First Principles Fundraising #2

In Part 1 of our First Principles Fundraising series, we examined whether raising venture capital is the right move for your startup, focusing on its demands—rapid growth, potential dilution, and the loss of control over time. If you’ve decided that external funding aligns with your strategic goals, the next step is to determine your actual readiness to approach investors. This decision is more complex than just checking revenue milestones or assembling a pitch deck; it requires a thorough analysis of where your company stands in terms of risk, traction, and future potential.

- Part 1 – Is fundraising the right move for your startup?

- Part 2 – Are you investment ready?

- Part 3 – How to choose the right investor

- Part 4 – How to run a tight fundraising process

- Part 5 – How to make the most of investor meetings

While many guides emphasize fundraising readiness through preparing documents like pitch decks, cap tables, or financial projections, these are actually fairly superficial needs. Similarly, goalposts in terms of traction are constantly shifting and very situational. Instead, understanding your readiness to raise money requires looking at your unique proposition through the lens of risk and your ability to hit inflection points, showing investors that their capital will serve as a catalyst for growth rather than a crutch.

The Real Measure of Investment Readiness

At its core, venture capital investment is about risk and return. Investors are constantly assessing whether a startup is in a position where their capital can effectively reduce risk and accelerate growth. A company’s stage, business model, market type, and capital requirements all impact what “de-risking” means and what evidence should be in place to demonstrate it.

Revenue, while often an indicator of a startup’s progress, is not a universal readiness metric. The time it takes to reach revenue varies widely between business models and sectors. e.g.

- Biotech or Hardware: Typically require years of R&D and regulatory approval before generating revenue. Here, readiness is more about scientific validation, strategic partnerships, or pilot programs rather than immediate sales.

- B2B SaaS: In contrast, a lean SaaS startup may see revenue weeks after launch, as long as the product is viable and there’s a clear customer need.

These extremes illustrate why “readiness” can’t be generically associated with revenue — it must account for the unique milestones relevant to each company’s stage and type.

Fundraising Stages and Risk Expectations

Different stages of funding demand different levels of de-risking. Understanding what each stage represents allows founders to position their startup as a viable investment at each step.

Pre-Seed: At this early stage, your goal is to convince investors of the market opportunity. Investors typically look for:

- Clear, research-backed evidence of a market need or opportunity.

- A compelling and coherent solution which addresses the need and creates value.

- A qualified team that can execute on the vision to build and scale the solution.

Seed: Building on pre-seed, you’re now expected to show more concrete evidence:

- Evidence of customer interest — either revenue, partnerships, or even usage statistics — to prove your solution resonates in the market.

- While it’s not necessary that you should be profitable, or even have positive unit economics at this stage, you should be building a case towards that in future.

Series A: Moving beyond initial traction, raising a Series A is about demonstrating scalability:

- Investors will want evidence that your startup can capture a meaningful portion of the (even fairly small, initial) market.

- Signs of replicable, scalable customer acquisition, sustainable revenue growth.

Each stage’s expectations boil down to your ability to show reduced uncertainty around product viability, customer interest, and market demand.

Why Your Startup Needs Funding Now

While founders often focus on what the capital will do for their immediate business needs (and it’s always easy to make the case that capital will drive growth), investors will want to know the story beyond the current round. Why does it make sense for them to invest right now?

Investors seek companies on the cusp of an inflection point—a significant shift in growth trajectory that will dramatically alter a company’s value. Venture capital often provides the fuel to reach or accelerate through these pivotal moments, enabling a company to enter the market, gain traction, or scale rapidly. This pursuit of inflection points explains the gamble that venture investors take, betting that the right injection of capital will turn a promising but early-stage company into a high-growth venture.

In simple terms, if a company’s current valuation is “X” and it receives an investment of “Y,” then its immediate post-investment value can be thought of as “X + Y.” However, if that capital fails to drive meaningful growth or is spent inefficiently, the company’s resulting value may potentially fall below “X + Y.” In the ideal case, the investment unlocks an inflection point, multiplying the company’s value — perhaps to three or four times “X.” This exponential potential is why investors are willing to take significant risk, as one success can compensate for multiple failures.

