Startup Valuation & Fundraising Strategy: The Deep-Tech Playbook

Fundraising for deeptech is nothing like the copy-and-paste playbooks you see for SaaS: timelines…

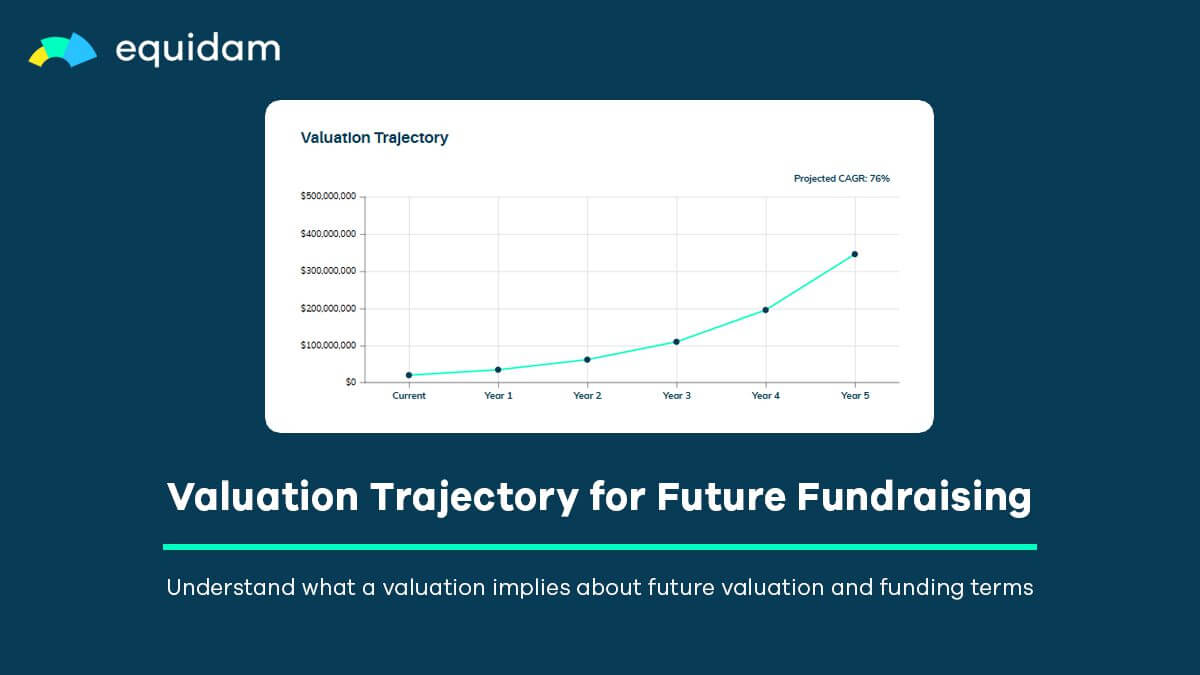

How Equidam Models Valuation Trajectory for Easier Future Fundraising

Venture capital is built on staged commitments. Rather than betting the farm up front, investors…

Standard Capital's Series A Fundraising Documents: Founder Guide

In startup financing, standardized fundraising documents transform what was once a maze of bespoke…

