AI Valuation Explained: Surge AI vs Scale AI

The artificial intelligence sector is currently defined by dizzying valuations and capital raises…

How Valuation Drives Innovation, and Better Investments

Venture capital is supposed to finance the improbable; spotting the outliers amongst a field of…

PARAMETERS UPDATE P6.1

On July 30th, 2025, you’ll be upgraded to the latest version of Equidam with updated valuation…

Dilution 101: Calculation And Examples

What is dilution? TLDR: Dilution is the reduction in the ownership percentage in a certain…

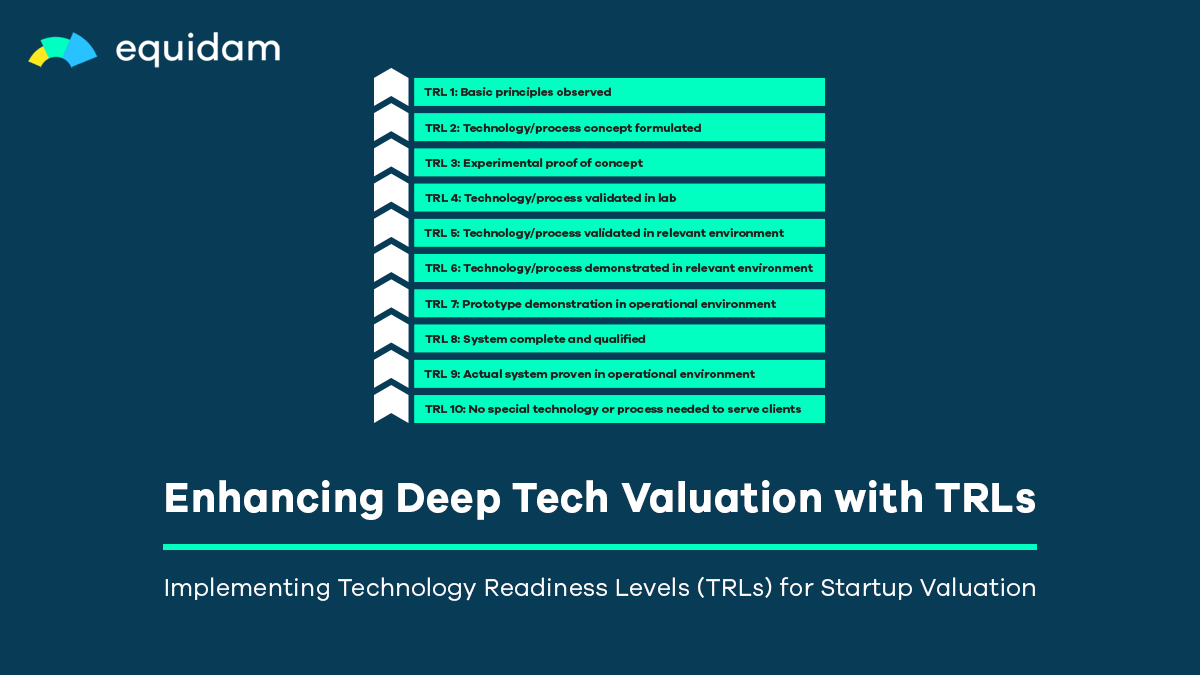

Deep Tech Valuation: Using Technology Readiness Levels

Early-stage valuation has always been about capturing potential before it becomes obvious. For deep…

