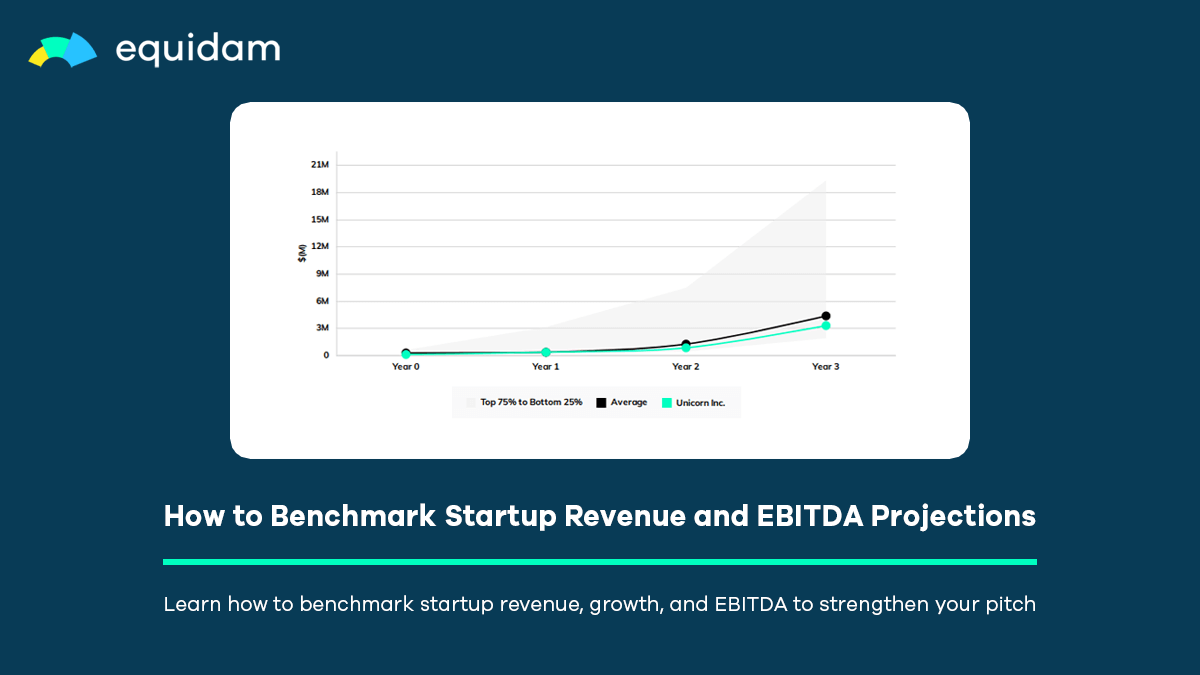

How to Benchmark Startup Revenue and EBITDA Projections

Financial projections form the backbone of startup valuation. While qualitative methods like our…

