to be in the market in 3 to 5 years.

The next step involves the analysis of your strengths in the long term and how they will differentiate you from the competitors. In this task you should also consider the market share your competitors have today and for how long have they been established in the industry, taking into account also switching costs from competition.

After these considerations, you should have a ballpoint figure of the market share that you would have in 5 years in the market. It is not going to be precise, projections never are, but it will be based on facts, development plans, and competitive advantages.

With that figure in mind for the fifth year, you can establish a revenue growth path that arrives at that figure in the upcoming four years

Read more about top-down financial projections in this article.

The second method is, as discussed, opposite in a sense. It is defined as the:

Bottom-Up approach

This approach almost omits the size of the market, assuming that the number of customers is unlimited- you just need to reach them. Indeed, it does not even start form the fifth year working backwards, but from the first year working forward. Considering what the product, the business model, and the customer acquisition technique are, you can estimate how many customers and how much growth you will be able to acquire in the coming year.

So for example, if your customer acquisition technique is online advertising, you will be able to estimate how much traffic a campaign with a determinate budget will produce to your website, you will then estimate conversion rates from visitor to customer and reinvest part of the profits for new acquisition.

This strategy of course does not only apply to online advertising or online businesses but to all customer acquisitions strategies. It can be applied to a number of sales agents the businesses have, the number of leads that can be reached by them and by how many of these leads actually become customers.

The procedure for the coming years is similar, but with a new bottom line of working capital to be used in customer acquisition.

You could argue that this technique is not applicable to the word of mouth, social media, or viral marketing. However, the same metrics apply to these distribution techniques. Virality has a coefficient, and especially has a timeline and a time slack that takes to the second level lead to become a customer after the referral from the first one. These coefficients can be used to calculate your startup projections for the coming years.

Read more about bottom-up financial projections in this article.

Need help turning your Startup Projections into a full Valuation? We can help you. Get started with Equidam now and discover how much your Startup is worth!

Which approach is better for your Startup Projections?

In general, each of them has valuable points that could be more appropriate for different businesses or business models. My opinion is that a combination of the two is always the best solution. For example, you could easily start with a top down approach and estimate a market share in one specific country of 5% in 5 years. Then you extrapolate the growth for the coming years. Afterwards, you could apply a bottom up approach and answer questions as: “is this growth actually feasible?”, “what is the viral coefficient that I would need to achieve 5% market share?”, “how many agents should I hire?”, “what would be the working capital necessary and can I raise it from investors?”.

On the opposite side, starting with a bottom up approach and checking it with a top down approach will tell you what is the market share you are going to achieve in 5 years. Next, you could take into consideration your reasoning on the product, competition, and competitive advantage and answer questions like: “Would these numbers be feasible in this competitive market?”, “How is the competition going to be in the future and will I be able to maintain my conversion rates?”, “Is this market share achievable?”

So we could conclude that both of these approaches have strong and weak points. However, the combination of the two might give you maximum insights into how the company could evolve and also the strongest arguments to plan a better strategy and achieve those numbers in the future.

P.S. Are Excel calculations the problem?

If Excel and the models are your struggle, check out this Financial Projections Template, an already made Excel spreadsheet that constitutes a strong base for your startup projections. You can use it right away! It incorporates both bottom-up and top-down approaches and has clear and simple guidelines to follow in changing the numbers!

My experiences so far only support the bottom up approach as long as it’s based on primary conversion data from running small experiments. Estimated and market reports are indicators for aggregates, not early stage innovation/startups.

Hi Hamzah, definitely agree with you. At early stage is much easier to forecast based on the internal metrics. That gives you not only a forecast but a strategy to get there. What I’m saying is that looking outside at the market is very important to get a reality check. Sometimes by making internal calculations, we all expect very high numbers, that might not just be there when you actually go and sell.

very useful blog

Thanks Daniel, I usually recommend the pragmatic bottom-up approach for year 1 & 2 and the top-down approach to estimate potential in Y5, with an ultimate consistency check between both approach. I have also created a super easy & free financial forecast tool for startups (excel template) : http://www.businessmodelforecast.com/ Check it out! 🙂

Many entrepreneurs struggle with using Excel templates for financial projections. We built a “TurboTax for financial projections” called ProjectionHub. It is a web app that helps entrepreneurs create realistic financial projections without the need for a PhD in spreadsheet modeling – http://www.projectionhub.com