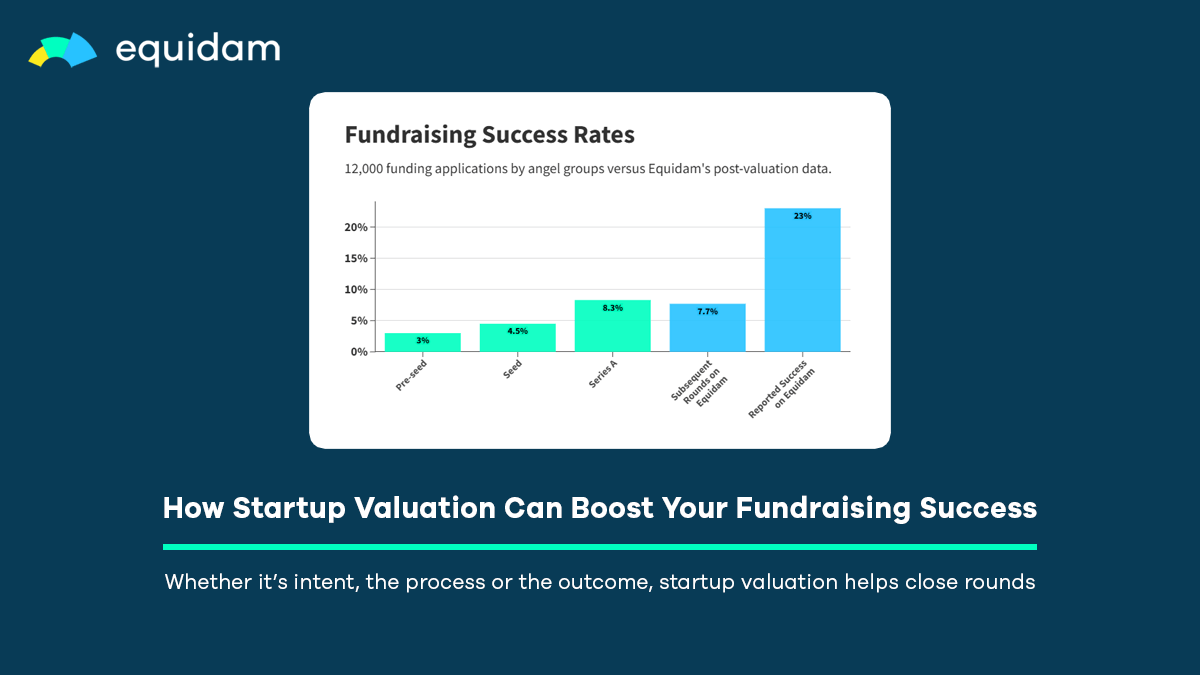

How a Startup Valuation Can Boost Your Fundraising Success

Raising venture capital is notoriously difficult, especially for early-stage startups. Even in boom…

EBITDA Multiples by Industry in 2025

You can find in the table below the EBITDA multiples for the industries available on the Equidam…

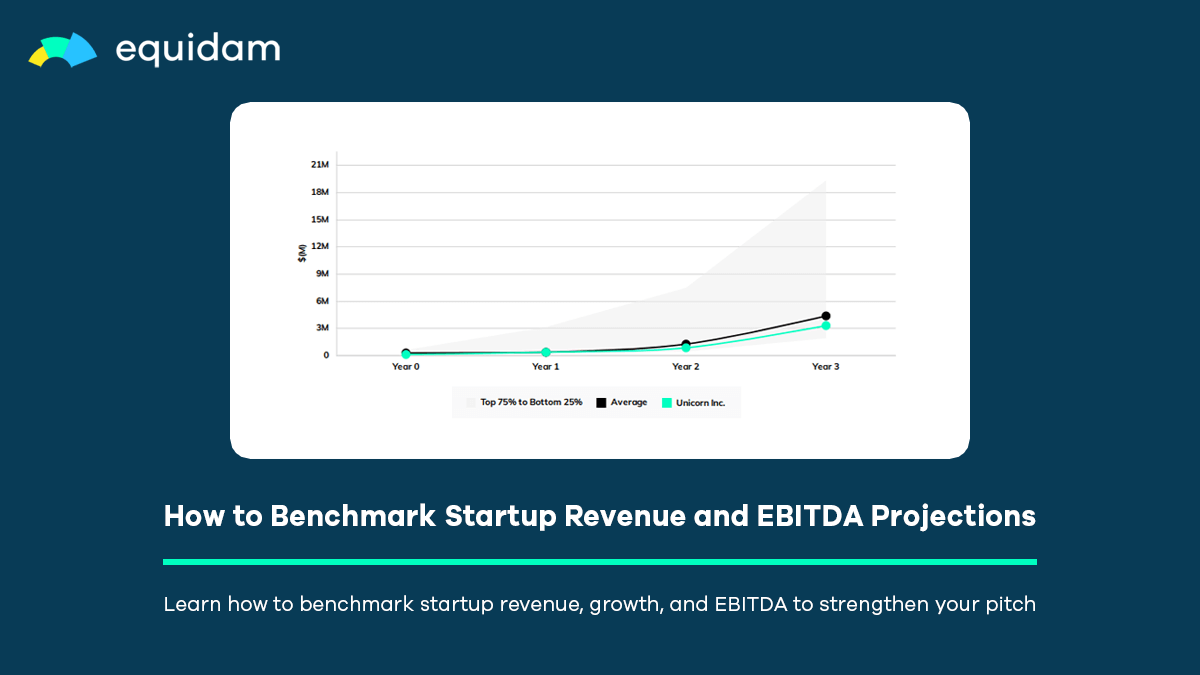

How to Benchmark Startup Revenue and EBITDA Projections

Financial projections form the backbone of startup valuation. While qualitative methods like our…