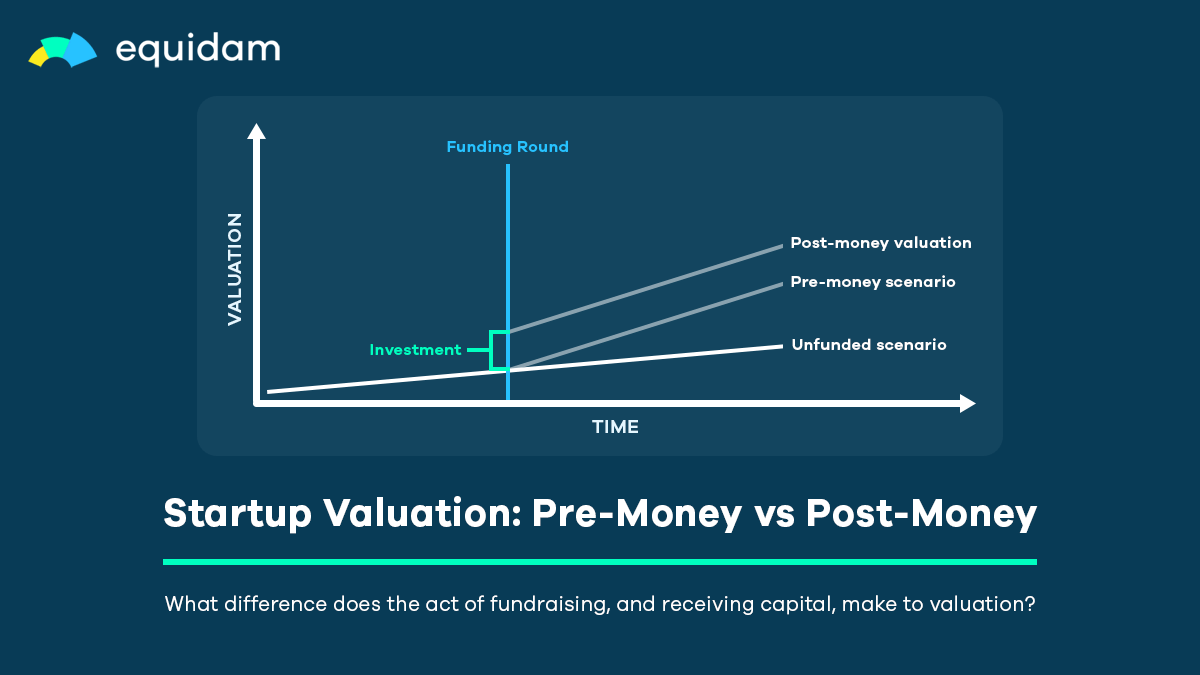

Startup Valuation Explained: Pre-Money vs Post-Money

One of the most fundamental yet confusing aspects of startup fundraising is understanding the…

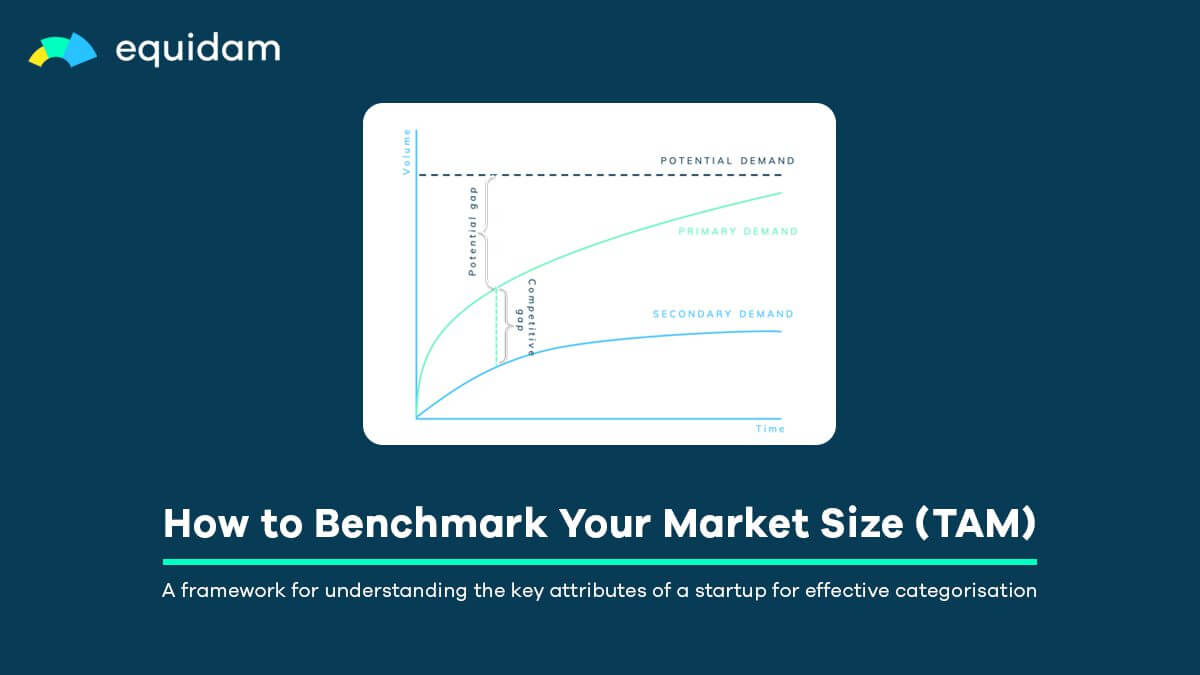

How to Benchmark Your TAM and Build Investor Confidence in Your Market Size

The Role of TAM in Startup Fundraising For startups navigating a funding round, a well-defined and…