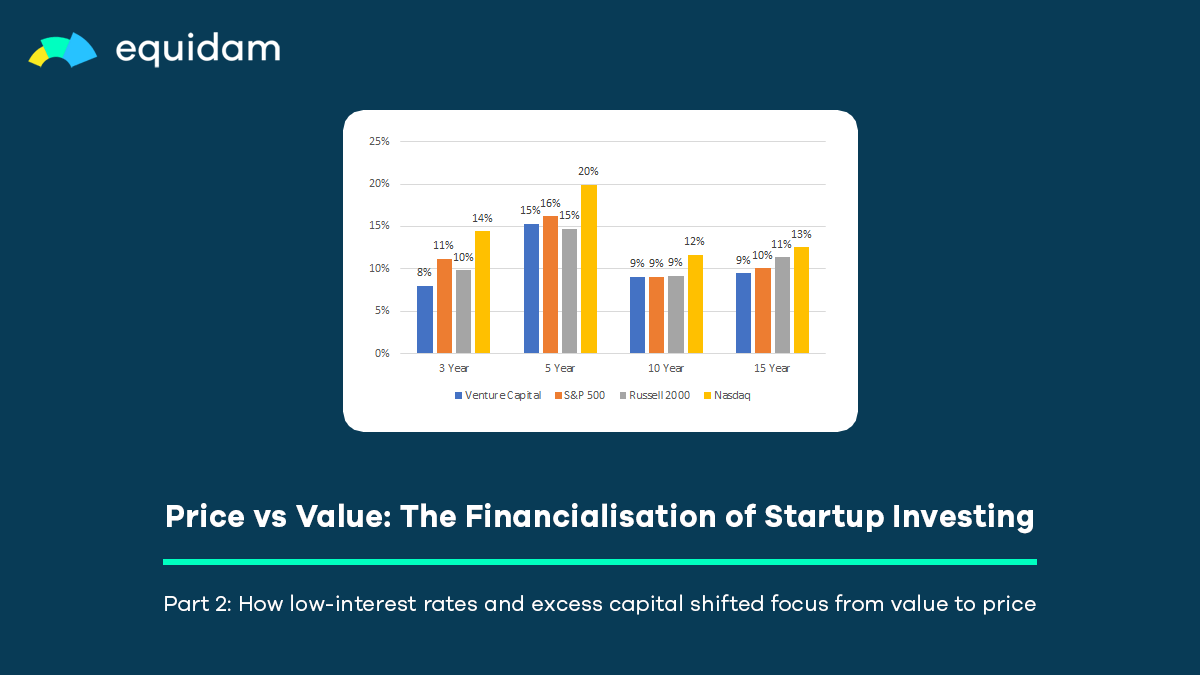

Price vs Value (Part 2): The Financialisation of Startup Investing

Price vs Value (Part 1): The Momentum Trap in VC Venture capital has long been about finding and…

17 June 2025

How to Get a BSPCE Valuation for Your Startup’s Employee Share Plan

BSPCE (Bons de Souscription de Parts de Créateur d’Entreprise) are a special type of employee stock…