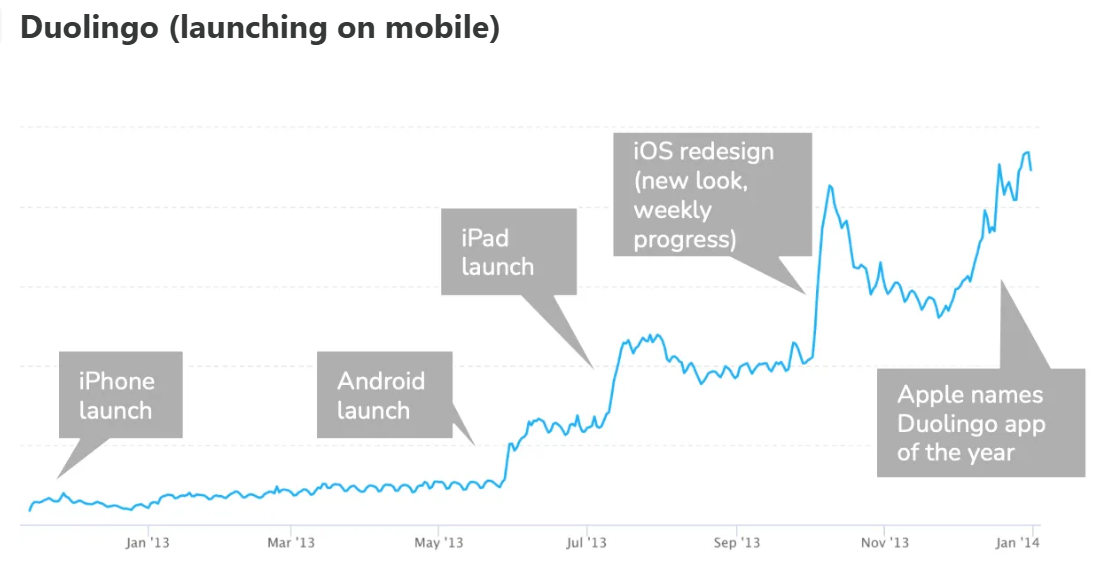

Duolingo’s impressive growth is shown with a number of inflection points, each of which will have required significant investment to achieve. Check out some more examples, including Figma, Snap, Airbnb and more in Lenny Rachitsky’s article.

For founders, the takeaway is clear: an investor is not just buying into your company as it is today but is betting on its near-term potential to reach an inflection point and what that means for the future. You need to demonstrate why this capital at this time will trigger that shift, and why the timing of this opportunity makes the case for investment stronger than it might ever be again.

When You Shouldn’t Be Raising

Unfortunately, many founders try to raise capital when they need it just to keep the business running. This means raising money from a position of weakness, without a compelling narrative, which is incredibly difficult.

For example, early revenue can actually hurt your fundraising narrative. You may believe that getting the first dollars through the door provide crucial validation (and you would be right), but you have to consider your company from the perspective of investors: if you can generate revenue, then why do you need their money? You have obviously developed the product to the point that you can make sales, so why raise now?

The implication might be that you can’t grow effectively, and you want cash to provide runway so you can figure out how to improve your growth engine. It might be that customers are churning too quickly, or are costing too much to acquire. This is obviously not an appealing pitch to investors. In fact, here’s a simple heuristic: investors want to be told that their capital is going directly into scaling something that works well, not figuring out how to fix it (even if ultimately you always do both). That’s why you approach funding rounds with the mindset of milestones and inflection points.

Building the Narrative

To effectively approach investors, founders need a cohesive story that highlights the strategic need for funding and demonstrates clear de-risking. The key elements include:

- Market Opportunity & Product Fit: Demonstrate a well-researched understanding of the market and how your product addresses a specific gap.

- Customer Validation: Show real proof of interest, be it through revenue, partnerships, pilot programs or even just research and feedback at the earliest stages.

- Team & Execution: Reinforce the team’s ability to execute, especially in terms of technical skill, industry experience, or unique qualifications that differentiate your approach.

- Capital Roadmap: Illustrate how the capital will de-risk the path forward—be it for growth, customer acquisition, or achieving the next milestone.

Readiness is not a simple checklist of pitch materials or revenue milestones. It’s a nuanced assessment of whether your startup has de-risked sufficiently for investors to view their capital as a valuable growth accelerant rather than a risk buffer. By evaluating your company’s unique risk profile and aligning your fundraising narrative accordingly, you position yourself as a compelling, investable business in the eyes of the investor.