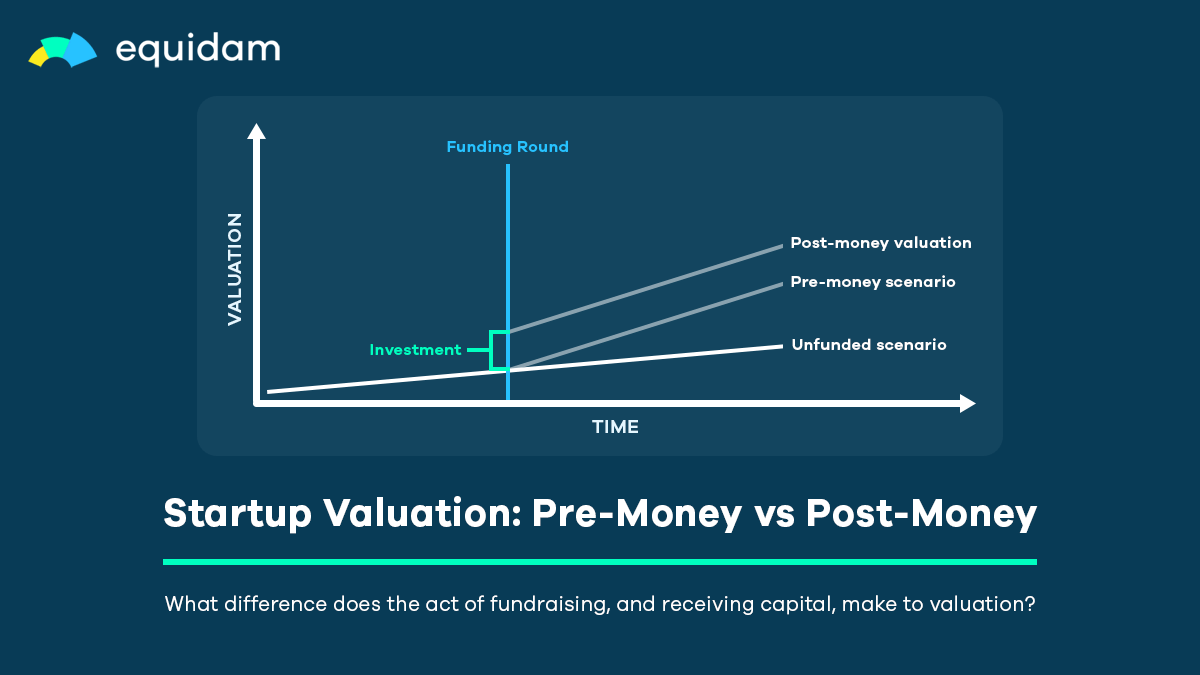

Startup Valuation Explained: Pre-Money vs Post-Money

One of the most fundamental yet confusing aspects of startup fundraising is understanding the…

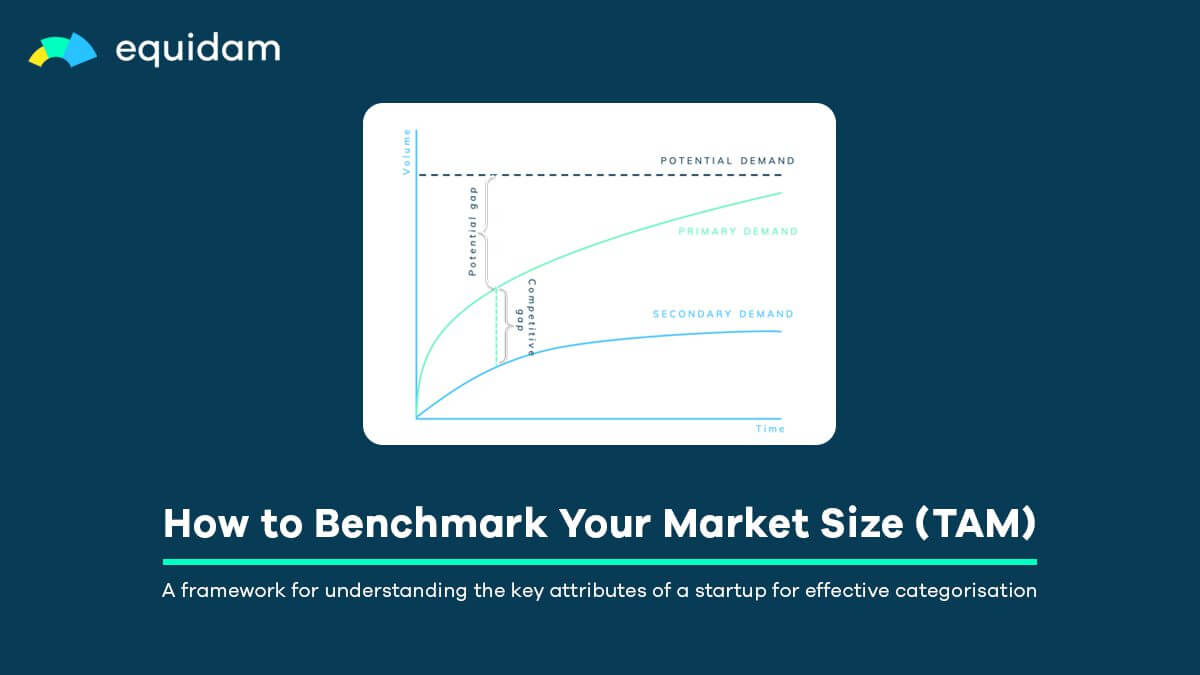

How to Benchmark Your TAM and Build Investor Confidence in Your Market Size

The Role of TAM in Startup Fundraising For startups navigating a funding round, a well-defined and…