How to Use Comparables Effectively in Startup Valuation

In the context of startup valuation, "comparables" (often shortened to "comps") refer to companies…

How to Value Pre-Revenue Startups

One of the murkiest topics within the venture capital and startup ecosystem is the valuation of…

Startup Valuation: The Ultimate Guide for Founders

For many early-stage founders, the topic of startup valuation can feel like navigating a dense fog.…

Startup Valuation: The Ultimate Guide

Startup valuation underpins all startup fundraising activity, enabling novel propositions to be…

ESS Valuations Made Easy: How Australian Founders Can Streamline the Process

For Australian startups, the talent war is real. While established companies can offer hefty…

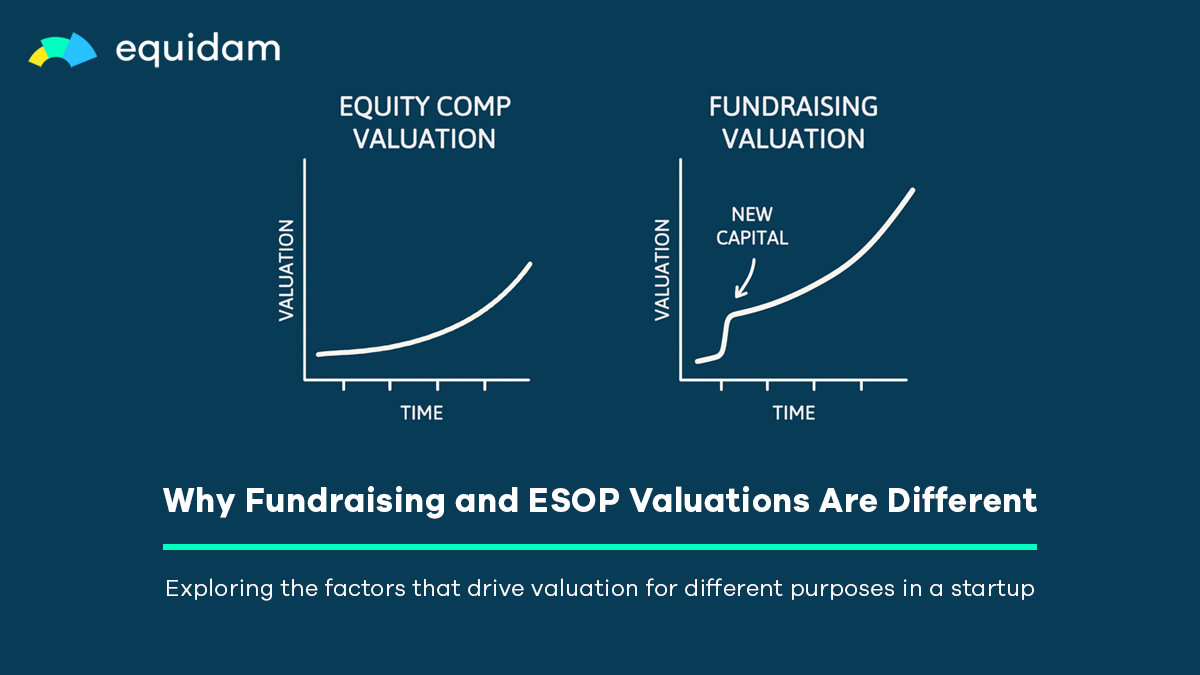

Why Fundraising and ESOP Valuations Are Different

When founders think about valuation, it’s often in the context of raising money — negotiating…