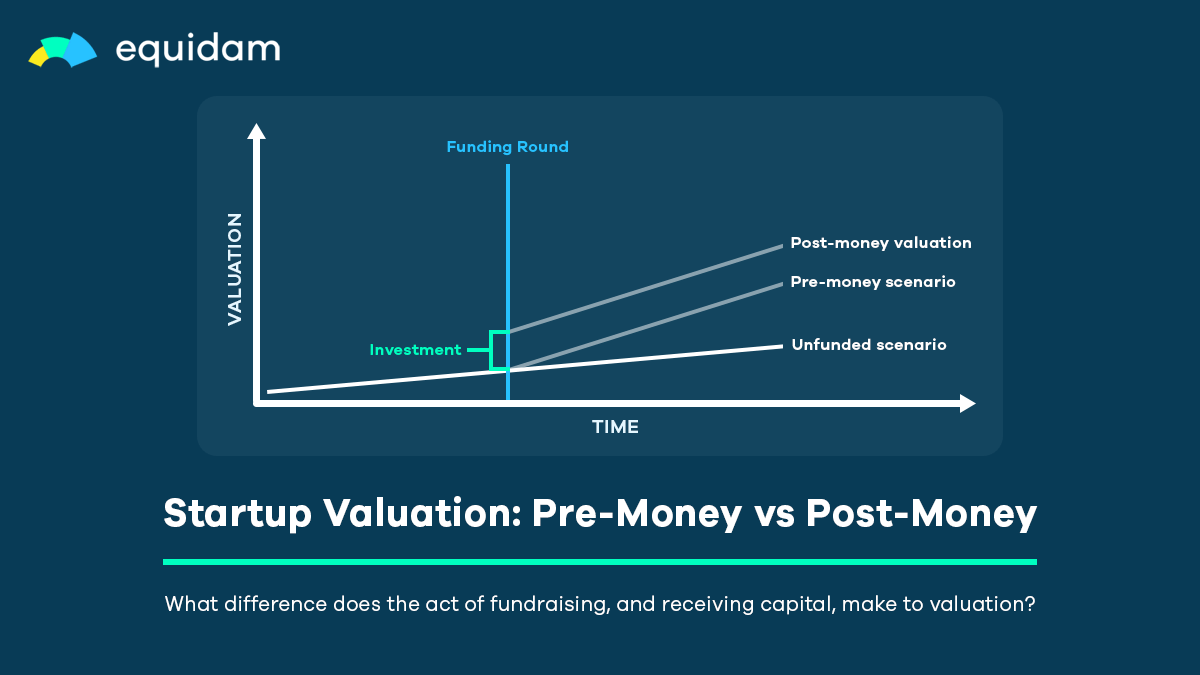

Startup Valuation Explained: Pre-Money vs Post-Money

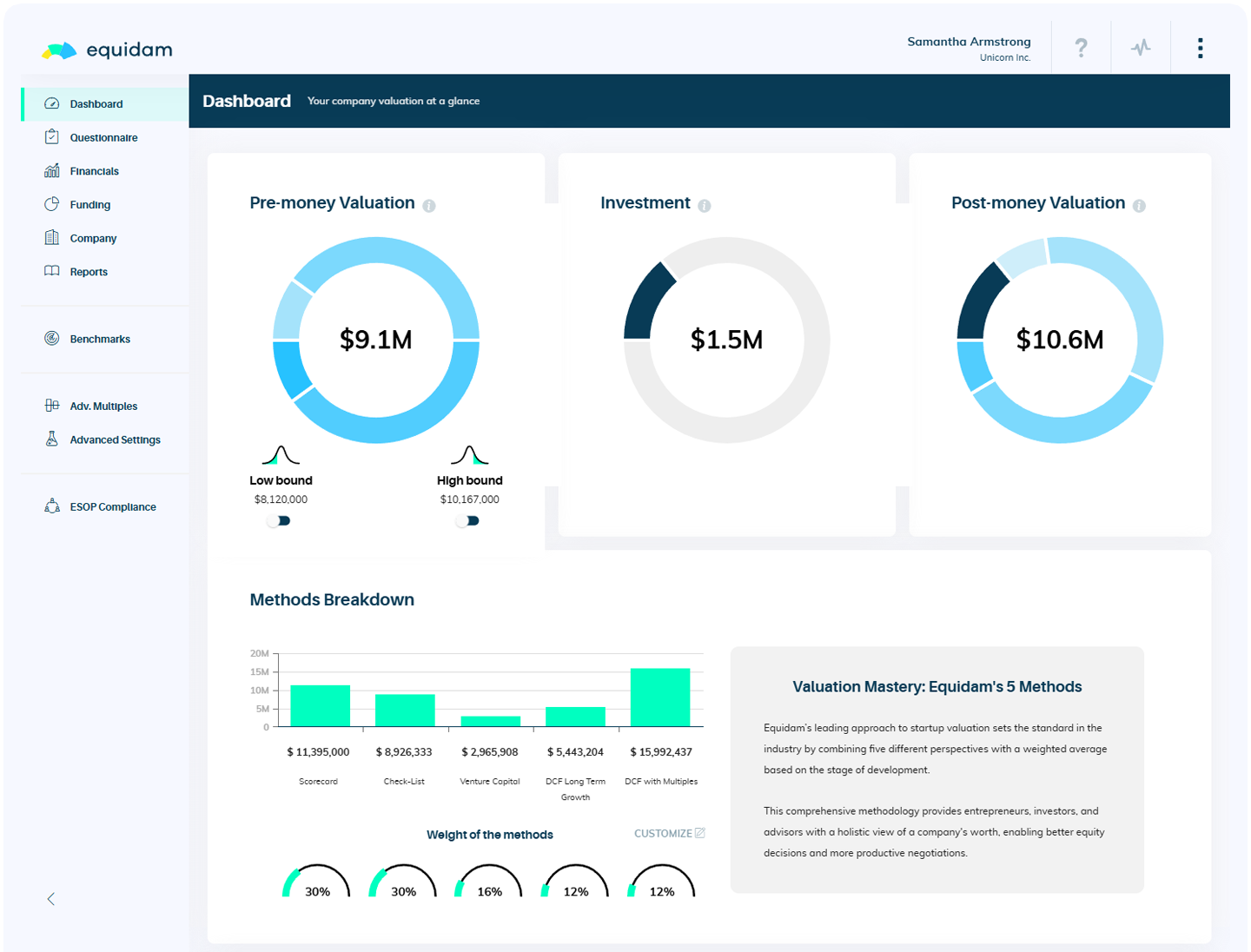

One of the most fundamental yet confusing aspects of startup fundraising is understanding the…

The Multiple Method: A New Tool for Investor Flexibility

We’re pleased to announce the addition of a new valuation method to the Equidam platform:…

How to Value Real Estate Companies

Valuing real estate companies presents a unique set of challenges. Unlike…